Second Quarter 2018

Supplemental

| Plymouth Industrial REIT, Inc. |

| Table of Contents |

| Introduction | ||||||||

| Management, Board of Directors & Investor Contacts | 2 | |||||||

| Executive Summary | 3 | |||||||

| Transaction Activity Since IPO | 4 | |||||||

| Capitalization Analysis | 5 | |||||||

| Financial Information | ||||||||

| Consolidated Balance Sheets (unaudited) | 6 | |||||||

| Consolidated Statements of Operations - GAAP (unaudited) | 7 | |||||||

| Same Store Net Operating Income (NOI) | 8 | |||||||

| NOI | 9 | |||||||

| Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) | 10 | |||||||

| Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO) | 11 | |||||||

| Debt Overview | 12 | |||||||

| Operational & Portfolio Information | ||||||||

| Property Overview - Square Feet & Occupancy | 13 | |||||||

| Market Summary | 14 | |||||||

| Leasing Activity | 15 | |||||||

| Lease Expiration Schedule | 16 | |||||||

| Appendix | ||||||||

| Glossary | 17 | |||||||

| Forward looking statements: This supplemental package contains forward-looking statements within the meaning of the U.S. federal securities laws. We make statements in this supplemental package that are forward-looking statements, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. Our forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by our forward-looking statements are reasonable, we can give no assurance that our plans, intentions, expectations, strategies or prospects will be attained or achieved and you should not place undue reliance on these forward-looking statements. Furthermore, actual results may differ materially from those described in the forward-looking statements and may be affected by a variety of risks and factors. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. | |

| Definitions and reconciliations: For definitions of certain terms used throughout this supplemental, including certain non-GAAP financial measures, see the Glossary on pages 17. For reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures, see pages 9-11. |

2Q 2018 Supplemental

1

| Plymouth Industrial REIT, Inc. |

| Management, Board of Directors & Investor Contacts |

| Corporate | ||||

| 260 Franklin Street, Suite 700 | ||||

| Boston, Massachusetts 02110 | ||||

| 617.340.3814 | ||||

| www.plymouthreit.com | ||||

| Executive and Senior Management | ||||

| Jeffrey E. Witherell | Pendleton P. White, Jr. | Daniel C. Wright | ||

| Chief Executive Officer | President and Chief Investment | Executive Vice President | ||

| and Chairman | Officer | and Chief Financial Officer | ||

| Board of Directors | ||||

| Martin Barber | Philip S. Cottone | Richard J. DeAgazio | ||

| Independent Director | Independent Director | Independent Director | ||

| David G. Gaw | Pendleton P. White, Jr. | Jeffery E. Witherell | ||

| Independent Director | President and Chief Investment | Chief Executive Officer | ||

| Officer | and Chairman | |||

| Transfer Agent | ||||

| Continental Stock Transfer & Trust Company | ||||

| 1 State Street, 30th Floor | ||||

| New York, New York 10004 | ||||

| 212.509.4000 | ||||

| Investor Relations | ||||

| Tripp Sullivan | ||||

| SCR Partners | ||||

| 615.760.1104 | ||||

| TSullivan@scr-ir.com | ||||

2Q 2018 Supplemental

2

| Plymouth Industrial REIT, Inc. |

| Executive Summary |

| Company overview: Plymouth Industrial REIT, Inc. (NYSE American: PLYM) is a vertically integrated and self-managed real estate investment trust focused on the acquisition and operation of single and multi-tenant industrial properties located in secondary and select primary markets across the United States. The Company seeks to acquire properties that provide income and growth that enable the Company to leverage its real estate operating expertise to enhance shareholder value through active asset management, prudent property re-positioning and disciplined capital deployment. | |||

| Unaudited | |||

| As of 06/30/18 | |||

| Select Portfolio Statistics | |||

| Number of Properties | 51 | ||

| Square Footage | 9,484,117 | ||

| Occupancy | 93.4% | ||

| Weighted Average Lease Term Remaining | 3.29 | ||

| Balance Sheet ($ in thousands) | |||

| Cash | $ 12,128 | ||

| Gross Assets | $ 381,258 | ||

| Total Debt | $ 276,150 | ||

| Net Debt (Total Debt less Cash) | $ 264,022 | ||

| Net Debt / Gross Assets | 69.3% | ||

| For the three months ended June 30, | |||

| Operating results ($ in thousands) | 2018 | 2017 | |

| Total revenue | $ 12,047 | $ 5,027 | |

| Net operating income | $ 8,189 | $ 3,509 | |

| 2018 Capital Activity ($ in thousands) | |||

| Increased secured line of credit agreement with KeyBank National | 3/8/2018 | $ 45,000 | |

| Secured 10 year term loan with Minnesota Insurance | 4/30/2018 | $ 21,500 | |

| Secured term loan with KeyBank | 5/23/2018 | $ 35,700 | |

| Repaid Torchlight Mezzanine Loan | 5/24/2018 | $ (35,000) | |

| Subsequent Capital Activity: | |||

| Secured 10 year term loan with Aegon | 7/10/2018 | $ 78,000 | |

| Repaid MWG Portfolio Loan | 7/10/2018 | $ (79,800) | |

| Issued 1,102,464 common shares @ $15.60 per share | 7/23/2018 | $ 16,253 | |

| Paid down KeyBank Term Loan | 7/25/2018 | $ (4,064) | |

2Q 2018 Supplemental

3

| Plymouth Industrial REIT, Inc. |

| Transaction Activity Since IPO |

| Unaudited ($ in thousands) (at 6/30/2018) | |||||

| Acquisitions | |||||

| Location | Acquisition Date | # of Properties | Purchase Price (1) | Square Footage | Projected Initial Yield |

| Elgin/Arlington Heights, IL | 4/9/2018 | 2 | $ 15,675 | 269,999 | 8.0% |

| Elgin, IL | 12/22/2017 | 1 | 4,050 | 75,000 | 9.7% |

| Atlanta. GA | 12/21/2017 | 3 | 11,425 | 330,361 | 8.3% |

| Multiple | 11/30/2017 | 15 | 99,750 | 3,027,987 | 8.1% |

| Memphis, TN | 9/8/2017 | 1 | 3,700 | 131,904 | 8.6% |

| Memphis, TN | 8/16/2017 | 1 | 7,825 | 235,000 | 10.5% |

| Columbus, OH | 8/16/2017 | 1 | 3,700 | 121,440 | 9.0% |

| Indianapolis, IN | 8/11/2017 | 2 | 16,875 | 606,871 | 8.5% |

| Southbend, IN | 7/20/2017 | 5 | 26,000 | 667,000 | 8.5% |

| Total - Acquisitions | 31 | $ 189,000 | 5,465,562 | ||

| (1) Represents total consideration paid rather than GAAP cost basis. | |||||

2Q 2018 Supplemental

4

| Plymouth Industrial REIT, Inc. |

| Capitalization Analysis |

| Unaudited (in thousands except for per-share data and percentages) | |||||||

| Three Months Ended | |||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | ||||

| Common Stock Data | |||||||

| Weighted-Average Shares Outstanding - Basic | 3,400 | 3,647 | 3,656 | 3,636 | |||

| Weighted-Average Shares Outstanding - Diluted | 3,400 | 3,647 | 3,656 | 3,636 | |||

| High Closing Price | $ 17.91 | $ 18.52 | $ 18.98 | $ 19.00 | |||

| Low Closing Price | $ 15.09 | $ 16.25 | $ 17.22 | $ 16.50 | |||

| Average Closing Price | $ 16.99 | $ 17.46 | $ 18.15 | $ 17.90 | |||

| Closing Price (as of period end) | $ 16.00 | $ 17.18 | $ 18.48 | $ 18.21 | |||

| Dividends / Share (annualized) (1) | $ 1.50 | $ 1.50 | $ 1.50 | $ 1.50 | |||

| Dividend Yield (annualized) (2) | 9.4% | 8.7% | 8.1% | 8.2% | |||

| Common Shares Outstanding (2) | 3,556 | 3,556 | 3,819 | 3,813 | |||

| Market Value of Common Shares (2) | $ 56,896 | $ 61,092 | $ 70,579 | $ 69,433 | |||

| Total Market Capitalization (2) (3) | $ 333,046 | $ 314,217 | $ 321,704 | $ 243,258 | |||

| Equity Research Coverage (4) | |||||||

| D.A. Davidson & Co. | National Securities Corporation | ||||||

| Barry Oxford | John Benda | ||||||

| 646.885.5423 | 212.417.8127 | ||||||

| Investor Conference Call and Webcast: The Company will hold a conference call and live audio webcast, both open for the general public to hear, on August 9, 2018 at 10:00 a.m. Eastern Time. The number to call for this interactive teleconference is (412) 717-9587. A replay of the call will be available through August 16, 2018 by dialing (412) 317-0088 and entering the replay access code, 10122697. | |||||||

| (1) Based on annualized dividend declared for the quarter. |

| (2) Based on closing price and ending shares for the last trading day of the quarter. |

| (3) Market value of shares plus total debt as of quarter end. |

| (4) The analysts listed provide research coverage on the Company. Any opinions, estimates or forecasts regarding the Company's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts by the Company or its management. The Company does not by reference above imply its endorsement of or concurrence with such information, conclusions or recommendations. |

2Q 2018 Supplemental

5

| Plymouth Industrial REIT, Inc. | ||||

| Consolidated Balance Sheets (unaudited) | ||||

| (in thousands) | |||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 (1) | 9/30/2017 | ||

| Assets: | |||||

| Real estate properties: | |||||

| Land | $ 63,688 | $ 59,799 | $ 59,797 | $ 25,069 | |

| Building and improvements | 257,175 | 244,428 | 243,605 | 165,066 | |

| Less accumulated depreciation | (32,809) | (28,828) | (25,013) | (22,094) | |

| Total real estate properties, net | $ 288,054 | $ 275,399 | $ 278,389 | $ 168,041 | |

| Cash and cash equivalents | 12,128 | 13,097 | 19,163 | 10,818 | |

| Deferred lease intangibles, net | 25,020 | 25,297 | 27,619 | 16,446 | |

| Other assets | 7,430 | 5,284 | 4,782 | 2,286 | |

| Total assets | $ 332,632 | $ 319,077 | $ 329,953 | $ 197,591 | |

| Liabilities: | |||||

| Debt, net | $ 270,597 | $ 247,753 | $ 245,632 | $ 169,196 | |

| Deferred interest | - | 1,575 | 1,357 | 765 | |

| Accounts payable, accrued expenses and other liabilities | 16,864 | 15,174 | 16,015 | 7,476 | |

| Deferred lease intangibles, net | 6,657 | 6,261 | 6,807 | 1,911 | |

| Total liabilities | $ 294,118 | $ 270,763 | $ 269,811 | $ 179,348 | |

| Preferred Stock - Series A | $ 48,868 | $ 48,878 | $ 48,931 | $ - | |

| Equity: | |||||

| Common stock | $ 36 | $ 36 | $ 39 | $ 39 | |

| Additional paid in capital | 114,085 | 116,183 | 123,270 | 125,231 | |

| Accumulated deficit | (129,982) | (123,277) | (119,213) | (114,789) | |

| Total Plymouth Industrial REIT, Inc. stockholders' equity | (15,861) | (7,058) | 4,096 | 10,481 | |

| Noncontrolling interest | 5,507 | 6,494 | 7,115 | 7,762 | |

| Total equity | $ (10,354) | $ (564) | $ 11,211 | $ 18,243 | |

| Total liabilities, Series A preferred stock and equity | $ 332,632 | $ 319,077 | $ 329,953 | $ 197,591 | |

| (1) Audited consolidated financial statements and notes for the year ended December 31, 2017 are available within our 2017 Annual Report on Form 10-K. | |||||

2Q 2018 Supplemental

6

| Plymouth Industrial REIT, Inc. | |

| Consolidated Statements of Operations - GAAP (unaudited) | |

| (in thousands, except per-share amounts) | |||||||||||

| Three Months Ended | |||||||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | ||||||||

| Revenues: | |||||||||||

| Rental income | $ 9,019 | $ 8,483 | $ 6,379 | $ 4,699 | |||||||

| Tenant recoveries | 2,957 | 2,946 | 2,031 | 1,743 | |||||||

| Other revenue | 71 | 450 | 1 | 1 | |||||||

| Total revenues | $ 12,047 | $ 11,879 | $ 8,411 | $ 6,443 | |||||||

| Operating expenses: | |||||||||||

| Property related | 3,787 | 4,452 | 3,122 | 2,159 | |||||||

| Depreciation and amortization | 6,444 | 6,542 | 4,943 | 3,499 | |||||||

| General and administrative | 1,533 | 1,373 | 2,031 | 1,224 | |||||||

| Acquisition costs | - | - | 17 | 4 | |||||||

| Total operating expenses | $ 11,764 | $ 12,367 | $ 10,113 | $ 6,886 | |||||||

| Operating income | $ 283 | $ (488) | $ (1,702) | $ (443) | |||||||

| Other income (expense): | |||||||||||

| Gain on disposition of equity investment | - | - | 8 | 223 | |||||||

| Interest expense | (4,216) | (3,985) | (3,219) | (2,619) | |||||||

| Loss on debt extinguishment | (3,601) | - | - | - | |||||||

| Total other income (expense) | $ (7,817) | $ (3,985) | $ (3,211) | $ (2,396) | |||||||

| Net loss | $ (7,534) | $ (4,473) | $ (4,913) | $ (2,839) | |||||||

| Less: Net income attributable to noncontrolling interest | (829) | (463) | (489) | (157) | |||||||

| Net loss attributable to Plymouth Industrial REIT, Inc. | $ (6,705) | $ (4,010) | $ (4,424) | $ (2,682) | |||||||

| Less: Series A preferred stock dividends (2) | 956 | 956 | 723 | - | |||||||

| Less: Amount allocated to participating securities | 46 | 61 | 128 | - | |||||||

| Net income (loss) attributable to common stockholders | $ (7,707) | $ (5,027) | $ (5,275) | $ (2,682) | |||||||

| Net income (loss) attributable to common stockholders per share - basic and diluted | $ (2.27) | $ (1.38) | $ (1.44) | $ (0.74) | |||||||

| Weighted-average shares outstanding - basic | 3,400 | 3,647 | 3,656 | 3,636 | |||||||

| Weighted-average shares outstanding - diluted | 3,400 | 3,647 | 3,656 | 3,636 | |||||||

| (1) Audited consolidated financial statements and notes for the year ended December 31, 2017 are available within our 2017 Annual Report on Form 10-K. |

| (2) Preferred stock dividend for the fourth quarter of 2017 of $0.46875, which was pro-rated to $0.3542 per share to reflect the period commencing October 25, 2017 (original issue date) and ending December 31, 2017, was declared in December 2017 and paid in January 2018. |

2Q 2018 Supplemental

7

| Plymouth Industrial REIT, Inc. |

| Same Store Net Operating Income (NOI) |

| Unaudited (in thousands) | ||||||||

| Trailing four quarter same store NOI | Three Months Ended | |||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | |||||

| Same store properties | 20 | 20 | 20 | 20 | ||||

| Revenues: | ||||||||

| Rental income | $ 3,423 | $ 3,455 | $ 3,626 | $ 3,644 | ||||

| Tenant recoveries | 1,425 | 1,382 | 1,334 | 1,392 | ||||

| Total operating revenues | $ 4,848 | $ 4,837 | $ 4,960 | $ 5,036 | ||||

| Property expenses | $ 1,388 | $ 1,815 | $ 2,031 | $ 1,606 | ||||

| Same store net operating income | $ 3,460 | $ 3,022 | $ 2,929 | $ 3,430 | ||||

| Trailing two quarter same store NOI | Three Months Ended | ||||

| 6/30/2018 | 3/31/2018 | ||||

| Same store properties | 49 | 49 | |||

| Revenues: | |||||

| Rental income | $ 8,657 | $ 8,483 | |||

| Tenant recoveries | 2,945 | 2,946 | |||

| Total operating revenues | $ 11,602 | $ 11,429 | |||

| Property expenses | $ 3,707 | $ 4,452 | |||

| Same store net operating income | $ 7,895 | $ 6,977 | |||

2Q 2018 Supplemental

8

| Plymouth Industrial REIT, Inc. |

| NOI |

| Unaudited (in thousands) | ||||||

| Three Months Ended | ||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | |||

| Net loss | $ (7,534) | $ (4,473) | $ (4,913) | $ (2,839) | ||

| General and administrative | 1,533 | 1,373 | 2,031 | 1,224 | ||

| Acquisition expense | - | - | 17 | 4 | ||

| Interest expense | 4,216 | 3,985 | 3,219 | 2,619 | ||

| Depreciation and amortization | 6,444 | 6,542 | 4,943 | 3,499 | ||

| Loss on debt extinguishment | 3,601 | - | - | - | ||

| Other income | (71) | (450) | (9) | (224) | ||

| Net Operating Income | $ 8,189 | $ 6,977 | $ 5,288 | $ 4,283 | ||

2Q 2018 Supplemental

9

| Plymouth Industrial REIT, Inc. |

| Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) |

| Unaudited (in thousands) | ||||||

| Three Months Ended | ||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | |||

| Net loss | $ (7,534) | $ (4,473) | $ (4,913) | $ (2,839) | ||

| Depreciation and amortization | 6,444 | 6,542 | 4,943 | 3,499 | ||

| Interest expense | 4,216 | 3,985 | 3,219 | 2,619 | ||

| Loss on debt extinguishment | 3,601 | - | - | - | ||

| EBITDA | $ 6,727 | $ 6,054 | $ 3,249 | $ 3,279 | ||

2Q 2018 Supplemental

10

| Plymouth Industrial REIT, Inc. |

| Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO) |

| Unaudited (in thousands, except per-share amounts) | ||||||

| Three Months Ended | ||||||

| 6/30/2018 | 3/31/2018 | 12/31/2017 | 9/30/2017 | |||

| Net loss | $ (7,534) | $ (4,473) | $ (4,913) | $ (2,839) | ||

| Depreciation and amortization | 6,444 | 6,542 | 4,943 | 3,499 | ||

| Loss on debt extinguishment | 3,601 | - | - | - | ||

| Gain on disposition of equity investment | - | - | (8) | (223) | ||

| FFO | $ 2,511 | $ 2,069 | $ 22 | $ 437 | ||

| Preferred stock dividend | (956) | (956) | (723) | - | ||

| FFO attributable to common stockholders and unit holders | $ 1,555 | $ 1,113 | $ (701) | $ 437 | ||

| Deferred finance fee amortization | 466 | 387 | 259 | 202 | ||

| Acquisition costs | - | - | 17 | 4 | ||

| Non-cash interest expense | 560 | 247 | 900 | 565 | ||

| Stock compensation | 200 | 200 | 192 | 208 | ||

| Straight line rent | (461) | (357) | (82) | (32) | ||

| Above/below market lease rents | (306) | (411) | (168) | (89) | ||

| Recurring capital expenditures (1) | (350) | (992) | (227) | (63) | ||

| AFFO | $ 1,664 | $ 187 | $ 190 | $ 1,232 | ||

| Weighted average common shares and units outstanding | 3,977 | 4,232 | 4,234 | 3,913 | ||

| FFO attributable to common stockholders and unit holders per share | $ 0.39 | $ 0.26 | $ (0.17) | $ 0.11 | ||

| AFFO attributable to common stockholders and unit holders per share | $ 0.42 | $ 0.04 | $ 0.04 | $ 0.31 | ||

(1) Excludes non-recurring capital expenditures of $874, $373, $819 and $440 for the three months ending June 30, March 31, 2018, December 31, and September 30, 2017, respectively.

2Q 2018 Supplemental

11

| Plymouth Industrial REIT, Inc. |

| Debt Overview |

| Unaudited ($ in thousands) at 6/30/2018 | |||||||

| Debt Instrument - Secured Facility | Maturity | Rate | Rate Type | Properties Encumbered | Balance | % of Total Debt | |

| $45 million line of credit | August-21 | 4.75%(1) | Floating | 9 | $ 19,150 | 6.9% | |

| $120 million AIG Loan | October-23 | 4.08% | Fixed | 20 | $ 120,000 | 43.5% | |

| $79.8 million MWG Loan | November-19 | 5.08% (2) | Floating | 15 | $ 79,800 | 28.9% | |

| $35.7 million KeyBank Term Loan (4) | August-21 | 9.09% (3) | Floating | - | $ 35,700 | 12.9% | |

| $21.5 million Minnesota Life Loan | May-28 | 3.78% | Fixed | 6 | $ 21,500 | 7.8% | |

| 50 | $ 276,150 | 100.0% | |||||

| Balance Sheet ($ in thousands) at 6/30/2018 | ||||

| Cash | $ 12,128 | |||

| Gross Assets (5) | $ 381,258 | |||

| Total Debt | $ 276,150 | |||

| Net Debt | $ 264,022 | |||

| Subsquent Event | |

| On July 10, 2018, we entered into a secured loan agreement with Aegon USA Realty Advisors, as agent for one of its affiliated life insurance companies, or the Aegon Lender, in the original principal amount of $78,000. The Aegon Secured Term Loan bears interest at 4.35% per annum and has a ten-year term, maturing on August 1, 2028. The Aegon Secured Term Loan provides for monthly payments of interest only for the first year of the term and thereafter monthly principal and interest payments based on a 30-year amortization period. The borrowings under the Aegon Secured Term Loan are secured by first lien mortgages on eighteen of the Company’s properties. Proceeds from the Aegon Secured Term Loan were used to retire the outstanding borrowings under the MWG Portfolio Secured Loan. | |

| (1) Interest rate paid for the month of June 30, 2018. Borrowings under the Line of Credit Agreement bear interest at either (1) the base rate (determined from the highest of (a) KeyBank’s prime rate, (b) the federal funds rate plus 0.50% and (c) the one month LIBOR rate plus 1.0%) or (2) LIBOR, plus, in either case, a spread between 250 and 300 basis points depending on our total leverage ratio. | |

| (2) Interest rate paid for the month of June 30, 2018. Interest for the first year at a rate per annum equal to LIBOR plus 3.10% and for the second year at a rate per annum equal to LIBOR plus 3.35%. | |

| (3) Interest rate for the month of June 30, 2018. Borrowings under the KeyBank Term Loan bear interest at either (1) LIBOR plus 7% or (2) KeyBank’s base rate plus 6%. | |

| (4) The KeyBank Term Loan is secured by Plymouth Industrial REIT's equity interest within the Plymouth 20 and each of its property owning subsidiaries. | |

| (5) The carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company's consolidated financial statements. | |

2Q 2018 Supplemental

12

| Plymouth Industrial REIT, Inc. |

| Property Overview - Square Feet & Occupancy |

| Unaudited ($ in thousands) at 6/30/18 | |||||

| Property | Market | Rentable Square Feet |

Leased Square Feet |

Occupancy | |

| 32 Dart Road | Atlanta | 194,800 | 194,800 | 100.0% | |

| 1665 Dogwood Drive SW | Atlanta | 198,000 | 198,000 | 100.0% | |

| 1715 Dogwood Drive | Atlanta | 100,000 | 100,000 | 100.0% | |

| 11236 Harland Drive | Atlanta | 32,361 | 32,361 | 100.0% | |

| Subtotal - Atlanta | 525,161 | 525,161 | 100.0% | ||

| 11351 W 183rd Street | Chicago | 18,768 | 18,768 | 100.0% | |

| 11601 Central Avenue | Chicago | 260,000 | 260,000 | 100.0% | |

| 13040 South Pulaski Avenue | Chicago | 395,466 | 395,466 | 100.0% | |

| 1355 Holmes Road | Chicago | 82,456 | 82,456 | 100.0% | |

| 13970 West Laurel Drive | Chicago | 70,196 | 70,196 | 100.0% | |

| 1455-1645 Greenleaf Avenue | Chicago | 150,000 | 150,000 | 100.0% | |

| 1600 Fleetwood Drive | Chicago | 247,000 | 247,000 | 100.0% | |

| 1750 South Lincoln Drive | Chicago | 499,200 | 499,200 | 100.0% | |

| 1796 Sherwin Avenue | Chicago | 98,879 | 98,879 | 100.0% | |

| 1875 Holmes Road | Chicago | 134,415 | 134,415 | 100.0% | |

| 189 Seegers Road | Chicago | 25,000 | 25,000 | 100.0% | |

| 2401 Commerce Drive | Chicago | 78,574 | 78,574 | 100.0% | |

| 28160 North Keith Drive | Chicago | 77,924 | 77,924 | 100.0% | |

| 3 West College Drive | Chicago | 33,263 | 33,263 | 100.0% | |

| 3841-3865 Swanson Court | Chicago | 99,625 | 99,625 | 100.0% | |

| 3940 Stern Avenue | Chicago | 146,798 | 146,798 | 100.0% | |

| 440 South McLean | Chicago | 74,613 | 74,613 | 100.0% | |

| 6000 West 73rd Street | Chicago | 148,091 | 148,091 | 100.0% | |

| 6510 West 73rd Street | Chicago | 306,552 | 306,552 | 100.0% | |

| 6558 West 73rd Street | Chicago | 301,000 | 301,000 | 100.0% | |

| 6751 Sayre Avenue | Chicago | 242,690 | 242,690 | 100.0% | |

| 7200 Mason Ave | Chicago | 207,345 | 207,345 | 100.0% | |

| 5110 South 6th Street | Milwaukee | 58,500 | 58,500 | 100.0% | |

| 525 West Marquette Avenue | Milwaukee | 112,144 | 40,000 | 35.7% | |

| Subtotal - Chicago | 3,868,499 | 3,796,355 | 98.1% | ||

| Mosteller Distribution Center | Cincinnati | 358,386 | 358,386 | 100.0% | |

| 4115 Thunderbird Lane | Cincinnati | 70,000 | 70,000 | 100.0% | |

| Subtotal - Cincinnati | 428,386 | 428,386 | 100.0% | ||

| 3500 Southwest Boulevard | Columbus | 527,127 | 527,127 | 100.0% | |

| 3100 Creekside Parkway | Columbus | 340,000 | - | 0.0% | |

| 8288 Green Meadows Dr. | Columbus | 300,000 | 300,000 | 100.0% | |

| 8273 Green Meadows Dr. | Columbus | 77,271 | 77,271 | 100.0% | |

| 7001 American Pkwy | Columbus | 54,100 | 54,100 | 100.0% | |

| 2120 - 2138 New World Drive | Columbus | 121,200 | 121,200 | 100.0% | |

| Subtotal - Columbus | 1,419,698 | 1,079,698 | 76.1% | ||

| 3035 North Shadeland Ave | Indianapolis | 562,497 | 537,497 | 95.6% | |

| 3169 North Shadeland Ave | Indianapolis | 44,374 | 41,960 | 94.6% | |

| 5861 W Cleveland Road | South Bend | 62,550 | 62,550 | 100.0% | |

| West Brick Road | South Bend | 101,450 | 101,450 | 100.0% | |

| 4491 N Mayflower Road | South Bend | 77,000 | 77,000 | 100.0% | |

| 5855 West Carbonmill Road | South Bend | 198,000 | 198,000 | 100.0% | |

| 4955 Ameritech Drive | South Bend | 228,000 | 228,000 | 100.0% | |

| Subtotal - Indianapolis/South Bend | 1,273,871 | 1,246,457 | 97.8% | ||

| 6005, 6045 & 6075 Shelby Dr. | Memphis | 202,303 | 167,018 | 82.6% | |

| 210 American Dr. | Jackson | 638,400 | 638,400 | 100.0% | |

| 3635 Knight Road | Memphis | 131,904 | 131,904 | 100.0% | |

| Business Park Drive | Memphis | 235,006 | 128,457 | 54.7% | |

| Subtotal - Memphis/Jackson | 1,207,613 | 1,065,779 | 88.3% | ||

| 7585 Empire Drive | Florence, KY | 148,415 | 148,415 | 100.0% | |

| 56 Milliken Road | Portland, ME | 200,625 | 200,625 | 100.0% | |

| 4 East Stow Road | Marlton, NJ | 156,279 | 134,959 | 86.4% | |

| 1755 Enterprise Parkway | Cleveland, OH | 255,570 | 234,370 | 91.7% | |

| Subtotal - Others | 760,889 | 718,369 | 94.4% | ||

| Total - All Properties | 9,484,117 | 8,860,205 | 93.4% | ||

2Q 2018 Supplemental

13

| Plymouth Industrial REIT, Inc. |

| Market Summary |

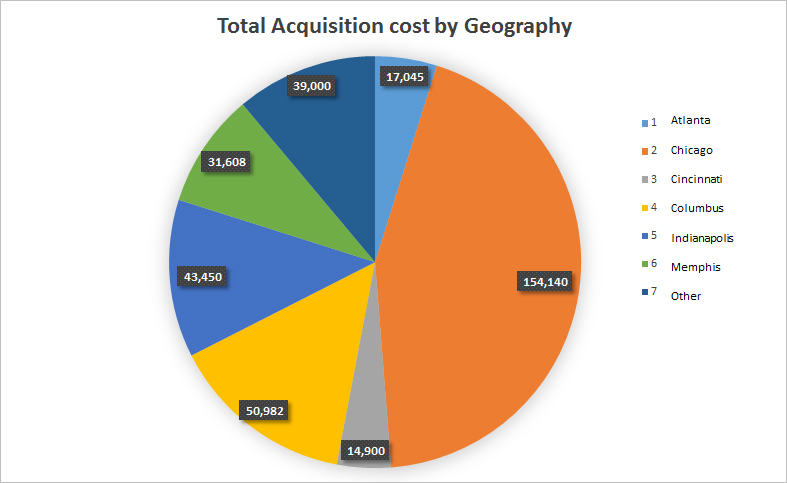

| Unaudited (SF and $ in thousands) (at 6/30/2018) | ||||||

| Geography | State | Properties | Total Acquisition Cost (1) |

Gross Real Estate Assets (2) |

% Gross Real Estate Assets | |

| Atlanta | GA | 4 | $ 17,045 | $ 15,765 | 4.9% | |

| Chicago | IL, WI | 24 | 154,140 | 143,179 | 44.6% | |

| Cincinnati | OH | 2 | 14,900 | 13,349 | 4.2% | |

| Columbus | OH | 6 | 50,982 | 48,427 | 15.1% | |

| Indianapolis/South Bend | IN | 7 | 43,450 | 38,358 | 12.0% | |

| Memphis/Jackson | TN | 4 | 31,608 | 26,345 | 8.2% | |

| Other | Various | 4 | 39,000 | 35,163 | 11.0% | |

| Total | 51 | $ 351,125 | $ 320,586 | 100% | ||

| (1) Total acquisition cost prior to allocations per US GAAP. |

| (2) The gross book value of real estate assets as of June 30, 2018 excluding $277 in leasehold improvements related to our Corporate office. Gross book value of real estate assets excludes depreciation and the allocation of the acquisition cost towards intangible asset and liabilities required by US GAAP. |

2Q 2018 Supplemental

14

| Plymouth Industrial REIT, Inc. |

| Leasing Activity |

| Year | Type | Square Footage |

Percent | Expiring Rent |

New Rent | % Change | Tenant Improvements $/SF/YR | Lease Commissions $/SF/YR |

| 2017 | Renewals | 234,679 | 84.1% | $ 4.25 | $ 4.51 | 6.2% | $ 0.07 | $ 0.13 |

| New Leases | 44,268 | 15.9% | $ 2.16 | $ 3.00 | 38.7% | $ 0.41 | $ 0.27 | |

| Total | 278,947 | 100.0% | $ 3.92 | $ 4.27 | 9.1% | $ 0.13 | $ 0.15 | |

| Q1 2018 | Renewals | 146,798 | 47.5% | $ 4.25 | $ 4.30 | 1.2% | $ - | $ 0.11 |

| New Leases | 162,119 | 52.5% | $ 3.17 | $ 3.99 | 26.1% | $ 0.09 | $ 0.04 | |

| Total | 308,917 | 100.0% | $ 3.68 | $ 4.07 | 10.6% | $ 0.05 | $ 0.07 | |

| Q2 2018 | Renewals | 146,874 | 13.1% | $ 4.83 | $ 5.00 | 3.6% | $ 0.14 | $ 0.13 |

| New Leases | 664,828 | 59.3% | $ 3.67 | $ 3.92 | 6.9% | $ 0.42 | $ 0.25 | |

| Total | 811,702 | 100.0% | $ 3.88 | $ 4.21 | 8.4% | $ 0.37 | $ 0.23 | |

| 2018 | Renewals | 293,672 | 26.2% | $ 4.54 | $ 4.65 | 2.4% | $ 0.07 | $ 0.11 |

| New Leases | 826,947 | 73.8% | $ 3.58 | $ 3.94 | 10.0% | $ 0.35 | $ 0.21 | |

| Total | 1,120,619 | 100.0% | $ 3.83 | $ 4.13 | 7.7% | $ 0.28 | $ 0.18 | |

| Total | Renewals | 528,351 | 37.8% | $ 4.41 | $ 4.59 | 4.1% | $ 0.07 | $ 0.12 |

| New Leases | 871,215 | 62.2% | $ 3.51 | $ 3.89 | 10.9% | $ 0.36 | $ 0.22 | |

| Total | 1,399,566 | 100% | $ 3.85 | $ 4.16 | 8.0% | $ 0.25 | $ 0.18 |

2Q 2018 Supplemental

15

| Plymouth Industrial REIT, Inc. |

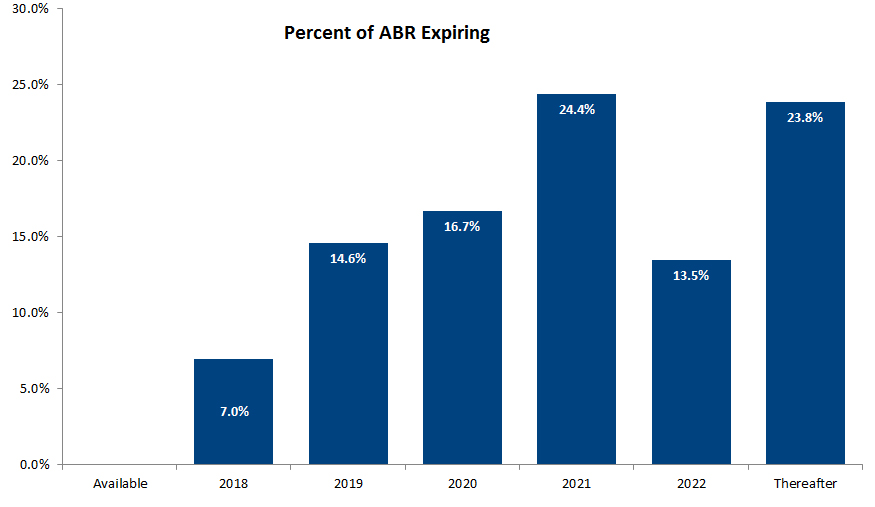

| Lease Expiration Schedule |

| Unaudited ($ in thousands) (at 6/30/2018) |

| Year | Square Footage |

Annualized Base Rent (ABR) (1) |

% of ABR Expiring (2) |

| Available | 623,911 | $ - | - |

| 2018 | 439,676 | 2,345 | 7.0% |

| 2019 | 1,480,835 | 4,897 | 14.6% |

| 2020 | 1,613,610 | 5,596 | 16.7% |

| 2021 | 2,173,308 | 8,190 | 24.4% |

| 2022 | 963,685 | 4,510 | 13.5% |

| Thereafter | 2,189,092 | 7,996 | 23.8% |

| Total | 9,484,117 | $ 33,534 | 100.0% |

| (1) Annualized base rent is calculated as monthly contracted base rent per the terms of such lease, as of June 30, 2018, multiplied by 12. Excludes billboard and antenna revenue and rent abatements. |

| (2) Calculated as annualized base rent set forth in this table divided by total annualized base rent for the Company Portfolio as of June 30, 2018. |

2Q 2018 Supplemental

16

| Plymouth Industrial REIT, Inc. |

| Glossary |

| Non-GAAP Financial Measures Definitions: |

| Net Operating Income (NOI): We consider net operating income, or NOI, to be an appropriate supplemental measure to net income because it helps both investors and management understand the core operations of our properties. We define NOI as total revenue (including rental revenue, tenant reimbursements, management, leasing and development services revenue and other income) less property-level operating expenses including allocated overhead. NOI excludes depreciation and amortization, general and administrative expenses, impairments, gain/loss on sale of real estate, interest expense, and other non-operating items. |

| EBITDA: We believe that earnings before interest, taxes, depreciation and amortization, or EBITDA, is helpful to investors as a supplemental measure of our operating performance as a real estate company because it is a direct measure of the actual operating results of our industrial properties. We also use this measure in ratios to compare our performance to that of our industry peers. EBITDA as presented herein is equal to EBITDAre as defined by NAREIT. |

| Funds From Operations attributable to common stockholders (“FFO”): Funds from operations, or FFO, is a non-GAAP financial measure that is widely recognized as a measure of REIT operating performance. We consider FFO to be an appropriate supplemental measure of our operating performance as it is based on a net income analysis of property portfolio performance that excludes non-cash items such as depreciation. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values rise and fall with market conditions, presentations of operating results for a REIT, using historical accounting for depreciation, could be less informative. We define FFO, consistent with the National Association of Real Estate Investment Trusts, or NAREIT, definition, as net income, computed in accordance with GAAP, excluding gains (or losses) from sales of property, depreciation and amortization of real estate assets, impairment losses, loss on extinguishment of debt and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. Other equity REITs may not calculate FFO (in accordance with the NAREIT definition) as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. FFO should not be used as a measure of our liquidity, and is not indicative of funds available for our cash needs, including our ability to pay dividends. |

| Adjusted Funds From Operations attributable to common stockholders (“AFFO”): Adjusted funds from operation, or AFFO, is presented in addition to FFO. AFFO is defined as FFO, excluding certain non-cash operating revenues and expenses, acquisition and transaction related costs for transactions not completed and recurring capitalized expenditures. Recurring capitalized expenditures includes expenditures required to maintain and re-tenant our properties, tenant improvements and leasing commissions. AFFO further adjusts FFO for certain other non-cash items, including the amortization or accretion of above or below market rents included in revenues, straight line rent adjustments, impairment losses, non-cash equity compensation and non-cash interest expense. We believe AFFO provides a useful supplemental measure of our operating performance because it provides a consistent comparison of our operating performance across time periods that is comparable for each type of real estate investment and is consistent with management’s analysis of the operating performance of our properties. As a result, we believe that the use of AFFO, together with the required GAAP presentations, provide a more complete understanding of our operating performance. As with FFO, our reported AFFO may not be comparable to other REITs’ AFFO, should not be used as a measure of our liquidity, and is not indicative of our funds available for our cash needs, including our ability to pay dividends. |

| Other Definitions: |

| GAAP: U.S generally accepted accounting principles. |

Gross Assets: the carrying amount of total assets plus accumulated depreciation and amortization, as reported in the Company’s consolidated financial statements. For gross assets as of June 30, 2018 and December 31, 2017, the calculation is as follows:

| 6/30/2018 | |

| Total Assets | $332,632 |

| Add back depreciation expense | 32,809 |

| Add back intangible asset amortization | 15,817 |

| Gross assets | $381,258 |

| Non-Recurring Capital Expenditures: Non-recurring capital expenditures include capital expenditures of long lived improvements required to upgrade/replace existing systems or items that previously did not exist. |

| Occupancy: We define occupany as the percentage of total leasable square footage in which either the sooner of lease term commencement or revenue recognition in accordance to GAAP has commenced as of the close of the reporting period. |

| Recurring Capital Expenditures: Recurring capitalized expenditures includes capital expenditures required to maintain and re-tenant our properties, tenant improvements and leasing commissions. |

| Same Store Portfolio: Our Same Property Portfolio is a subset of our consolidated portfolio and includes properties that were wholly-owned by us for the entire period presented. The trailing 4 quarters same store portfolio includes properties owned as of April 1, 2017, and still owned by us as of June 30, 2018. Therefore, we excluded from our Same Store Portfolio any properties that were acquired or sold during the period from April 1, 2017 through June 30, 2018. The trailing 2 quarters same store portfolio includes properties owned as of January 1, 2018, and still owned by us as of June 30, 2018. Therefore, we excluded from our Same Store Portfolio any properties that were acquired or sold during the period from January 1, 2018 through June 30, 2018. The Company's computation of same store NOI may not be comparable to other REITs. |

| Weighted average lease term remaining: The average contractual lease term remaining as of the close of the reporting period (in years) weighted by square footage. |

2Q 2018 Supplemental

17