Exhibit 99.3

FIRST QUARTER 2024 PREPARED COMMENTARY

MAY 1, 2024

This prepared commentary should be read in conjunction with the earnings press release, quarterly supplemental financial information and the Form 10-Q. All this information can be found on our Investor Relations page at ir.plymouthreit.com.

Before we get into the relevant detail from each area of the company, we’d like to call out some of the important takeaways from the quarter:

| · | The results were in line with our expectations for the quarter and consistent with the full year forecast we provided on February 21, 2024. |

| · | SSNOI growth of 7.0% on a cash basis was consistent with our full year outlook. |

| · | We started the year with strong leasing results, have addressed 58% of our 2024 expirations, and are on track for our expected mark-to-market of 18% to 20%. |

| · | The development program is now 93% leased with one space left to lease. |

| · | Net debt to Adjusted EBITDA increased sequentially from 6.5X at year end to 6.7X at March 31 with the transitory uptick due to the effects of operating expense seasonality, coupled with the timing of recoveries and the previously discussed sequential decline in occupancy in Q1. There was no incremental borrowing in the quarter. |

Golden Triangle and PLYM Market Commentary

We were pleased to see continued investment in the Golden Triangle region and adjacent markets through reshoring, onshoring, and nearshoring. Just last week, Toyota announced a new $1.4 billion investment in its Princeton, Indiana facility that raises its total investment in Indiana to $8 billion. This facility is located nearly equidistant between St. Louis and Indianapolis. Toyota also has a $13.9 billion lithium-ion battery facility outside Greensboro, North Carolina slated to begin production in 2025.

In an example of a nearshoring investment, Honda Motor made an announcement last week that it plans to establish a “comprehensive electric vehicle value chain” in Ontario, Canada. Honda and its joint venture partners are expected to invest approximately CAD$15 billion in this value chain. Honda Motor referenced their Honda EV Hub project in Ohio and how that project is an important part of their value chain in North America.

For ease of research, we have included links to the Toyota and Honda announcements below:

Toyota (April 25, 2024)

https://pressroom.toyota.com/toyota-charges-up-investment-and-jobs-in-u-s-manufacturing/

Honda (April 24, 2024)

https://global.honda/en/newsroom/news/2024/c240425deng.html?from=latest_area

Honda (April 12, 2024)

https://hondanews.com/en-US/honda-corporate/releases/release-c0e904130abdddafe05400397a01473d-honda-progress-in-establishment-of-ev-hub-in-ohio-will-lead-to-ev-production-in-north-america

The Honda investment is one of several we have previously referenced in Ohio, and it is noted in our new market portrait for Columbus. During 2024, we intend to showcase individual PLYM markets. Columbus is our first market report that we’ve prepared in conjunction with the team at Avison Young. You can find a copy of this report on our corporate site at https://www.plymouthreit.com/columbus.

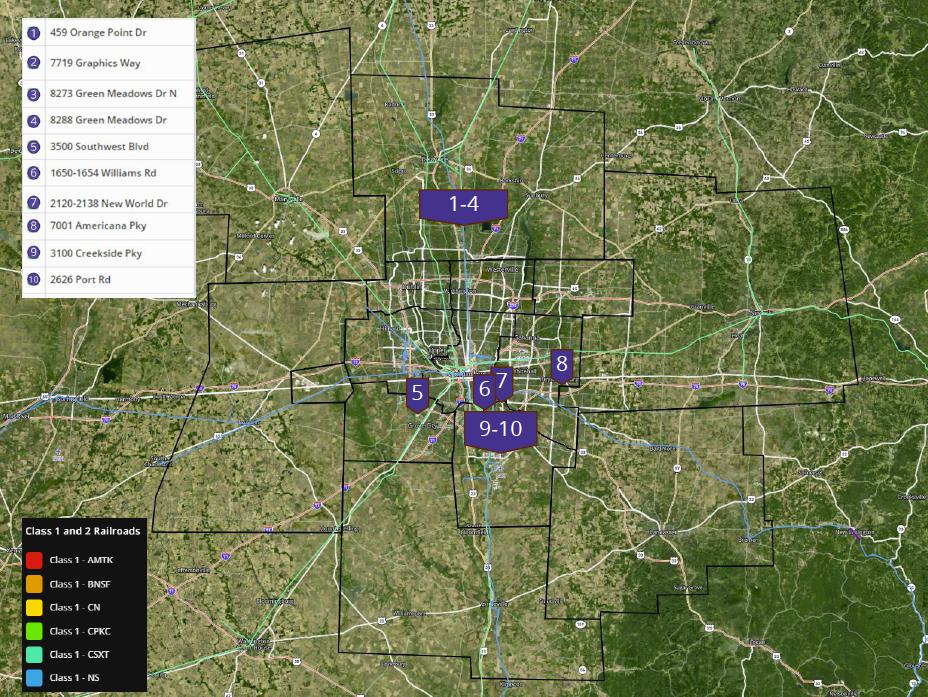

One of the highlights from the Columbus report is a snapshot of where some of our Columbus properties are located in relation to key logistics infrastructure such as the railroads and John Glenn Columbus International Airport and Rickenbacker International Airport.

There are two buildings in the Rickenbacker Submarket. 2626 Port Road is a rear load, 156,000- square-foot building which practically overlooks the Rickenbacker Airport. 3100 Creekside Parkway in Lockbourne also benefits from close proximity to Rickenbacker as it is 3.2 miles north of the airport. New World Drive and Williams Road are less than 10 miles from Norfolk Southern Rickenbacker Intermodal.

7001 Americana Parkway in Reynoldsburg measures 54,100 square feet and is the closest building in the portfolio to the technology and data center developments on the northeast side of the market. This asset also is just under 1.5 miles from the I-70 / Brice Road full interchange.

The second largest building in the portfolio, measures 527,100 square feet and is located at 3500 Southwest Boulevard in Grove City next door to Walmart’s Regional DC and two doors down from FedEx Ground. This building is also the closest to CSX Intermodal and UPS Hub at I-70 & I-270.

The four Lewis Center assets on the north side of the market have less proximity to logistics infrastructure but benefit from proximity to affluent housing clusters and major corporate employment hubs and retail.

Source: Avison Young, US Industrial Group

The other five assets we own in the Columbus market total 1,191,536 square feet and are located approximately one-hour from Columbus.

Development Program Update

We have one project left to deliver in the first phase of our development program. This project is a 52,920-square-foot fully leased industrial building in Jacksonville that will deliver in Q4 of this year. With the signing of a 54,008-square-foot lease at our project in Cincinnati, we are now 93% leased across the entire 772,622-square-foot program. We have several RFPs out with tenants on the remaining 53,000 square feet available in Cincinnati.

The development program will ultimately represent a total investment of $68.5 million, $61.1 million of which has been funded (see page 7 of the supplemental). The proforma stabilized cash NOI yields on the projects under construction and completed range between 7% to 9%.

Leasing Update

Leasing activity at our properties remains strong, with nearly 1.4 million square feet of leases commencing during Q1 at a rate 17.1% higher than expiring rents. These results are tempered by the large number of fixed rate renewals that kicked in during the quarter. The leasing results for Q1 are broken down as follows for leases commencing during these periods (calculated on a cash basis and excluding development program leases):

| · | First quarter |

| o | 928,217 SF of renewal leases commenced at a 5.9% increase |

| o | Renewal rate was 66.9% |

| o | 41.6% of these renewals were contractual, which are typically at a lower rental rate increases and are frequently exercised earlier in the year |

| o | 459,760 SF of new leases commenced at a 48.4% increase |

| o | Blended increase of 17.1% |

As reported last quarter, we addressed over 45% of our 2024 lease rollover before the year began. With additional activity performed through April 29, we now have addressed over 58% of the 2024 expirations.

Based on the blended rate of 16.5% achieved to date and the leases yet to expire, we estimate the mark-to-market in the portfolio to be 18% to 20%. Again, our results so far are a bit tempered by the fixed rate renewals (these contractual renewals show up in the early part of the year since they usually have a six-to-nine-month notification requirement). There will be no further fixed rate renewals impacting 2024 rate increases. If you add in annual lease escalators that are now approximately 3% across the portfolio, we have a significant opportunity to drive organic growth through our leasing activities.

| · | Full year 2024 (executed through April 29, 2024) |

| o | 3,310,261 SF of renewal leases signed at a 13.1% increase |

| o | Renewal rate so far of 79.8% |

| o | 25.8% of these renewals were contractual |

| o | 838,583 SF of new leases signed at a 28.9% increase |

| o | Blended increase of 16.5% |

We continue to actively market our largest lease expiration in 2024, the 769,500-square-foot single-tenant lease at our Class A industrial building in the Metro East submarket of St. Louis. Over the past several weeks we have been working with two manufacturing groups and a leading logistics provider to potentially relocate their operations into our facility. As they continue to work on their business plans over the next few weeks, we expect to refine our lease proposals to meet their requirements. In addition to these activities, we are also aggressively marketing the property to users across the country. A marketing video of the property can be found at the following link: https://walkthruit.com/3919-lakeview-drive/. As you can see, the building is located in an attractive park with access to major interstates in the St. Louis area. We are confident we will be able to get this building leased given its location and recent build. We have not updated any of the possible scenarios with this property that we previously outlined in our Fourth Quarter 2023 Commentary. We refer investors to those comments.

Looking across the portfolio, there are no other tenants within our top 10 list scheduled to expire during the year, but Communication Test Design, Inc does expire at the end of the year (see page 24 of the supplemental). We have been in renewal negotiations with this tenant and expect to have this lease addressed shortly.

There are two known moveouts that we discussed on the Q3 call. These two expirations were the drivers for the overall occupancy drop from Q4 2023 from 98.1% to 96.9% at the end of Q1 2024. The first is for 313,982 square feet in Chicago which occurred at the end of 2023. We are actively marketing that space and the moveout is baked into guidance, but we have several very good prospects looking at the space, including interest from another in-place tenant.

The second known move out, is located at 9150 Latty Avenue in St. Louis. We had previously mentioned that we had agreed to terms with a new tenant for this 142,364-square-foot facility and continue to work through a longer tenant deliberation as we progress toward execution.

Disposition Update

During the three months ended March 31, 2024, the tenant occupying an industrial property located in Columbus, Ohio, provided notice of its intention to exercise the fixed purchase option stated within their lease. The lease agreement requires the sale to close in August 2024 at a fixed price of approximately $21.5 million. In accordance with GAAP, we reclassified the respective real estate property to net investment in sales-type lease totaling $21.5 million on our condensed consolidated balance sheets, de-recognized the net book value of the property assets for $13.5 million and recognized a gain on sale of real estate of $8.0 million related to this transaction. For more detailed information on the accounting treatment for sales-type leases, please refer to Footnote 4 of our Form 10-Q.

In addition to the exercise of the tenant purchase option noted above, there are a handful of potential dispositions that we continue to evaluate over the next twelve months. These potential dispositions would serve as accretive sources of capital to fund additional growth opportunities; we would estimate that these potential dispositions could generate net proceeds of up to $50 million in 2024.

We now have better visibility on a number of acquisition opportunities that we are evaluating in our existing markets in which we could realize accretive yields, capture incremental property management fees and drive value creation. The size of these acquisitions range from $10 million for our traditional “singles and doubles” type takedowns to $100 million for larger portfolios that contain a mix of single- and multi-tenant occupiers, generally less than 4 years of remaining lease term, with above 85% occupancy and mark-to-market opportunities consistent with our portfolio averages.

Balance Sheet Update

Some of the balance sheet highlights as of March 31, 2024 are as follows (see pages 15-16 of the supplemental):

| · | Net debt to EBITDA of 6.7X |

| · | 69.4% of our total debt is unsecured |

| · | 93.7% of our debt is fixed, including with the use of interest rate swaps with a total weighted average cost of 3.99% |

| · | $194.6 million of capacity on our unsecured credit facility |

| · | Our only debt maturity until August 2025 is a life company secured mortgage loan totaling $18.2 million that matures in August 2024, which we plan to pay off through borrowings on the credit facility |

As previously discussed, we intend to stay in the 6X range in terms of net debt to Adjusted EBITDA. We will fluctuate a bit this year based on seasonality – like we saw in the first quarter. We will be flexible to go a little below where we were at year end 2023 to slightly above it to complete a transaction – assuming that we don’t have disposition proceeds to help offset those borrowings as well. Our bias for 2025 is still to operate at the low end of the 6X range.

Discussion of First Quarter of 2024

The first quarter Core FFO was $0.45 per share driven by the elimination of preferred stock dividends as a result of the redemption of the Series A Preferred Stock completed September 2023, sequential improvement in leasing spreads within our same store portfolio, contributions from our phase 1 developments, namely Jacksonville and Atlanta, partially offset by increases in operating expenses primarily due to increase real estate tax assessments and decline in occupancy during Q1 2024.

Same store NOI, excluding early termination fees, experienced a 7.0% increase on a cash basis during the quarter which is consistent with the full year guidance. Same store performance reflects the sequential growth in revenue from our new and renewal leasing in the portfolio supported by improved expense reimbursement as we convert expiring rollover to triple-net lease structures.

G&A for the quarter was slightly lower than anticipated but consistent with Q1 2023 results.

Interest expense during the first quarter reflected the full quarterly net impact of the AIG refinancing using the line of credit and the $100 million of interest rate swaps that were executed. As of March 31, 2024, our only variable rate exposure is the $55.4 million of the $155.4 million outstanding balance on the line of credit that has not been fixed via interest rate swaps.

Discussion of 2024 Guidance and Assumptions

For our FY 2024 outlook (see page 9 of the supplemental), absent the potential impacts from the leasing surrounding the 769,500-square-foot building in St. Louis, we anticipate the quarterly cadence within Core FFO to trend very similar to FY 2023, with Q1 being more muted as a result of weather-related impacts and the timing of professional fees, then ramping up during the second half of the year as the balance of phase 1 developments stabilize, we execute on the reminder of 2024 lease expirations and experience improved flow through on tenant recoveries as a percentage of operating expenses. With 93.7% of our debt fixed (inclusive of interest rate swaps) and only $18.2 million of 2024 debt maturities, we do not anticipate interest rate variability to be notable.

Additionally, similar to what we’ve experienced in the second half of 2023, we expect GAAP rent adjustments to remain subdued (meaning that there are less straight line rent adjustments included within Core FFO to report and therefore to project in guidance or modeling) as market rent adjustments recorded upon prior acquisitions continue to burn off, coupled with a decline in free rent concessions and other lease incentives during recent lease executions and negotiations. This trend also means that NOI on a GAAP basis is now converging with NOI on a cash basis.

We affirmed our full year guidance range for Core FFO that we issued on February 21, 2024, and included the impacts of the aforementioned tenant exercise of its purchase option. The reconciliation of net income attributable to common stockholders and unit holders per share to Core FFO guidance was updated to reflect the gain on sale of real estate associated with the tenant purchase option.

Conclusion

Looking ahead to the balance of the year, we are focused on driving growth through improved portfolio operations in the three areas we mentioned last quarter: SS NOI growth, stabilization of the development program, and improvement in NOI margin.

Thank you for your continued interest and investment in Plymouth.

Jeff Witherell, Chairman and CEO

Forward-Looking Statements

This commentary includes “forward-looking statements” that are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and of Section 21E of the Securities Exchange Act of 1934. The forward-looking statements in this release do not constitute guarantees of future performance. Investors are cautioned that statements in this commentary, which are not strictly historical statements, including, without limitation, statements regarding management's plans, objectives and strategies, constitute forward-looking statements. Such forward-looking statements are subject to a number of known and unknown risks and uncertainties that could cause actual results to differ materially from those anticipated by the forward-looking statement, many of which may be beyond our control, including, without limitation, those factors described under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Any forward-looking information presented herein is made only as of the date of this commentary, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.