SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 |

| PLYMOUTH INDUSTRIAL REIT, INC. |

| (Name of Registrant as Specified In Its Charter) |

| Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Plymouth

Industrial REIT, Inc.

20 Custom House Street, 11th Floor

Boston, Massachusetts 02110

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 30, 2021

Dear Stockholder:

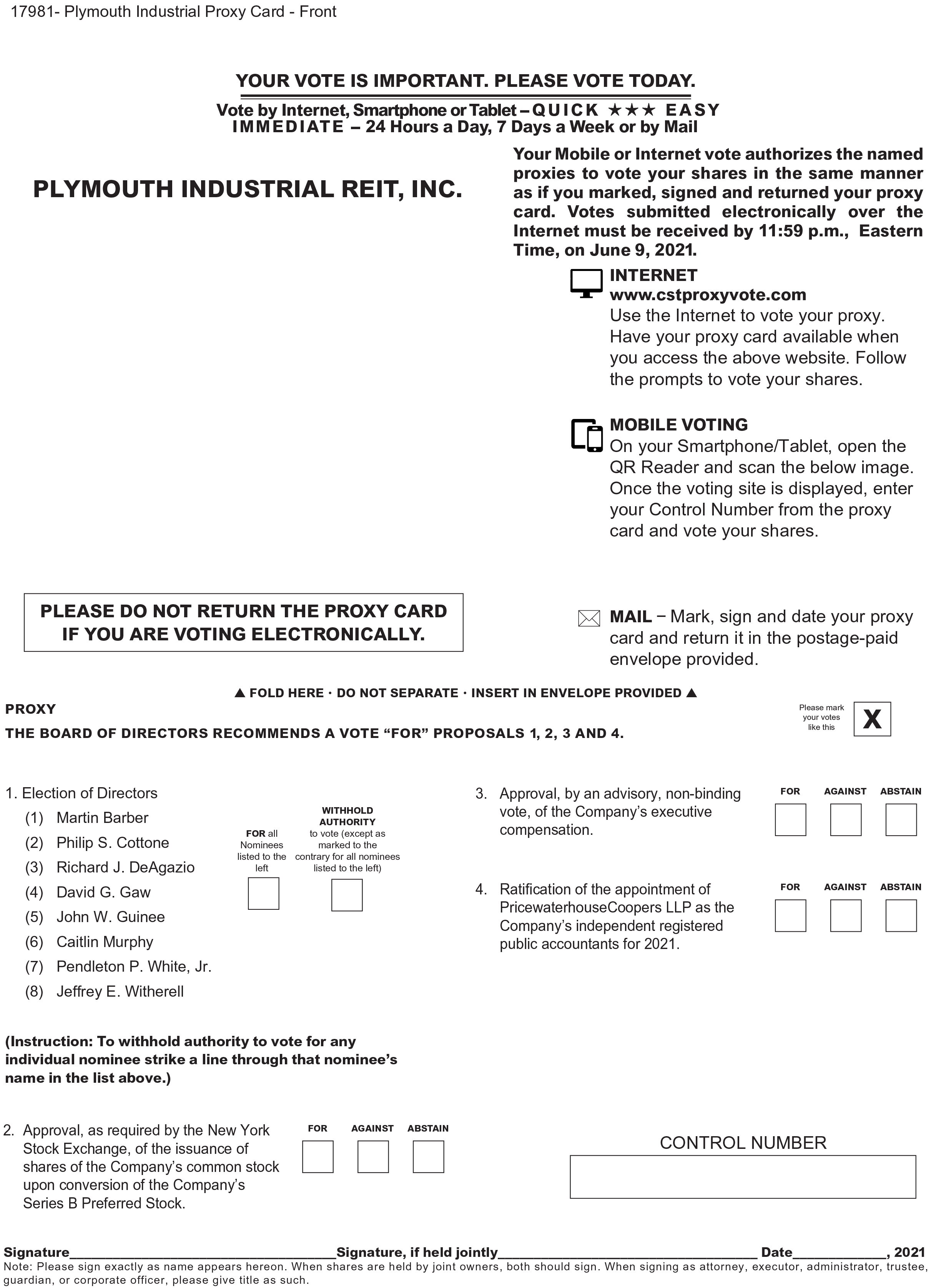

On behalf of the Board of Directors, we cordially invite you to attend the 2021 Annual Meeting of Stockholders of Plymouth Industrial REIT, Inc. (the “Company”). The Annual Meeting will be held beginning at 3:00 p.m., Eastern Time, on Thursday, June 10, 2021 at the principal offices of the Company, located at 20 Custom House Street, 11th Floor, Boston, Massachusetts 02110. At the Annual Meeting, you will be asked to consider and vote on:

| 1. | the election of eight directors, each to serve a one-year term expiring in 2022; |

| 2. | the approval, as required by the New York Stock Exchange, of the issuance of shares of the Company’s common stock upon conversion of the Company’s Series B Preferred Stock; |

| 3. | the approval, by an advisory, non-binding vote, of our executive compensation; and |

| 4. | the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021. |

The accompanying proxy statement provides detailed information concerning the matters to be acted upon at the Annual Meeting. We urge you to review this proxy statement and each of the proposals carefully. Your vote is very important. It is important that your views be represented at the Annual Meeting regardless of the number of shares of common stock you own or whether you are able to attend the Annual Meeting in person.

Stockholders of record at the close of business on April 9, 2021 are entitled to notice of, and to vote at, the Annual Meeting. This proxy statement, a proxy card and our 2020 Annual Report to Stockholders is being mailed to you on or about April 30, 2021. A copy of this proxy statement and our 2020 Annual Report to Stockholders have been posted and made available for viewing online at www.plymouthreit.com. Paper copies will be provided without charge upon written request. To obtain directions to be able to attend our Annual Meeting and vote in person, please contact Anne A. Hayward, at anne.hayward@plymouthrei.com.

On behalf of our Board of Directors, I would like to express our appreciation for your continued interest in Plymouth Industrial REIT, Inc.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 10, 2021

Plymouth Industrial REIT Inc.’s 2021 proxy statement, proxy card and 2020 Annual Report to Stockholders are available at www.plymouthreit.com.

|

Sincerely,

| ||

| Jeffrey E. Witherell Chairman of the Board and Chief Executive Officer |

PLYMOUTH INDUSTRIAL REIT, INC.

PROXY STATEMENT

INDEX

PLYMOUTH INDUSTRIAL REIT, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 10, 2021

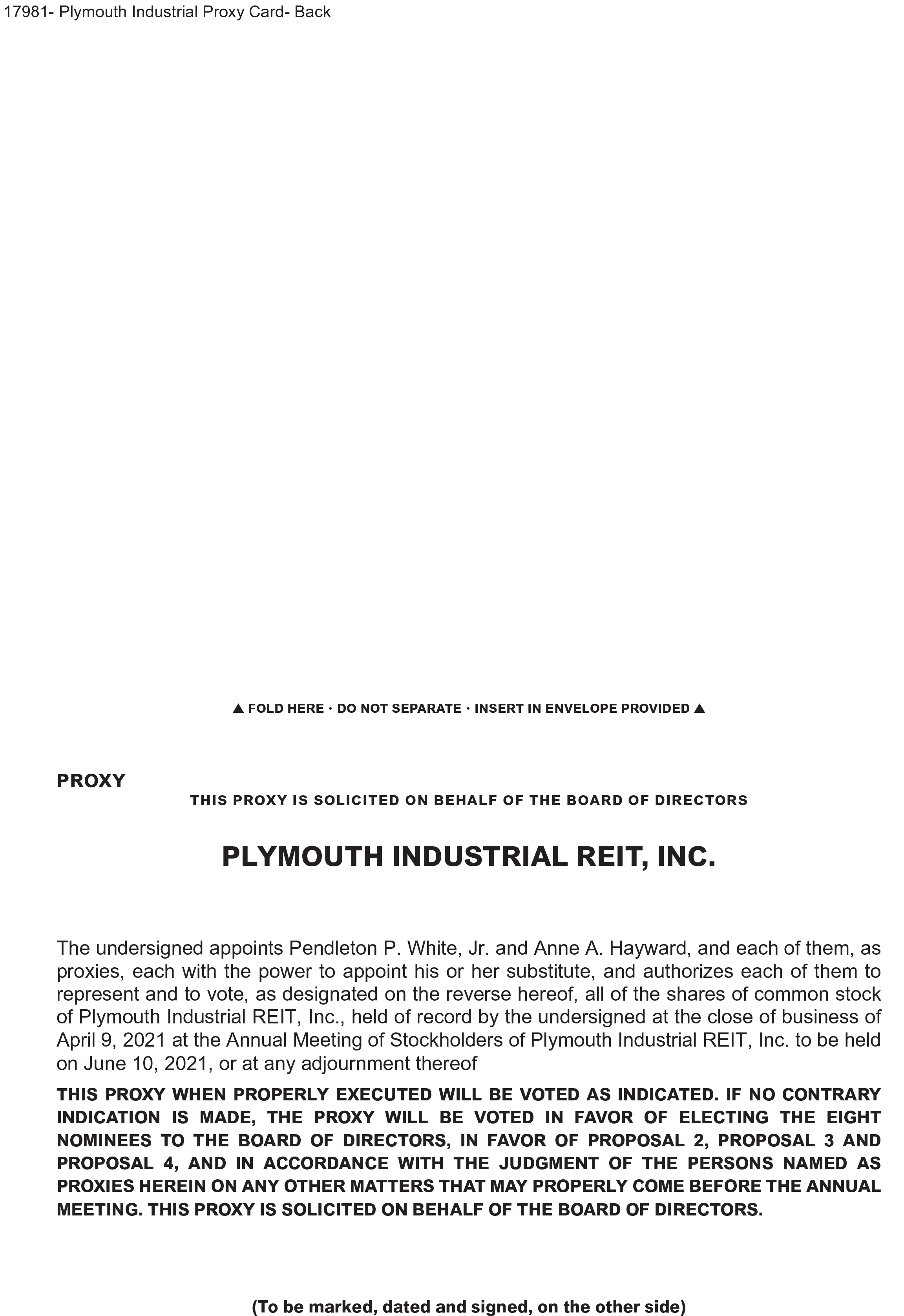

We are furnishing this proxy statement to the stockholders of record of Plymouth Industrial REIT, Inc. as of April 9, 2021 in connection with the solicitation of proxies by its Board of Directors for use at the Annual Meeting of Stockholders (the “Annual Meeting”) of Plymouth Industrial REIT, Inc. to be held at 3:00 p.m., Eastern time, on Thursday, June 10, 2021 at 20 Custom House Street, 11th Floor, Boston, Massachusetts 02110, as well as in connection with any adjournments or postponements of the meeting. This solicitation is made by Plymouth Industrial REIT, Inc. on behalf of our Board of Directors (also referred to as the “Board” in this proxy statement). “We,” “our,” “us” and the “Company” refer to Plymouth Industrial REIT, Inc., a Maryland corporation.

Our proxy statement and accompanying proxy card are first being mailed to stockholders on or about April 30, 2021. This proxy statement, proxy card and our annual report to stockholders are available at www.plymouthreit.com. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

2020 Business Highlights

We are a real estate investment trust focused on the acquisition, ownership and management of single and multi-tenant industrial properties, including distribution centers, warehouses, light industrial and small bay industrial properties, located in primary and secondary markets within the main industrial, distribution and logistics corridors of the United States.

In a year of unprecedented challenges, our company continued to execute on its consistent track record of achieving significant growth through accretive acquisitions in our targeted markets, enhancing operations, and improving our capital structure.

During 2020, we acquired 27 wholly owned buildings totaling approximately 5.5 million square feet for a total purchase price of approximately $243.6 million or $47 per square foot. In addition, we expanded our portfolio through the execution of a strategic $150 million equity joint venture to acquire the partnership’s first 28 industrial buildings totaling 2.3 million square feet. Since our IPO in June of 2017, we have acquired 95 buildings totaling approximately 19.3 million square feet for a total purchase price of approximately $801.6 million or $48 per square foot.

Our ability to execute on our operational goals and maintain strong occupancy throughout the year is a testament to the commitment of our team, the resiliency of our tenants and the strong fundamentals within our targeted markets. In 2020, we collected more than 99 percent of rents and experienced nearly zero bad debt expense. Our leasing activity across all our markets included the execution of lease renewals and new leases for over 2.6 million square feet yielding a rental rate increase of 8.7% over prior leases on a cash basis.

We ended 2020 in a strong financial position closing on a new $300 million unsecured credit facility, comprised of a $200 million revolving line and a $100 million term loan, providing expanded capacity and greater capital structure flexibility with lower borrowing costs to support our continued growth throughout 2021.

QUESTIONS AND ANSWERS REGARDING THE 2021 ANNUAL MEETING OF STOCKHOLDERS

Who is soliciting proxies from the stockholders?

Our Board of Directors is soliciting your proxy. The proxy provides you with the opportunity to vote on the proposals presented at the Annual Meeting, whether or not you attend the meeting.

What will be voted on at the Annual Meeting?

Our stockholders will vote on four proposals at the Annual Meeting:

| 1. | The election of eight directors, who are each to serve a one-year term expiring in 2022 or until his or her successor is elected and qualified; | |

| 2. | The approval, as required by the New York Stock Exchange (the “NYSE”) of the issuance of shares of the Company’s common stock upon conversion of the Company’s Series B Preferred Stock (the “Stock Issuance Proposal”); | |

| 3. | The approval, by an advisory, non-binding vote, of our executive compensation; and | |

| 4. | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021. |

1

Your proxy will also give the proxy holders discretionary authority to vote the shares represented by the proxy on any matter, other than the above proposals, that is properly presented for action at the Annual Meeting.

How will we solicit proxies, and who bears the cost of proxy solicitation?

Our directors, officers and employees may solicit proxies by telephone, mail, facsimile, via the Internet or by overnight delivery service. These individuals do not receive separate compensation for these services. In accordance with SEC regulations, we will reimburse brokerage firms and other persons representing beneficial owners of our common stock for their reasonable expenses in forwarding solicitation materials to such beneficial owners.

Who can vote at the Annual Meeting?

Our Board of Directors has fixed the close of business on Friday, April 9, 2021, as the record date for the Annual Meeting. Only stockholders of record on that date are entitled to receive notice of and vote at the Annual Meeting. As of April 9, 2021, the only outstanding class of our securities entitled to vote at the Annual Meeting is our common stock, $0.01 par value per share. On that date, we had 900,000,000 shares of common stock authorized, of which 28,443,593 shares were outstanding.

You (if you, rather than your broker, are the record holder of our stock) can vote either (1) in person by attending the Annual Meeting or (2) by proxy, whether or not you attend the Annual Meeting. If you would like to attend the Annual Meeting in person and need directions, please contact Anne A. Hayward by e-mail at anne.hayward@plymouthrei.com or by telephone at 617-340-6343. You may vote your shares on the Internet or via mobile device (smartphone or tablet) or, to the extent you request written proxy materials, by signing, dating and mailing the accompanying proxy card in the envelope provided. Instructions regarding the three methods of voting by proxy are contained on the Notice and the proxy card.

How many votes must be present to hold the Annual Meeting?

A “quorum” must be present to hold the Annual Meeting. The presence, in person or by proxy, of a majority of the votes entitled to be cast at the Annual Meeting constitutes a quorum. Your shares, once represented for any purpose at the Annual Meeting, are deemed present for purposes of determining a quorum for the remainder of the meeting and for any adjournment, unless a new record date is set for the adjourned meeting. This is true even if you abstain from voting with respect to any matter brought before the Annual Meeting. As of April 9, 2021, we had 28,443,593 shares of common stock outstanding; thus, we anticipate that the quorum for the Annual Meeting will be 14,221,797 shares.

How many votes does a stockholder have per share?

Our stockholders are entitled to one vote for each share of common stock held.

What is the required vote on each proposal?

Directors are elected by a plurality vote; the candidates up for election who receive the highest number of votes cast, up to the number of directors to be elected, are elected. Stockholders do not have the right to cumulate their votes.

The advisory vote approving executive compensation requires the affirmative vote of the majority of the votes cast.

The ratification of our appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021 requires the affirmative vote of a majority of the votes cast.

How will the proxy be voted, and how are votes counted?

If you vote by proxy (either by voting on the Internet, mobile device or by properly completing and returning a paper proxy card that you receive upon requesting written proxy materials), the shares represented by your proxy will be voted at the Annual Meeting as you instruct, including at any adjournments or postponements of the meeting. If you return a signed proxy card but no voting instructions are given, the proxy holders will exercise their discretionary authority to vote the shares represented by the proxy at the Annual Meeting and any adjournments or postponements as follows:

| 1. | “FOR” the election of nominees to the Board of Directors: Martin Barber, Philip S. Cottone, Richard J. DeAgazio, David G. Gaw, John W. Guinee, Caitlin Murphy, Pendleton P. White, Jr. and Jeffrey E. Witherell; | |

| 2. | “FOR” the Stock Issuance Proposal; |

2

| 3. | “FOR” the executive officer compensation program; and | |

| 4. | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021. |

With respect to any other matter that properly comes before the meeting or any adjournment or postponement thereof, the representatives holding proxies will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

If you are the beneficial owner of shares held by a broker, bank or other nominee, you must provide voting instructions to such broker, bank or other nominee as to how to vote your shares. If you do not provide instructions to your broker, bank or other nominee, your shares will not be voted in any matter on which your broker does not have discretionary authority to vote. A vote that is not cast for this reason is called a “broker non-vote.” Broker non-votes will be treated as shares present for the purpose of determining whether a quorum is present at the meeting, but they will not be considered present for purposes of calculating the vote on a particular matter, nor will they be counted as a vote FOR or AGAINST a matter or as an abstention on the matter. Under the rules of the NYSE, which is the stock exchange on which our common stock is listed, the ratification of the appointment of our independent registered public accountants is considered a “discretionary” matter, which means that brokerage firms may vote in their discretion on this matter. In contrast, the election of directors, the Stock Issuance Proposal and the adoption of the advisory, non-binding vote on executive compensation are “non-discretionary” items, which means that brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. It is important that you instruct your broker as to how you wish to have your shares voted, even if you wish to vote as recommended by our Board of Directors.

Can a proxy be revoked?

Yes. You can revoke your proxy

at any time before it is voted. You revoke your proxy (1) by giving written notice to our Corporate Secretary, Pendleton P. White,

Jr., before the Annual Meeting, (2) by granting a subsequent proxy on the Internet or mobile device, or (3) by delivering a

signed proxy card dated later than your previous proxy. If you, rather than your broker, are the record holder of your stock, a proxy

can also be revoked by appearing in person and voting at the Annual Meeting. Written notice of the revocation of a proxy should be delivered

to the following address: Plymouth Industrial REIT, Inc., 20 Custom House Street, 11th Floor, Boston, Massachusetts 02110, Attention:

Pendleton P. White, Jr., Corporate Secretary.

3

PROPOSAL 1

ELECTION OF DIRECTORS

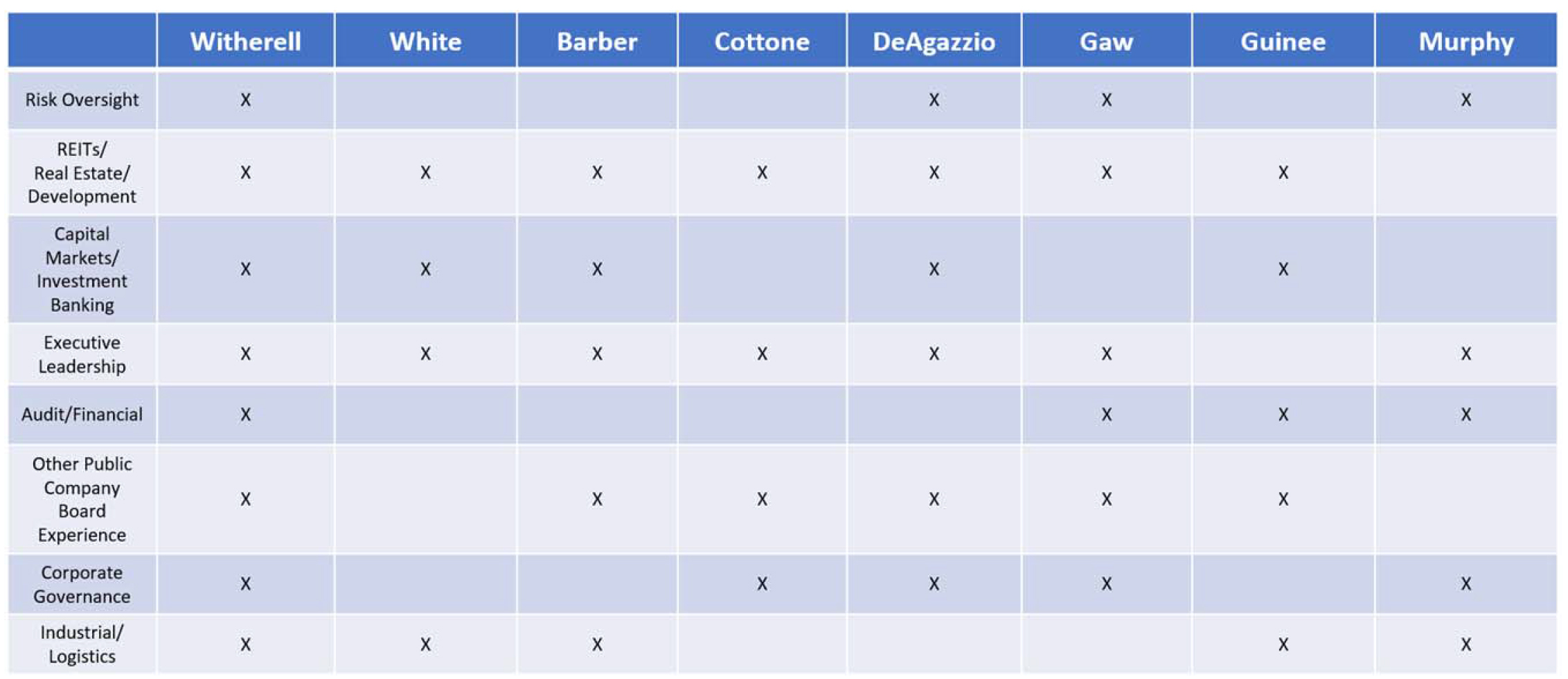

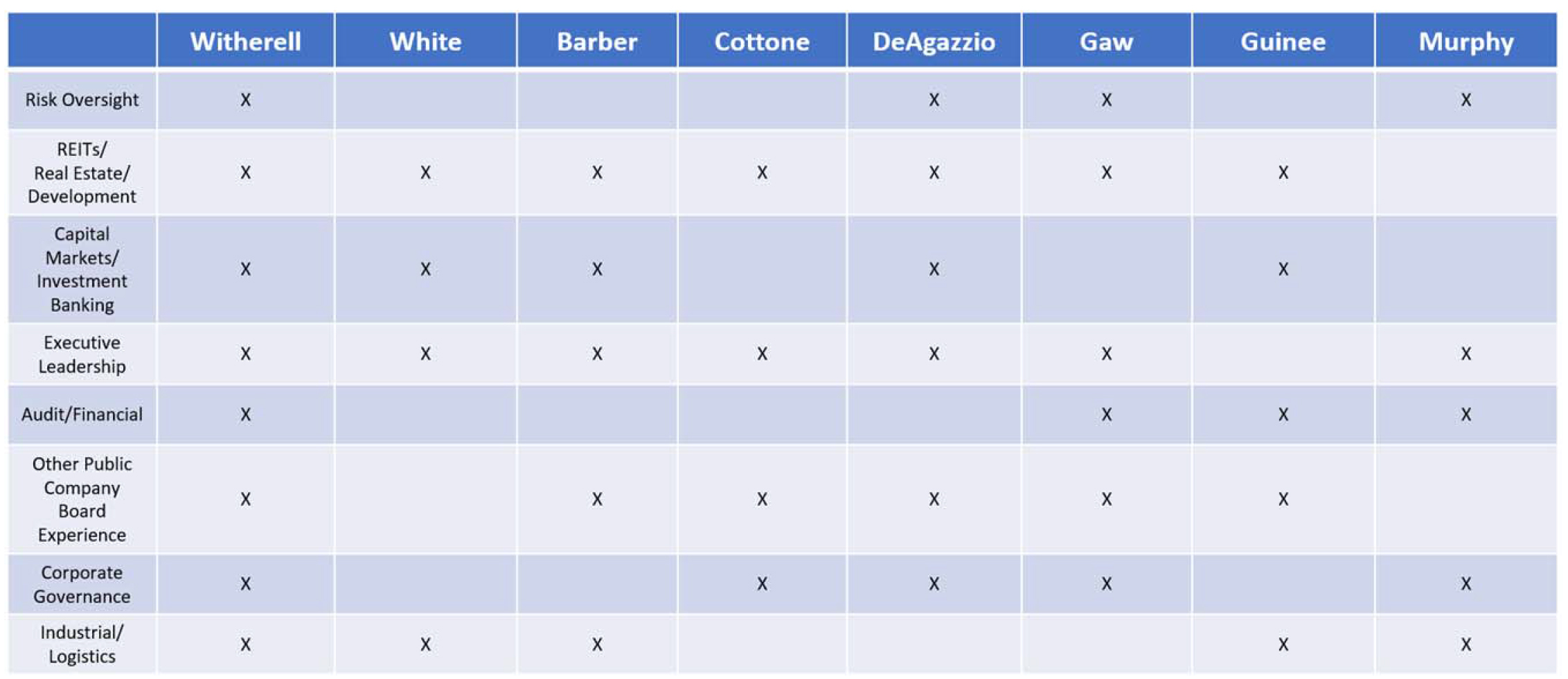

The following table and biographical descriptions set forth certain information regarding each director currently serving on our Board of Directors and includes a brief description of the experience, qualification and skills that led us to conclude that such individual should be and remain a member of our Board. We believe that our Board of Directors consists of a diverse collection of individuals who possess the integrity, education, work ethic and ability to work with others necessary to oversee our business effectively and to represent the interests of our stockholders, including the qualities described below. We have attempted below to highlight certain notable experience qualifications and skills for each director, rather than provide an exhaustive catalog of each and every qualification and skill that a director possesses. Each of the nominees set forth below is currently serving as a director of the Company.

Board of Directors’ Qualifications/Experience

| Name | Age | Background, Qualification and Skills | ||

| Martin Barber | 76 | Mr. Barber is one of our independent directors, a position he has held since February 2015. He has also served as a director of Steamroller Restaurants since 1999. From 1991 to 2004, Mr. Barber served as chairman of Transeuropean Properties 1 and 2, comprised of European real estate funds managed by the U.S. based Prudential Insurance Group. In 1974 Mr. Barber founded and assumed responsibility as CEO of Capital & Regional PLC, a British-based real estate investment fund which when he retired had approximately $5 billion in assets under management in Great Britain. It was listed on the London Stock Exchange in 1986. It was unusual because approximately 60% of its assets were in the U.S. In 1996, the U.S. assets were separated from Capital & Regional, re-named CenterPoint Properties Trust and listed on the New York Stock Exchange. CenterPoint was the first industrial REIT in the U.S. and Mr. Barber served as its chairman and lead independent trustee until its $3.4 billion sale in April, 2006. He retired from Capital & Regional in 2006. Mr. Barber also currently serves as an independent director for Applied Residential, a provider of creative lease-purchase financing structures for the residential housing industry. Mr. Barber was selected as a director because of his extensive experience with real estate ownership and management and his experience with public REITs. | ||

4

| Name | Age | Background, Qualification and Skills | ||

| Philip S. Cottone | 81 | Mr. Cottone has been one of our independent directors since the completion of our initial listed public offering. He previously served as one of our independent directors and chairman of the compensation committee from November 2011 until September 2016. He is an attorney by background and has been an arbitrator since 1977 as well as a mediator since 1995 for FINRA, the American Arbitration Association, and the Counselors of Real Estate, primarily concentrating in securities, real estate and general commercial matters. He has been certified by the International Mediation Institute at The Hague, and is a member of the American College of Civil Trial Mediators. For six years, through 2015, he was an officer of the governing Council of the ABA Dispute Resolution Section, a member of the Faculty of the Annual Arbitration and Mediation Institutes, and Co-Chair of the Arbitration Institute in 2016 and 2017. From 2003 to 2008, Mr. Cottone was a member of the Board of Government Properties Trust (NYSE – GPT) and Chair of the Nominating and Governance Committee, and from 2004 to 2009 he was Lead Director of Boston Capital REIT, a public, non-traded REIT. In 1981, Mr. Cottone co-founded Ascott Investment Corporation, a real estate investment, development and syndication company, and as Chairman and CEO, and founder and President of its NASD broker-dealer, he headed a staff of 65 people in the acquisition, management, capital raising and sale of more than thirty real estate programs in fourteen states. From 1972 to 1981, Mr. Cottone was Senior Real Estate officer and Group Executive of IU International (NYSE – IU), a $2 billion Fortune 100 company, and previously, from 1966 to 1972, he was Manager of Real Estate at the Port of NY Authority, where, among other things, he was responsible for the acquisition of the World Trade Center property in Manhattan. From 1977 through 1983, and again from 1998 through 2002, he was General Counsel and member of the Executive Committee of the International Right of Way Association, and from 1988 to 1997 he was Trustee and Treasurer of the IRWA Foundation. In 1988 he was national President of RESSI, the Real Estate Securities and Syndication Institute, and in 2004 he was national Chair of The Counselors of Real Estate, both affiliates of the National Association of Realtors. From 1989 to 1991 he was Governor of the NASD (National Association of Securities Dealers) Board, the predecessor to FINRA, and was Vice Chairman in 1991. He was a member of the National Business Conduct Committee of the Board in 1989, and Chair in 1990. For ten years, from 1995 to 2005, he was an adjunct on the faculty of the Real Estate Institute at New York University, teaching a course he wrote in real estate securities. Mr. Cottone has an A.B. from Columbia College where he was awarded the Burdette Kinne Prize for Humanities, and an L.L.B. from New York University where he received the Administrative Law Prize. Mr. Cottone was selected as a director because of his extensive investment and finance experience, board service and corporate governance experience. | ||

5

| Name | Age | Background, Qualification and Skills | ||

| Richard J. DeAgazio | 76 | Richard J. DeAgazio has been one of our independent directors since the completion of our initial listed public offering. He had previously served as one of our independent directors and chairman of our corporate governance committee from November 2011 until September 2016. Mr. DeAgazio has been the principal of Ironsides Assoc. LLC., a consulting company in marketing and sales in the financial services industry, since he founded the company in June 2007. He is also currently, and has been since 2009, Chairman of the Soom, Inc., a supply chain software company and a member of the Board of Directors of Commodore Builders, a construction management firm, also from 2009 to the present. Mr. DeAgazio is, and has been since 2016, Chairman of the Advisory Board of Billaway.com, a cloud-based technology platform in the mobile data industry. In 1981, he joined Boston Capital Corp., a diversified real estate and investment banking firm, which, through its various investment funds, owns over $12 billion in real estate assets, as Executive Vice President and Principal. He founded and served as the President of Boston Capital Securities, Inc., a FINRA-registered broker dealer, which is an affiliate of Boston Capital Corp., from 1981 through December 2007. Mr. DeAgazio formerly served on the National Board of Governors of FINRA and served as a member of the National Adjudicatory Council of FINRA. He was the Vice Chairman of FINRA’s District 11, and served as Chairman of the FINRA’s Statutory Disqualification Subcommittee of the National Business Conduct Committee. He also served on the FINRA State Liaison Committee, the Direct Participation Program Committee and as Chairman of the Nominating Committee. He is a founder and past President of the National Real Estate Investment Association. He is past President of the National Real Estate Securities and Syndication Institute and past President of the Real Estate Securities and Syndication Institute (MA Chapter). Prior to joining Boston Capital in 1981, Mr. DeAgazio was the Senior Vice President and Director of the Brokerage Division of Dresdner Securities (USA), Inc., an international investment-banking firm owned by four major European banks, and was a Vice President of Burgess & Leith/Advest. He was member of the Boston Stock Exchange for 42 years. He was on the Board of Directors of Cognistar Corporation and FurnitureFind.com and recently retired from serving as Vice-Chairman of the Board of Trustees of Bunker Hill Community College, the Board of Trustees of Junior Achievement of Massachusetts and the Board of Advisors for the Ron Burton Kid’s Training Village. He is on the Board of Corporators of Northeastern University and also is active on the Boards of numerous not-for-profit organizations. He graduated from Northeastern University. Mr. DeAgazio was selected as a director because of his extensive senior executive officer and board service experience and experience with real estate operations. | ||

| David G. Gaw | 69 | David G. Gaw has been one of our independent directors since the completion of our initial listed public offering. He previously served as one of our independent directors and chairman of our audit committee from November 2011 until September 2016. Mr. Gaw is currently a real estate project consultant. From November 2009 through January 2011, Mr. Gaw served as Chief Financial Officer of Pyramid Hotels and Resorts, a REIT that focused on hospitality properties. From September 2008 through November 2009, Mr. Gaw was engaged in managing his personal investments. From June 2007 to September 2008, he was Chief Financial Officer of Berkshire Development, a private real estate developer that focused on retail development. From April 2001 until June 2007, he served as the Senior Vice President, Chief Financial Officer and Treasurer of Heritage Property Investment Trust, Inc., a then-publicly traded REIT listed on the NYSE (NYSE:HTG). Mr. Gaw was serving in those capacities when Heritage Property engaged in its initial public offering. Mr. Gaw served as Senior Vice President of Boston Properties, Inc., a publicly traded REIT listed on the NYSE (NYSE: BXP, from 1982 - 2000, and also served as its Chief Financial Officer beginning at the time of its initial public offering in 1997. Mr. Gaw received a bachelor of science degree and an MBA from Suffolk University. Mr. Gaw was selected as a director because of his extensive experience with financial reporting, accounting and controls and REIT management. | ||

6

| Name | Age | Background, Qualification and Skills | ||

| John W. Guinee | 65 | John W. Guinee has been one of our independent directors since January 2021. Mr. Guinee is currently acting as a capital markets consultant and private real estate investor. From March 2005 until July 2020, he was a Managing Director of Stifel, where he covered over 40 REITs in the office, industrial, multifamily, and diversified public sectors. During his 15-year career as a REIT research analyst, Mr. Guinee led the creation of new valuation methods for REITs, including estimating premiums and discounts over replacement costs and estimating the value creation of REITs over time. From March 2003 to March 2005, he was the Executive Vice President and Chief Investment Officer for Duke Realty (NYSE: DRE), where he participated in the company’s transition from an office/industrial REIT to an industrial only REIT. Prior to that, Mr. Guinee was the Executive Vice President and Chief Investment Officer for Charles E. Smith Residential Realty, where he led the growth of the company’s portfolio from 17,000 to 30,000 multifamily units, while transitioning the company from a single market REIT to a multi-market urban oriented REIT. Beginning in 1985, he served 11 years as Managing Director of LaSalle Investment Management and LaSalle Partners. From 1982 until 1985, Mr. Guinee worked as a property manager at Hines in San Francisco. He currently serves on the Artemis Real Estate Partners Advisory Board and the board of the Irvine Nature Center. Mr. Guinee received a Bachelor of Arts degree in economics from the University of Virginia and an MBA from the Darden School of Business at the University of Virginia. Mr. Guinee was selected as a director because of his extensive experience in real estate investments and capital markets transactions. | ||

| Caitlin Murphy | 34 | Ms. Murphy is one of our independent directors, a position she has held since April 2021. Ms. Murphy founded Global Gateway Logistics, a global freight forwarding and trade consulting firm, in September 2017 and has been Chief Executive Officer since that time. Prior to founding Global Gateway Logistics, she was Director of Business Development for Axis Worldwide Supply Chain & Logistics from September 2015 through April 2017. Prior to that, Ms. Murphy was an International General Commodities Specialist for UniGroup Worldwide Logistics, and she began her career with IM Force in Beijing, China as an Associate in business development and marketing. During her 11-year career in domestic and global logistics, Ms. Murphy managed an extensive portfolio of large scale domestic and global hospitality logistics and warehousing projects. Ms. Murphy received a BSBA in International Business from the University of Missouri and attended Peking University. She is on the board of Camp Circle Star, a Missouri based nonprofit organization that provides camp opportunities for children with disabilities throughout the region. Ms. Murphy was selected as a director because of her extensive experience in the logistics industry and firsthand knowledge of industrial markets throughout the Midwest, including the fundamentals driving demand for industrial space. | ||

| Pendleton P. White, Jr. | 61 | Pendleton P. White, Jr. is our President and Chief Investment Officer and one of our directors. He has served in these positions since the formation of the Company. Along with Mr. Witherell, Mr. White actively participates in the management of our company and is primarily responsible for its overall investment strategy and acquisition activities. Mr. White has over 25 years of experience in commercial real estate, serving in numerous capacities including investment banking, property acquisitions and leasing. From November 2008 through March 2011, Mr. White was engaged in the formation of Plymouth Group Real Estate. Prior to that, Mr. White was Executive Vice President and Managing Director at Scanlan Kemper Bard (SKB) from September 2006 through November 2008, where he ran SKB’s East Coast office and managed the funding of SKB Real Estate Investors Fund I. From March 2002 through September 2006, Mr. White was employed as an investment executive with Franklin Street Properties Corp., a publicly traded REIT, and its subsidiary, FSP Investments LLC. During that time, Mr. White was involved in the acquisition and syndication of numerous structured REITs throughout the United States. From 1997 to 2001, Mr. White was Principal and Director of North Shore Holdings, a family-owned real estate investment firm. From 1993-1997, Mr. White was Co-Director of Investment Sales at Coldwell Banker Commercial Real Estate Services (now CBRE) and was responsible for overseeing the acquisition and disposition of commercial properties throughout New England. Mr. White also was Vice President at Spaulding & Slye (now Jones Lang LaSalle) from 1991-1993 and Senior Sales Consultant at the Charles E. Smith Companies (now Vornado), in Washington, DC, from 1987-1992 and was responsible for property leasing and investment sale transactions. Mr. White began his career at Coldwell Banker in 1982. Since then, he has been involved in over $1 billion of real estate transactions either serving as a broker, investor, consultant or investment banker. Mr. White received a Bachelor of Science degree from Boston University and is a member of several real estate organizations. Mr. White was selected as a director because of his extensive knowledge and insight regarding industrial properties and detailed knowledge of our acquisition and operational opportunities and challenges. | ||

7

| Name | Age | Background, Qualification and Skills | ||

| Jeffrey E. Witherell | 56 | Jeffrey E. Witherell is our Chief Executive Officer and Chairman of the Board and has held these positions since the formation of the Company. Mr. Witherell oversees all aspects of our business activities, including the acquisition, management and disposition of assets. Mr. Witherell has been involved in real estate investment, development and banking activities for over 25 years. He, along with Mr. White, formed Plymouth Industrial REIT in 2011. From April 2008 through 2011, Mr. Witherell was engaged in the formation and operation of Plymouth Group Real Estate and Plymouth Real Estate Capital LLC, a FINRA registered broker/dealer. From April 2000 to March 2008, Mr. Witherell was employed as an investment executive with Franklin Street Properties Corp., a publicly traded REIT, and its subsidiary, FSP Investments LLC. During that time, Mr. Witherell was involved in the acquisition and syndication of 34 separate property investments, structured as single asset REITs, in 12 states, which raised in the aggregate approximately $1.2 billion. From 1999 to 2000, he was affiliated with IndyMac Bank where he was responsible for closed-loan acquisitions. From 1996 to 1999, Mr. Witherell was COO for GAP LP, a real estate investment firm where he was responsible for the acquisition and subsequent development of several real estate investments in Pennsylvania, Massachusetts, Wyoming and Nova Scotia, Canada. From 1994 to 1996, he founded and served as president of Devonshire Development, Inc., a Massachusetts based real estate development firm, where he was responsible for the acquisition and subsequent development of several real estate ventures. From 1990 to 1994, he was vice president of property management at New Boston Management, Inc., a Boston based real estate management firm. His responsibilities included property management and property disposition services. From 1987 to 1990, he was vice president of development for Kirkwood Development, an Oklahoma City based real estate development firm. His responsibilities included the development and construction of twelve development projects throughout New England. From 1982 to 1987, Mr. Witherell was employed at Dewsnap Engineering, a Boston based civil engineering and land surveying firm, where he was responsible for performing land surveying, permitting, design, and construction management services. Mr. Witherell graduated from Emmanuel College in Boston with a Bachelor of Science degree in business, earned his MBA from Endicott College and is a member of several real estate organizations. He is a board member of AdventCare Inc., a Massachusetts based nonprofit organization that owns and operates skilled nursing facilities. In addition, he is a member of the Advisory Board at the Ohio State University Center for Real Estate. Mr. Witherell was selected as a director because of his ability to lead our company and his detailed knowledge of our strategic opportunities, challenges, competition, financial position and business. |

Each of the persons listed above has been nominated by our Board of Directors to serve as a director for a one-year term expiring at the annual meeting of stockholders occurring in 2022. Each nominee has consented to serve on our Board of Directors. If any nominee were to become unavailable to serve as a director, our Board of Directors may designate a substitute nominee. In that case, the persons named as proxies on the accompanying proxy card will vote for the substitute nominee designated by our Board of Directors.

Required Vote

Directors are elected by a plurality vote; the nominees who receive the highest number of votes cast, up to the number of directors to be elected in that class, are elected.

Our Board of Directors unanimously

recommends a vote “FOR” the election of each of the eight

nominees for director to the Board of Directors.

8

CORPORATE GOVERNANCE

Corporate Governance Profile

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| Annual election of directors |

| Regular executive sessions of independent directors |

| Independent board: six of our eight directors are “independent” under NYSE rules |

| Lead independent director |

| All members of the audit committee, compensation committee and nominating and corporate governance committee are “independent” under NYSE rules |

| Two of the four members of the audit committee qualify as "audit committee financial experts" as defined by the SEC |

| Annual board, committee and director self-evaluations, assisted by outside counsel |

| Stockholder ability to amend bylaws |

| No stockholder rights plan (i.e., “poison pill”) without stockholder approval or ratification |

| Opted out of Maryland control share acquisition and business combination statutes and may not opt back in without stockholder approval |

| Anti-hedging and anti-pledging policies |

| Code of business conduct and ethics for employees and directors |

Our directors stay informed about our business by attending meetings of our board of directors and its committees and through supplemental reports and communications. As warranted, our independent directors meet in executive sessions without the presence of our corporate officers or non-independent directors.

Board Leadership Structure

Our business is managed through the oversight and direction of our Board of Directors. Our Board of Directors currently consists of eight members: Martin Barber, Philip S. Cottone, Richard J. DeAgazio, David G. Gaw, John W. Guinee, Caitlin Murphy, Pendleton P. White, Jr. and Jeffrey E. Witherell. Assuming that all of our nominees for director are elected, after the Annual Meeting there will be eight directors, each of whom will have been elected for a one-year term. Our Board has determined that each of Martin Barber, Philip S. Cottone, Richard J. DeAgazio, David G. Gaw, John W. Guinee and Caitlin Murphy is an “independent director” as defined under the listing rules of the NYSE, Rule 10A-3 under the Exchange Act and the Company’s Corporate Governance Guidelines.

Our Board considered the relationships between our directors and the Company when determining each director’s status as an “independent director” under the listing rules of the NYSE, Rule 10A-3 of the Exchange Act and the Company’s Corporate Governance Guidelines, including the relationships listed below under “Certain Relationships and Related Party Transactions.” The Board determined that these relationships did not affect any director’s status as an “independent director.” Furthermore, we are not aware of any family relationships between any director, executive officer or person nominated to become a director or executive officer.

As required by the NYSE rules, the independent directors of our Board of Director meet in executive session, without the presence of management or non-independent directors. Generally, these executive sessions follow each quarterly meeting. In 2020, the independent directors of our Board of Directors and our Audit Committee met in executive session four times (at each respective quarterly meeting). Our lead independent director, Mr. Gaw, presides over such independent, non-management sessions of our Board and our Audit Committee (Mr. Gaw is the chairman of our Audit Committee).

9

Jeffrey E. Witherell, our Chief Executive Officer, serves as Chairman of the Board of the Company. We have chosen a Board leadership structure with Mr. Witherell serving as our Chairman because we believe this structure results in a single voice speaking for the Company and presents a unified and clear chain of command to execute our strategic initiatives and business plans. Also, the Chairman of the Board manages the Board in performing its duties and leads Board discussions. As our Chief Executive Officer, Mr. Witherell is ideally positioned to provide insight on the current status of our overall operations, our future plans and prospects and the risks that we face. Thus, he is the individual with the most knowledge about us and our operations and is responsible for leading the Board’s discussions. The Board retains the authority to separate the positions of chairman and chief executive officer if it finds that the Board’s responsibilities can be better fulfilled with a different structure. Since the chairman and the chief executive officer are the same person, our Board of Directors has designated a lead independent director to coordinate the activities of the other non-management directors and to perform any other duties and responsibilities that our Board of Directors may deem to be advisable. Mr. Gaw serves as our lead independent director and his responsibilities include: (1) serving as liaison between our chairman and the independent directors, (2) reviewing the type of information to be sent our Board of Directors, (3) reviewing, in consultation with our chairman and others, agendas and schedules for board meetings and (4) having the authority to call meetings of the independent directors.

We have implemented procedures for interested parties, including stockholders, to communicate directly with our independent directors. We believe that providing a method for interested parties to communicate directly with our independent directors rather than our full Board of Directors, provides a more confidential, candid and efficient method of relaying any interested party’s concerns or comments. See “Communications with our Board of Directors, Independent Directors and the Audit Committee.”

Role of the Board in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from its three standing committees, the audit committee, the nominating and corporate governance committee and the compensation committee, each of which addresses risks specific to their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken and will take to monitor and control these exposures, including, setting guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements in addition to oversight of the performance of our system of internal controls and reporting. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Our Board of Directors held 29 meetings in 2020. In 2020, our directors attended all of our Board meetings as well as all of the meetings of the committees on which they served.

Board Committees

Our Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The principal functions of each committee are briefly described below. We comply with the listing requirements and other rules and regulations of the NYSE, as amended or modified from time to time, and each of these committees is comprised exclusively of independent directors. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of our Company.

Audit Committee

Our Audit Committee consists of Messrs. Cottone, DeAgazio, Gaw and Guinee, with Mr. Gaw serving as chairman. Each of Mr. Gaw and Mr. Guinee qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NYSE corporate governance listing standards. Our Board of Directors has determined that each of the Audit Committee members is “financially literate” as that term is defined by the NYSE corporate governance listing standards. We have adopted an audit committee charter, which details the principal functions of the Audit Committee, including oversight related to:

| • | our accounting and financial reporting processes; | |

| • | the integrity of our consolidated financial statements and financial reporting process; | |

| • | our systems of disclosure controls and procedures and internal control over financial reporting; | |

| • | our compliance with financial, legal and regulatory requirements; | |

| • | the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; and | |

| • | our overall risk profile. |

10

Our Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee also prepares the Audit Committee Report required by SEC regulations to be included in this proxy statement.

Our Audit Committee met five times in 2020. A copy of the charter of our Audit Committee is available on the investor relations webpage of our website, www.plymouthreit.com.

Compensation Committee

Our Compensation Committee consists of Messrs. Barber, DeAgazio and Gaw, with Mr. Barber serving as chairman. We have adopted a compensation committee charter, which details the principal functions of the Compensation Committee, including:

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to our chief executive officer’s compensation, evaluating our chief executive officer’s performance in light of such goals and objectives and determining and approving the remuneration of our chief executive officer based on such evaluation; | |

| • | reviewing and approving the compensation of all of our other officers; | |

| • | reviewing our executive compensation policies and plans; | |

| • | implementing and administering our incentive compensation equity-based remuneration plans; | |

| • | assisting management in complying with our proxy statement and annual report disclosure requirements; | |

| • | producing a report on executive compensation to be included in our annual proxy statement; and | |

| • | reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. |

Our Compensation Committee met two times in 2020. A copy of the charter of our Compensation Committee is available on the investor relations webpage of our website, www.plymouthreit.com.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Messrs. Barber, DeAgazio and Cottone, with Mr. DeAgazio serving as chairman. We have adopted a nominating and corporate governance committee charter, which details the principal functions of the Nominating and Corporate Governance Committee, including:

| • | identifying and recommending to the full board of directors qualified candidates for election as directors to fill vacancies on the board and/or recommending nominees for election of directors at the annual meeting of stockholders; | |

| • | developing and recommending to our board of directors corporate governance guidelines and implementing and monitoring such guidelines; | |

| • | reviewing and making recommendations on matters involving the general operation of our board of directors, including board size and composition, and committee composition and structure; | |

| • | recommending to our board of directors nominees for each committee of our board of directors; | |

| • | annually facilitating the assessment of our board of directors’ performance as a whole and of the individual directors, as required by applicable laws, regulations and the NYSE corporate governance listing standards; and | |

| • | overseeing our board of directors’ evaluation of management. |

In identifying and recommending nominees for election as directors, the nominating and corporate governance committee may consider diversity of relevant experience, expertise and background.

Our Nominating and Corporate Governance Committee met one time in 2020. A copy of the charter of the Nominating and Corporate Governance Committee is available on the investor relations webpage of our website, www.plymouthreit.com. Our Corporate Governance Guidelines and Code of Ethics and Business Conduct are also available on the investor relations webpage of our website, www.plymouthreit.com. If we make any substantive amendment to the code of ethics or grant any waiver, including any implicit waiver, from a provision of the code of ethics to certain executive officers, we are obligated to disclose the nature of such amendment or waiver, the name of the person to whom any waiver was granted, and the date of waiver on our website or in a report on Form 8-K.

Usually, nominees for election to the Board are proposed by the current members of the Board. Our Nominating and Corporate Governance Committee will also consider candidates that stockholders and others recommend. Stockholder recommendations should be addressed to: Pendleton P. White, Jr., Corporate Secretary, 20 Custom House Street, 11th Floor, Boston, Massachusetts 02110. Your recommendations must be submitted to us no earlier than December 1, 2021 and no later than 5:00 p.m., Eastern Time on December 31, 2021 for consideration as a possible nominee for election to the Board at our 2022 annual meeting.

11

Communications with our Board of Directors, Independent Directors and the Audit Committee

Our full Board of Directors can be contacted by any party by addressing the correspondence to the Board of the Directors or the independent directors and submitting the correspondence to Pendleton P. White, Jr., our Corporate Secretary, in one of the following ways:

| • | By writing to Plymouth Industrial REIT, Inc., 20 Custom Street, 11th Floor, Boston, Massachusetts 02110, Attention: Corporate Secretary; | ||

| • | By e-mail to pen.white@plymouthrei.com; or | ||

| • | By phone at 617-340-3814. |

Our independent directors can be contacted by addressing correspondence to the address set forth above. In addition, appropriate e-mail correspondence can be sent to our lead independent director at the following address: leadindependendirector@plymouthreit.com.

Relevant communications are distributed to the Board or any individual director or directors, as appropriate, depending on the facts and circumstances outlined in the communications. In that regard, the Board has requested that certain items that are unrelated to the duties and responsibilities of the Board should be excluded or redirected, as appropriate, such as: business solicitations, junk mail and mass mailings, resumes and other forms of job inquiries and surveys. In addition, material that is unduly hostile, threatening, potentially illegal or similarly unsuitable will be excluded; however, any communication that is excluded will be made available to any outside director upon request.

The Audit Committee has adopted a process for anyone to send communications to the Audit Committee with concerns or complaints concerning our regulatory compliance, accounting, audit or internal controls. The Audit Committee may be contacted by any party via mail or e-mail at the addresses listed below:

Chairman

Audit Committee

Plymouth Industrial REIT, Inc.

20 Custom House Street, 11th Floor

Boston, Massachusetts 02110

auditcommittee@plymouthreit.com

Code of Ethics and Business Conduct

Our Board of Directors has established a Code of Ethics and Business Conduct that applies to our officers, directors and employees. Among other matters, our Code of Ethics and Business Conduct is designed to deter wrongdoing and to promote:

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; | |

| • | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; | |

| • | compliance with laws, rules and regulations; | |

| • | prompt internal reporting of violations of the code to appropriate persons identified in the code; and | |

| • | accountability for adherence to the code of business conduct and ethics. |

Any waiver of the Code of Ethics and Business Conduct for our executive officers or directors must be approved by a majority of our independent directors, and any such waiver shall be promptly disclosed as required by law or NYSE Regulations. Our Code of Ethics and Business Conduct, which is posted on our website (www.plymouthreit.com), is a “code of ethics,” as defined in Item 406(b) of Regulation S-K. The information contained on, or accessible from, our website is not part of this proxy statement by reference or otherwise. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Ethics and Business Conduct on our website.

Director Compensation

Our board of directors has approved a compensation program for our non-employee directors, which consists of annual retainer fees and long-term equity awards. The material terms of the program are described below:

12

2020 Compensation of Directors

The following table sets forth compensation paid during 2020 to each of our non-employee directors:

| Fees Earned or Paid | ||||||||||||||||||||

| Name | Fees Paid in Cash(1) | Fees Paid in Stock | Stock Awards(2) | All Other Compensation | Total | |||||||||||||||

| Martin Barber | $ | 30,000 | $ | — | $ | 35,007 | $ | — | $ | 65,007 | ||||||||||

| Philip S. Cottone | $ | 25,000 | $ | — | $ | 35,007 | $ | — | $ | 60,007 | ||||||||||

| Richard J. DeAgazio | $ | 30,000 | $ | — | $ | 35,007 | $ | — | $ | 65,007 | ||||||||||

| David G. Gaw | $ | 30,000 | $ | — | $ | 35,007 | $ | — | $ | 65,007 | ||||||||||

_____________

| (1) | This column represents non-employee director annual retainer and additional annual retainer amounts, 100% of which was paid in cash and 0% was paid in shares of our common stock in lieu of cash. |

| (2) | Represents the grant date fair value computed in accordance with FASB ASC Topic 718 of awards of restricted stock to the non-employee directors under the Second Amended and Restated 2014 Incentive Award Plan, or the 2020 Director Awards, with each award vesting on the earlier to occur of (a) the date of the annual meeting of stockholders immediately following the grant date and (b) the first anniversary of the grant date, subject in each case to the director's continued service as a director of the Company. |

Cash Compensation

Under the program, each non-employee director will be entitled to receive an annual cash retainer of $25,000. In addition, each committee chairperson will receive a $5,000 annual cash retainer. Annual retainers will be paid in cash quarterly in arrears.

Equity Compensation

In addition, under the Second Amended and Restated 2014 Incentive Award Plan (the “Incentive Award Plan”), each non-employee director who is serving on our Board of Directors as of the date of each annual meeting of stockholders, will be granted an award of restricted stock in a denominated dollar value equal to $35,000. These awards will vest on the earlier to occur of (a) the date of the annual meeting of stockholders immediately following the grant date and (b) the first anniversary of the grant date, subject in each case to continued service on our Board of Directors.

13

ENVIRONMENTAL STEWARDSHIP, SOCIAL RESPONSIBILITY AND GOVERNANCE

The Company and its Board of Directors are focused on building and maintaining a socially responsible and sustainable business that succeeds by delivering long-term value for our stockholders. Set forth below is an overview of the Company’s ongoing process to implement ESG strategies.

Environmental Stewardship

We are demonstrating our commitment to environmental sustainability by operating, redeveloping and upgrading our existing buildings located in primary and secondary markets within the main industrial, distribution and logistics corridors of the United States. During the upgrading and/or redevelopment of our buildings, wherever possible, we attempt to recycle building materials and focus on design solutions that reduce our impact on the environment by using environmentally friendly building materials and systems. In addition, we are installing energy efficient lighting in our buildings and have been pursuing solar panel installations in certain markets.

Social Responsibility

We recognize that our success is driven by the talent, knowledge and experience of our employees. We strive to establish a workforce that reflects diversity and includes employees who possess a broad range of backgrounds and skillsets. We are comprised of exceptional people collaborating as a team to accomplish our goals. Our employees are encouraged to make healthy lifestyle decisions that can ultimately benefit the Company by reducing insurance claims and boosting productivity.

We are aware of the importance of housing in our community and are committed to providing assistance to organizations that provide shelter and affiliated services to those in need. We support our employees in giving back to their communities and match a portion of employee donations to qualifying nonprofit organizations.

Respect for human rights is one of the Company’s fundamental values. We comply with all applicable human rights and labor rights laws. We expect our vendors and suppliers to adhere to these laws and encourage them to adopt similar policies within their own businesses.

Governance

We are committed to strong corporate governance and transparency for our stockholders. Our directors stand for election every year. We have opted out of anti-takeover provisions and stockholder rights plans and we will not opt back in to those provisions without stockholder approval. Our directors and employees comply with a comprehensive Code of Ethics and Business Conduct that encourages honesty, accountability and mutual respect, and offers communication channels for addressing any issues.

Our long-term incentive compensation plan is fully aligned with the goals of our stockholders and our employees. We believe that our executive officers, directors and employees should own a meaningful equity interest in the Company to more closely align their interests with those of our stockholders.

14

PROPOSAL 2

APPROVAL OF STOCK ISSUANCE PROPOSAL

Our Board of Directors is seeking stockholder approval, as required by NYSE Rule 312.03(c), to permit the conversion of the Company’s Series B Convertible Redeemable Preferred Stock (the “Series B Preferred Stock”) into shares of the Company’s common stock in an aggregate amount exceeding 19.99% of the amount of common stock outstanding at the time the Series B Preferred Stock was originally issued.

Transaction Background

As previously disclosed, in December 2018, the Company issued 4,411,764 shares of its Series B Preferred Stock to MIRELF VI Pilgrim, LLC, an affiliate of Madison International Realty Holdings, LLC (the “Investor”), for an aggregate purchase price of $75.0 million. The proceeds of the issuance of the Series B Preferred Stock were used to acquire additional industrial properties and to repay certain indebtedness.

The shares of Series B Preferred Stock have a liquidation preference in an amount per share equal to the greater of (1) an amount necessary for the Investor to receive a 12% annual rate of return on the issue price of $17.00 and (2) $21.89 (subject to adjustment), plus accrued and unpaid cash dividends (the “Liquidation Preference”). The Series B Preferred Stock bears cumulative dividends, payable in cash, at a rate of (a) 3.75% through and including December 31, 2021, (b) 4.00% from January 1, 2022 through and including December 31, 2022, (c) 6.50% from January 1, 2023 through and including December 31, 2023, (d) 12.00% from January 1, 2024 through and including December 31, 2024 and (e) 15.00% from and after January 1, 2025.

The Series B Preferred Stock is convertible at the option of the Investor from and after January 1, 2022. Any conversion of shares of Series B Preferred Stock may be settled by the Company, at its option, in shares of common stock, cash or any combination thereof. However, unless and until the Company’s stockholders have approved (“Stockholder Approval”) the issuance of greater than 19.99% of the outstanding shares of common stock as of the date of the issuance of the Series B Preferred Stock (which amount was 4,821,876 shares), the Series B Preferred Stock may not be converted into more than 963,893 shares of common stock. Each share of Series B Preferred Stock is convertible into a number of shares of common stock equal to the greater of (i) one (1) share of common stock or (ii) the quotient of the Liquidation Preference divided by the 20-day VWAP.

Requirement for Stockholder Approval

The Company’s common stock is listed on the New York Stock Exchange. Rule 312.03(c) of the New York Stock Exchange Listed Company Manual and the terms of the Series B Preferred Stock require Stockholder Approval in order for the Company to be able to issue more than 19.99% of its outstanding common stock at the time of issuance of the Series B Preferred Stock upon the conversion thereof. Our Board of Directors is not seeking the approval of the Company’s stockholders to authorize the issuance of the Series B Preferred Stock. The issuance and sale of the shares of Series B Preferred Stock has already occurred and such shares will remain outstanding regardless of the outcome of the vote on this proposal. The failure of the Company’s stockholders to approve this proposal will only mean that the Series B Preferred Stock cannot be converted into more than 963,893 shares of common stock.

Vote Required

Approval of this proposal requires the affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on this proposal. Accordingly, abstentions have the same effect as a vote against this proposal. In addition, this proposal is a non-routine matter, and if you hold your shares in street name through a broker, bank or other nominee, your shares may not be voted by your broker, bank or other nominee if you do not submit voting instructions.

Our Board of Directors unanimously recommends a vote “FOR” the approval of this proposal to permit the issuance of shares of common stock in excess of 19.99% of the outstanding shares of common stock as of the date of the issuance of the Series B Preferred Stock.

15

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Exchange Act, we are seeking an advisory, non-binding vote on the compensation of named executive officers as disclosed in the section of this Proxy Statement entitled “Executive Compensation.” At the 2018 annual meeting of stockholders held on May 4, 2018, our stockholders voted on, among other things, a proposal regarding the frequency of holding an advisory, non-binding vote on the compensation of the named executive officers. A majority of the votes cast on the frequency proposal were cast in favor of holding an advisory, non-binding vote on the compensation of the named executive officers every three years, which was consistent with the recommendation of our Board of Directors. Accordingly, stockholders are being asked to vote on the following advisory resolution:

RESOLVED, that the stockholders approve the compensation paid to the Company’s

executive

officers, as disclosed in the Company’s Proxy Statement pursuant to the compensation disclosure

rule of the Securities and Exchange Commission under the caption “Executive Compensation,”

including the compensation table and any related material.

The goal of the Company’s executive compensation program is to retain and reward executives who create long-term value for our stockholders. Our compensation program rewards financial and operating performance as well as leadership excellence. The overall program is designed to align the executive’s long-term interests to the attainment of financial and other performance measures that the Board believes promote the creation of long-term stockholder value and motivate the executive to remain with the Company for years. The Company’s approach to executive compensation is designed to attract and retain top talent while, at the same time, creating a close relationship between performance and compensation. The Compensation Committee and the Board believe that the design of the program, and therefore the compensation awarded to the named executive officers under the current program, fulfills this objective and is fair and reasonable. Stockholders are urged to read the “Executive Compensation” section, including the compensation tables and related narrative discussion, of this Proxy Statement, which discuss in detail the elements and implementation of the executive compensation program.

Vote Required

Although the vote on this advisory proposal is non-binding, the Compensation Committee and the Board will review the voting results in connection with their ongoing evaluation of the Company’s executive compensation program. For purposes of this advisory vote, the abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote.

Board Recommendation

The Board of Directors recommends that you vote “FOR” the advisory approval of the resolution set forth above.

16

PROPOSAL 4

RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTANTS FOR 2021

General

We are asking our stockholders to ratify the selection of PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accountants for 2021. Although current law, rules and regulations, as well as the charter of the Audit Committee, require the Audit Committee to engage, retain and supervise our independent registered public accountants, we view the selection of the independent registered public accountants as an important matter of stockholder concern and thus are submitting the selection of PwC for ratification by stockholders as a matter of good corporate practice.

The Audit Committee has appointed PwC to serve as our independent registered public accountants for the 2021 fiscal year. [A representative of PwC is expected to participate in the Annual Meeting.] If present, the representative will have the opportunity to make a statement and will be available to respond to appropriate questions. PwC has served as our independent registered public accountants and audited our financial statements since June 2020. Prior to June 2020, the Company’s independent registered public accountants were Marcum LLP.

Principal Accounting Fees and Services

The following table sets forth the aggregate fees and expenses billed to us by PwC for fiscal years 2020 and 2019

| 2020 | 2019 | |||||||

| Audit Fees | $ | 845,255 | $ | — | ||||

| Audit-Related Fees | 93,000 | — | ||||||

| Tax Fees | 284,780 | $ | 249,599 | |||||

| All Other Fees | — | — | ||||||

| Total | $ | 1,223,035 | $ | 249,599 | ||||

Audit Fees are for professional services for our annual audit, reviews of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements. Audit-related fees in fiscal year 2020 are for professional services associated with acquisition activities and SEC filings that include pro forma financial statements of acquired entities and services provided in connection with our public offerings in fiscal year 2020.

The Audit Committee maintains policies and procedures for the pre-approval of work performed by the independent auditors in that, under the Audit Committee charter, all auditor engagements must be approved in advance by the Audit Committee. All of the services provided to the Company by PwC during fiscal year 2020 were pre-approved by the Audit Committee.

Required Vote

The affirmative vote by a majority of the shares of common stock represented in person or by proxy and entitled to vote on this item will be required for the ratification of the appointment of PwC as our independent registered public accountants. Abstentions will be counted as represented and entitled to vote and will, therefore, have the effect of a negative vote. If our stockholders fail to ratify this appointment, the Audit Committee will reconsider whether to retain PwC and may retain that firm or another firm without resubmitting the matter to our stockholders. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accountant at any time during the year if it determines that such change would be in the best interests of the Company and our stockholders.

Our Board of Directors unanimously recommends a vote “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accountants for 2021.

17

REPORT OF THE AUDIT COMMITTEE

The information provided in this section shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to its proxy regulations or to the liabilities of Section 18 of the Exchange Act. The information provided in this section shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

The Audit Committee oversees our financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the preparation, consistency and fair presentation of the financial statements, the accounting and financial reporting process, the systems of internal control, and the procedures designed to ensure compliance with accounting standards, applicable laws and regulations. Management is also responsible for its assessment of the design and effectiveness of our internal control over financial reporting. Our independent registered public accountants are responsible for performing an audit in accordance with the standards of the Public Company Accounting Oversight Board (United States), or PCAOB, to obtain reasonable assurance that our consolidated financial statements are free from material misstatement and expressing an opinion on the conformity of the financial statements of the Company with U.S. generally accepted accounting principles.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements of the Company for the year ended December 31, 2020 and management’s assessment of the design and effectiveness of our internal control over financial reporting as of December 31, 2020. The discussion addressed the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The committee reviewed and discussed with the independent public accountants their judgments as to the quality of our accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards including, without limitation, the results of the integrated audit of Internal Controls over Financial Reporting and matters required to be discussed by PCAOB Auditing Standard No. 16. In addition, the committee received the written disclosures and the letter from the independent registered public accountants required by applicable requirements of the PCAOB regarding the independent registered public accountants’ communications with the Audit Committee concerning independence, discussed with the independent registered public accountants their independence from management and the Company, and considered the compatibility of non-audit services with the auditors’ independence.

The committee discussed with our independent registered public accountants the overall scope and plans for their respective audits. The committee met with the independent registered public accountants, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of the Company’s financial reporting.

In reliance upon the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in our annual report to stockholders for filing with the SEC.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including with respect to auditor independence. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and the independent registered public accounting firm. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with the standards of the PCAOB, that the financial statements are presented in accordance with generally accepted accounting principles or that PricewaterhouseCoopers LLP is in fact “independent”.

Audit Committee:

David G. Gaw (Chairman)

Philip S. Cottone

Richard J. DeAgazio

John W. Guinee

18

BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK

Directors, Executive Officers and Other Stockholders

As of April 9, 2021, we had 127 holders of record of our common stock. The following table sets forth certain information regarding the ownership of shares of our common stock as of April 9, 2021 by:

| • | each of our directors; | |

| • | each of our named executive officers; | |

| • | each person who will be the beneficial owner of more than 5% of our outstanding common stock; and | |

| • | all directors and executive officers as a group. |

The SEC has defined “beneficial ownership” of a security to mean the possession, directly or indirectly, of voting power and/or investment power over such security. A stockholder is also deemed to be, as of any date, the beneficial owner of all securities that such stockholder has the right to acquire within 60 days after that date through (1) the exercise of any option, warrant or right, (2) the conversion of a security, (3) the power to revoke a trust, discretionary account or similar arrangement or (4) the automatic termination of a trust, discretionary account or similar arrangement. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, our common stock subject to options or other rights (as set forth above) held by that person that are currently exercisable or will become exercisable within 60 days thereafter, are deemed outstanding, while such shares are not deemed outstanding for purposes of computing percentage ownership of any other person.

Unless otherwise indicated, all shares are owned directly, and the indicated person has sole voting and investment power. Except as indicated in the footnotes to the table below, the business address of the stockholders listed below is the address of our principal executive office, 20 Custom House Street, 11th Floor, Boston, Massachusetts 02110. As of April 9, 2021, we had 28,443,593 shares of common stock outstanding.

| Name | Number of Shares Beneficially Owned(1) | Percent of All Shares | ||||||

| Jeffrey E. Witherell | 138,157 | (2) | * | |||||

| Pendleton P. White, Jr. | 91,847 | (3) | * | |||||

| Daniel C. Wright | 64,916 | * | ||||||

| Martin Barber | 11,003 | * | ||||||

| Philip S. Cottone | 14,789 | * | ||||||

| Richard J. DeAgazio | 19,362 | * | ||||||

| David G. Gaw | 14,262 | * | ||||||

| John W. Guinee | 24,140 | * | ||||||

| Caitlin Murphy | — | * | ||||||

| Total Held by Executive Officers and Directors as a Group | 378,476 | 1.3% | ||||||

_________________

| * | Less than 1.0%. |

| (1) | As used herein, “beneficially owned” means the power to vote or direct the voting of shares and/or the power to dispose or direct the disposition of shares. |

| (2) | Includes 11,923 shares of common stock owned by Plymouth Group Real Estate of which Mr. Witherell may be deemed to be the beneficial owner. |

| (3) | Includes 11,923 shares of common stock owned by Plymouth Group Real Estate of which Mr. White may be deemed to be the beneficial owner. |

19

EXECUTIVE OFFICERS

The name, age, position and business experience of our named executive officers, except for Messrs. Witherell and White, is listed below. Because they are also members of our Board, information about Messrs. Witherell and White, appeared previously under Proposal 1—Election of Directors. Our executive officers serve at the discretion of the Board and are parties to employment agreements.

| Name | Age | Position | ||