FIRST QUARTER 2024

Plymouth REIT

Supplemental

Information

|

FIRST QUARTER 2024 Plymouth REIT

|

1Q 2024 Supplemental | 1

Table of Contents

| Table of Contents | |

| Executive Summary | 4 |

| Company Overview, Management, Board of Directors, and Investor Relations | 4 |

| Portfolio Snapshot | 5 |

| Total Acquisition and Replacement Cost by Market | 5 |

| Acquisition Activity | 6 |

| Development Projects | 7 |

| Value Creation Examples | 8 |

| Guidance | 9 |

| Financial Information | |

| Consolidated Balance Sheets | 11 |

| Consolidated Statements of Operations | 12 |

| Non-GAAP Measurements | 13 |

| Same Store Net Operating Income (NOI) | 14 |

| Debt Summary | 15 |

| Capitalization and Capital Markets Activity | 16 |

| Net Asset Value Components | 17 |

| Rentable Square Feet and Annualized Base Rent by Market | 18 |

| Operational & Portfolio Information | |

| Leasing Activity: Lease Renewals and New Leases | 20 |

| Leasing Activity: Lease Expiration Schedule & % of Annual Base Rent Expiring | 21 |

| Leased Square Feet and Annualized Base Rent by Tenant Industry | 22 |

| Leased Square Feet and Annualized Base Rent by Type | 23 |

| Top 10 Tenants by Annualized Base Rent | 24 |

| Lease Segmentation by Size | 25 |

| Capital Expenditures | 26 |

| Appendix | |

| Glossary | 28 |

1Q 2024 Supplemental | 2

Disclaimers

Forward-Looking Statements

This Supplemental Information contains forward-looking statements that are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 and of Section 21E of the Securities Exchange Act of 1934. The forward-looking statements in this Supplemental Information do not constitute guarantees of future performance. Investors are cautioned that statements in this Supplemental Information, which are not strictly historical statements, including, without limitation, statements regarding management's plans, objectives and strategies, constitute forward-looking statements. Such forward-looking statements are subject to a number of known and unknown risks and uncertainties that could cause actual results to differ materially from those anticipated by the forward-looking statement, many of which may be beyond our control, including, without limitation, those factors described under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Any forward-looking information presented herein is made only as of the date of this Supplemental Information, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

Definitions and Reconciliations

For definitions of certain terms used throughout this Supplemental Information, including certain non-GAAP financial measures, refer to the Glossary on pages 28-30. For reconciliations of the non-GAAP financial measures to the most directly comparable U.S. GAAP measures, refer to page 13.

1Q 2024 Supplemental | 3

Executive Summary

Company Overview

Plymouth Industrial REIT, Inc. (NYSE: PLYM) is a full service, vertically integrated real estate investment company focused on the acquisition, ownership, and management of single and multi-tenant industrial properties. Our mission is to provide tenants with cost effective space that is functional, flexible and safe.

Management, Board of Directors, Investor Relations, and Equity RESEARCH Coverage

|

Corporate 20 Custom House Street Boston, Massachusetts 02110 617.340.3814 www.plymouthreit.com Investor Relations Tripp Sullivan SCR Partners IR@plymouthreit.com Continental Stock Transfer 1 State Street, 30th Floor New York, NY 10004 212.509.4000

|

Executive Management Jeffrey E. Witherell Chief Executive Officer Anthony J. Saladino Executive Vice President and Chief Financial Officer James M. Connolly Executive Vice President Asset Management Lyndon J. Blakesley Senior Vice President and Chief Accounting Officer

|

Benjamin P. Coues Senior Vice President and Head of Acquisitions Anne A. Hayward, ESQ. Senior Vice President and General Counsel Daniel R. Heffernan Senior Vice President Asset Management Scott L. Robinson Senior Vice President Corporate Development

|

Board of Directors Phillip S. Cottone Independent Director Richard DeAgazio Independent Director David G. Gaw Lead Independent Director John W. Guinee Independent Director

|

Caitlin Murphy Independent Director Pendleton P. White, Jr. Director Jeffrey E. Witherell Chief Executive Officer

|

Equity Research Coverage1 Baird Nicholas Thillman 414.298.5053 Barclays Brendan Lynch 212.526.9428 BMO Capital Markets John Kim 212.885.4115 BNP Paribas Exane Nate Crossett 646.725.3716 B Riley Securities Bryan Maher 646.885.5423

|

Colliers Securities Barry Oxford 203.961.6573 JMP Securities Mitch Germain 212.906.3537 J.P. Morgan Mike Mueller 212.622.6689 KeyBanc Capital Markets Todd Thomas 917.368.2375 Truist Securities Anthony Hau 212.303.4176

|

Investor Conference Call and Webcast

The Company will host a conference call and live audio webcast, both open for the general public to hear, on May 2, 2024 at 9:00 a.m. Eastern Time. The number to call for this interactive teleconference is (844) 784-1727 (international callers: (412) 717-9587). A replay of the call will be available through May 9, 2024 by dialing (877) 344-7529 and entering the replay access code, 6841649.

1 The analysts listed provide research coverage on the Company. Any opinions, estimates or forecasts regarding the Company's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts by the Company or its management. The Company does not by reference above imply its endorsement of or concurrence with such information, conclusions or recommendations.

1Q 2024 Supplemental | 4

Highlights

For Three Months Ended March 31, 2024

Portfolio Snapshot

| Number of Properties | 156 | |

| Number of Buildings | 211 | |

| Square Footage | 34,025,101 | |

| Portfolio Occupancy | 96.9% | |

| Same-Store Occupancy | 98.3% | |

| WA Lease Term Remaining (yrs.)1 |

3.2 | |

| Multi-Tenant as % of ABR |

54.3% | |

| Single Tenant as % of ABR |

45.7% | |

| WA Annual Rent Escalators | ~3.0% | |

| Triple Net Leases as % of ABR |

80.5% | |

| Net Debt to Annualized Adjusted EBITDA | 6.7x | |

| 1 The average contractual lease term remaining as of the close of the reporting period (in years) weighted by square footage. | ||

Total Acquisition and Replacement Cost by Market

($ in Thousands)

| Market | State | # of Buildings |

Rentable Square Feet | Total Acquisition Cost1 |

Replacement Cost2 | ||

| Atlanta | GA | 13 | 2,086,835 | $ | 111,988 | $ | 154,583 |

| Chicago | IL, IN, WI | 40 | 6,624,335 | 279,750 | 710,499 | ||

| Boston | ME | 2 | 268,713 | 19,023 | 40,729 | ||

| Charlotte | NC | 1 | 155,220 | 20,400 | 20,821 | ||

| Cincinnati | OH, KY | 12 | 2,710,964 | 106,705 | 190,851 | ||

| Cleveland | OH | 19 | 3,979,209 | 201,550 | 362,436 | ||

| Columbus | OH | 15 | 3,757,614 | 157,624 | 293,943 | ||

| Indianapolis | IN | 17 | 4,085,169 | 149,251 | 356,416 | ||

| Jacksonville | FL, GA | 28 | 2,132,396 | 159,621 | 219,679 | ||

| Kansas City | MO | 1 | 221,911 | 8,600 | 20,451 | ||

| Memphis | MS, TN | 49 | 4,783,046 | 185,407 | 349,852 | ||

| St. Louis | IL, MO | 14 | 3,219,689 | 213,787 | 325,818 | ||

| Total | 12 | 211 | 34,025,101 ’ | $ | 1,613,706 | $ | 3,046,078 |

| 1 | Represents total direct consideration paid prior to the allocations per U.S. GAAP and the allocated costs in accordance to GAAP of development properties placed in-service. |

| 2 | Replacement cost is based on the Marshall & Swift valuation methodology for the determination of building costs. Replacement cost includes land reflected at the allocated cost in accordance with GAAP. |

1Q 2024 Supplemental | 5

Acquisition Activity

As of March 31, 2024

Acquisitions ($ in Thousands)

| Location | Acquisition Date | # of Buildings |

Purchase Price1 | Square Footage | Projected Initial Yield2 |

Cost per Square Foot3 | |

| Multiple | Full Year 2022 | 44 | $ | 253,655 | 4,164,864 | 6.1% | $71.54 |

| Multiple | Full Year 2021 | 24 | $ | 370,977 | 6,380,302 | 6.7% | $63.15 |

| Multiple | Full Year 2020 | 27 | $ | 243,568 | 5,473,596 | 7.8% | $46.99 |

| Multiple | Full Year 2019 | 32 | $ | 220,115 | 5,776,928 | 8.4% | $42.21 |

| Multiple | Full Year 2018 | 24 | $ | 164,575 | 2,903,699 | 8.2% | $70.54 |

| Multiple | 2017 (since IPO) | 36 | $ | 173,325 | 5,195,563 | 8.4% | $33.81 |

| Total Acquisitions Post-IPO | 187 | $ | 1,426,215 | 29,894,952 | 7.4% | $55.94 | |

Note: Portfolio statistics and acquisitions include wholly owned industrial properties only; excludes our property management office located in Columbus, Ohio.

| 1 | Represents total direct consideration paid rather than GAAP cost basis. |

| 2 | Weighted based on Purchase Price. |

| 3 | Calculated as Purchase Price divided by square footage. |

1Q 2024 Supplemental | 6

Development Projects

As of March 31, 2024

The total investment in completed developments is approximately $61.1 million. The proforma stabilized cash NOI yields on development projects under construction and completed range between 7.0% - 9.0%. Plymouth is partnering with the Green Building Initiative to align our environmental objectives with the execution of all new development and portfolio enhancement activities. Thus far, Plymouth has achieved a Three Green Globe certification on our Cincinnati development and a Two Green Globe certification on our completed developments in Boston, Jacksonville (2) and Atlanta (2) 1. |

| Under Construction1 | # of Buildings |

Total Rentable Square Feet (RSF) |

% Leased |

Investment ($ in millions) |

% Funded | Estimated Completion | |

| Jacksonville - Liberty II | 1 | 52,920 | 100% | $ | 4.0 | 54% | Q4 2024 |

| Total | 1 | 52,920 | $ | 4.0 | |||

| Completed 2 | # of Buildings |

Total Rentable Square Feet (RSF) |

% Leased |

Investment ($ in millions) |

% Funded | Completed | |

| Boston - Milliken Road | 1 | 68,088 | 100% | $ | 9.3 | 100% | Q4 2022 |

| Atlanta - New Calhoun I | 1 | 236,600 | 100% | $ | 13.8 | 100% | Q1 2023 |

| Cincinnati - Fisher Park I | 1 | 154,692 | 66% | $ | 14.0 | 100% | Q1 2023 |

| Atlanta - New Calhoun II | 1 | 180,000 | 100% | $ | 12.1 | 100% | Q3 2023 |

| Jacksonville – Salisbury | 1 | 40,572 | 100% | $ | 6.2 | 100% | Q3 2023 |

| Jacksonville – Liberty I | 1 | 39,750 | 100% | $ | 5.7 | 100% | Q4 2023 |

| Total | 6 | 719,702 | 93% | $ | 61.1 | 100% | |

| 1 | The Company is a member organization of the Green Building Initiative (GBI), a nonprofit organization and American National Standards Institute (ANSI) Accredited Standards Developer dedicated to reducing climate impacts by improving the built environment. Founded in 2004, the organization is the global provider of the Green Globes and federal Guiding Principles Compliance certification and assessment programs. |

| 2 | Under construction represents projects for which vertical construction has commenced. Refer to the Developable Land section of the Net Asset Components on page 17 of this Supplemental Information for additional details on the Company's development activities. |

| 3 | Completed buildings are included within portfolio occupancy and square footage metrics as of March 31, 2024. |

1Q 2024 Supplemental | 7

Value Creation Examples

| INDIANAPOLIS: Lease-up / Building Refurbishment | JACKSONVILLE: New Industrial Development | CHICAGO: Disposition / Value Realized | ||

|

|

| ||

|

Expanded existing tenant in the building by an additional 42,910 square feet and extended term for 15 years at a rental rate increase of 18% over expiring rents. Expanded other existing tenant by an additional 147,310 square feet for 4 years without any downtime. The property was acquired at a going-in yield of 6.9%. Stabilized yield is now 8.0% with annual lease escalations averaging 3.75%. |

Delivered two buildings in 2023 totaling 80,322 square feet, both of which are fully leased. Commenced construction on a third, 100% pre-leased building at Liberty Business Park which will comprise 52,920 square feet. The anticipated delivery is Q4 2024. Marketing an additional fully designed and permit-ready site at Liberty Business Park that can provide 41,958 square feet. |

Sold a 306,552 square-foot industrial building at 6510 West 73rd Street in Chicago. Net proceeds after the payoff of a $6.7 million mortgage, return of lender escrow reserves, and other adjustments were $14.0 million. The disposition yielded a 4.9% cap rate on in-place NOI and an IRR of 31.1% over a six-year hold period. |

1Q 2024 Supplemental | 8

Guidance

As of March 31, 2024

Unaudited (in thousands, except per-share amounts)

PLYM affirmed its full year 2024 guidance range for Core FFO per weighted average common share and units previously issued on February 21, 2024, and updated its range for net income per weighted average common share and units and accompanying assumptions.

| Full Year 2024 Range1 | |||

| Low | High | ||

| Core FFO attributable to common stockholders and unit holders per share | $1.88 | $1.92 | |

| Same Store Portfolio NOI growth - cash basis2 | 7.00% | 7.50% | |

| Average Same Store Portfolio occupancy - full year | 97.5% | 98.5% | |

| General and administrative expenses3 | $15,650 | $15,150 | |

| Interest expense, net | $37,650 | $37,150 | |

| Weighted average common shares and units outstanding4 | 45,880 | 45,880 | |

| Reconciliation of net loss attributable to common stockholders and unit holders per share to Core FFO guidance: | |||

| Full Year 2024 Range1 | |||

| Low | High | ||

| Net income/(loss) | $ 0.08 | $ 0.12 | |

| Gain on sale of real estate | (0.18) | (0.18) | |

| Depreciation and amortization | 1.98 | 1.98 | |

| $1.88 | $1.92 | ||

| 1 | Our 2024 guidance refers to the Company's in-place portfolio as of April 29, 2024, the $21.5 million disposition scheduled to close in August 2024 and does not include the impact from prospective acquisitions, dispositions, or capitalization activities. |

| 2 | The Same Store Portfolio consists of 200 buildings aggregating 31,245,756 rentable square feet, representing approximately 92% of total in-place portfolio square footage. The Same Store projected performance reflects an annual NOI on a cash basis, excluding termination income. |

| 3 | Includes non-cash stock compensation of $4.3 million for 2024. |

| 4 | As of April 29, 2024, the Company has 45,872,375 common shares and units outstanding. |

1Q 2024 Supplemental | 9

|

Financial

|

1Q 2024 Supplemental | 10

Consolidated Balance Sheets

Unaudited ($ in thousands)

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | ||||||

| ASSETS | ||||||||||

| Real estate properties: | ||||||||||

| Land | $ | 224,532 | $ | 226,020 | $ | 227,599 | $ | 231,829 | $ | 231,829 |

| Building and improvements | 1,326,722 | 1,341,846 | 1,343,025 | 1,339,505 | 1,331,664 | |||||

| Net investment in sales-type lease1 | 21,459 | - | - | - | - | |||||

| Less accumulated depreciation | (277,253) | (268,046) | (254,402) | (239,306) | (222,418) | |||||

| Total real estate properties, net | $ | 1,295,460 | $ | 1,299,820 | $ | 1,316,222 | $ | 1,332,028 | $ | 1,341,075 |

| Cash, cash held in escrow and restricted cash | 27,237 | 26,204 | 30,272 | 38,517 | 38,432 | |||||

| Deferred lease intangibles, net | 46,396 | 51,474 | 56,316 | 60,304 | 66,109 | |||||

| Interest rate swaps2 | 26,382 | 21,667 | 34,115 | 31,180 | 23,045 | |||||

| Other assets | 39,670 | 42,734 | 39,585 | 38,631 | 37,798 | |||||

| Total assets | $ | 1,435,145 | $ | 1,441,899 | $ | 1,476,510 | $ | 1,500,660 | $ | 1,506,459 |

| LIABILITIES, PREFERRED STOCK AND EQUITY | ||||||||||

| Secured debt, net | $ | 265,619 | $ | 266,887 | $ | 377,714 | $ | 386,191 | $ | 387,942 |

| Unsecured debt, net3 | 603,558 | 603,390 | 512,823 | 535,155 | 534,994 | |||||

| Interest rate swaps2 | 189 | 1,161 | - | - | - | |||||

| Accounts payable, accrued expenses and other liabilities | 68,049 | 73,904 | 75,112 | 70,492 | 70,739 | |||||

| Deferred lease intangibles, net | 5,590 | 6,044 | 6,604 | 7,179 | 8,014 | |||||

| Financing lease liability4 | 2,278 | 2,271 | 2,265 | 2,260 | 2,254 | |||||

| Total liabilities | $ | 945,283 | $ | 953,657 | $ | 974,518 | $ | 1,001,277 | $ | 1,003,943 |

| Preferred stock - Series A | $ | - | $ | - | $ | - | $ | 46,803 | $ | 46,803 |

| Equity: | ||||||||||

| Common stock | $ | 453 | $ | 452 | $ | 452 | $ | 431 | $ | 430 |

| Additional paid in capital | 634,651 | 644,938 | 654,346 | 616,414 | 624,942 | |||||

| Accumulated deficit | (176,388) | (182,606) | (191,882) | (200,147) | (197,543) | |||||

| Accumulated other comprehensive income | 25,859 | 20,233 | 33,695 | 30,792 | 22,750 | |||||

| Total stockholders' equity | 484,575 | 483,017 | 496,611 | 447,490 | 450,579 | |||||

| Non-controlling interest | 5,287 | 5,225 | 5,381 | 5,090 | 5,134 | |||||

| Total equity | $ | 489,862 | $ | 488,242 | $ | 501,992 | $ | 452,580 | $ | 455,713 |

| Total liabilities, preferred stock and equity | $ | 1,435,145 | $ | 1,441,899 | $ | 1,476,510 | $ | 1,500,660 | $ | 1,506,459 |

| 1 | During the three months ended March 31, 2024, the tenant occupying a single tenant industrial property located in Columbus, Ohio, provided notice of its intention to exercise its option to purchase the property at a fixed price of $21,480. We believe the exercise of the purchase option is reasonably probable and therefore, in accordance with ASC 842, Leases, there is a lease modification. As a result, we reclassified the respective real estate property to net investment in sales-type lease totaling $21,480 on our condensed consolidated balance sheets, effective as of the date of tenant notice, in the following amounts: (i) $19,605 from Real estate properties, (ii) $8,094 from Accumulated depreciation, (iii) $877 from net Deferred lease intangible assets, and (iv) $1,062 from Other assets. Further, we recognized a Gain on sale of real estate of $8,030 during the three months ended March 31, 2024 related to this transaction. |

| 2 | Represents the fair value of the Company's interest rate swaps. We minimize the credit risk in our derivative financial instruments by entering into transactions with various high-quality counterparties. Our exposure to credit risk at any point is generally limited to amounts recorded as assets on the accompanying consolidated balance sheets. A summary of the Company's interest rate swaps and accounting are detailed in Note 6 of our most recent Quarterly Report on Form 10-Q for expanded disclosure. |

| 3 | Includes borrowings under line of credit and term loans. Refer to Debt Summary in this Supplemental Information for additional details. |

| 4 | As of March 31, 2024, we have a single finance lease in which we are the sublessee for a ground lease with a remaining lease term of approximately 32 years. Refer to our most recent Quarterly Report on Form 10-Q for expanded disclosure. |

1Q 2024 Supplemental | 11

Consolidated Statements of Operations

Unaudited ($ in thousands, except per-share amounts)

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | ||||||

| Revenues: | ||||||||||

| Rental revenue | $ | 37,331 | $ | 38,642 | $ | 37,416 | $ | 37,814 | $ | 37,586 |

| Tenant recoveries | 12,859 | 12,112 | 12,320 | 12,085 | 11,785 | |||||

| Management fee revenue and other income | 38 | 30 | 29 | - | 29 | |||||

| Total revenues | $ | 50,228 | $ | 50,784 | $ | 49,765 | $ | 49,899 | $ | 49,400 |

| Operating expenses: | ||||||||||

| Property | 16,642 | 15,144 | 15,754 | 15,690 | 15,954 | |||||

| Depreciation and amortization | 22,368 | 22,793 | 22,881 | 23,417 | 23,800 | |||||

| General and administrative | 3,364 | 4,318 | 3,297 | 3,842 | 3,447 | |||||

| Total operating expenses | $ | 42,374 | $ | 42,255 | $ | 41,932 | $ | 42,949 | $ | 43,201 |

| Other income (expense): | ||||||||||

| Interest expense | (9,598) | (9,686) | (9,473) | (9,584) | (9,535) | |||||

| Loss on extinguishment of debt | - | - | (72) | - | - | |||||

| Gain on sale of real estate1 | 8,030 | 10,534 | 12,112 | - | - | |||||

| Total other income (expense) | $ | (1,568) | $ | 848 | $ | 2,567 | $ | (9,584) | $ | (9,535) |

| Net income (loss) | $ | 6,286 | $ | 9,377 | $ | 10,400 | $ | (2,634) | $ | (3,336) |

| Less: Net income (loss) attributable to non-controlling interest | 68 | 101 | 114 | (30) | (38) | |||||

| Net income (loss) attributable to Plymouth Industrial REIT, Inc. | $ | 6,218 | $ | 9,276 | $ | 10,286 | $ | (2,604) | $ | (3,298) |

| Less: Preferred Stock dividends | - | - | 677 | 916 | 916 | |||||

| Less: Loss on extinguishment/redemption of Series A Preferred Stock | - | - | 2,021 | - | 2 | |||||

| Less: Amount allocated to participating securities | 94 | 84 | 83 | 82 | 88 | |||||

| Net income (loss) attributable to common stockholders | $ | 6,124 | $ | 9,192 | $ | 7,505 | $ | (3,602) | $ | (4,304) |

| Net income (loss) per share attributable to common stockholders – basic2 | $ | 0.14 | $ | 0.20 | $ | 0.17 | $ | (0.08) | $ | (0.10) |

| Net income (loss) per share attributable to common stockholders – diluted2 | $ | 0.14 | $ | 0.20 | $ | 0.17 | $ | (0.08) | $ | (0.10) |

| Weighted-average common shares outstanding - basic | 44,937 | 44,879 | 44,057 | 42,647 | 42,605 | |||||

| Weighted-average common shares outstanding - diluted | 44,971 | 44,992 | 44,140 | 42,647 | 42,605 | |||||

| 1 | During the three months ended March 31, 2024, the tenant occupying an industrial property located in Columbus, Ohio, provided notice of its intention to exercise its option to purchase the property. We re-evaluated the lease classification of the lease in accordance to ASC 842, Leases, concluding that the lease had transitioned to a sales-type lease, thereby recognizing a $8 million gain on sale of real estate during Q1 2024. The sale is expected to close in Q3 2024. |

| 2 | Refer to the Q1 2024 Quarterly Report on Form 10-Q for additional information. |

1Q 2024 Supplemental | 12

Non-GAAP Measurements

Unaudited ($ in thousands, except per-share amounts)

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | ||||||

| Consolidated NOI | ||||||||||

| Net income (loss) | $ | 6,286 | $ | 9,377 | $ | 10,400 | $ | (2,634) | $ | (3,336) |

| General and administrative | 3,364 | 4,318 | 3,297 | 3,842 | 3,447 | |||||

| Depreciation and amortization | 22,368 | 22,793 | 22,881 | 23,417 | 23,800 | |||||

| Interest expense | 9,598 | 9,686 | 9,473 | 9,584 | 9,535 | |||||

| Loss on extinguishment of debt | - | - | 72 | - | - | |||||

| Gain on sale of real estate1 | (8,030) | (10,534) | (12,112) | - | - | |||||

| Management fee revenue and other income | (38) | (30) | (29) | - | (29) | |||||

| Net Operating Income | $ | 33,548 | $ | 35,610 | $ | 33,982 | $ | 34,209 | $ | 33,417 |

| Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) | ||||||||||

| Net income (loss) | $ | 6,286 | $ | 9,377 | $ | 10,400 | $ | (2,634) | $ | (3,336) |

| Depreciation and amortization | 22,368 | 22,793 | 22,881 | 23,417 | 23,800 | |||||

| Interest expense | 9,598 | 9,686 | 9,473 | 9,584 | 9,535 | |||||

| Loss on extinguishment of debt | - | - | 72 | - | - | |||||

| Gain on sale of real estate | (8,030) | (10,534) | (12,112) | - | - | |||||

| EBITDAre | $ | 30,222 | $ | 31,322 | $ | 30,714 | $ | 30,367 | $ | 29,999 |

| Stock compensation | 914 | 838 | 827 | 716 | 585 | |||||

| Acquisition expenses | - | - | - | 4 | 81 | |||||

| Pro forma effect of acquisitions/developments2 | 216 | 432 | 542 | 308 | 453 | |||||

| Adjusted EBITDA | $ | 31,352 | $ | 32,592 | $ | 32,083 | $ | 31,395 | $ | 31,118 |

| Funds from Operations (FFO), Core FFO & Adjusted Funds from Operations (AFFO) | ||||||||||

| Net income (loss) | $ | 6,286 | $ | 9,377 | $ | 10,400 | $ | (2,634) | $ | (3,336) |

| Gain on sale of real estate1 | (8,030) | (10,534) | (12,112) | - | - | |||||

| Depreciation and amortization | 22,368 | 22,793 | 22,881 | 23,417 | 23,800 | |||||

| FFO | $ | 20,624 | $ | 21,636 | $ | 21,169 | $ | 20,783 | $ | 20,464 |

| Preferred stock dividends | - | - | (677) | (916) | (916) | |||||

| Acquisition expenses | - | - | - | 4 | 81 | |||||

| Loss on extinguishment of debt | - | - | 72 | - | - | |||||

| Core FFO | $ | 20,624 | $ | 21,636 | $ | 20,564 | $ | 19,871 | $ | 19,629 |

| Amortization of debt related costs | 438 | 476 | 570 | 570 | 568 | |||||

| Non-cash interest expense | (102) | 582 | (50) | 158 | 294 | |||||

| Stock compensation | 914 | 838 | 827 | 716 | 585 | |||||

| Capitalized interest | (75) | (134) | (282) | (351) | (335) | |||||

| Straight line rent | (15) | (111) | (216) | (705) | (912) | |||||

| Above/below market lease rents | (318) | (401) | (417) | (669) | (734) | |||||

| Recurring capital expenditures3 | (994) | (880) | (1,965) | (1,092) | (1,806) | |||||

| AFFO | $ | 20,472 | $ | 22,006 | $ | 19,031 | $ | 18,498 | $ | 17,289 |

| Weighted-average common shares and units outstanding4 | 45,809 | 45,740 | 44,922 | 43,526 | 43,432 | |||||

| Core FFO attributable to common stockholders and unit holders per share | $ | 0.45 | $ | 0.47 | $ | 0.46 | $ | 0.46 | $ | 0.45 |

| AFFO attributable to common stockholders and unit holders per share | $ | 0.45 | $ | 0.48 | $ | 0.42 | $ | 0.42 | $ | 0.40 |

| 1 | During the three months ended March 31, 2024, the tenant occupying an industrial property located in Columbus, Ohio, provided notice of its intention to exercise its option to purchase the property. We re-evaluated the lease classification of the lease in accordance to ASC 842, Leases, concluding that the lease had transitioned to a sales-type lease, thereby recognizing a $8 million gain on sale of real estate during Q1 2024. The sale is expected to close in Q3 2024. |

| 2 | Represents the estimated impact of wholly owned acquisitions and development properties as if they had been acquired or stabilized on the first day of each respective quarter in which the acquisitions occurred or developments were placed in-service. We have made a number of assumptions in such estimates and there can be no assurance that we would have generated the projected levels of EBITDA had we owned the acquired properties and/or placed the development properties in-service as of the beginning of the respective periods. |

| 3 | Excludes non-recurring capital expenditures of $3,000 and $8,413 for the three months ended March 31, 2024 and 2023, respectively. |

| 4 | Weighted-average common shares and units outstanding includes common stock, OP units, and restricted stock units as of March 31, 2024 and excludes 51,410 performance stock units as they are deemed to be non-participatory. |

1Q 2024 Supplemental | 13

Same Store Net Operating Income (NOI)

Unaudited ($ and SF in thousands)

| Same Store Portfolio Statistics | |||||||||||

| Square footage | 31,246 |

Includes: wholly owned properties as of December 31, 2022; determined and set once per year for the following twelve months (refer to Glossary for Same Store definition) Excludes: wholly owned properties classified as repositioning, lease-up during 2023 or 2024 (6 buildings representing approximately 1,755,000 of rentable square feet), placed into service 2023 and 2024, and under contract for sale. | |||||||||

| Number of properties | 146 | ||||||||||

| Number of buildings | 200 | ||||||||||

| Percentage of total portfolio square footage | 91.8% | ||||||||||

| Occupancy at period end | 98.3% | ||||||||||

| Same Store NOI - GAAP Basis | |||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||||

| Same Store NOI - GAAP Basis | |||||||||||

| Rental revenue | $ | 46,930 | $ | 46,072 | $ | 45,609 | $ | 45,715 | $ | 45,342 | |

| Property expenses | 15,213 | 13,296 | 14,343 | 14,392 | 14,371 | ||||||

| Same Store NOI - GAAP Basis | $ | 31,717 | $ | 32,776 | $ | 31,266 | $ | 31,323 | $ | 30,971 | |

| Early termination revenue | 23 | 6 | 75 | 124 | 160 | ||||||

| Same Store NOI - GAAP Basis excluding early termination revenue | $ | 31,694 | $ | 32,770 | $ | 31,191 | $ | 31,199 | $ | 30,811 | |

| Same Store NOI - Cash Basis | |||||||||||

| Same Store Adjustments: | |||||||||||

| Straight line rent and above (below) market lease | 136 | 411 | 550 | 1,184 | 1,314 | ||||||

| Same Store NOI - Cash Basis | $ | 31,581 | $ | 32,365 | $ | 30,716 | $ | 30,139 | $ | 29,657 | |

| Early termination revenue | 23 | 6 | 75 | 124 | 160 | ||||||

| Same Store NOI - Cash Basis excluding early termination revenue | $ | 31,558 | $ | 32,359 | $ | 30,641 | $ | 30,015 | $ | 29,497 | |

| Same store occupancy at period end | 98.3% | 98.1% | 97.7% | 98.2% | 98.3% | ||||||

| Percentage of total portfolio square footage | 91.8% | 91.8% | 91.5% | 91.3% | 91.3% | ||||||

| Same Store NOI - GAAP Basis percent change1 | 2.9% | ||||||||||

| Same Store NOI - Cash Basis percent change1 | 7.0% | ||||||||||

| 1 | Represents the year-over-year change between the three months ended March 31, 2024 and three months ended March 31, 2023. |

1Q 2024 Supplemental | 14

Debt Summary

As of March 31, 2024

Unaudited ($ in thousands, except per-share amounts)

| Maturity Date | Interest Rate | Commitment | Principal Balance | |

| Unsecured Debt: | ||||

| KeyBank Line of Credit | August-25 | 6.51%1,2 | $ 350,000 | $ 155,400 |

| $100m KeyBank Term Loan | August-26 | 3.00%1,2 | 100,000 | 100,000 |

| $200m KeyBank Term Loan | February-27 | 3.03%1,2 | 200,000 | 200,000 |

| $150m KeyBank Term Loan | May-27 | 4.40%1,2 | 150,000 | 150,000 |

| Total / Weighted Average Unsecured Debt | 4.26% ` | $ 800,000 | $ 605,400 | |

| Maturity Date | Interest Rate | # of Buildings | Principal Balance | |

| Secured Debt: | ||||

| Ohio National Life Mortgage3 | August-24 | 4.14% | 6 | $ 18,245 |

| Allianz Loan | April-26 | 4.07% | 22 | 60,971 |

| Nationwide Loan | October-27 | 2.97% | 2 | 14,870 |

| Lincoln Life Gateway Mortgage3 | January-28 | 3.43% | 2 | 28,800 |

| Minnesota Life Memphis Industrial Loan3 | January-28 | 3.15% | 28 | 54,666 |

| Midland National Life Insurance Mortgage3 | March-28 | 3.50% | 1 | 10,612 |

| Minnesota Life Loan | May-28 | 3.78% | 7 | 19,454 |

| Transamerica Loan | August-28 | 4.35% | 15 | 59,041 |

| Total / Weighted Average Secured Debt | 3.77% | 83 | $ 266,659 | |

| Total / Weighted Average Debt | 4.11% | $ 872,059 |

| 1 | For the month of March 2024, the one-month term SOFR for our unsecured debt was 5.323% and the one-month term SOFR for our borrowings under line of credit was at a weighted average of 5.327%. The spread over the applicable rate for the $100m, $150m, and $200m KeyBank Term Loans and KeyBank unsecured line of credit is based on the Company’s total leverage ratio plus the 0.1% SOFR index adjustment. |

| 2 | The one-month term SOFR for the $100m, $150m and $200m KeyBank Term Loans was swapped to a fixed rate of 1.504%, 2.904%, and 1.527%, respectively. The $100 million of the outstanding borrowings under the KeyBank unsecured line of credit was swapped to a fixed USD-SOFR rate at a weighted average of 4.754%. |

| 3 | Debt assumed at acquisition. |

1Q 2024 Supplemental | 15

Capitalization

As of March 31, 2024

Unaudited ($ in thousands, except per-share amounts)

| Net Debt: | March 31,2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | |||||

| Total Debt1 | $ | 872,059 | $ | 873,364 | $ | 893,877 | $ | 925,033 | $ | 926,959 |

| Less: Cash | 27,237 | 26,204 | 30,272 | 38,517 | 38,432 | |||||

| Net Debt | $ | 844,822 | $ | 847,160 | $ | 863,605 | $ | 886,516 | $ | 888,527 |

| Common Shares and Units Outstanding2 | 45,872 | 45,740 | 45,740 | 43,591 | 43,521 | |||||

| Closing Price (as of period end) | $ | 22.50 | $ | 24.07 | $ | 20.95 | $ | 23.02 | $ | 21.01 |

| Market Value of Common Shares3 | $ | 1,032,120 | $ | 1,100,962 | $ | 958,253 | $ | 1,003,465 | $ | 914,376 |

| Preferred Stock - Series A (at liquidation preference)4 | - | - | - | 48,845 | 48,845 | |||||

| Total Market Capitalization3,5 | $ | 1,904,179 | $ | 1,974,326 | $ | 1,852,130 | $ | 1,977,343 | $ | 1,890,180 |

| Dividend / Share (annualized) | $ | 0.96 | $ | 0.90 | $ | 0.90 | $ | 0.90 | $ | 0.90 |

| Dividend Yield (annualized) | 4.3% | 3.7% | 4.3% | 3.9% | 4.3% | |||||

| Total Debt-to-Total Market Capitalization | 45.8% | 44.2% | 48.3% | 46.8% | 49.0% | |||||

| Secured Debt as a % of Total Debt | 30.6% | 30.7% | 42.4% | 41.9% | 42.0% | |||||

| Unsecured Debt as a % of Total Debt | 69.4% | 69.3% | 57.6% | 58.1% | 58.0% | |||||

| Net Debt-to-Annualized Adjusted EBITDA (quarter annualized) | 6.7x | 6.5x | 6.7x | 7.1x | 7.1x | |||||

| Net Debt plus Preferred-to-Annualized Adjusted EBITDA (quarter annualized) | 6.7x | 6.5x | 6.7x | 7.4x | 7.5x | |||||

| Weighted Average Maturity of Total Debt (years) | 2.7 | 3.0 | 3.0 | 3.2 | 3.4 | |||||

| Capital Markets Activity | ||||

| Common Shares | Avg. Price | Offering | Period | Net Proceeds |

| - | $ - | N/A | Q1 2024 | $ - |

| 1 | Total Debt is not adjusted for the amortization of debt issuance costs or fair market premiums or discounts. |

| 2 | Common shares and units outstanding include 490 units outstanding at the end of each of the quarters presented. |

| 3 | Based on closing price as of last trading day of the quarter and common shares and units as of the period ended. |

| 4 | On September 6, 2023 ("Redemption Date"), the Company redeemed all outstanding Series A Preferred Stock in cash at a redemption price equal to $25.00 per share. As of the Redemption Date and through March 31, 2024, the shares of Series A Preferred Stock were no longer outstanding. |

| 5 | Market value of shares and units plus total debt and preferred stock as of period end. |

1Q 2024 Supplemental | 16

Net Asset Value Components

As of March 31, 2024

Unaudited ($ in thousands)

| Net Operating Income | ||

| Three Months Ended March 31, 2024 | ||

| Pro Forma Net Operating Income (NOI) | ||

| Total Operating NOI | $ | 33,548 |

| Pro Forma Effect of New Lease Activity1 | 690 | |

| Pro Forma Effect of Acquisitions2 | - | |

| Pro Forma Effect of Repositioning / Development3 | 1,586 | |

| Pro Forma NOI | $ | 35,824 |

| Amortization of above / below market lease intangibles, net | (318) | |

| Straight-line rental revenue adjustment | (15) | |

| Pro Forma Cash NOI | $ | 35,491 |

| Developable Land | |||||

| Market | Owned Land (acres)4 |

Developable GLA (SF)4 |

Under Construction (SF)5 |

Est. Investment / Est. Completion |

Under Development (SF)5 |

| Atlanta | 9 | 200,000 | |||

| Chicago | 11 | 220,000 | |||

| Cincinnati | 18 | 285,308 | 285,308 | ||

| Jacksonville | 12 | 95,587 | 52,920 | $7.4M/Q4-’24 | 42,667 |

| Memphis | 23 | 475,000 | |||

| St. Louis | 31 | 300,000 | |||

| Charlotte | 6 | 100,000 | |||

| 110 | 1,675,895 | 52,920 | 327,975 | ||

| Other Assets and Liabilities | ||

| Three Months Ended March 31, 2024 | ||

| Cash, cash held in escrow and restricted cash | $ | 27,237 |

| Other assets | $ | 39,670 |

| CIP | $ | 7,630 |

| Accounts payable, accrued expenses and other liabilities | $ | 68,049 |

| Debt and Common Stock | ||

| Three Months Ended March 31, 2024 | ||

| Secured Debt | $ | 266,659 |

| Unsecured Debt | $ | 605,400 |

| Common shares and units outstanding6 | 45,872 | |

Note: We have made a number of assumptions with respect to the pro forma effects and there can be no assurance that we would have generated the projected levels of NOI had we actually owned the acquired properties and / or fully stabilized the repositioning / development properties as of the beginning of the period. Refer to Glossary in this Supplemental Information for a definition and discussion of non-GAAP financial measures.

| 1 | Represents the estimated incremental base rents from uncommenced new leases as if rent commencement had occurred as of the beginning of the period. |

| 2 | Represents the estimated impact of acquisitions as if they had been acquired at the beginning of the period. |

| 3 | Represents the estimated impact of properties that are undergoing repositioning or lease-up and development properties placed in-service as if the properties were stabilized and rents had commenced as of the beginning of the period. |

| 4 | Developable land represents acreage currently owned by us and identified for potential development. The developable gross leasable area (GLA) is based on the developable land area and a land to building ratio. Developable land and GLA are estimated and can change periodically due to changes in site design, road and storm water requirements, parking requirements and other factors. We have made a number of assumptions in such estimates and there can be no assurance that we will develop land that we own. |

| 5 | Under construction represents projects for which vertical construction has commenced. Under development represents projects in the pre-construction phase. |

| 6 | Common shares and units outstanding were 45,382 and 490 as of March 31, 2024 respectively. |

1Q 2024 Supplemental | 17

Rentable Square Feet and Annualized Base Rent by Market

As of March 31, 2024

Unaudited ($ in thousands)

| # of Properties |

# of Buildings |

Occupancy | Total Rentable Square Feet |

% Rentable Square Feet |

ABR2 | % ABR | ||

| Primary Markets1 | ||||||||

| Atlanta | 11 | 13 | 99.9% | 2,086,835 | 6.1% | $ | 9,833 | 6.5% |

| Chicago | 39 | 40 | 94.8% | 6,624,335 | 19.4% | 29,277 | 19.4% | |

| Primary Markets Total | 50 | 53 | 96.1% | 8,711,170 | 25.5% | $ | 39,110 | 25.9% |

| Secondary Markets1 | ||||||||

| Boston | 1 | 2 | 100.0% | 268,713 | 0.8% | $ | 2,146 | 1.4% |

| Charlotte | 1 | 1 | 100.0% | 155,220 | 0.5% | 1,229 | 0.8% | |

| Cincinnati | 10 | 12 | 94.9% | 2,710,964 | 8.0% | 11,077 | 7.3% | |

| Cleveland | 16 | 19 | 98.5% | 3,979,209 | 11.7% | 18,628 | 12.3% | |

| Columbus | 15 | 15 | 100.0% | 3,757,614 | 11.0% | 13,737 | 9.1% | |

| Indianapolis | 17 | 17 | 95.6% | 4,085,169 | 12.0% | 15,228 | 10.1% | |

| Jacksonville | 8 | 28 | 99.6% | 2,132,396 | 6.3% | 16,227 | 10.7% | |

| Kansas City | 1 | 1 | 69.1% | 221,911 | 0.7% | 558 | 0.4% | |

| Memphis | 25 | 49 | 97.9% | 4,783,046 | 14.0% | 18,645 | 12.3% | |

| St. Louis | 12 | 14 | 95.0% | 3,219,689 | 9.5% | 14,639 | 9.7% | |

| Secondary Markets Total | 106 | 158 | 97.2% | 25,313,931 | 75.5% | $ | 112,114 | 74.1% |

| Total | 156 | 211 | 96.9% | 34,025,101 | 100.0% | $ | 151,224 | 100.0% |

| 1 | Primary markets means the following two metropolitan areas in the U.S., each generally consisting of more than 300 million square feet of industrial space: Chicago and Atlanta. Secondary markets means non-primary markets, each generally consisting of between 100 million and 300 million square feet of industrial space, including the following metropolitan areas in the U.S.: Boston, Charlotte, Cincinnati, Cleveland, Columbus, Indianapolis, Jacksonville, Kansas City, Memphis, Milwaukee, South Florida, and St. Louis. Our definitions of primary and secondary markets may vary from the definitions of these terms used by investors, analysts, or other industrial REITs. |

| 2 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

1Q 2024 Supplemental | 18

|

Operational &

|

1Q 2024 Supplemental | 19

Leasing Activity

As of March 31, 2024

Unaudited

| Lease Renewals and New Leases | ||||||||||||

| Year | Type | Square Footage | Percent | Expiring Rent | New Rent | % Change | Tenant Improvements1 |

Lease Commissions1 | ||||

| 2020 | Renewals | 1,881,346 | 71.1% | $ | 3.75 | $ | 3.93 | 4.8% | $ | 0.13 | $ | 0.08 |

| New Leases | 764,314 | 28.9% | $ | 4.31 | $ | 5.07 | 17.6% | $ | 0.24 | $ | 0.19 | |

| Total | 2,645,660 | 100.0% | $ | 3.92 | $ | 4.26 | 8.7% | $ | 0.16 | $ | 0.11 | |

| 2021 | Renewals | 2,487,589 | 49.3% | $ | 4.25 | $ | 4.50 | 5.9% | $ | 0.19 | $ | 0.10 |

| New Leases | 2,557,312 | 50.7% | $ | 3.76 | $ | 4.40 | 17.0% | $ | 0.23 | $ | 0.22 | |

| Total | 5,044,901 | 100.0% | $ | 4.00 | $ | 4.45 | 11.1% | $ | 0.21 | $ | 0.16 | |

| 2022 | Renewals | 4,602,355 | 60.2% | $ | 4.31 | $ | 4.87 | 13.1% | $ | 0.15 | $ | 0.16 |

| New Leases | 3,041,526 | 39.8% | $ | 3.51 | $ | 4.51 | 28.6% | $ | 0.40 | $ | 0.23 | |

| Total | 7,643,881 | 100.0% | $ | 3.99 | $ | 4.73 | 18.5% | $ | 0.25 | $ | 0.19 | |

| 2023 | Renewals | 3,945,024 | 70.4% | $ | 3.75 | $ | 4.36 | 16.3% | $ | 0.14 | $ | 0.15 |

| New Leases | 1,654,919 | 29.6% | $ | 3.82 | $ | 5.03 | 31.7% | $ | 0.35 | $ | 0.35 | |

| Total | 5,599,943 | 100.0% | $ | 3.77 | $ | 4.56 | 21.0% | $ | 0.21 | $ | 0.21 | |

| Q1 2024 | Renewals | 928,217 | 66.9% | $ | 4.71 | $ | 4.99 | 5.9% | $ | 0.17 | $ | 0.12 |

| New Leases | 459,760 | 33.1% | $ | 3.41 | $ | 5.06 | 48.4% | $ | 0.12 | $ | 0.20 | |

| Total | 1,387,977 | 100.0% | $ | 4.28 | $ | 5.01 | 17.1% | $ | 0.15 | $ | 0.14 | |

Note: Lease renewals and new lease activity excludes leases with terms less than six months, and leases associated with construction.

| 1 | Shown as per dollar, per square foot, per year. |

1Q 2024 Supplemental | 20

Leasing Activity (continued)

As of March 31, 2024

Unaudited

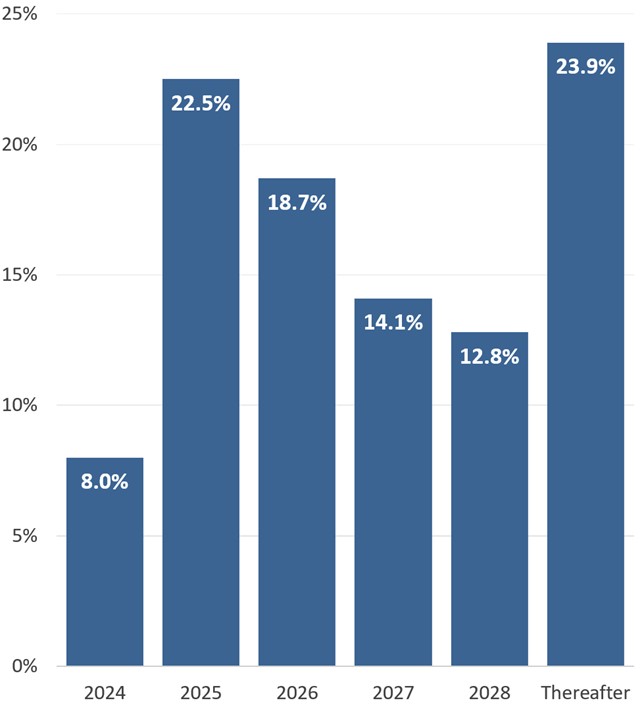

| Lease Expiration Schedule | ||||

| Year | Square Footage |

ABR1 | % of ABR Expiring2 | |

| Available | 1,061,525 | $ | - | - |

| 2024 | 2,643,167 | 12,101,668 | 8.0% | |

| 2025 | 7,766,714 | 33,999,980 | 22.5% | |

| 2026 | 5,927,934 | 28,203,681 | 18.7% | |

| 2027 | 4,493,284 | 21,396,180 | 14.1% | |

| 2028 | 4,150,735 | 19,319,026 | 12.8% | |

| Thereafter | 7,981,742 | 36,203,077 | 23.9% | |

| Total | 34,025,101 | $ | 151,223,612 | 100.0% |

% of Annual Base Rent Expiring2

| 1 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

| 2 | Calculated as annualized base rent set forth in this table divided by total annualized base rent as of March 31, 2024. |

1Q 2024 Supplemental | 21

Leased Square Feet and Annualized Base Rent by Tenant Industry

As of March 31, 2024

Unaudited

| Industry | Total Leased Square Feet |

# of Leases |

% Rentable Square Feet |

ABR1 | % ABR | ABR Per Square Foot | ||

| Logistics & Transportation | 9,780,990 | 84 | 29.7% | $ | 40,761,535 | 27.0% | $ | $ 4.17 |

| Wholesale/Retail | 2,397,143 | 28 | 7.3% | 11,939,672 | 7.9% | 4.98 | ||

| Automotive | 2,258,860 | 26 | 6.9% | 10,573,834 | 7.0% | 4.68 | ||

| Printing & Paper | 1,942,978 | 16 | 5.9% | 7,436,389 | 4.9% | 3.83 | ||

| Home & Garden | 1,914,586 | 18 | 5.8% | 6,585,525 | 4.4% | 3.44 | ||

| Construction | 1,527,936 | 41 | 4.6% | 7,293,813 | 4.8% | 4.77 | ||

| Cardboard and Packaging | 1,294,442 | 17 | 3.9% | 5,689,437 | 3.8% | 4.40 | ||

| Food & Beverage | 1,663,050 | 24 | 5.0% | 8,675,750 | 5.7% | 5.22 | ||

| Light Manufacturing | 1,227,572 | 11 | 3.7% | 4,445,727 | 2.9% | 3.62 | ||

| Healthcare | 1,024,416 | 39 | 3.1% | 6,234,416 | 4.1% | 6.09 | ||

| Plastics | 955,728 | 13 | 2.9% | 4,578,064 | 3.0% | 4.79 | ||

| Education | 925,840 | 8 | 2.8% | 4,515,840 | 3.0% | 4.88 | ||

| Industrial Equipment Components | 852,039 | 24 | 2.6% | 4,140,649 | 2.7% | 4.86 | ||

| Other Industries2 | 5,197,996 | 154 | 15.8% | 28,352,961 | 18.8% | 5.45 | ||

| Total | 32,963,576 | 503 | 100.0% | $ | 151,223,612 | 100.0% | $ | 4.59 |

| 1 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

| 2 | Includes over 20 tenant industries for which the total leased square feet aggregates to less than 250,000 square feet or 3% of ABR. |

1Q 2024 Supplemental | 22

Leased Square Feet and Annualized Base Rent by Type

As of March 31, 2024

Unaudited

| Leased Square Feet and Annualized Base Rent by Lease Type | ||||||||

| Lease Type | Total Leased Square Feet |

# of Leases |

% Leased Square Feet |

Annualized Base Rent1 | % ABR | ABR Per Square Foot | ||

| Triple Net | 27,247,340 | 397 | 82.7% | $ | 121,805,248 | 80.5% | $ | 4.47 |

| Modified Net | 3,694,231 | 62 | 11.2% | 19,017,017 | 12.6% | 5.15 | ||

| Gross | 2,022,005 | 44 | 6.1% | 10,401,347 | 6.9% | 5.14 | ||

| Total | 32,963,576 | 503 | 100.0% | $ | 151,223,612 | 100.0% | $ | 4.59 |

| Leased Square Feet and Annualized Base Rent by Tenant Type | ||||||||

| Tenant Type | Total Leased Square Feet |

# of Leases |

% Leased Square Feet |

Annualized Base Rent1 | % ABR | ABR Per Square Foot | ||

| Multi-Tenant | 16,426,039 | 398 | 49.8% | $ | 82,047,826 | 54.3% | $ | 4.99 |

| Single-Tenant | 16,537,537 | 105 | 50.2% | 69,175,786 | 45.7% | 4.18 | ||

| Total | 32,963,576 | 503 | 100.0% | $ | 151,223,612 | 100.0% | $ | 4.59 |

| Leased Square Feet and Annualized Base Rent by Building Type | ||||||||

| Building Type | Total Leased Square Feet |

# of Buildings |

% Leased Square Feet |

Annualized Base Rent1 | % ABR | ABR Per Square Foot | ||

| Warehouse/Distribution | 21,228,496 | 118 | 64.4% | $ | 85,703,511 | 56.7% | $ | 4.04 |

| Warehouse/Light Manufacturing | 8,349,976 | 41 | 25.3% | 39,190,300 | 25.9% | 4.69 | ||

| Small Bay Industrial2 | 3,385,104 | 52 | 10.3% | 26,329,801 | 17.4% | 7.78 | ||

| Total | 32,963,576 | 211 | 100.0% | $ | 151,223,612 | 100.0% | 4.59 | |

| 1 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

| 2 | Small bay industrial is inclusive of flex space totaling 606,799 leased square feet and annualized base rent of $6,988,186. Small bay industrial is multipurpose space; flex space includes office space that accounts for greater than 50% of the total rentable area. |

1Q 2024 Supplemental | 23

Top 10 Tenants by Annualized Base Rent

As of March 31, 2024

Unaudited

| Tenant | Market | Industry | # of Leases | Total Leased Square Feet | Expiration | ABR Per Square Foot |

Annualized Base Rent1 | % Total ABR | ||

| FedEx Supply Chain, Inc. | St. Louis | Logistics & Transportation | 1 | 769,500 | 7/31/24 | $ | 4.60 | $ | 3,539,875 | 2.3% |

| Geodis Logistics, LLC | St. Louis | Logistics & Transportation | 1 | 624,159 | 8/31/25 | 4.36 | 2,718,993 | 1.8% | ||

| Royal Canin U.S.A, Inc. | St. Louis | Wholesale/Retail | 1 | 521,171 | 12/31/25 | 4.89 | 2,549,829 | 1.7% | ||

| Houghton Mifflin Harcourt Company | Chicago | Education | 1 | 513,512 | 3/31/26 | 4.56 | 2,341,615 | 1.5% | ||

| ODW Logistics, Inc. | Columbus | Logistics & Transportation | 1 | 772,450 | 6/30/25 | 2.99 | 2,312,163 | 1.5% | ||

| Archway Marketing Holdings, Inc. | Chicago | Logistics & Transportation | 3 | 503,000 | 3/31/26 | 4.51 | 2,268,180 | 1.5% | ||

| ASW Supply Chain Services, LLC | Cleveland | Logistics & Transportation | 5 | 577,237 | 11/30/27 | 3.65 | 2,104,932 | 1.4% | ||

| Balta US, Inc. | Jacksonville | Home & Garden | 2 | 629,084 | 10/31/29 | 3.16 | 1,988,036 | 1.3% | ||

| Communications Test Design, Inc. | Memphis | Logistics & Transportation | 2 | 566,281 | 12/31/24 | 3.41 | 1,930,826 | 1.3% | ||

| Winston Products, LLC | Cleveland | Wholesale/Retail | 2 | 266,803 | 4/30/32 | 6.94 | 1,852,295 | 1.2% | ||

| Total Largest Tenants by Annualized Rent | 19 | 5,743,197 | $ | 4.11 | $ | 23,606,744 | 15.5% | |||

| All Other Tenants | 484 | 27,220,379 | $ | 4.69 | $ | 127,616,868 | 84.5% | |||

| Total Company Portfolio | 503 | 32,963,576 | $ | 4.59 | $ | 151,223,612 | 100.0% | |||

| 1 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

1Q 2024 Supplemental | 24

Lease Segmentation by Size

As of March 31, 2024

Unaudited

| Square Feet | # of Leases | Total Leased Square Feet |

Total Rentable Square Feet | Total Leased % |

Total Leased % Excluding Repositioning1 | Annualized Base Rent2 | In-Place + Uncommenced ABR3 |

% of Total In-Place + Uncommenced ABR |

In-Place + Uncommenced ABR Per SF4 | ||

| < 4,999 | 60 | 171,905 | 234,511 | 73.3% | 75.2% | $ | 1,701,656 | $ | 1,701,656 | 1.1% | $ 9.90 |

| 5,000 - 9,999 | 71 | 500,626 | 592,362 | 84.5% | 85.3% | 4,451,389 | 4,591,349 | 3.0% | 8.92 | ||

| 10,000 - 24,999 | 111 | 1,891,624 | 1,942,255 | 97.4% | 97.4% | 14,185,137 | 14,185,137 | 9.3% | 7.50 | ||

| 25,000 - 49,999 | 90 | 3,192,194 | 3,301,311 | 96.7% | 96.7% | 18,829,017 | 18,829,017 | 12.4% | 5.90 | ||

| 50,000 - 99,999 | 79 | 5,535,583 | 5,711,472 | 96.9% | 98.0% | 25,669,202 | 26,039,650 | 17.2% | 4.66 | ||

| 100,000 - 249,999 | 63 | 10,268,208 | 10,525,772 | 97.6% | 98.9% | 44,633,924 | 44,633,924 | 29.4% | 4.35 | ||

| > 250,000 | 29 | 11,403,436 | 11,717,418 | 97.3% | 100.0% | 41,753,287 | 41,753,287 | 27.6% | 3.66 | ||

| Total/Weighted Avg. | 503 | 32,963,576 | 34,025,101 | 96.9% | 98.4% | $ | 151,223,612 | $ | 151,734,020 | 100.0% | $ 4.59 |

| 1 | Total Leased % Excluding Repositioning excludes vacant square footage being refurbished or repositioned. |

| 2 | Annualized base rent is calculated as monthly contracted base rent as of March 31, 2024, multiplied by 12. Excludes rent abatements. |

| 3 | In-Place + Uncommenced ABR calculated as in-place current annualized base rent as of March 31, 2024 plus annualized base rent for leases signed but not commenced as of March 31, 2024. |

| 4 | In-Place + Uncommenced ABR per SF is calculated as in-place current rent annualized base rent as of March 31, 2024 plus annualized base rent for leases signed but not commenced as of March 31, 2024, divided by leased square feet plus uncommenced leased square feet. |

1Q 2024 Supplemental | 25

Capital Expenditures

Unaudited ($ in thousands)

| March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | ||||||

| Tenant improvements | $ | 320 | $ | 375 | $ | 290 | $ | 361 | $ | 425 |

| Lease commissions | $ | 674 | $ | 505 | $ | 1,675 | $ | 731 | $ | 1,381 |

| Total Recurring Capital Expenditures | $ | 994 | $ | 880 | $ | 1,965 | $ | 1,092 | $ | 1,806 |

| Capital expenditures | $ | 664 | $ | 5,074 | $ | 5,638 | $ | 4,217 | $ | 2,593 |

| Development | $ | 2,336 | $ | 1,107 | $ | 2,494 | $ | 3,423 | $ | 5,820 |

| Total Non-recurring Capital Expenditures | $ | 3,000 | $ | 6,181 | $ | 8,132 | $ | 7,640 | $ | 8,413 |

| Total Capital Expenditures | $ | 3,994 | $ | 7,061 | $ | 10,097 | $ | 8,732 | $ | 10,219 |

1Q 2024 Supplemental | 26

|

Appendix

|

1Q 2024 Supplemental | 27

Glossary

This glossary contains additional details for sections throughout this Supplemental Information, including explanations and reconciliations of certain non-GAAP financial measures, and the reasons why we use these supplemental measures of performance and believe they provide useful information to investors. Additional detail can be found in our most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, as well as other documents filed with or furnished to the SEC from time to time.

Non-GAAP Financial Measures Definitions:

Net Operating Income (NOI): We consider net operating income, or NOI, to be an appropriate supplemental measure to net income in that it helps both investors and management understand the core operations of our properties. We define NOI as total revenue (including rental revenue and tenant reimbursements) less property-level operating expenses. NOI excludes depreciation and amortization, general and administrative expenses, impairments, gain/loss on sale of real estate, interest expense, and other non-operating items.

Cash Net Operating Income - (Cash NOI): We define Cash NOI as NOI excluding straight-line rent adjustments and amortization of above and below market leases.

EBITDAre and Adjusted EBITDA: We define earnings before interest, taxes, depreciation and amortization for real estate in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). EBITDAre represents net income (loss), computed in accordance with GAAP, before interest expense, tax, depreciation and amortization, gains or losses on the sale of rental property, appreciation/(depreciation) of warrants, loss on impairments, and loss on extinguishment of debt. We calculate Adjusted EBITDA by adding or subtracting from EBITDAre the following items: (i) non-cash stock compensation, (ii) loss on extinguishment of debt, (iii) acquisition expenses (iv) the proforma impacts of acquisition, dispositions and developments and (v) non-cash impairments on real estate lease. We believe that EBITDAre and Adjusted EBITDA are helpful to investors as supplemental measures of our operating performance as a real estate company as they are direct measures of the actual operating results of our industrial properties. EBITDAre and Adjusted EBITDA should not be used as measures of our liquidity and may not be comparable to how other REITs' calculate EBITDAre and Adjusted EBITDA.

Funds From Operations ("FFO"): Funds from operations, or FFO, is a non-GAAP financial measure that is widely recognized as a measure of an REIT’s operating performance, thereby, providing investors the potential to compare our operating performance with that of other REITs. We consider FFO to be an appropriate supplemental measure of our operating performance as it is based on a net income analysis of property portfolio performance that excludes non-cash items such as depreciation. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values rise and fall with market conditions, presentations of operating results for a REIT, using historical accounting for depreciation, could be less informative. In December 2018, NAREIT issued a white paper restating the definition of FFO. The purpose of the restatement was not to change the fundamental definition of FFO, but to clarify existing NAREIT guidance. The restated definition of FFO is as follows: Net Income (calculated in accordance with GAAP), excluding: (i) Depreciation and amortization related to real estate, (ii) Gains and losses from the sale of certain real estate assets, (iii) Gain and losses from change in control, and (iv) Impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. We define FFO, consistent with the NAREIT definition. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. Other equity REITs may not calculate FFO as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. FFO should not be used as a measure of our liquidity and is not indicative of funds available for our cash needs, including our ability to pay dividends.

1Q 2024 Supplemental | 28

Glossary (continued)

Non-GAAP Financial Measures Definitions (continued):

Core Funds from Operations (“Core FFO”): We calculate Core FFO by adjusting FFO for non-comparable items such as dividends paid (or declared) to holders of our preferred stock, acquisition and transaction related expenses for transactions not completed, and certain non-cash operating expenses such as impairment on real estate lease, appreciation/(depreciation) of warrants and loss on extinguishment of debt. We believe that Core FFO is a useful supplemental measure in addition to FFO by adjusting for items that are not considered by us to be part of the period over period operating performance of our property portfolio, thereby, providing a more meaningful and consistent comparison of our operating and financial performance during the periods presented. As with FFO, our reported Core FFO may not be comparable to other REITs’ Core FFO, should not be used as a measure of our liquidity, and is not indicative of our funds available for our cash needs, including our ability to pay dividends.

Adjusted Funds from Operations attributable to common stockholders (“AFFO”): Adjusted funds from operations, or AFFO, is presented in addition to Core FFO. AFFO is defined as Core FFO, excluding certain non-cash operating revenues and expenses, capitalized interest and recurring capitalized expenditures. Recurring capitalized expenditures include expenditures required to maintain and re-tenant our properties, tenant improvements and leasing commissions. AFFO further adjusts Core FFOfor certain other non-cash items, including the amortization or accretion of above or below market rents included in revenues, straight line rent adjustments, non-cash equity compensation and non-cash interest expense.

We believe AFFO provides a useful supplemental measure of our operating performance because it provides a consistent comparison of our operating performance across time periods that is comparable for each type of real estate investment and is consistent with management's analysis of the operating performance of our properties. As a result, we believe that the use of AFFO, together with the required GAAP presentations, provide a more complete understanding of our operating performance.

As with Core FFO, our reported AFFO may not be comparable to other REITs’ AFFO, should not be used as a measure of our liquidity, and is not indicative of our funds available for our cash needs, including our ability to pay dividends.

Net Debt and Preferred Stock to Adjusted EBITDA: Net debt and preferred stock to Adjusted EBITDA is a non-GAAP financial measure that we believe is useful to investors as a supplemental measure in evaluating balance sheet leverage. Net debt and preferred stock is equal to the sum of total consolidated and our pro rata share of unconsolidated joint venture debt less cash, cash equivalents, and restricted cash, plus preferred stock calculated at its liquidation preference as of the end of the period.

1Q 2024 Supplemental | 29

Glossary (continued)

Other Definitions:

GAAP: U.S. generally accepted accounting principles.

Lease Type: We define our triple net leases in that the tenant is responsible for all aspects of and costs related to the property and its operation during the lease term. We define our modified net leases in that the landlord is responsible for some property related expenses during the lease term, but the cost of most of the expenses is passed through to the tenant. We define our gross leases in that the landlord is responsible for all aspects of and costs related to the property and its operation during the lease term.

Non-Recurring Capital Expenditures: Non-recurring capital expenditures include capital expenditures of long-lived improvements required to upgrade/replace existing systems or items that previously did not exist. Non-recurring capital expenditures also include costs associated with repositioning a property, redevelopment/development and capital improvements known at the time of acquisition.

Occupancy: We define occupancy as the percentage of total leasable square footage as the earlier of lease term commencement or revenue recognition in accordance to GAAP as of the close of the reporting period.

Recurring Capital Expenditures: Recurring capitalized expenditures includes capital expenditures required to maintain and re-tenant our buildings, tenant improvements and leasing commissions.

Replacement Cost: is based on the Marshall & Swift valuation methodology for the determination of building costs. The Marshall & Swift building cost data and analysis is widely recognized within the U.S. legal system and has been written into in law in over 30 U.S. states and recognized in the U.S. Treasury Department Internal Revenue Service Publication. Replacement cost includes land reflected at the allocated cost in accordance with Financial Accounting Standards Board ("FASB") ASC 805.

Same Store Portfolio: The Same Store Portfolio is a subset of the consolidated portfolio and includes properties that are wholly owned by the Company as of December 31, 2022. The Same Store Portfolio is evaluated and defined on an annual basis based on the growth and size of the consolidated portfolio. The Same Store Portfolio excludes properties that are classified as repositioning, lease-up during 2023 or 2024 (6 buildings representing approximately 1,755,000 of rentable square feet placed into service during 2023 or 2024) or under contract for sale. For 2024, the Same Store Portfolio consists of 146 properties aggregating 31.2 million rentable square feet. Properties that are being repositioned generally are defined as those properties where a significant amount of space is held vacant in order to implement capital improvements that enhance the functionality, rental cash flows, and value of that property. We define a significant amount of space at a property using both the size of the space and its proportion to the properties total square footage as a determinate. Our computation of same store NOI may not be comparable to other REITs.

Weighted Average Lease Term Remaining: The average contractual lease term remaining as of the close of the reporting period (in years) weighted by square footage.

1Q 2024 Supplemental | 30