PROSPECTUS

2,900,000 Shares

Common Stock

______________________

Plymouth Industrial REIT, Inc. is a full service, vertically integrated, self-administered and self-managed real estate investment trust, or REIT, focused on the acquisition, ownership and management of single and multi-tenant Class B industrial properties, including distribution centers, warehouses and light industrial properties, primarily located in secondary and select primary markets across the U.S. Upon completion of this offering and the Torchlight Transactions (as defined herein), we will own 100% of the interests in 20 industrial properties located in seven states with an aggregate of approximately 4.0 million rentable square feet.

This is our initial listed public offering. We are selling 2,900,000 shares of our common stock, $0.01 par value per share in this offering. In addition, concurrently with the closing of this offering, we will be privately issuing 263,158 shares of our common stock and warrants to acquire 250,000 shares of our common stock to affiliates of Torchlight Investors, LLC, or Torchlight, in connection with the Torchlight Transactions, as described herein.

Prior to this offering, there has been no public market for our common stock. Our common stock has been approved for listing, subject to official notice of issuance, on the NYSE MKT, under the symbol “PLYM.”

We were formed as a Maryland corporation in March 2011. We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2012. To assist us in maintaining our qualification as a REIT, stockholders are generally restricted from beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. Our charter contains additional restrictions on the ownership and transfer of shares of our common stock. See “Description of Stock—Restrictions on Ownership and Transfer.”

We are an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and will be subject to reduced public company reporting requirements. Investing in our common stock involves significant risks. You should read the section entitled “Risk Factors” beginning on page 16 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common stock.

| Per share | Total | |||||||

| Public offering price | $ | 19.00 | $ | 55,100,000 | ||||

| Underwriting discount (1) | $ | 1.33 | $ | 3,857,000 | ||||

| Proceeds, before expenses, to us | $ | 17.67 | $ | 51,243,000 | ||||

________________

| (1) | See “Underwriting” for additional disclosure regarding the compensation payable to the underwriters. |

The underwriters may also exercise their option to purchase up to an additional 435,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover over-allotments of shares, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of our common stock in book-entry form is expected to be made on or about June 14, 2017.

| D.A. Davidson & Co. | BB&T Capital Markets | Oppenheimer & Co. |

| National Securities Corporation | Wedbush Securities |

Janney Montgomery Scott

The date of this prospectus is June 8, 2017.

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 16 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 39 |

| USE OF PROCEEDS | 40 |

| DISTRIBUTION POLICY | 41 |

| CAPITALIZATION | 43 |

| DILUTION | 44 |

| SELECTED FINANCIAL INFORMATION | 46 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 49 |

| MARKET OVERVIEW | 64 |

| BUSINESS | 82 |

| MANAGEMENT | 98 |

| EXECUTIVE COMPENSATION | 106 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 112 |

| STRUCTURE OF OUR COMPANY | 113 |

| POLICIES WITH RESPECT TO CERTAIN ACTIVITIES | 115 |

| PRINCIPAL STOCKHOLDERS | 120 |

| DESCRIPTION OF CAPITAL STOCK | 121 |

| MATERIAL PROVISIONS OF MARYLAND LAW AND OF OUR CHARTER AND BYLAWS | 126 |

| SHARES ELIGIBLE FOR FUTURE SALE | 130 |

| DESCRIPTION OF THE PARTNERSHIP AGREEMENT OF PLYMOUTH INDUSTRIAL OP, LP. | 133 |

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | 136 |

| UNDERWRITING | 156 |

| LEGAL MATTERS | 158 |

| EXPERTS | 158 |

| WHERE YOU CAN FIND MORE INFORMATION | 158 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or any information to which we have referred you. We have not, and the underwriters have not, authorized any other person to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, in any free writing prospectus prepared by us and in any information to which we have referred you is accurate only as of their respective dates or on the date or dates which are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

i

Industry and Market Data

We use market data and industry forecasts and projections throughout this prospectus, including data from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently investigated or verified this information. Any forecasts prepared by REIS, Inc., or REIS, are based on data (including third-party data), models and experience of various professionals, and are based on various assumptions, all of which are subject to change without notice. In addition, the projections obtained from REIS that we have included in this prospectus have not been expertized and are, therefore, solely our responsibility. As a result, REIS does not and will not have any liability or responsibility whatsoever for any market data and industry forecasts and projections that are contained in this prospectus or otherwise disseminated in connection with the offer or sale of our common stock. If you purchase our common stock, your sole recourse for any alleged or actual inaccuracies in the forecasts and projections used in this prospectus will be against us. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this prospectus.

Glossary

In this prospectus:

| • | “annualized rent” means the monthly base rent for the applicable property or properties as of March 31, 2017, multiplied by 12 and then multiplied by our percentage ownership interest for such property, where applicable, and “total annualized rent” means the annualized rent for the applicable group of properties; | |

| • | “capitalization rate” means the ratio of a property’s annual net operating income to its purchase price; | |

| • | “Class A industrial properties” means industrial properties that typically possess most of the following characteristics: 15 years old or newer, square footage generally in excess of 300,000 square feet, concrete tilt-up construction, clear height in excess of 26 feet, a ratio of dock doors to floor area that is more than one door per 10,000 square feet and energy efficient design characteristics suitable for current and future tenants; | |

| • | “Class B industrial properties” means industrial properties that typically possess most of the following characteristics: more than 15 years old, clear heights between 18 and 26 feet, square footage between 50,000 and 300,000 square feet, and adequate building systems (mechanical, HVAC and utility) to deliver services currently required by tenants but which may need upgrades for future tenants; | |

| • | “Company Portfolio” means the 20 distribution centers, warehouse and light industrial properties in which our company currently has an interest and, upon completion of this offering and the Torchlight Transactions, will own 100% of the interests; | |

| • | “net operating income” or “NOI” means total revenue (including rental revenue, tenant reimbursements, management, leasing and development services revenue and other income) less property-level operating expenses including allocated overhead. NOI excludes depreciation and amortization, general and administrative expenses, impairments, gain/loss on sale of real estate, interest expense and other non-operating expenses; | |

| • | “on a pro forma basis” means after giving effect to the completion of this offering and the Torchlight Transactions and the application of the net proceeds of this offering as described under “Use of Proceeds;” | |

| • | “OP units” means units of limited partnership interest in our operating partnership; | |

ii

| • | “our operating partnership” means Plymouth Industrial OP, LP, a Delaware limited partnership, and the subsidiaries through which we will conduct substantially all of our business; | |

| • | “Plymouth,” “our company,” “we,” “us” and “our” refer to Plymouth Industrial REIT, Inc., a Maryland corporation, and its consolidated subsidiaries, except where it is clear from the context that the term only means Plymouth Industrial REIT, Inc., the issuer of the shares of common stock in this offering; | |

| • | “Preferred Interests” means the preferred membership interests issued by our subsidiary, Plymouth Industrial 20 LLC, to DOF IV Plymouth PM, LLC, an affiliate of our mezzanine lender; |

| • | “primary markets” means gateway cities and the following six largest metropolitan areas in the U.S., each generally consisting of more than 300 million square feet of industrial space: Los Angeles, San Francisco, New York, Chicago, Washington, DC and Boston; | |

| • | “secondary markets” means for our purposes non-gateway markets, each generally consisting of between 100 million and 300 million square feet of industrial space, including the following metropolitan areas in the U.S.: Atlanta, Austin, Baltimore, Charlotte, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Jacksonville, Kansas City, Memphis, Milwaukee, Nashville, Norfolk, Orlando, Philadelphia, Pittsburgh, Raleigh/Durham, San Antonio, South Florida, St. Louis and Tampa; | |

| • | “Torchlight” means Torchlight Investors, LLC and the Torchlight Entities, as applicable; | |

| • | “Torchlight Entities” means DOF IV REIT Holdings, LLC and DOF IV Plymouth PM, LLC, both of which are managed by Torchlight Investors, LLC; and | |

| • | “Torchlight Transactions” means the redemption of the Preferred Interests for $25.0 million, which will be paid by a combination of $20.0 million in cash with a portion of the net proceeds of this offering and 263,158 shares of common stock issued to Torchlight in a private placement, and the private issuance of warrants to Torchlight to acquire 250,000 shares of common stock, in each case concurrently with the closing of this offering. See “Prospectus Summary—Torchlight Transactions.” |

Our definitions of Class A industrial properties, Class B industrial properties, primary markets and secondary markets may vary from the definitions of these terms used by investors, analysts or other industrial REITs.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more detailed explanations of NOI, Earnings Before Interest, Taxes, Depreciation and Amortization, or EBITDA, and reconciliations of NOI, EBITDA and Funds from Operations, or FFO, to net income computed in accordance with U.S. generally accepted accounting principles, or GAAP.

iii

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. You should read carefully the entire prospectus, including “Risk Factors,” our financial statements, pro forma financial information, and related notes appearing elsewhere in this prospectus, before making a decision to invest in our common stock.

Unless indicated otherwise, the information included in this prospectus assumes (i) no exercise of the underwriters’ option to purchase up to 435,000 additional shares of our common stock to cover over-allotments, if any, and (ii) the completion of the Torchlight Transactions.

In addition, on April 21, 2017, our stockholders approved a one-for-four reverse stock split of our common stock. Effective May 1, 2017, we amended our charter to give effect to the reverse stock split with respect to all of our then-outstanding common stock. All share data included in this prospectus give retroactive effect to the stock split and related amendment to our charter. The reverse stock split had no effect on the shares authorized under our charter.

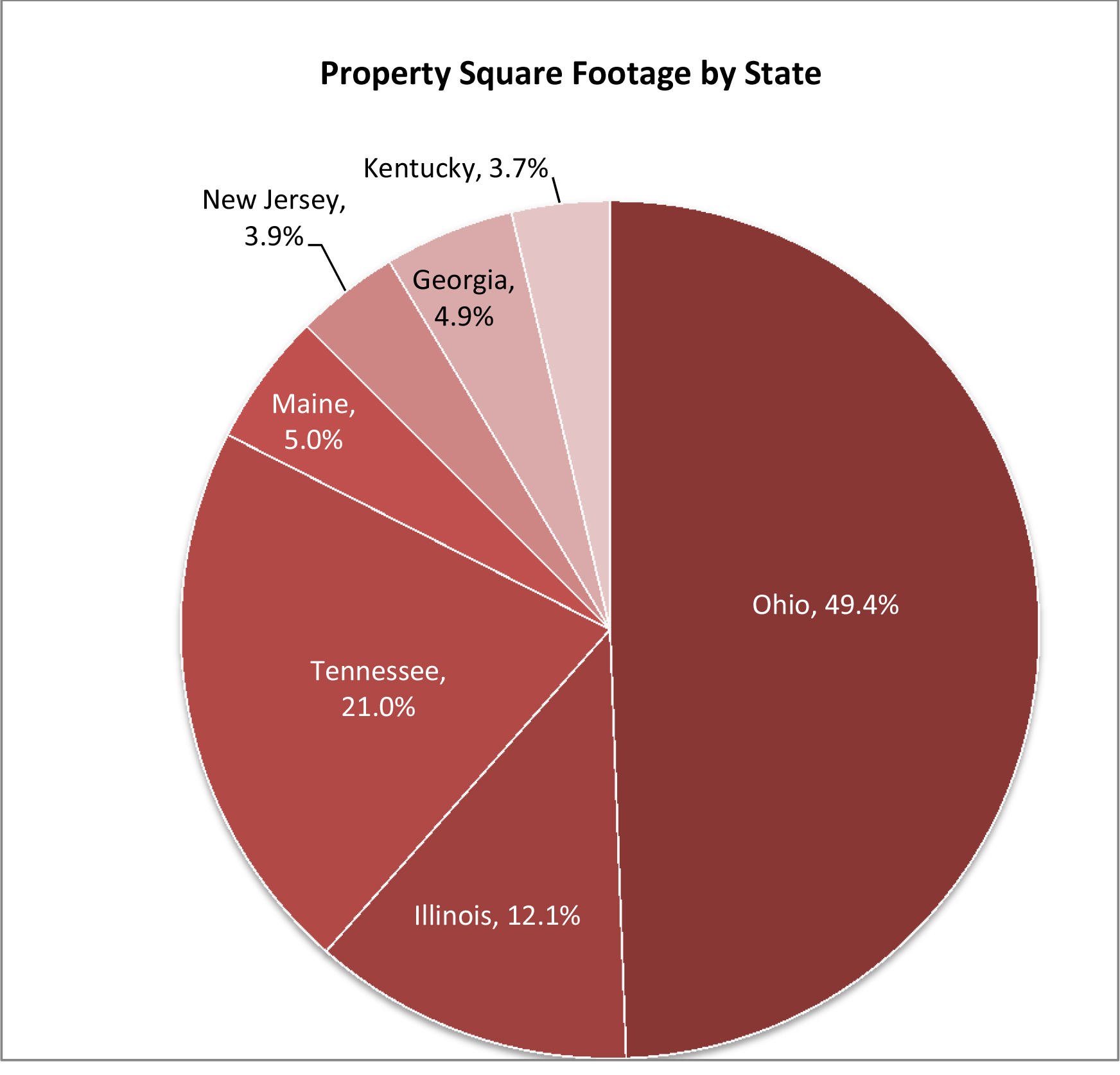

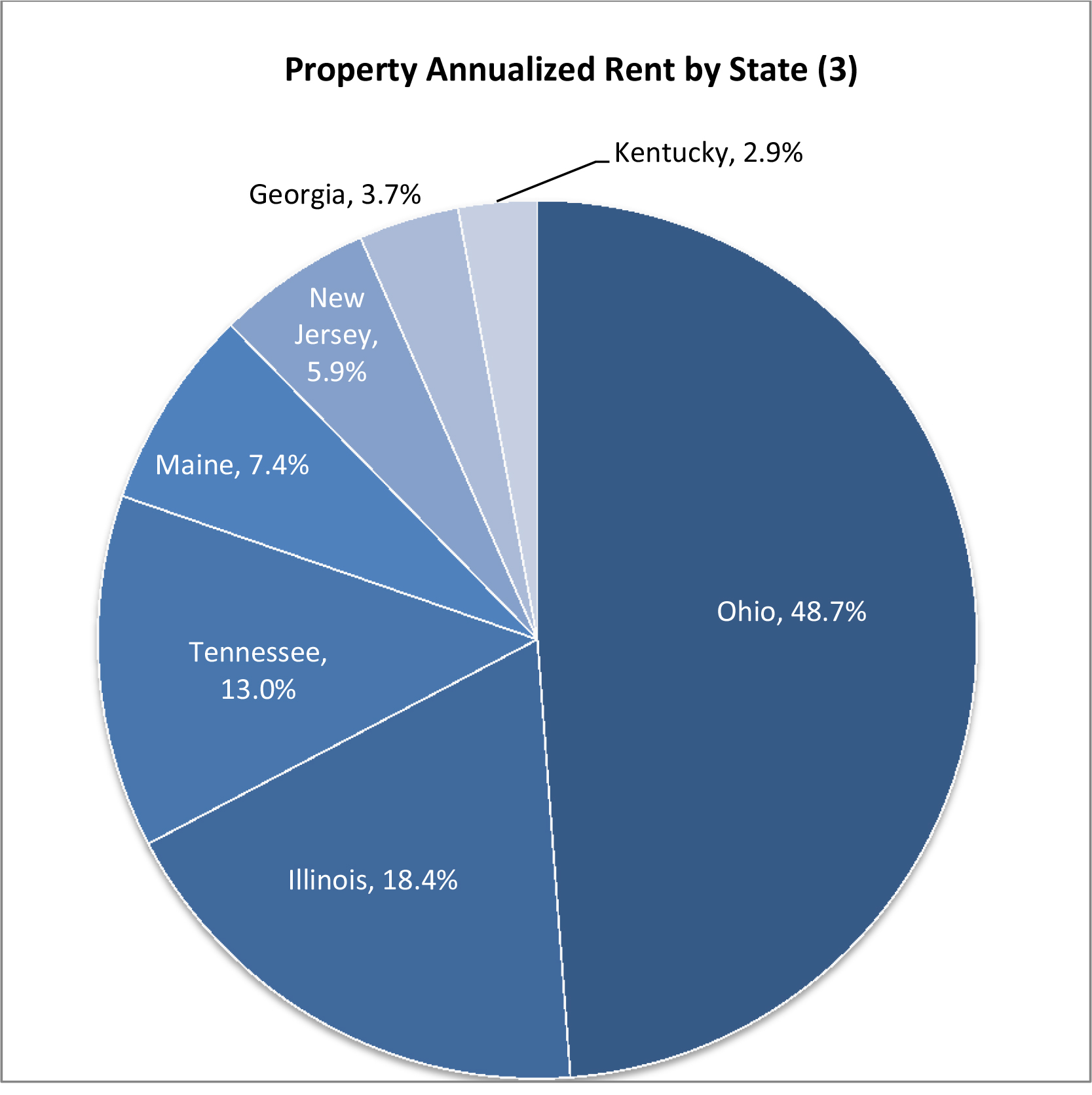

Overview

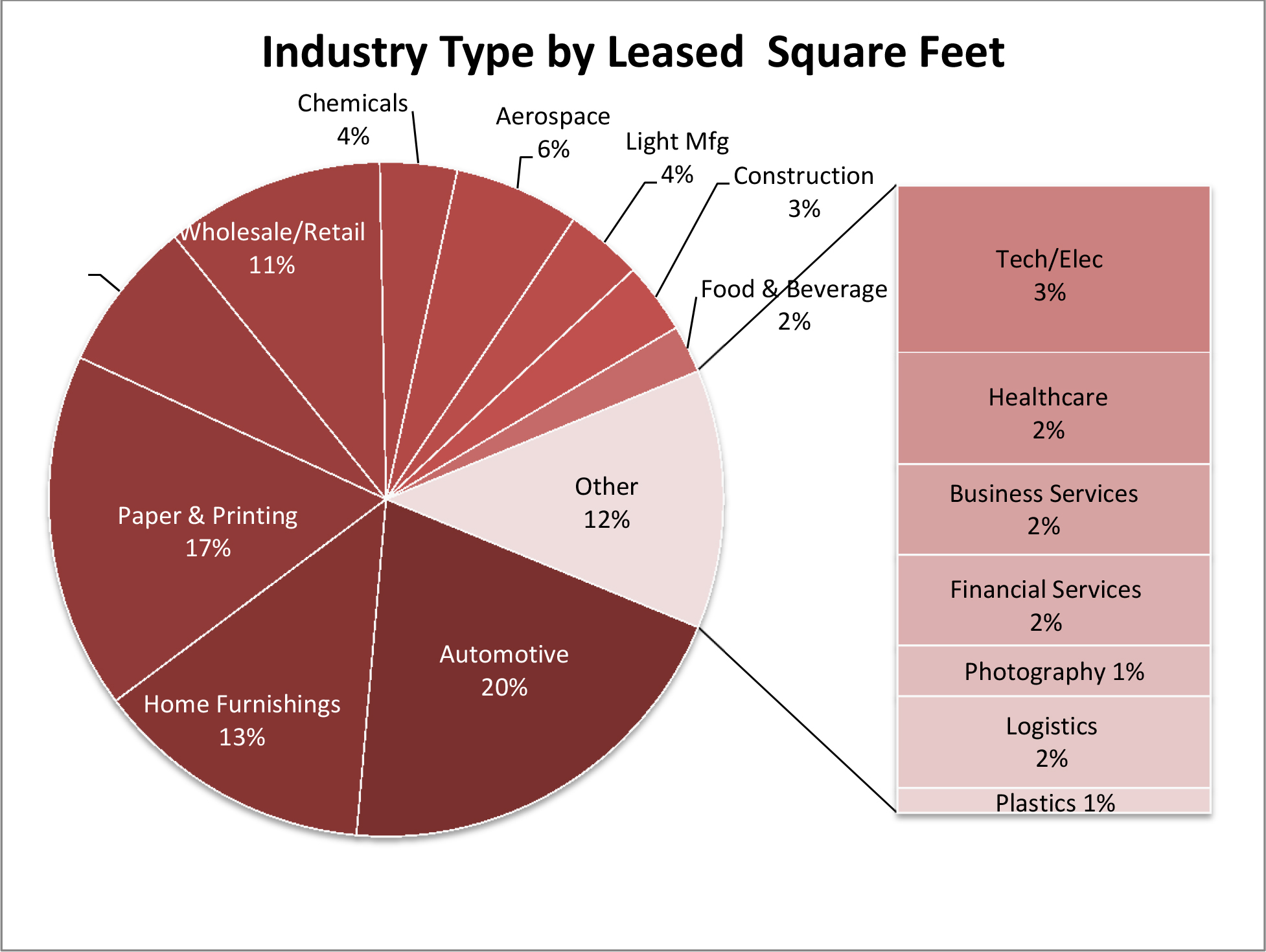

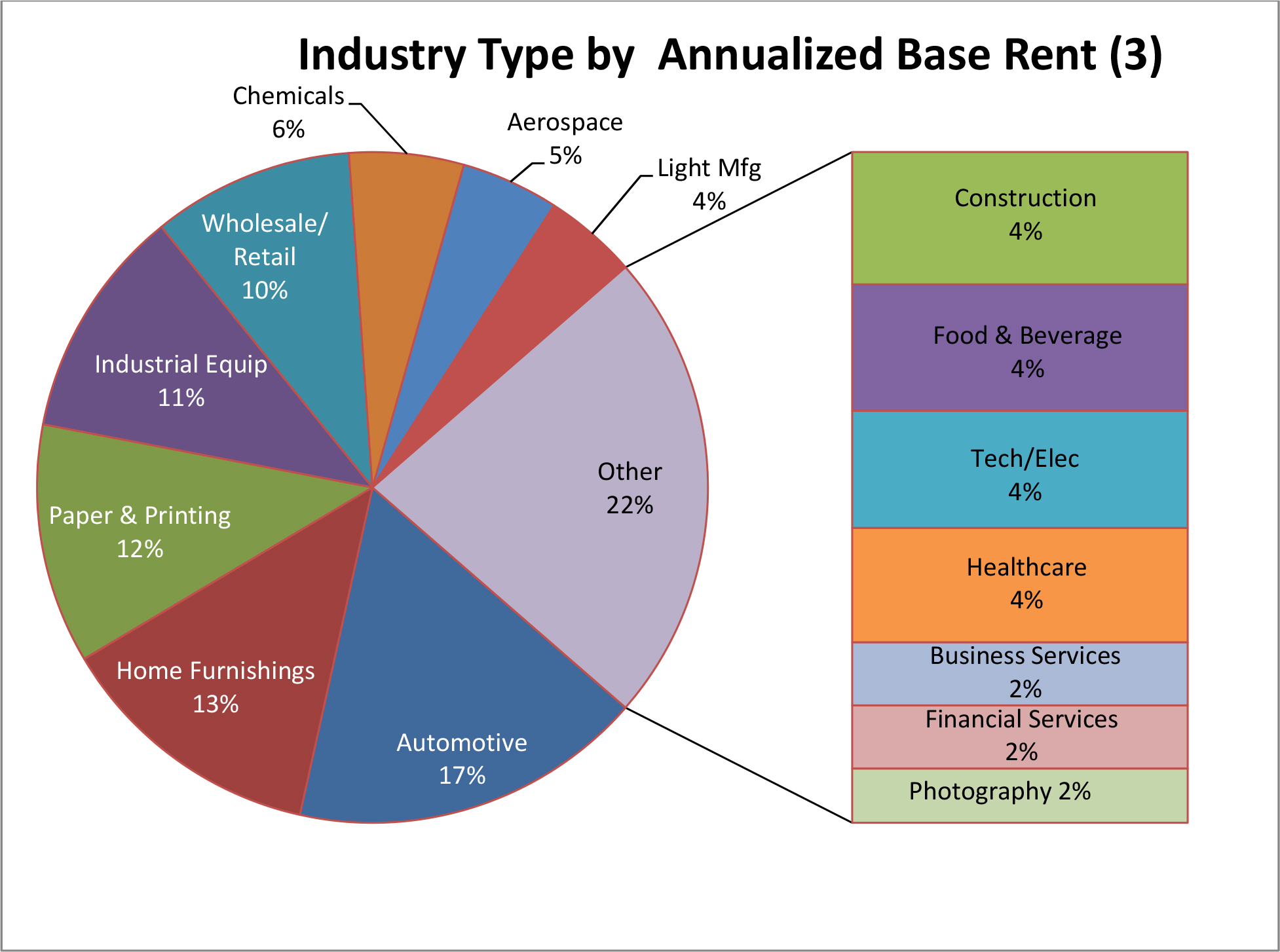

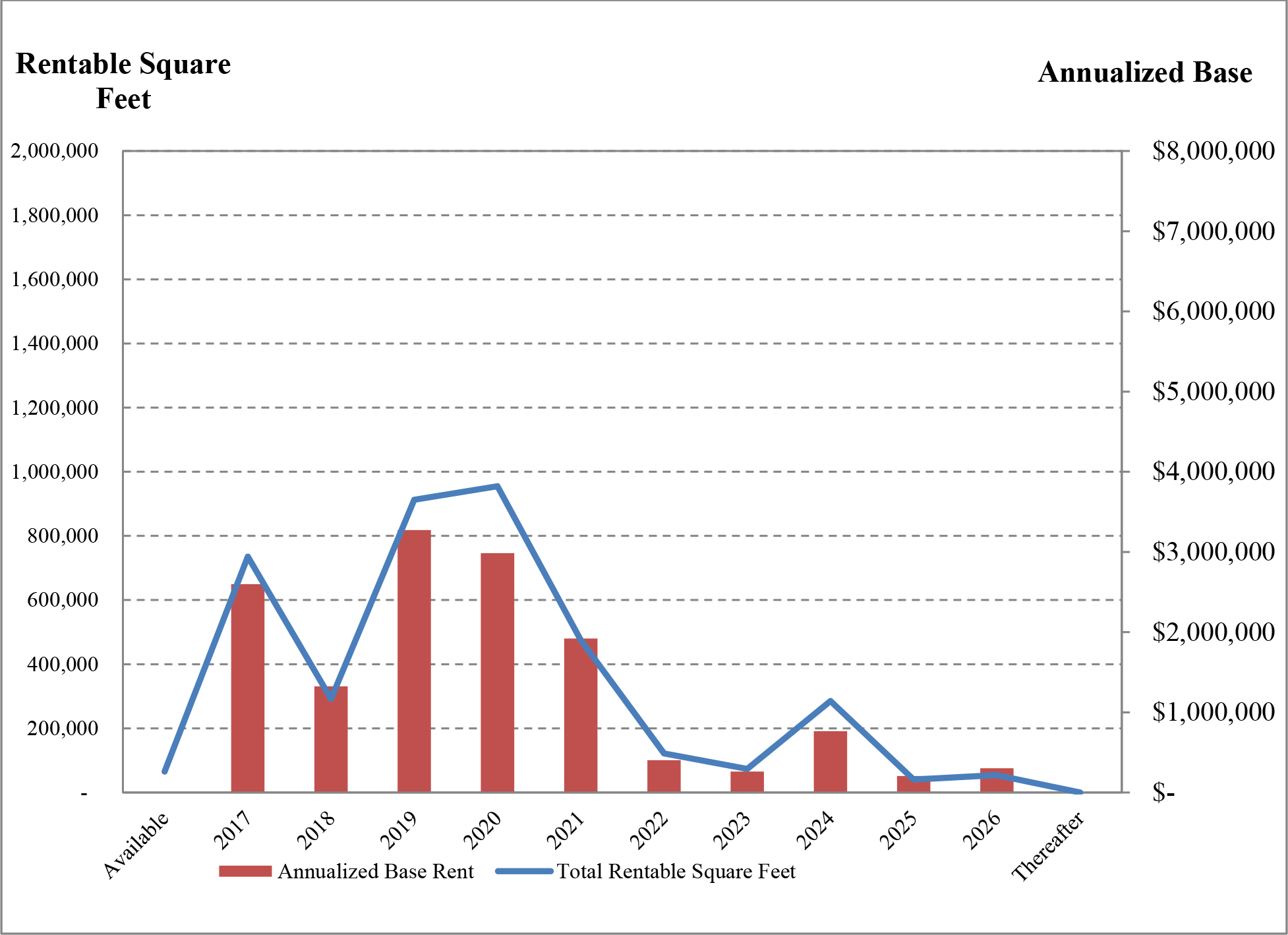

We are a full service, vertically integrated, self-administered and self-managed Maryland corporation focused on the acquisition, ownership and management of single and multi-tenant Class B industrial properties, including distribution centers, warehouses and light industrial properties, primarily located in secondary and select primary markets across the U.S. For our definition of Class B industrial properties, see “—Our Investment and Growth Strategies—Investment Strategy.” The Company Portfolio, which consists of 20 industrial properties located in seven states, is currently held through Plymouth Industrial 20 LLC, a joint venture with Torchlight in which we own a 0.5% interest. In connection with the completion of this offering and the Torchlight Transactions, we will redeem Torchlight’s interest in Plymouth Industrial 20 LLC, or Plymouth Industrial 20, and, as a result, we will own 100% of the interests in the Company Portfolio. See “—Torchlight Transactions.” As of March 31, 2017, the Company Portfolio was 98.4% leased to 37 different tenants across 17 industry types.

We intend to continue to focus on the acquisition of Class B industrial properties primarily in secondary markets with net rentable square footage ranging between approximately 100 million and 300 million square feet, which we refer to as our target markets. We believe industrial properties in such target markets will provide superior and consistent cash flow returns at generally lower acquisition costs relative to industrial properties in primary markets. Further, we believe there is a greater potential for higher rates of appreciation in the value of industrial properties in our target markets relative to industrial properties in primary markets.

We believe our target markets provide us with opportunities to acquire both stabilized properties generating favorable cash flows, as well as properties where we can enhance returns through value-add renovations and redevelopment. We focus primarily on the following investments:

| • | single-tenant industrial properties where tenants are paying below-market rents with near-term lease expirations that we believe have a high likelihood of renewal at market rents; and | |

| • | multi-tenant industrial properties that we believe would benefit from our value-add management approach to create attractive leasing options for our tenants, and as a result of the presence of smaller tenants, obtain higher per-square-foot rents. |

We believe there are a significant number of attractive acquisition opportunities available to us in our target markets and that the fragmented and complex nature of our target markets generally make it difficult for less-experienced or less-focused investors to access comparable opportunities on a consistent basis. See “Market Overview.”

Our company, which was formerly known as Plymouth Opportunity REIT, Inc., was founded in March 2011 by two of our executive officers, Jeffrey Witherell and Pendleton White, Jr., each of whom has at least 25 years of experience acquiring, owning and operating commercial real estate properties. Specifically, both were members of a team of senior investment executives that was responsible for the acquisition and capital formation of commercial properties for Franklin Street Properties (NYSE: FSP), or Franklin Street, a REIT based in Boston, MA, from 2000 to 2007, during which time Franklin Street listed its stock on the American Stock Exchange. Following their time at Franklin Street, our founders recognized a growing opportunity in the Class B industrial space, particularly in secondary markets and select primary markets, following the 2008-2010 recession, and founded our company to participate in the cyclical recovery of the U.S. economy. Between March 2011 to April 2014, we prepared for and engaged in a non-listed public offering of our common stock. We used the proceeds from that offering to acquire equity interests in five industrial properties. In 2014, we used the proceeds of a senior secured loan to acquire 100% fee ownership in three of these properties and 100% fee ownership in the remaining 17 properties that comprise the Company Portfolio. In July 2015 and January 2017, we sold our equity interests in the two properties in which we did not have 100% fee ownership.

1

Competitive Strengths

We believe that our investment strategy and operating model distinguish us from other owners, operators and acquirers of industrial real estate in several important ways, including the following:

High-Quality Portfolio with Strong Fundamentals: Since 2014, we have acquired a portfolio of 20 industrial assets with an aggregate of over four million square feet of rentable space. As of March 31, 2017, the Company Portfolio was 98.4% leased to 37 different tenants across 17 diversified industries, which we believe reduces our exposure to tenant default risk and earnings volatility. We have realized consistent increases in rental rates since the acquisition of the properties comprising the Company Portfolio. Rental rates on new leases signed in 2016 were approximately 57.1% higher than rental rates on prior leases, and rental rates for renewing tenants increased 3.8%. In addition, our tenant retention rate increased from 17.3% in 2015 to 73.7% in 2016. We believe that high occupancy rates across the Company Portfolio, as well as strong rental growth, are indicative of the consistent execution of our business strategy.

Strong Alignment of Interests: We believe the interests of our management team, our board of directors and our stockholders are strongly aligned. We will grant an aggregate of 131,579 restricted shares of common stock to our executive officers and independent directors upon the closing of this offering. In addition, following the completion of this offering and the Torchlight Transactions, the Torchlight Entities will own approximately 7.3% of our common stock (13.2% assuming the full exercise of the warrants to be issued in the Torchlight Transactions). Each of the members of our management team, our board of directors and Torchlight has entered into a lock-up agreement restricting the direct or indirect sale of such securities for 180 days after the date of this prospectus without the prior written consent of D.A. Davidson & Co.

Strategic Focus on Class B Industrial Properties in Secondary Markets with Stable and Predictable Cash Flows: We focus on Class B distribution centers, warehouses and light industrial properties rather than Class A industrial or other commercial properties for the following reasons, among others: fewer capital expenditure requirements, generally greater investment yields, overall greater tenant retention, generally higher current returns and lower earnings volatility. We believe the Company Portfolio is, and our future acquisitions will be, attractively positioned to participate in the recovering rental rates in our target markets while providing our stockholders with consistent, stable cash flows. For further discussion of our target markets, see “Market Overview—Our Target Markets.”

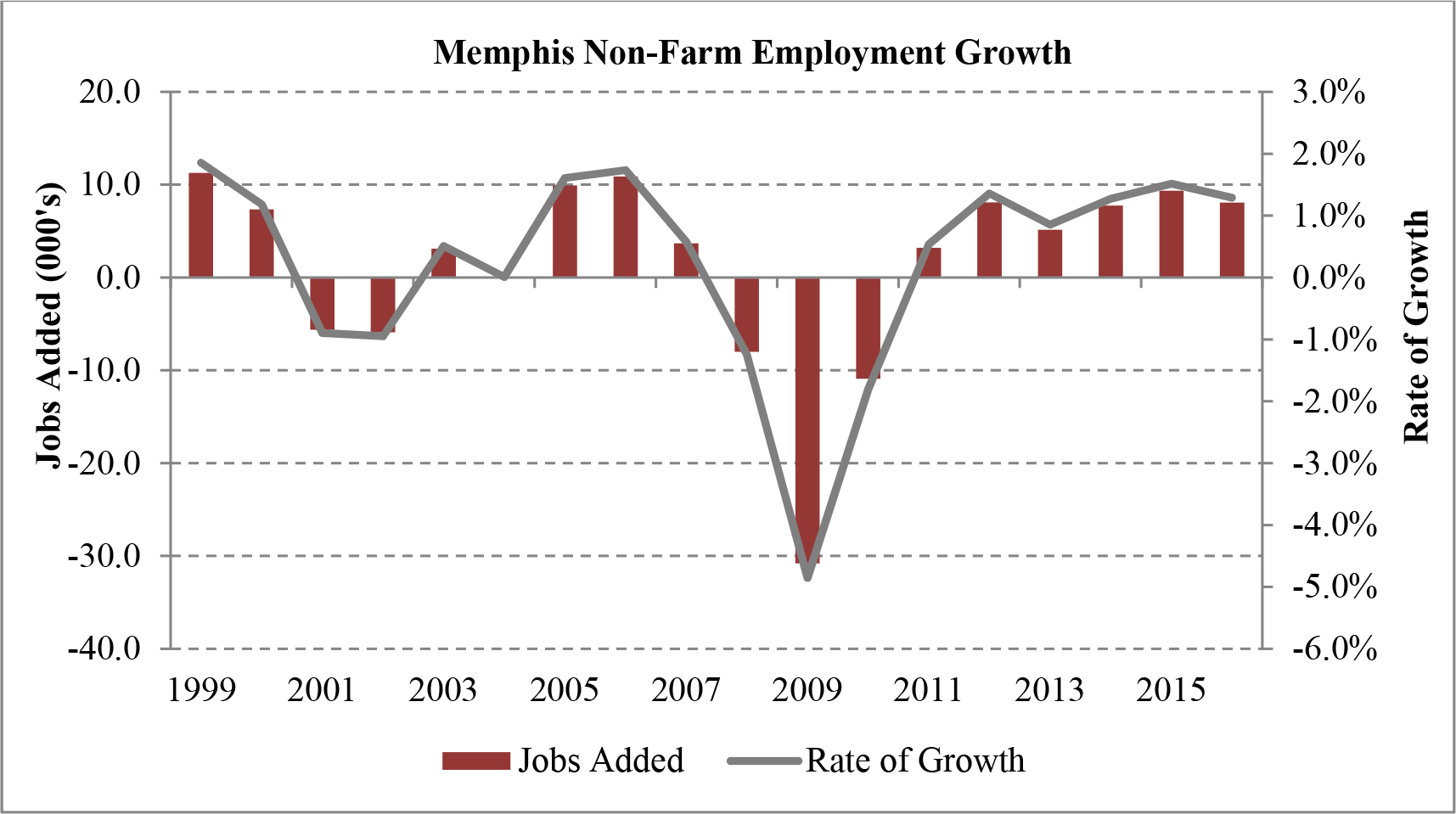

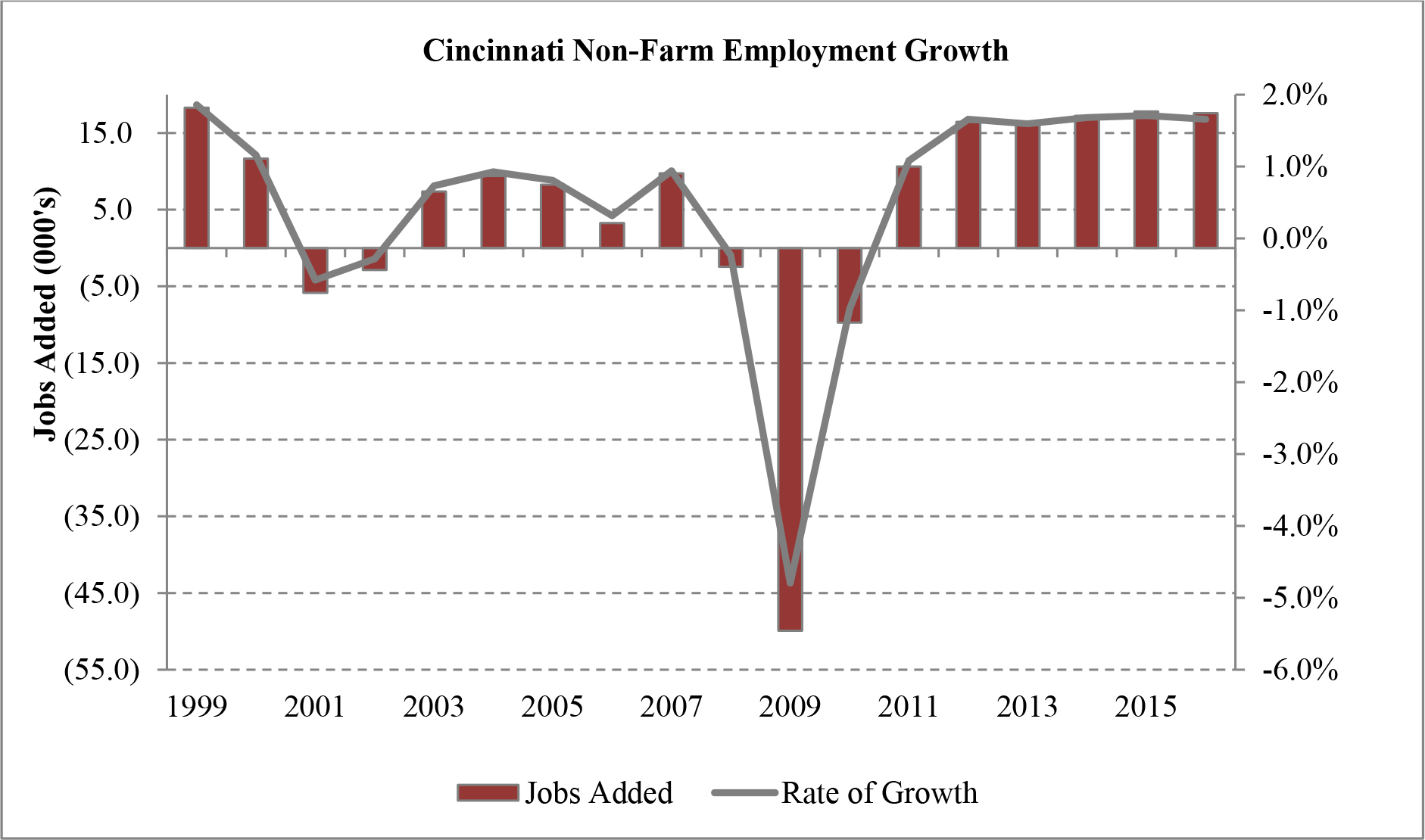

We intend to continue to focus on the acquisition of distribution centers, warehouses and light industrial properties in our target markets across the U.S. We believe that our target markets have exhibited, or will exhibit in the near future, positive demographic trends (i.e., population growth, decreasing unemployment rates, personal income growth and/or favorable tax climates), scarcity of available industrial space and favorable rental growth projections, which should help create superior long-term risk-adjusted returns.

Superior Access to Deal Flow: We believe our management team’s extensive personal relationships and research-driven origination methods will provide us access to off-market and lightly marketed acquisition opportunities, many of which may not be available to our competitors. Off-market and lightly marketed transactions are characterized by a lack of a formal marketing process and a lack of widely disseminated marketing materials. Our executive management and acquisition teams maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants, and greater than 50% of the Company Portfolio was sourced in off-market or lightly marketed transactions. We believe that our sourcing approach will provide us access to a significant number of attractive investment opportunities.

Experienced Management Team: Each of the three senior members of our executive management team has over 25 years of significant real estate industry experience, with each member having previous public REIT or public real estate company experience. Led by Mr. Witherell, our Chairman and Chief Executive Officer, Mr. White, our President and Chief Investment Officer, and Mr. Wright, our Chief Financial Officer, our management team has significant experience in acquiring, owning, operating and managing commercial real estate, with a particular emphasis on industrial assets. Throughout their careers, Mr. Witherell and Mr. White have had primary responsibility for overseeing the acquisition, financing, ownership and management of more than ten million square feet of office and industrial properties in our target markets, while over the past 18 years Mr. Wright has served as the Chief Financial Officer of two real estate companies, one of which had approximately $8 billion in assets.

2

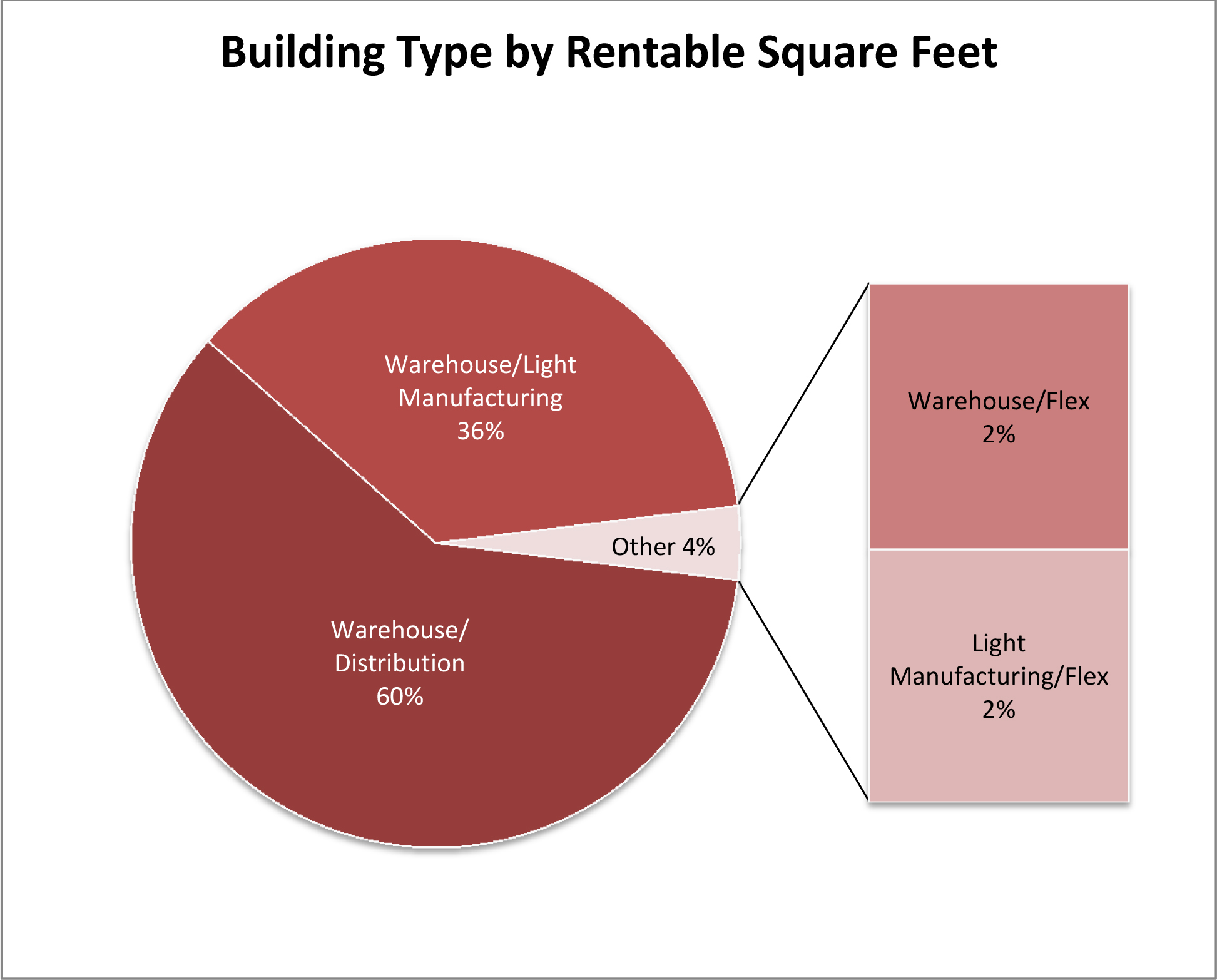

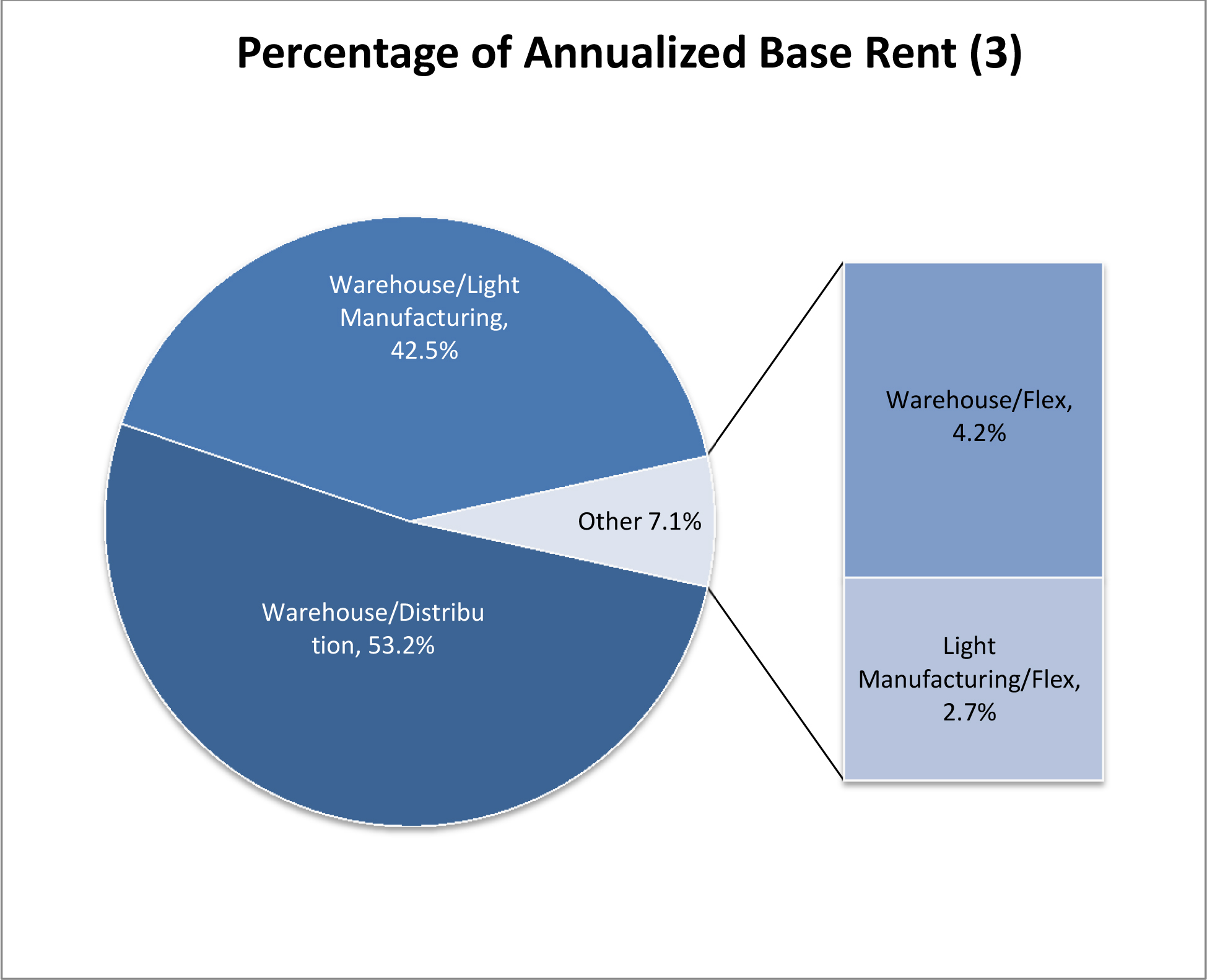

Our Investment and Growth Strategies

Our primary objective is to generate attractive risk-adjusted returns for our stockholders through dividends and capital appreciation primarily through the acquisition of Class B industrial properties located in secondary markets. We intend to focus our acquisition activities on our core property types, which include warehouse/distribution facilities and light manufacturing facilities, because we believe they generate higher tenant retention rates and require lower tenant improvement and re-leasing costs. To a lesser extent, we intend to focus on flex/office facilities (light assembly and research and development). We believe that pursuing the following strategies will enable us to achieve our investment objectives.

Our investment strategy will also focus on the burgeoning e-commerce industry by acquiring industrial properties that may service tenants’ e-commerce fulfillment needs, or “last mile” delivery requirements. These properties, termed “in-fill” properties, are typically located in highly populated areas, near city centers or populous suburban areas.

Investment Strategy

Our primary investment strategy is to acquire and own Class B industrial properties predominantly in secondary markets across the U.S. We generally define Class B industrial properties as industrial properties that are typically more than 15 years old, have clear heights between 18 and 26 feet and square footage between 50,000 and 300,000 square feet, with building systems that have adequate capacities to deliver the services currently needed by existing tenants, but may need upgrades for future tenants. In contrast, we define Class A industrial properties as industrial properties that typically are 15 years old or newer, have clear heights in excess of 26 feet and square footage in excess of 300,000 square feet, with energy efficient design characteristics suitable for current and future tenants.

We intend to own and acquire properties that we believe can achieve high initial yields and strong ongoing cash-on-cash returns and that exhibit the potential for increased rental growth in the near future. In addition, we may acquire Class A industrial properties that offer similar attractive return characteristics if the cost basis for such properties are comparable to those of Class B industrial properties in a given market or sub-market. While we will focus on investment opportunities in our target markets, we may make opportunistic acquisitions of Class A industrial properties or industrial properties in primary markets when we believe we can achieve attractive risk-adjusted returns.

We also intend to pursue joint venture arrangements with institutional partners which could provide management fee income as well as residual profit-sharing income. Such joint ventures may involve investing in industrial assets that would be characterized as opportunistic or value-add investments. These may involve development or re-development strategies that may require significant up-front capital expenditures, lengthy lease-up periods and result in inconsistent cash flows. As such, these properties’ risk profiles and return metrics would likely differ from the non-joint venture properties that we target for acquisition.

Following this offering, we believe we will have a competitive advantage in sourcing attractive acquisitions because the competition for our target assets is primarily from local investors who are not likely to have ready access to debt or equity capital. In addition, our umbrella partnership real estate investment trust, or UPREIT, structure may enable us to acquire industrial properties on a non-cash basis in a tax efficient manner through the issuance of OP units as consideration for the transaction. We will also continue to develop our large existing network of relationships with real estate and financial intermediaries. These individuals and companies give us access to significant deal flow—both those broadly marketed and those exposed through only limited marketing. These properties will be acquired primarily from third-party owners of existing leased buildings and secondarily from owner-occupiers through sale-leaseback transactions.

Growth Strategies

We seek to maximize our cash flows through proactive asset management. Our asset management team actively manages our properties in an effort to maintain high retention rates, lease vacant space, manage operating expenses and maintain our properties to an appropriate standard. In doing so, we have developed strong tenant relationships. We intend to leverage those relationships and market knowledge to increase renewals, properly prepare tenants for rent increases, obtain early notification of departures to provide longer re-leasing periods and work with tenants to properly maintain the quality and attractiveness of our properties. Our asset management team also collaborates with our internal credit function to actively monitor the credit profile of each of our tenants and prospective tenants on an ongoing basis.

Our asset management team functions include strategic planning and decision-making, centralized leasing activities and management of third-party leasing companies. Our asset management/credit team oversees property management activities relating to our properties which include controlling capital expenditures and expenses that are not reimbursable by tenants, making regular property inspections, overseeing rent collections and cost control and planning and budgeting activities. Tenant relations matters, including monitoring of tenant compliance with their property maintenance obligations and other lease provisions, will be handled by in-house personnel for most of our properties.

3

Financing Strategy

We intend to maintain a flexible and growth-oriented capital structure. We intend to use the net proceeds from this offering along with additional secured and unsecured indebtedness to acquire industrial properties. See “Use of Proceeds.” Our additional indebtedness may include arrangements such as revolving credit facility or term loan. We believe that we will have the ability to leverage newly-acquired properties up to a 65% debt-to-value ratio, though our long-term target debt-to-value ratio is less than 50%. We also anticipate using OP units to acquire properties from existing owners interested in tax-deferred transactions.

Investment Criteria

We believe that our market knowledge, operations systems and internal processes allow us to efficiently analyze the risks associated with an asset’s ability to produce cash flow going forward. We blend fundamental real estate analysis with corporate credit analysis to make a probabilistic assessment of cash flows that will be realized in future periods. We also use data-driven and event-driven analytics and primary research to identify and pursue emerging investment opportunities. See “Business—Our Investment and Growth Strategies—Investment Criteria.”

Our investment strategy focuses on Class B industrial properties in secondary markets for the following reasons:

| • | Class B industrial properties generally require less capital expenditures than both Class A industrial properties and other commercial property types; | |

| • | investment yields for Class B industrial properties are often greater than investment yields on both Class A industrial properties and other commercial property types; | |

| • | Class B industrial tenants tend to retain their current space more frequently than Class A industrial tenants; | |

| • | Class B industrial properties tend to have higher current returns and lower volatility than Class A industrial properties; | |

| • | we believe there is less competition for Class B industrial properties from institutional real estate buyers; our typical competitors are local investors who often do not have ready access to debt or equity capital; | |

| • | the Class B industrial real estate market is highly fragmented and complex, which we believe make it difficult for less-experienced or less-focused investors to access comparable opportunities on a consistent basis; | |

| • | we believe that there is a limited new supply of Class B industrial space in our target markets; | |

| • | secondary markets generally have less occupancy and rental rate volatility than primary markets; | |

| • | Class B properties and secondary markets are typically “cycle agnostic”; i.e., less prone to overall real estate cycle fluctuations; | |

| • | we believe secondary markets generally have more growth potential at a lower cost basis than primary markets; and | |

| • | we believe that the demand for e-commerce-related properties, or e-fulfillment facilities, will continue to grow and play a significant role in our investing strategy. |

Market Overview

Market Opportunity

A key component of our business strategy is to tap into forecasted U.S. economic growth by investing in industrial real estate that we believe will benefit from rental growth and increased tenant demand. We believe that in some cases there has already been significant growth and capitalization rate compression in primary markets in the Class A industrial sector, but that there still exists an opportunity to take advantage of capitalization rate compression, favorable pricing, limited supply and competition in secondary growth markets and in Class B properties. While we will focus on the acquisition of Class B industrial properties in secondary markets, we may also make opportunistic acquisitions of Class A industrial properties and industrial properties in primary markets.

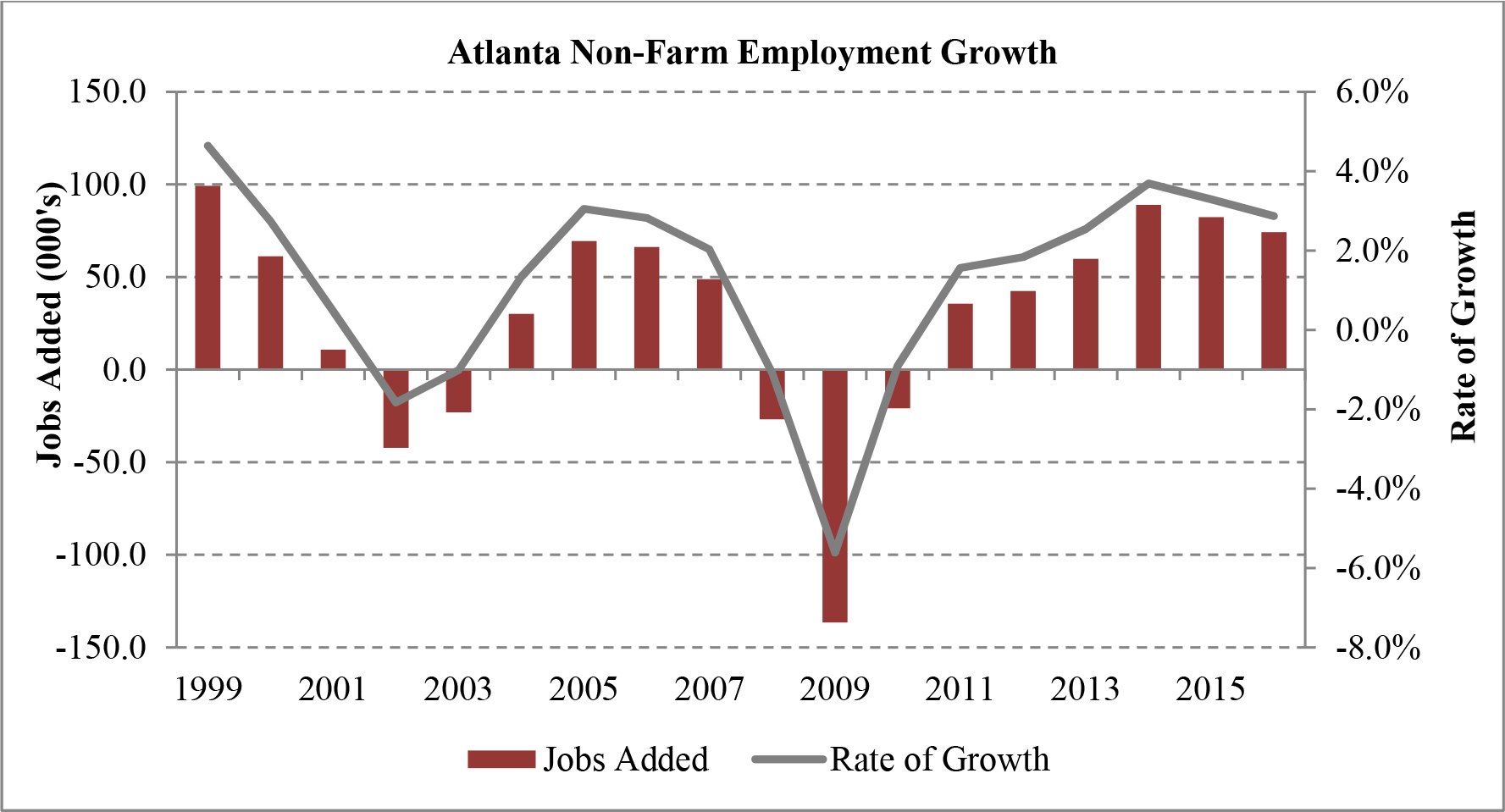

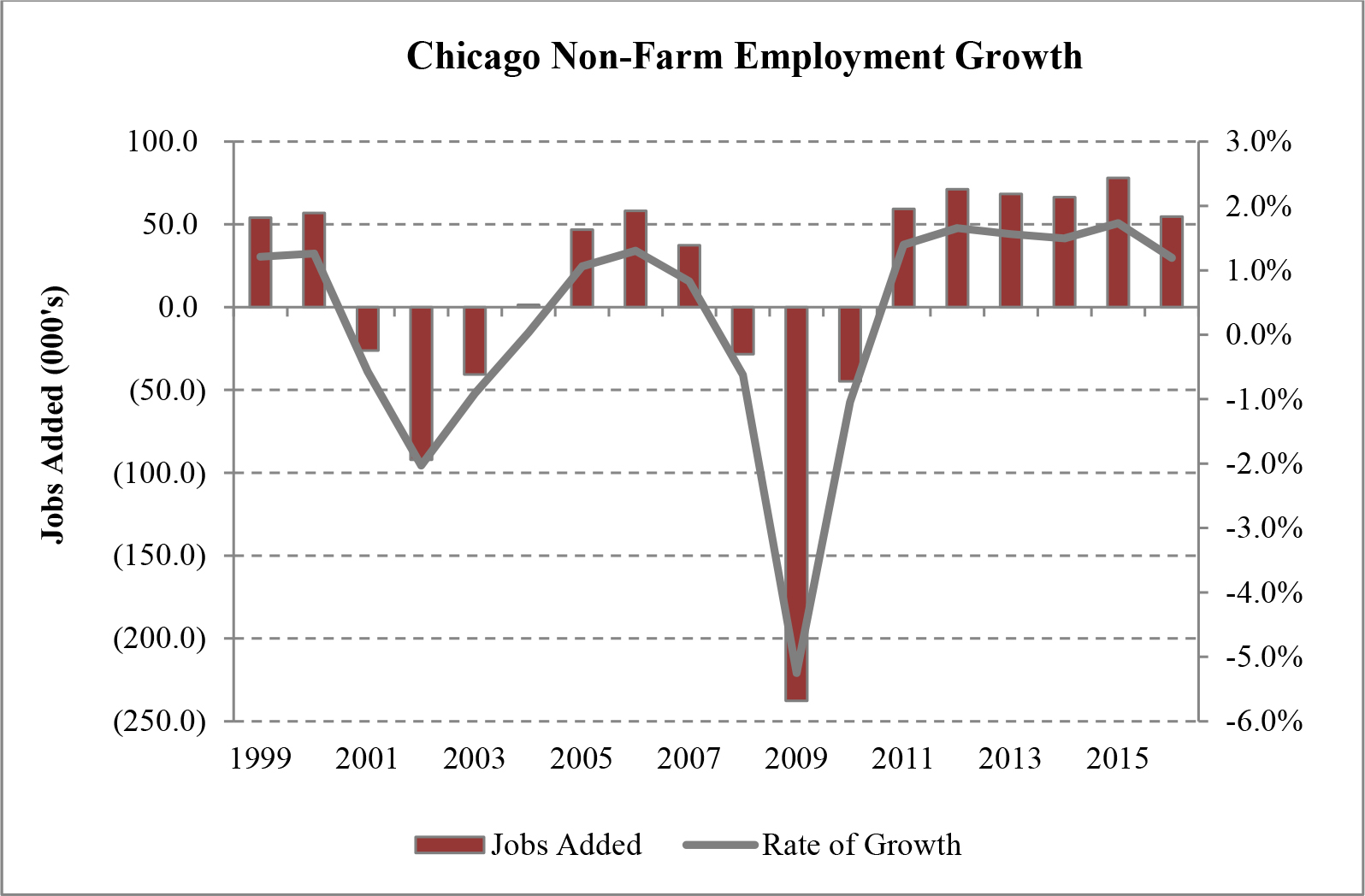

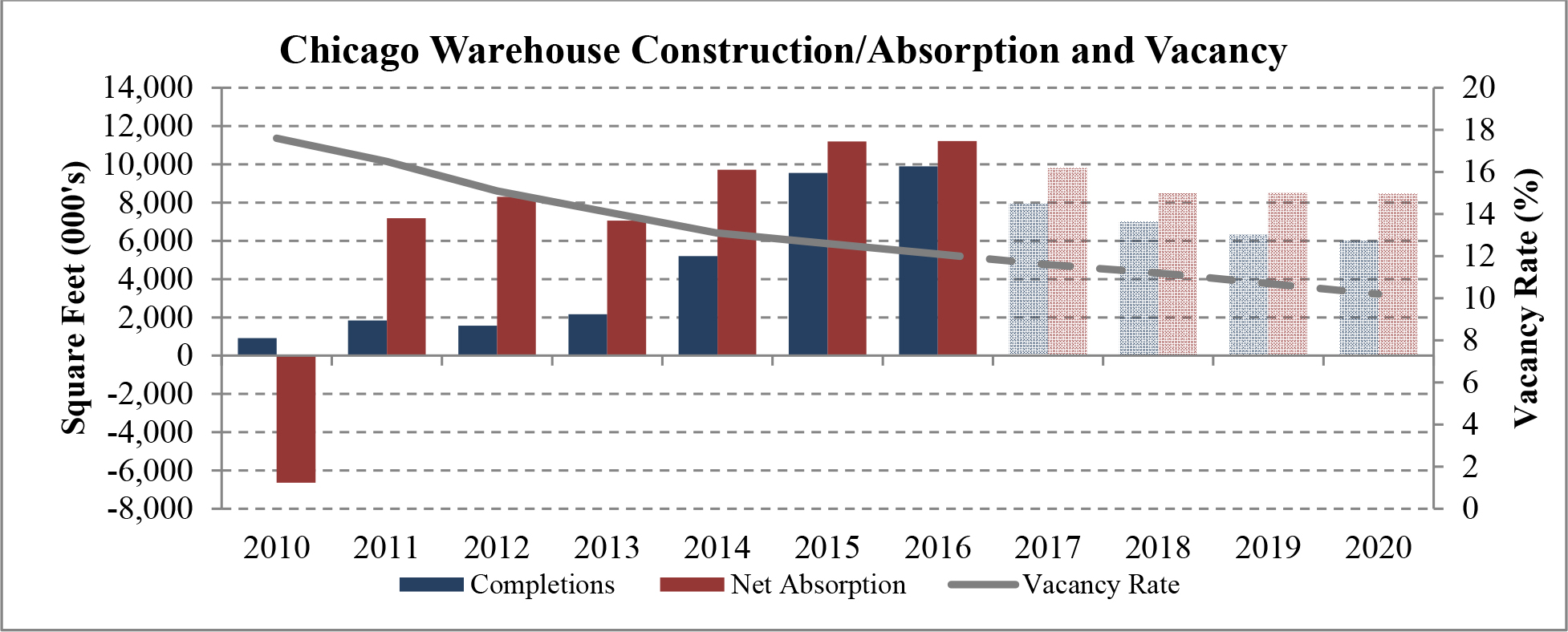

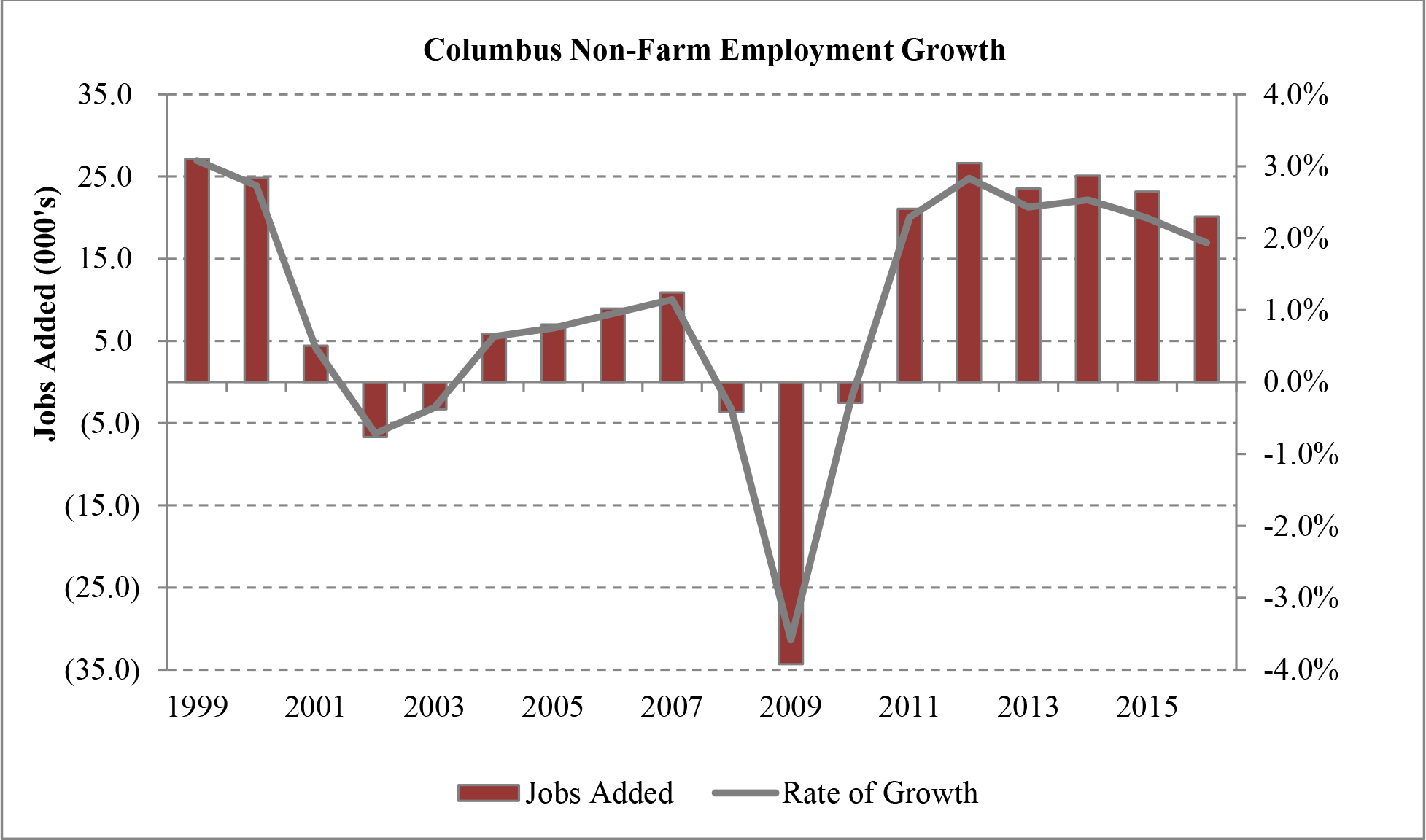

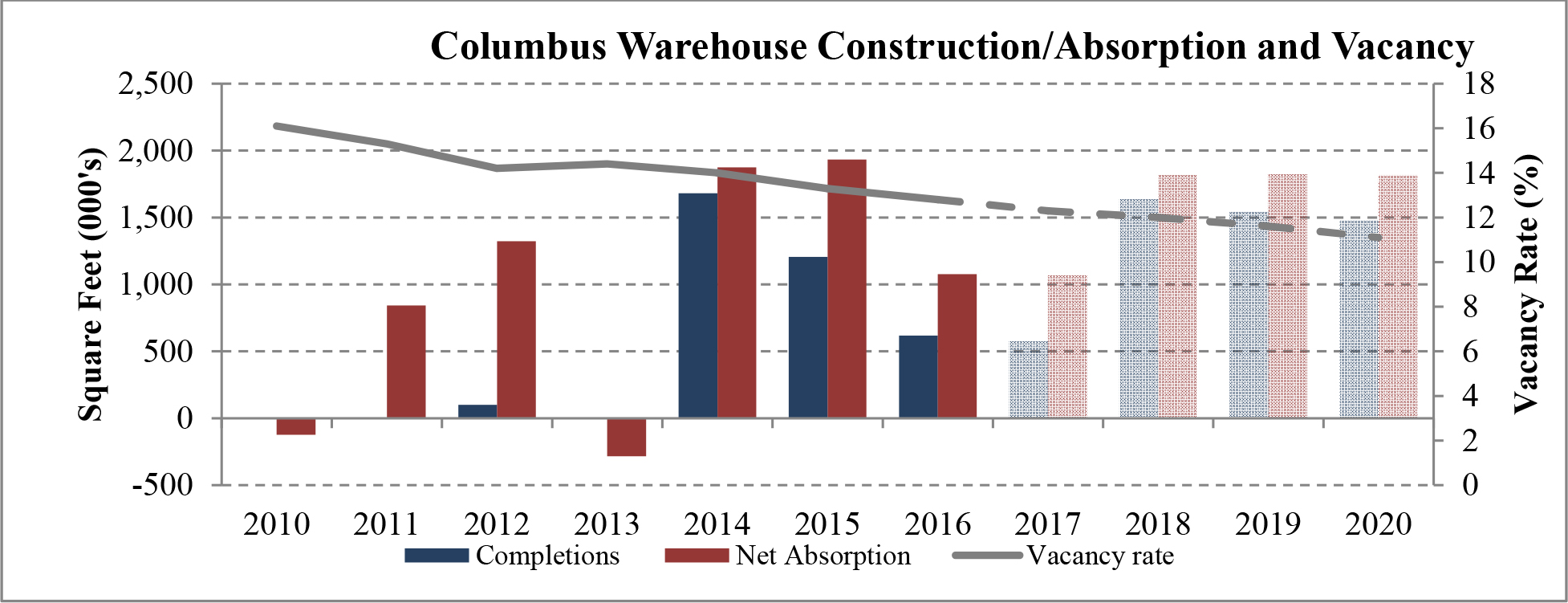

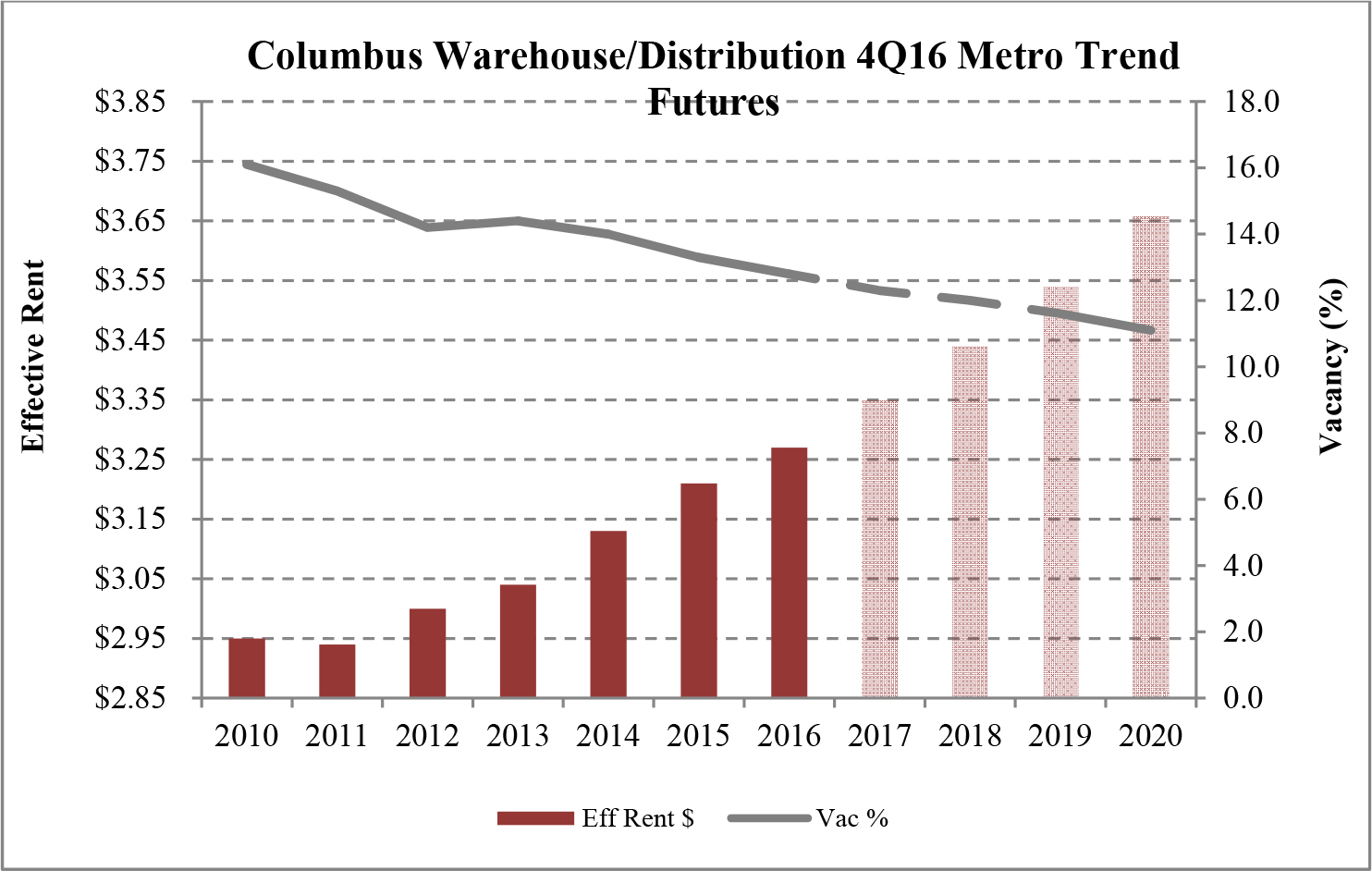

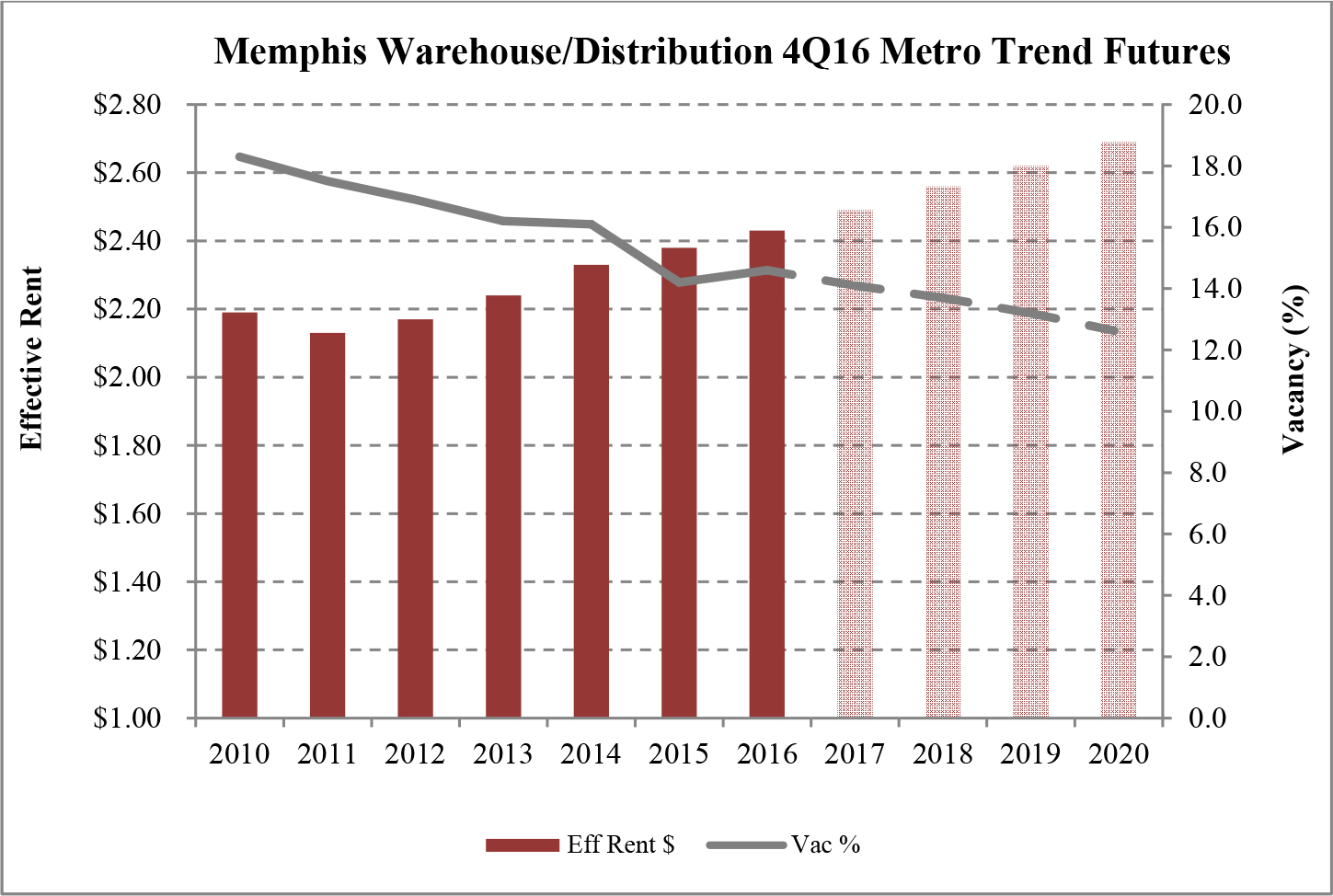

Our acquisition pipeline focuses on a select group of target markets, including, among others, Atlanta, Chicago, Cincinnati, Columbus and Memphis, which we believe possess certain characteristics that we believe are beneficial to industrial real estate investment. These characteristic include, but are not limited to, employment growth, recent and forecasted rent growth, a shortage of industrial development, and falling vacancy rates. We believe that these characteristics will allow us to increase rental rates, increase occupancy and drive value. For a more detailed overview of these markets, refer to the “Market Overview” section of this prospectus.

4

Industrial Real Estate Fundamentals

According to CB Richard Ellis, or CBRE, industrial real estate demand going into 2017 is strong. In many of our target markets vacancy rates are steadily dropping, construction is starting to slowly pick up and rent growth remains healthy. New construction has lagged leasing demand for 25 consecutive quarters. We believe that while construction starts continue to remain limited and economic demand drivers continue to power absorption, industrial fundamentals will continue to strengthen. We believe that, as a result of the lack of new construction and overall demand for industrial properties in many U.S. markets, vacancy rates will continue to fall until rent growth increases to a point where developers can justify undergoing more speculative projects.

Accelerating U.S. Economic Growth

According to forecasts by the United States Congressional Budget Office, or the CBO, inflation-adjusted U.S. GDP grew by 1.6% in 2016 and is expected to grow 2.3% in 2017, 1.9% in 2018, and 1.7% in 2019. The CBO expects that these increases in U.S. GDP will spur businesses to maintain and or grow hiring rates, which will continue to push down the unemployment rate and raise the rate of participation in the labor force. In particular, the CBO projects that the unemployment rate will maintain a range of 4.5% to 5.0% over the next 11 years. Overall, the CBO anticipates that over the next decade, inflation-adjusted U.S. GDP will increase at an average annual pace of 1.9%. We expect that increased employment will lead to increased consumer spending, further enhancing the demand for warehouse properties, particularly in an e-commerce retail environment.

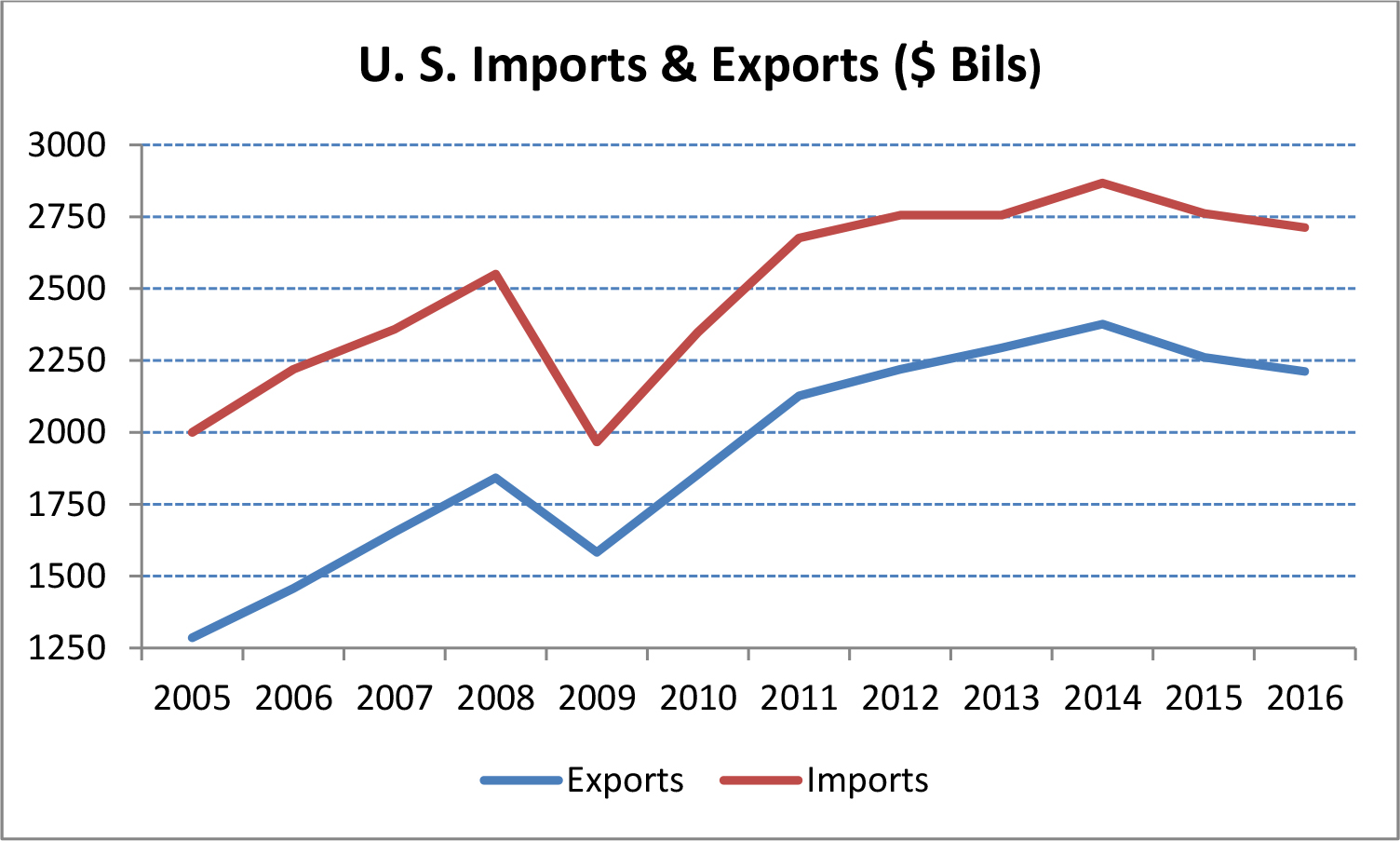

Industrial Trade

Industrial trade is one of the most important drivers of industrial real estate demand as import and export volume greatly determine the amount of space that is needed in order to store goods. Since the recession of 2008 - 2010, exports have been one of the key drivers of the recovery in trade, with export levels up now more than 20.1% from pre-recession levels. While import rates have not grown as quickly as export rates since the recession, import rates (excluding oil) have risen 6.4% over pre-recession levels, which have resulted in further increased demand for industrial real estate space. We believe that this recovery to import and export rates should continue during 2017 and beyond, which should help drive demand for industrial space.

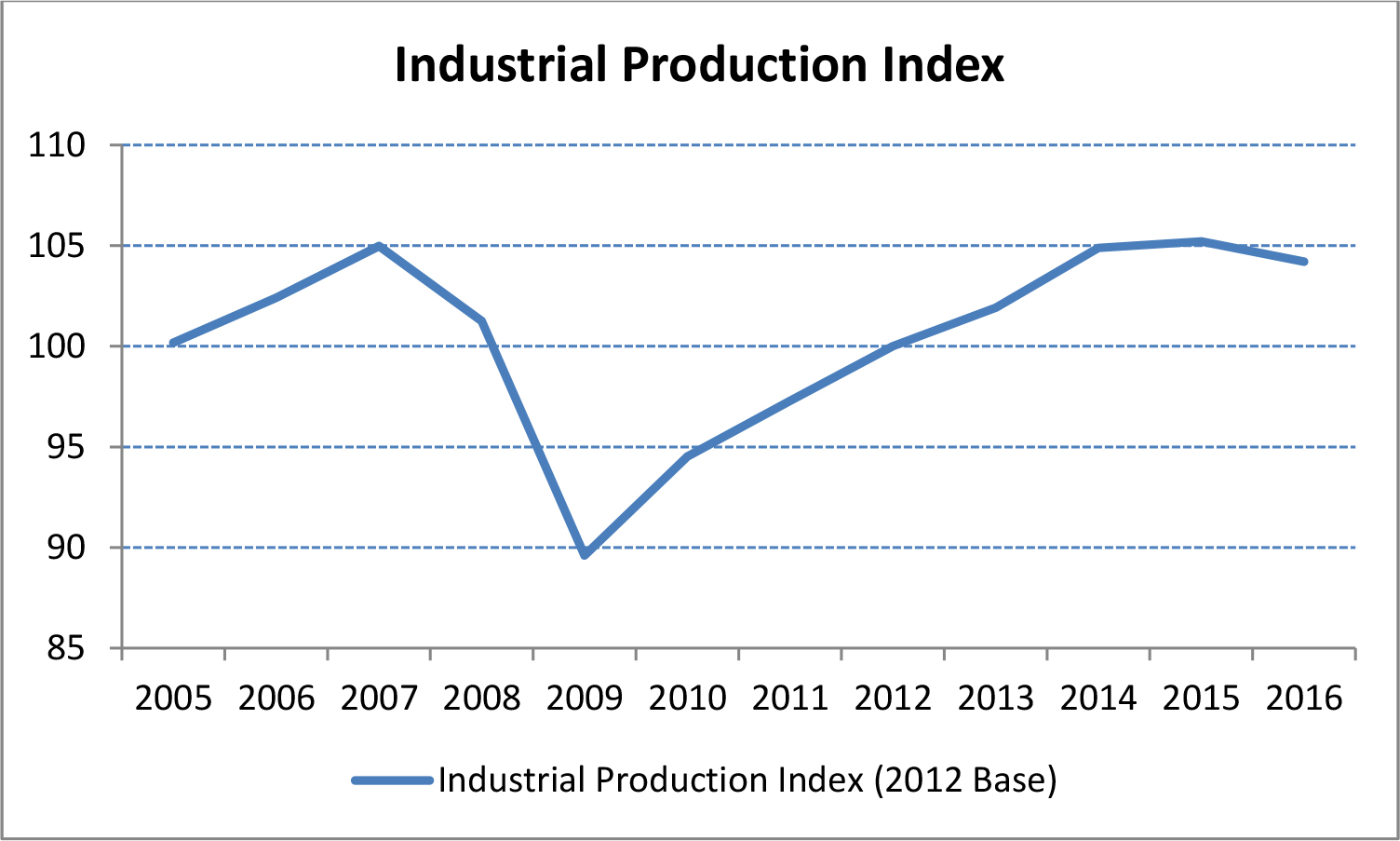

Manufacturing and Production

We believe that manufacturing and production is another key component of industrial real estate performance as the level of goods that are manufactured and produced has a positive correlation with the amount of space needed to store such goods. The productivity of U.S. mines and factories, as measured by the industrial production index, picked up pace in 2013 and has maintained its momentum to date. Due in large part to the surge in domestic energy production, the U.S. is enjoying lower energy costs, which, combined with more competitive labor costs, should allow industrial production to continue to expand in 2017.

In 2015, the U.S. industrial capacity utilization rate stood just above its historical average, with some sectors running well above their long-run averages. We believe that this suggests that more investment in industrial capacity will be needed for industrial production to continue growing The CBO is forecasting that business investment will grow by 5.0% in 2017 and grow on average around 2.2% the following three years. Likewise, CBO also forecasts total output to grow closer to 2.0% per year rather than the 1.4% increase realized between 2008 and 2016.

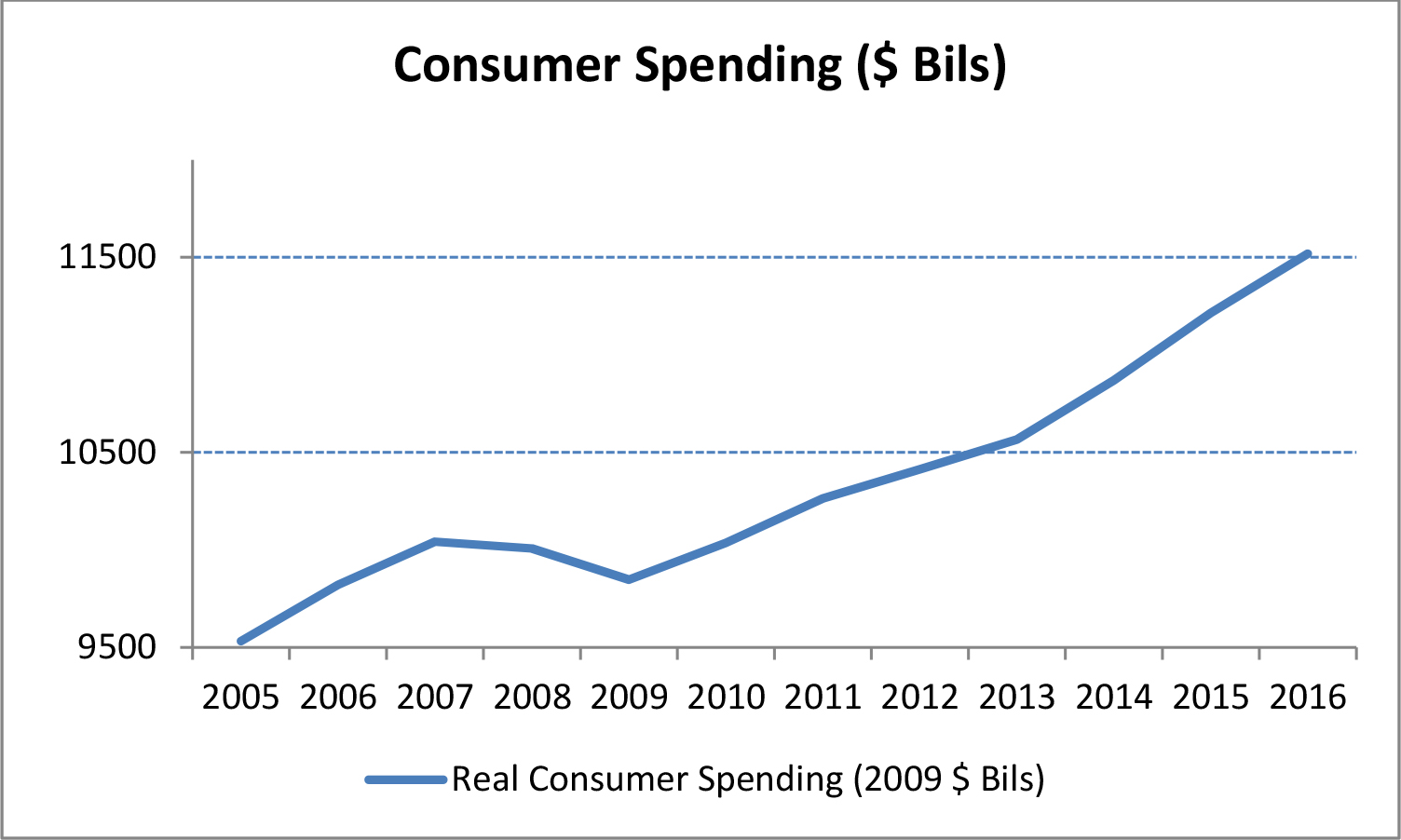

Consumer Consumption

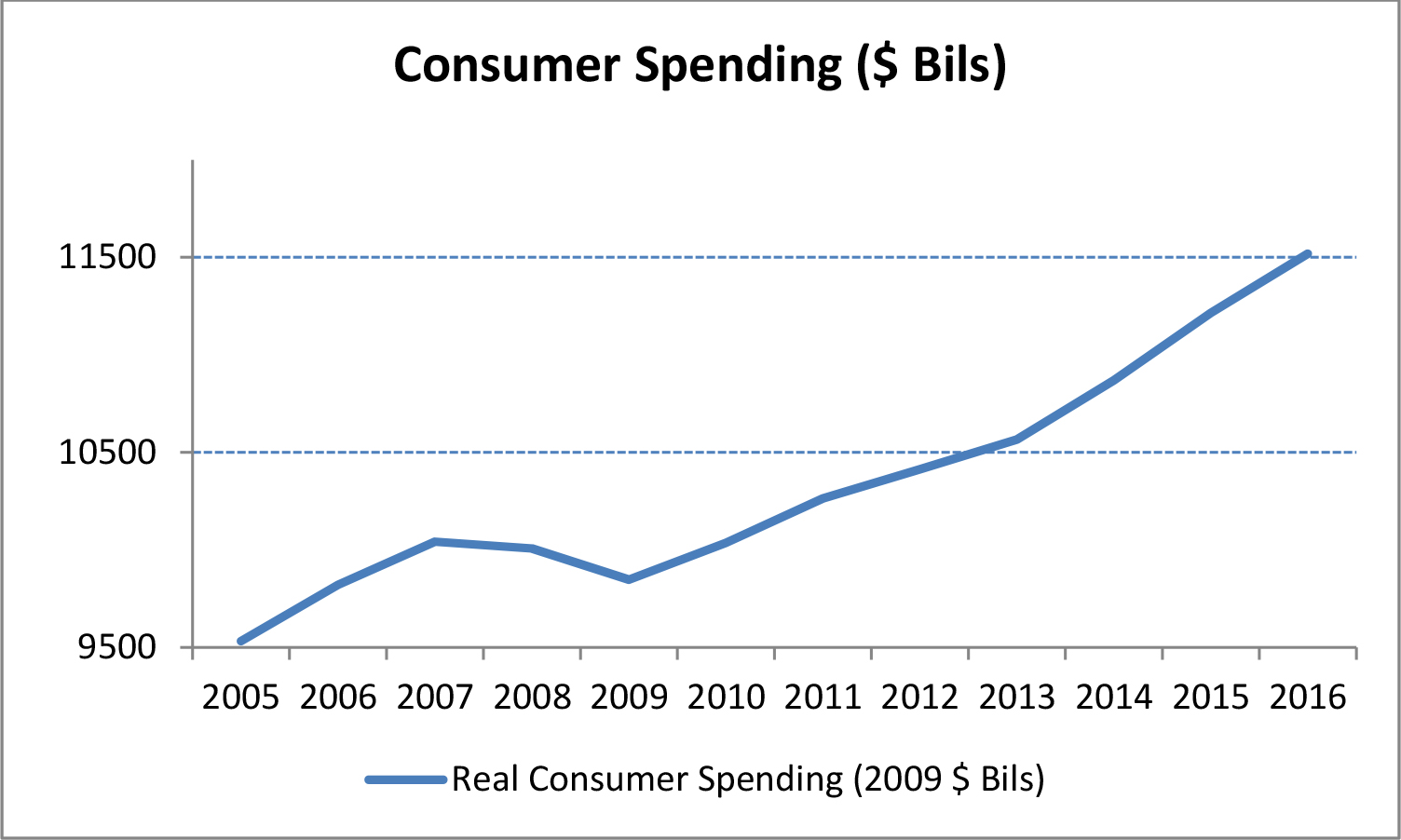

Consumer consumption, which accounts for two-thirds of U.S. GDP, declined during the recession, as high unemployment and stagnating wages forced people to cut back on non-essential spending. However, since 2009, real consumer spending has grown at an annual rate of 2.3%.

|

| Figure 3 (Source: US Department of Commerce — Bureau of Economic Analysis) |

5

Industrial Real Estate Fundamentals

Overview

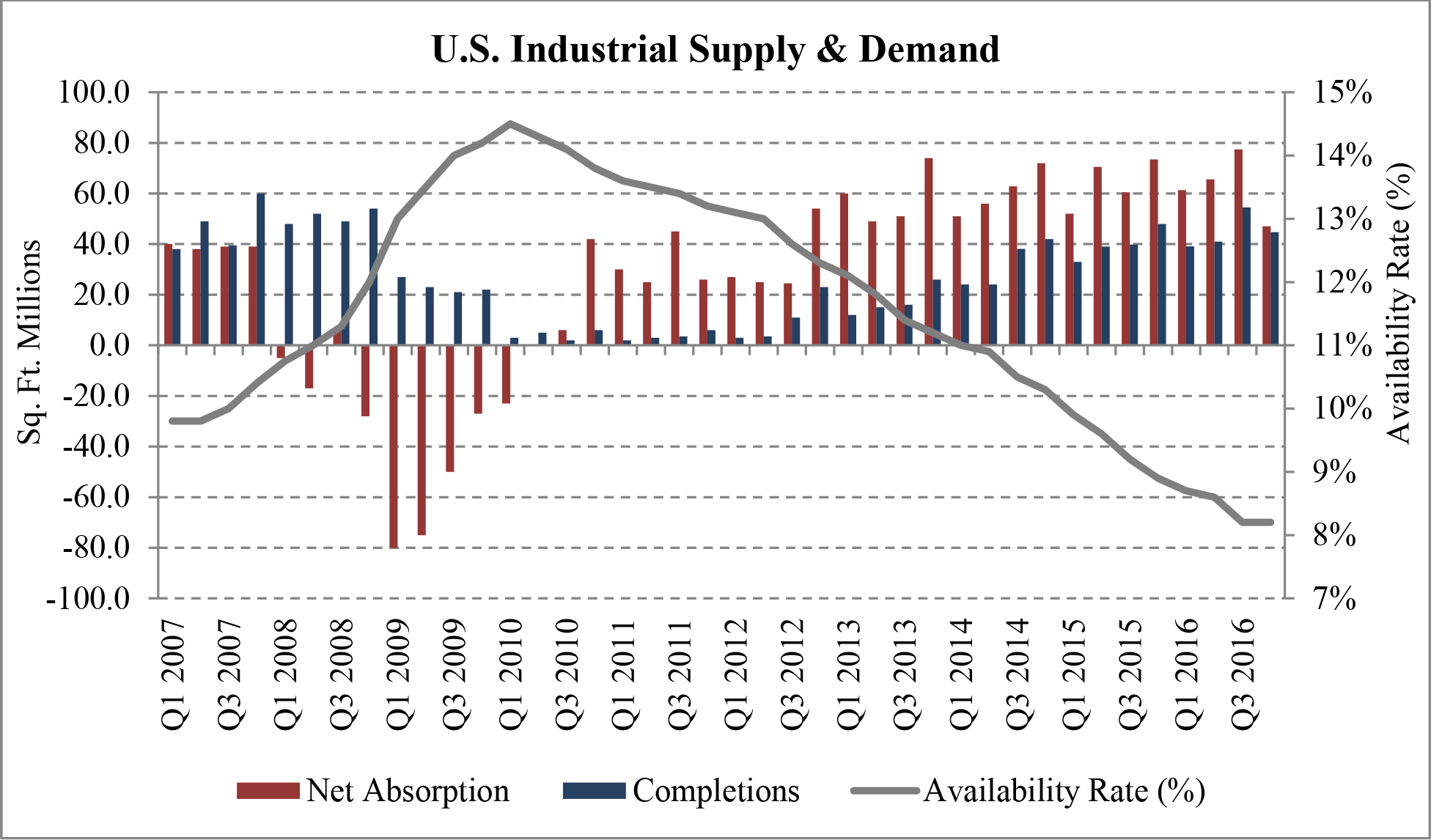

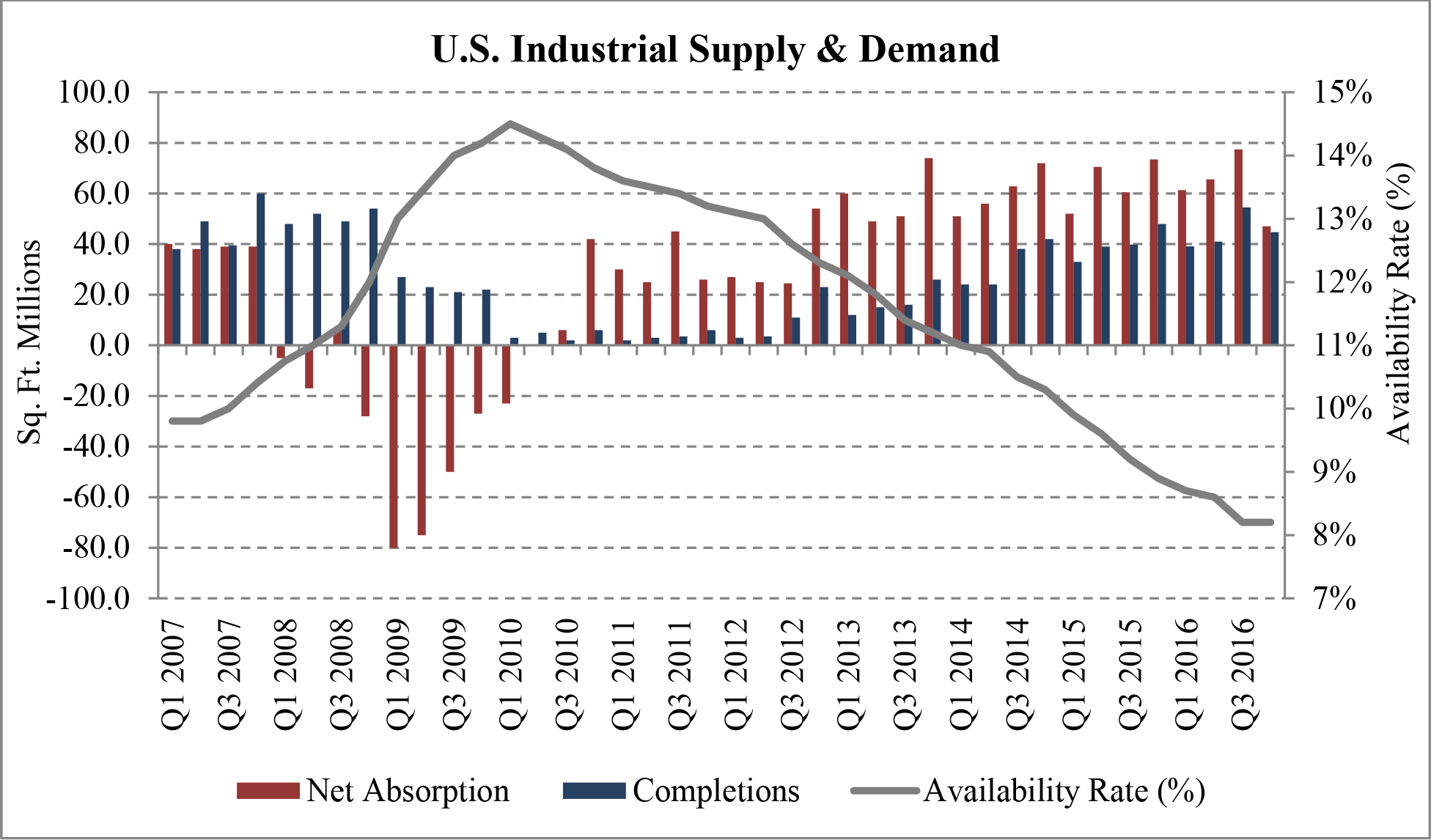

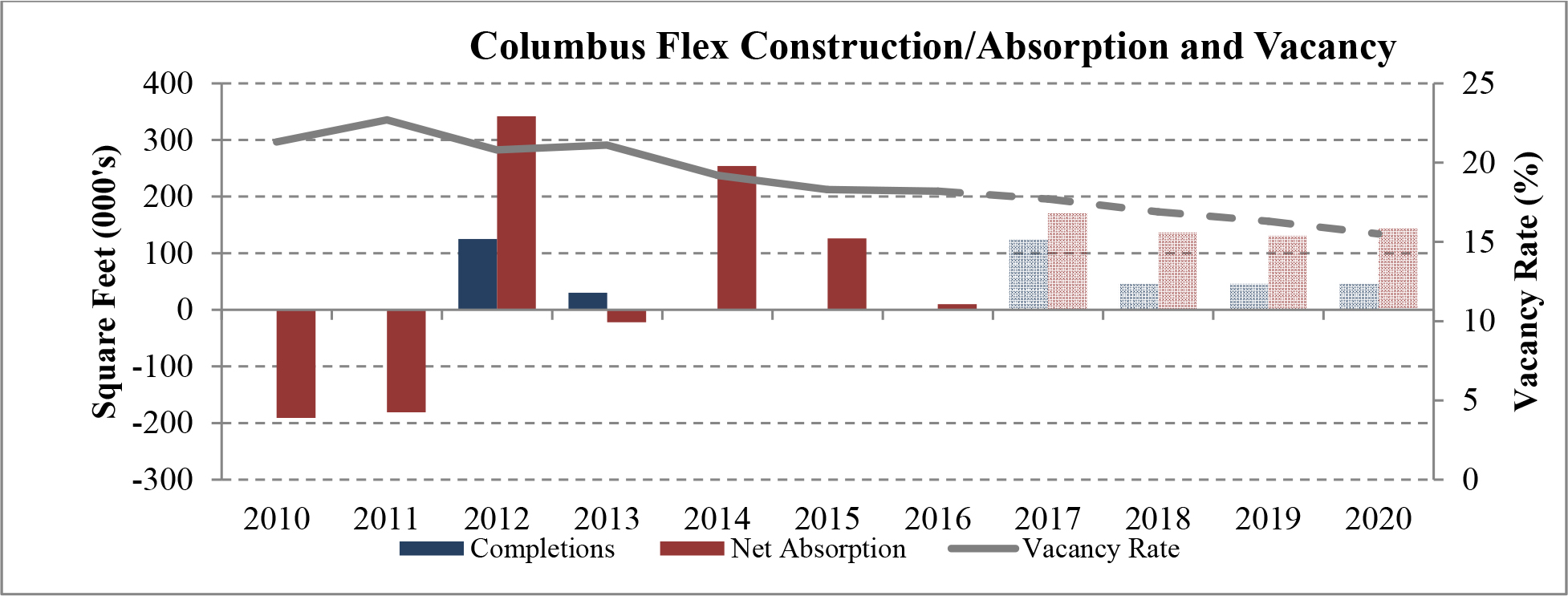

According to CBRE, industrial real estate demand going into 2017 is strong. In many of our target markets vacancy rates are steadily dropping, construction is starting to slowly pick up and rent growth remains healthy. New construction has lagged leasing demand for 25 consecutive quarters. We believe that while construction starts continue to remain limited and economic demand drivers continue to power absorption, industrial fundamentals will continue to strengthen. We believe that, as a result of the lack of new construction and overall demand for industrial properties in many U.S. markets, vacancy rates will continue to fall until rent growth increases to a point where developers can justify undergoing more speculative projects. The following graph illustrates this on an historical basis.

|

| Figure 4 (Source: CBRE) |

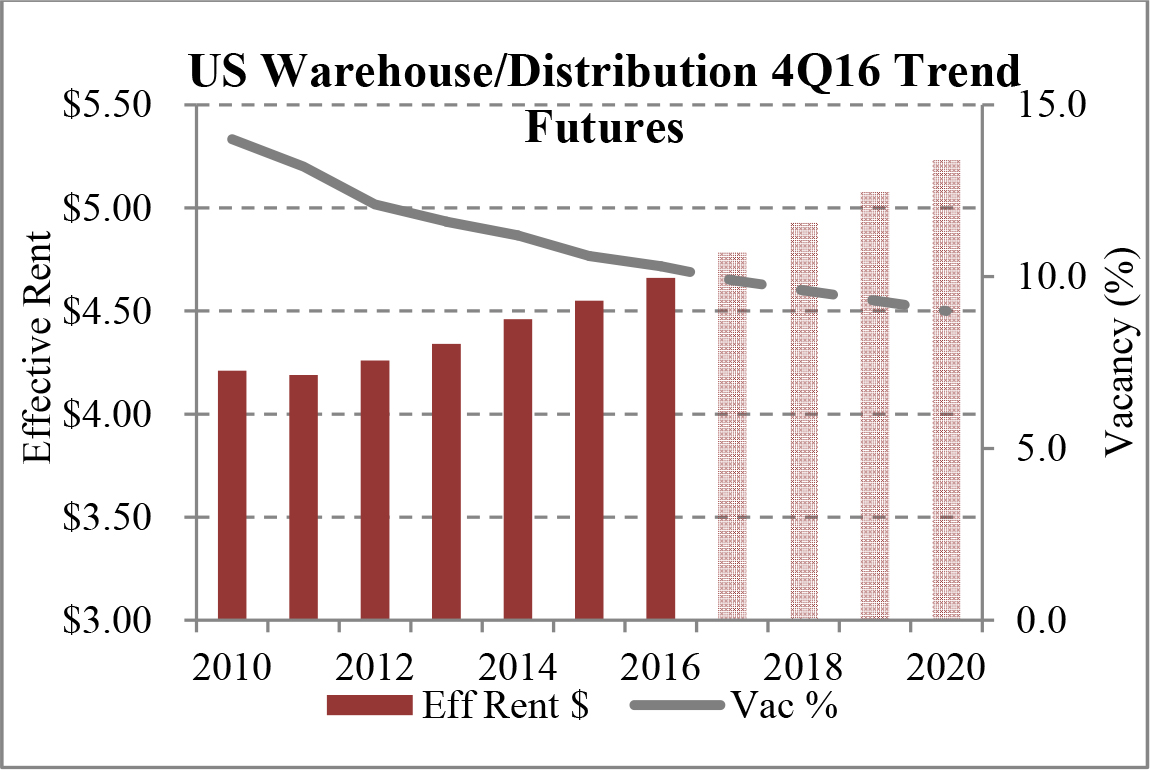

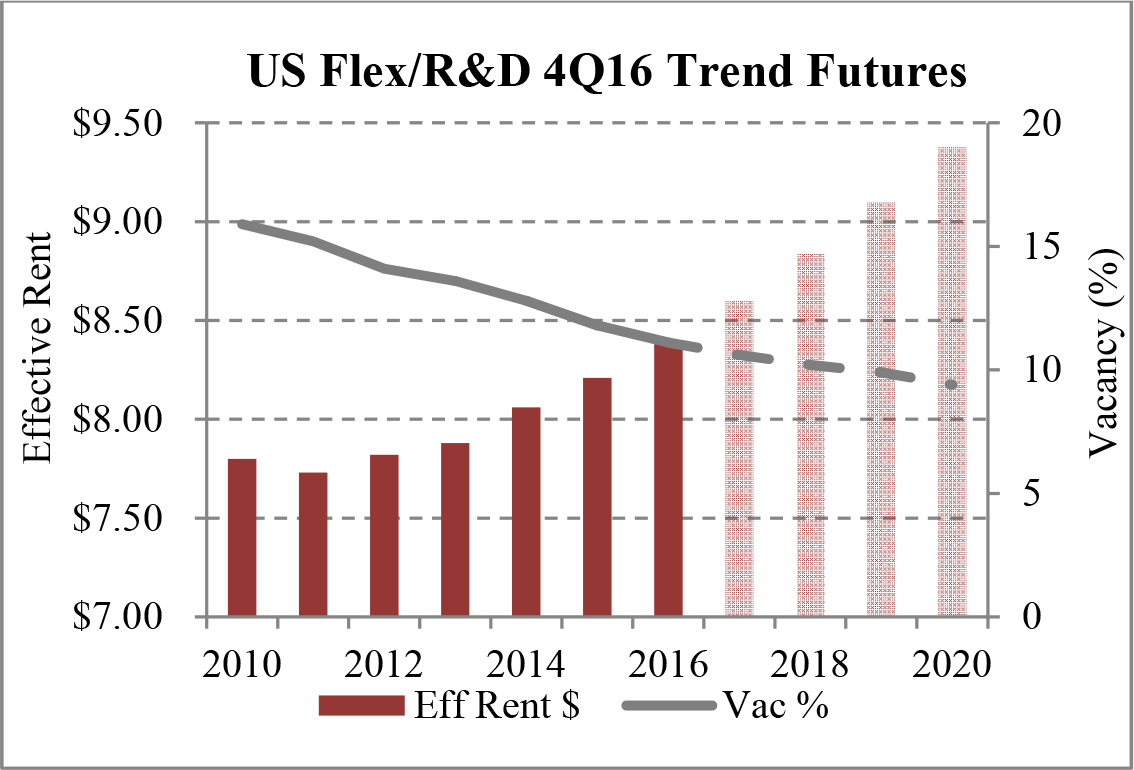

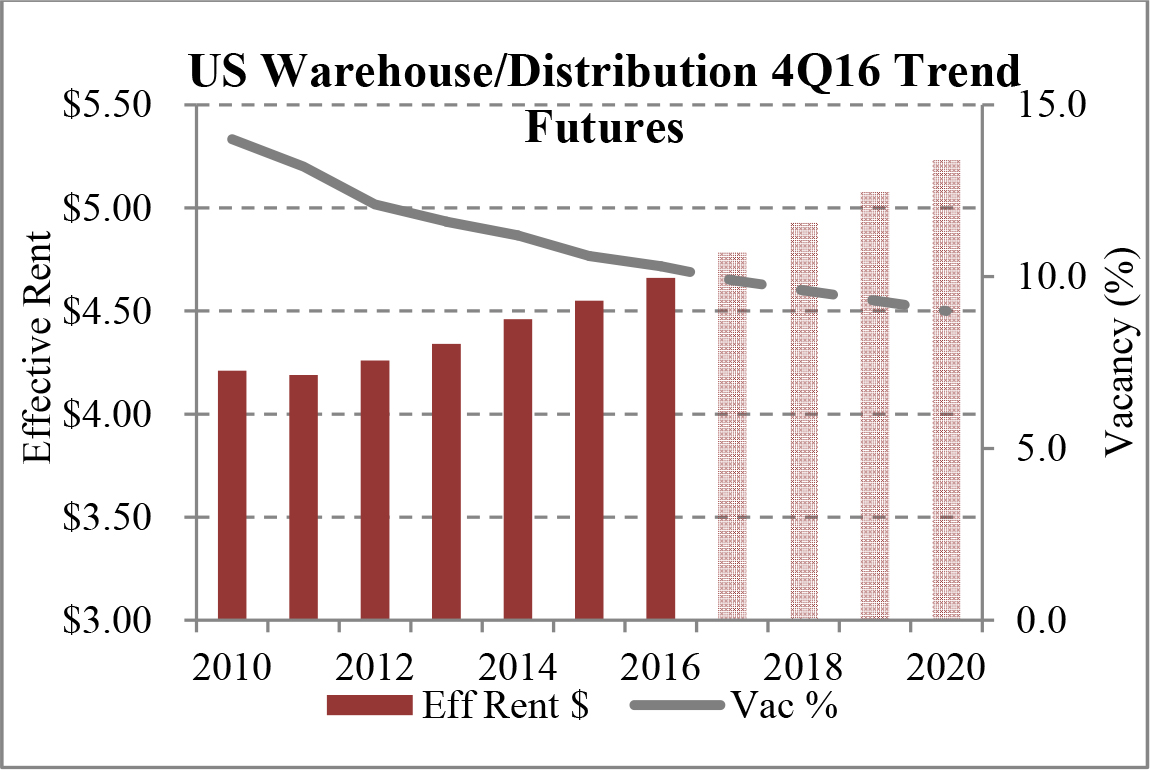

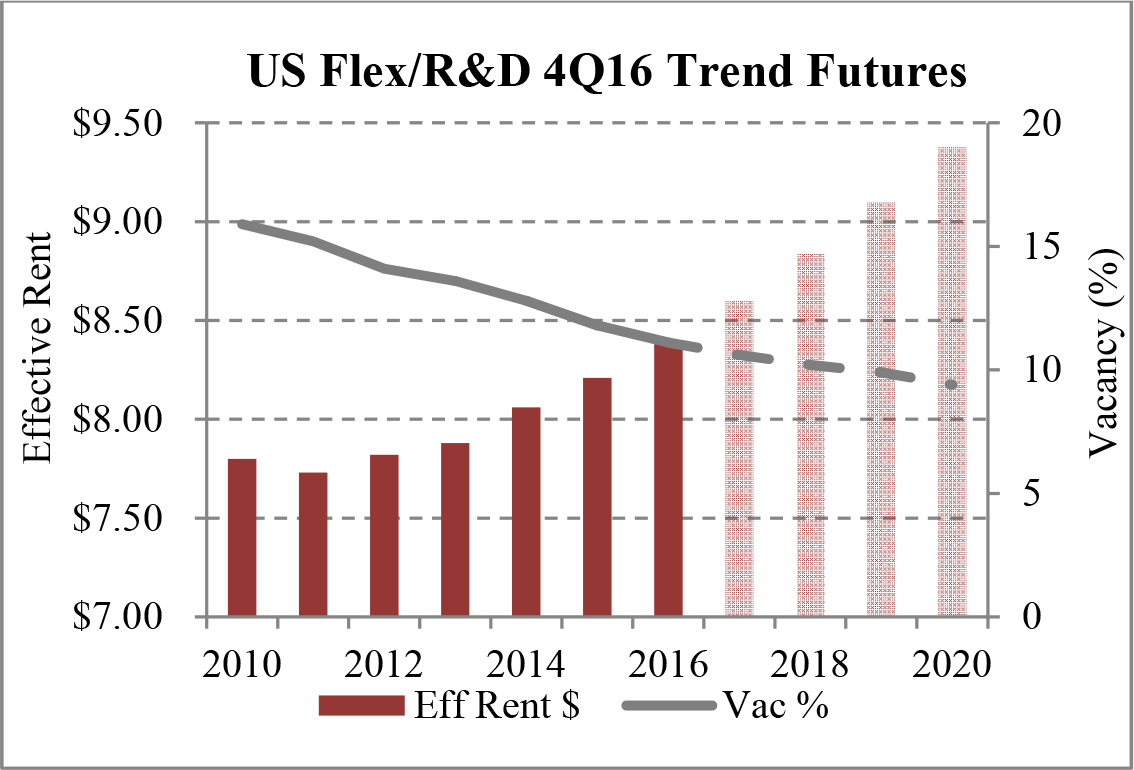

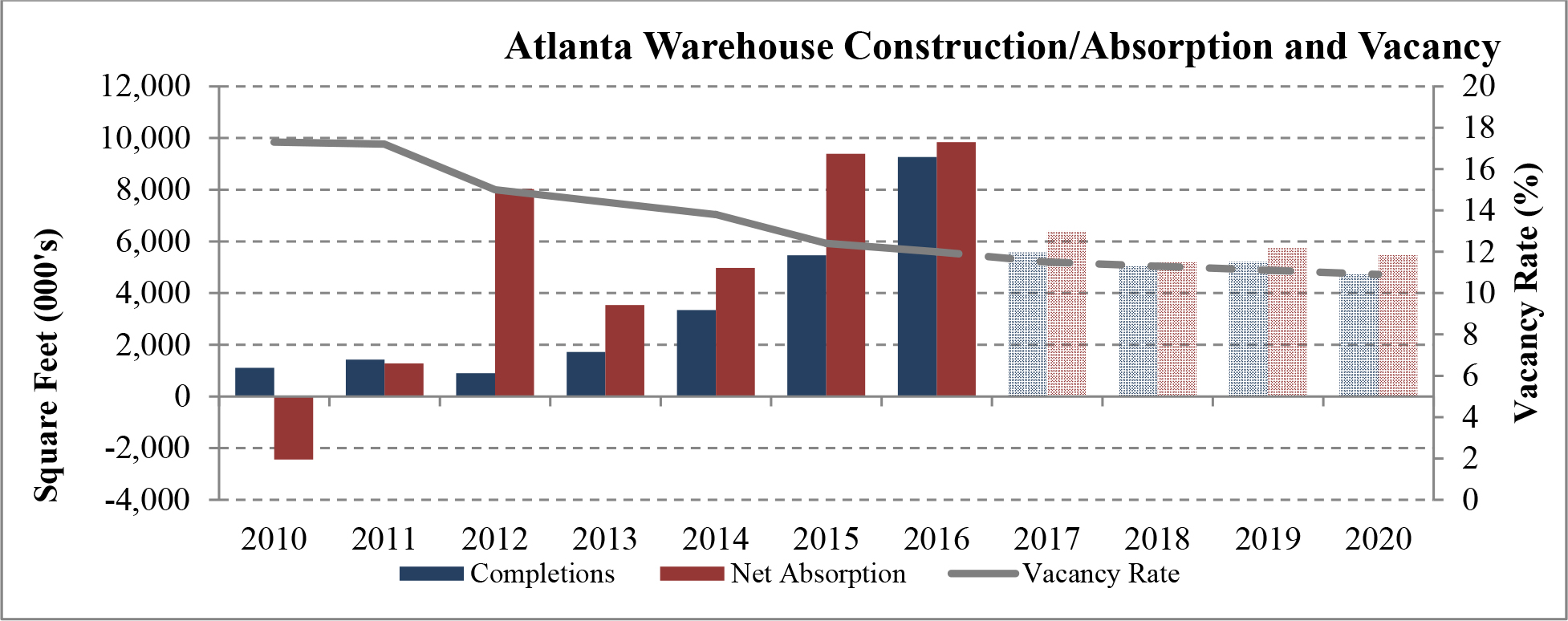

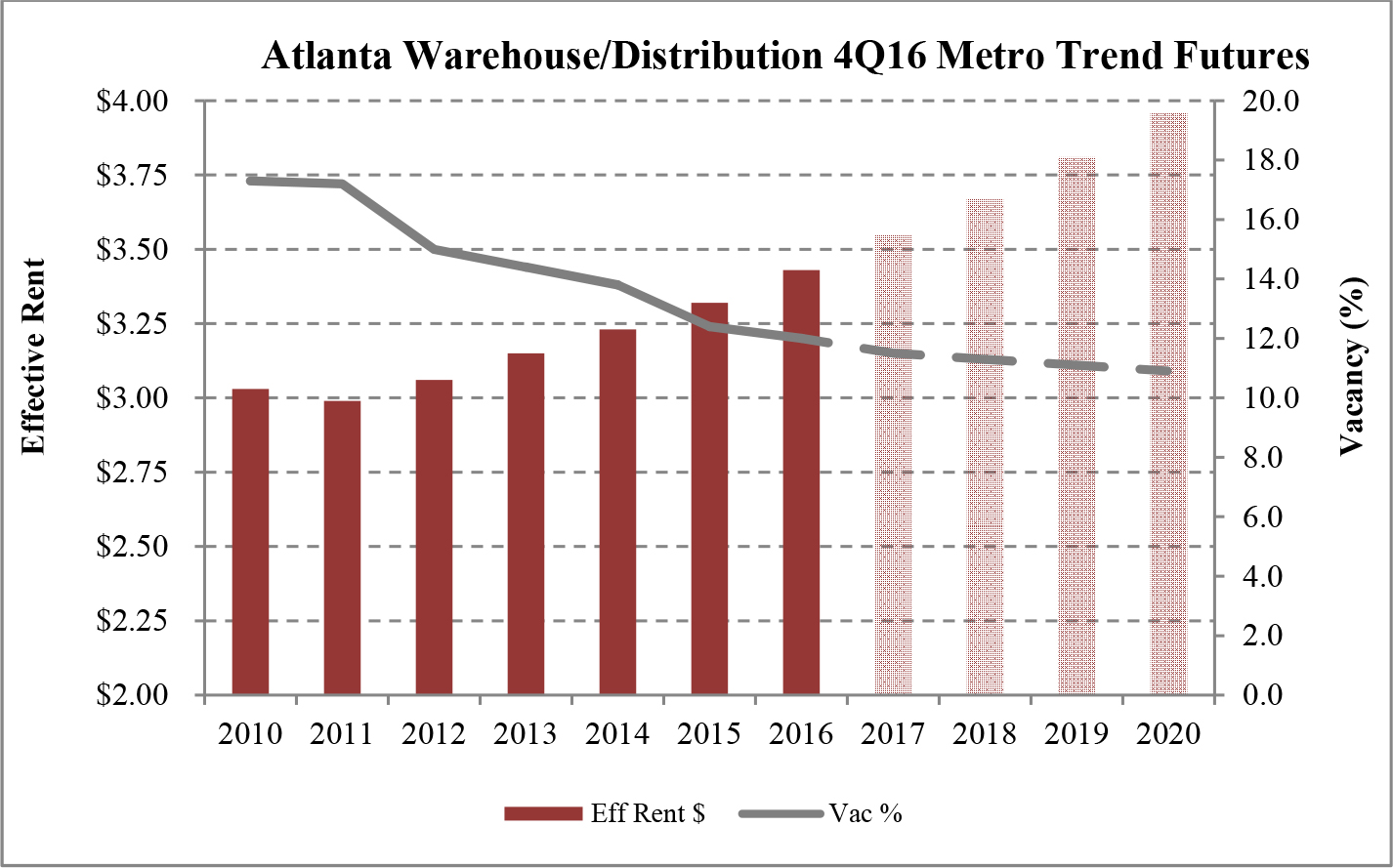

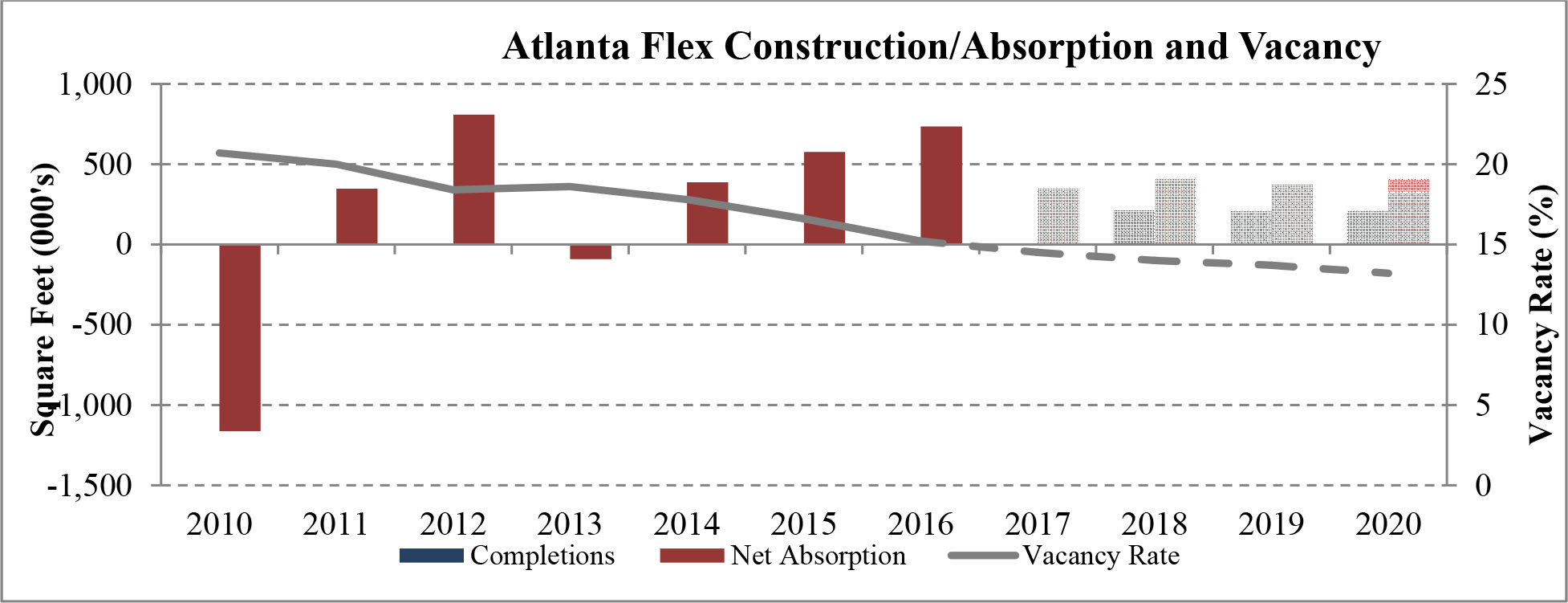

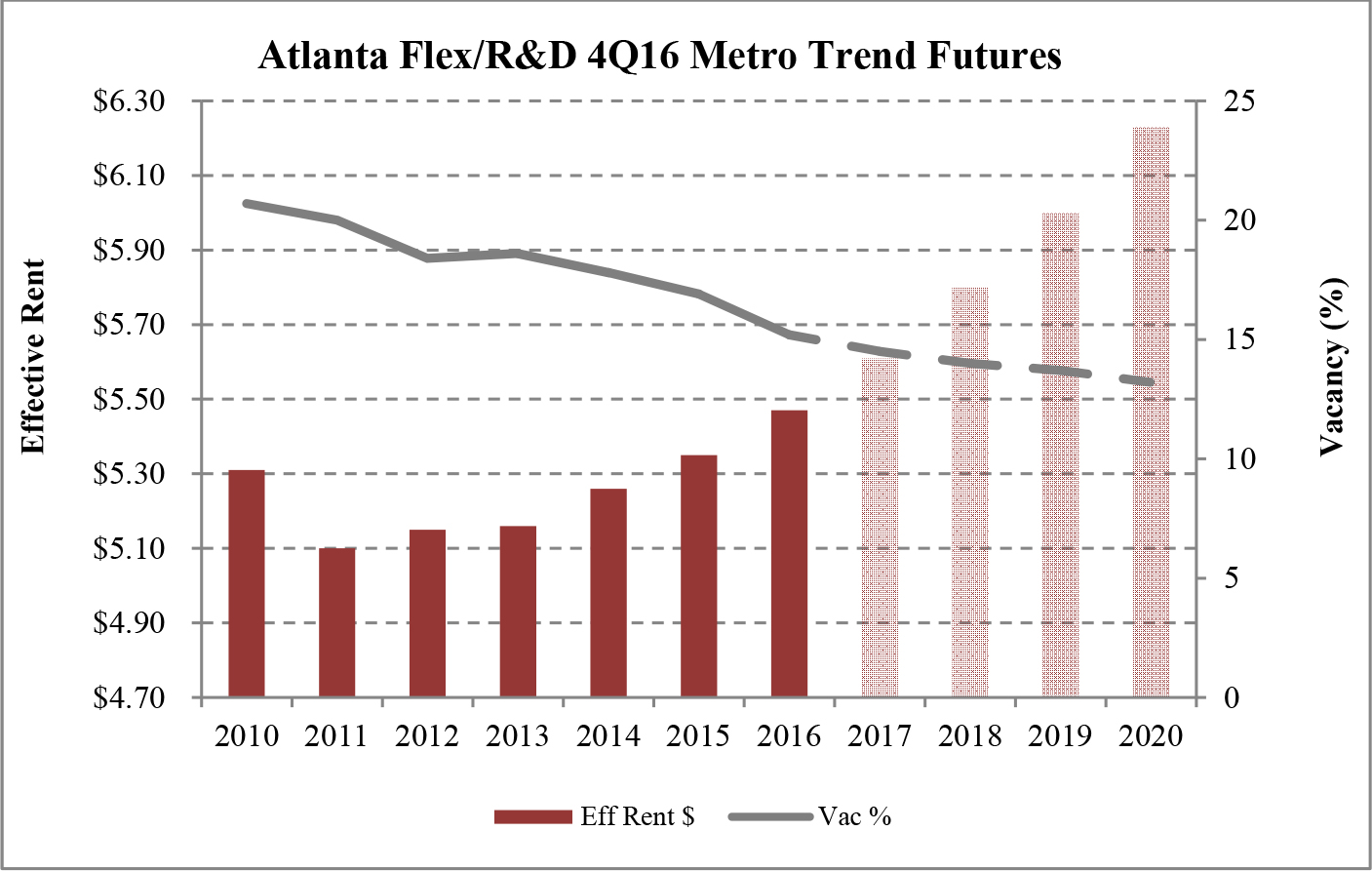

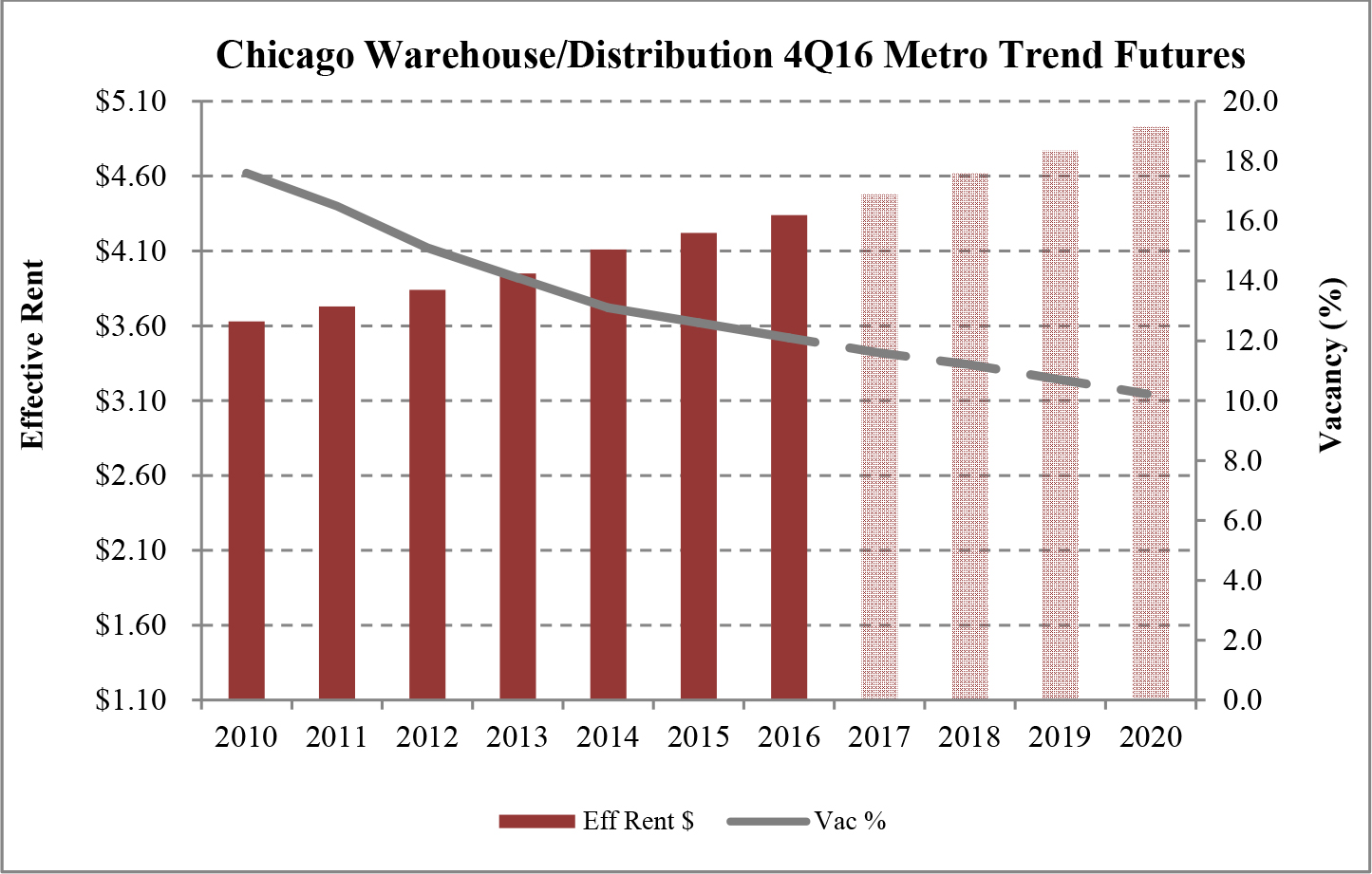

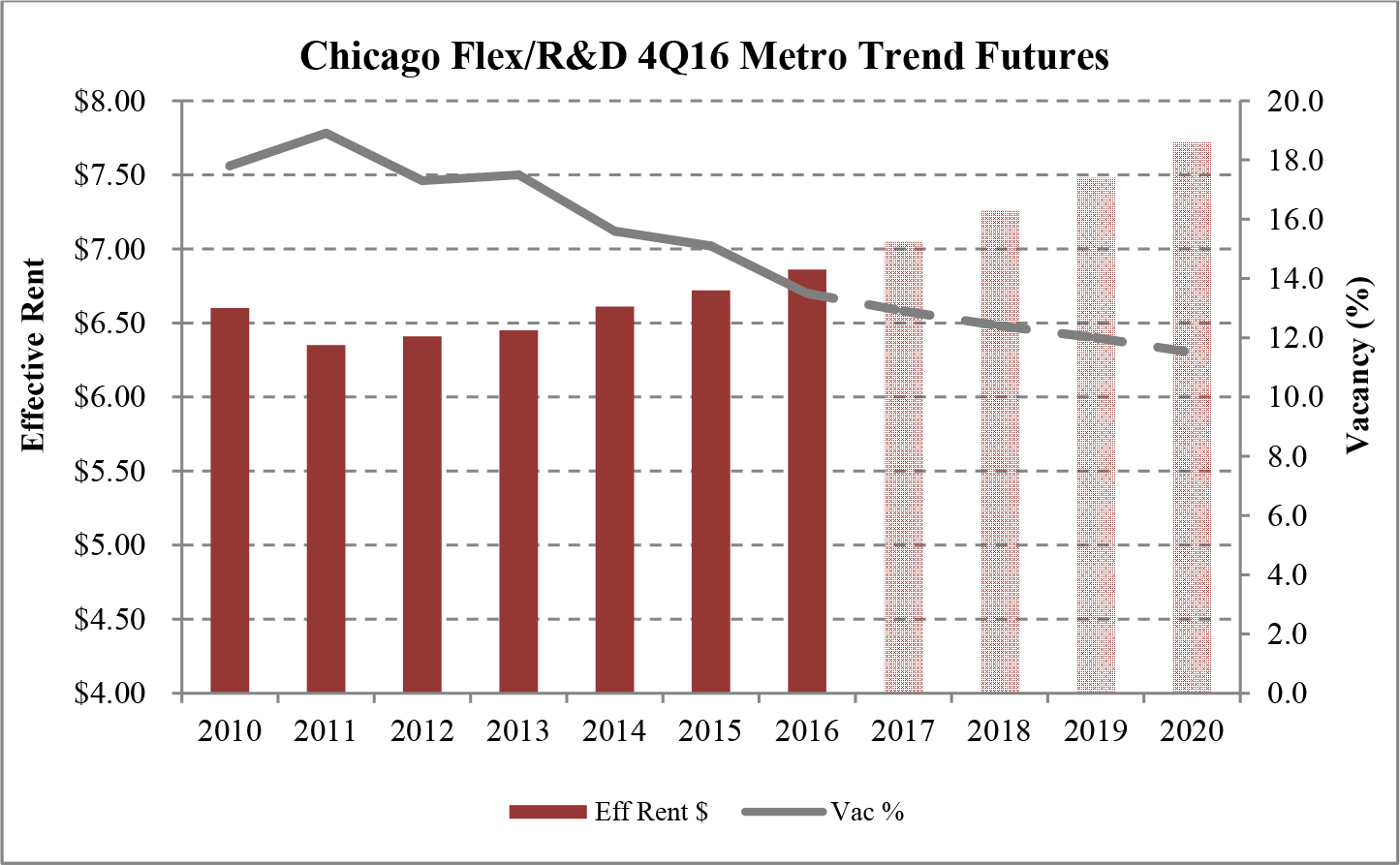

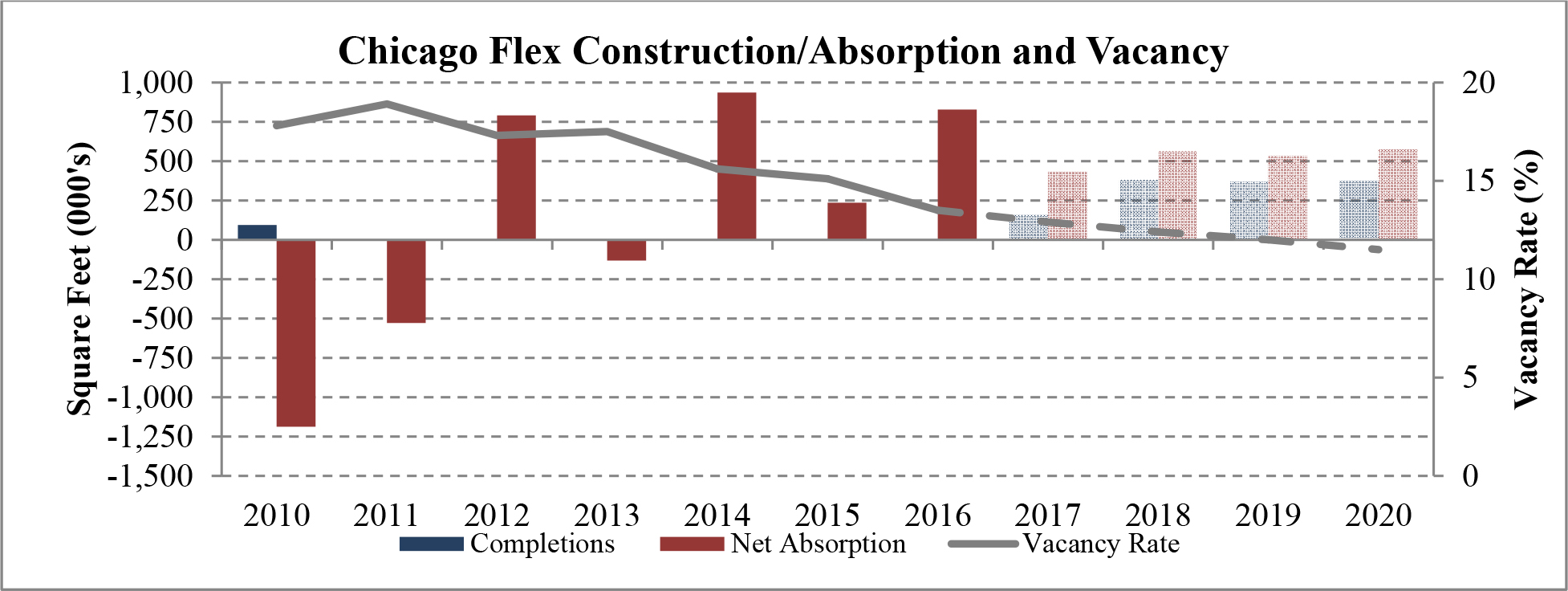

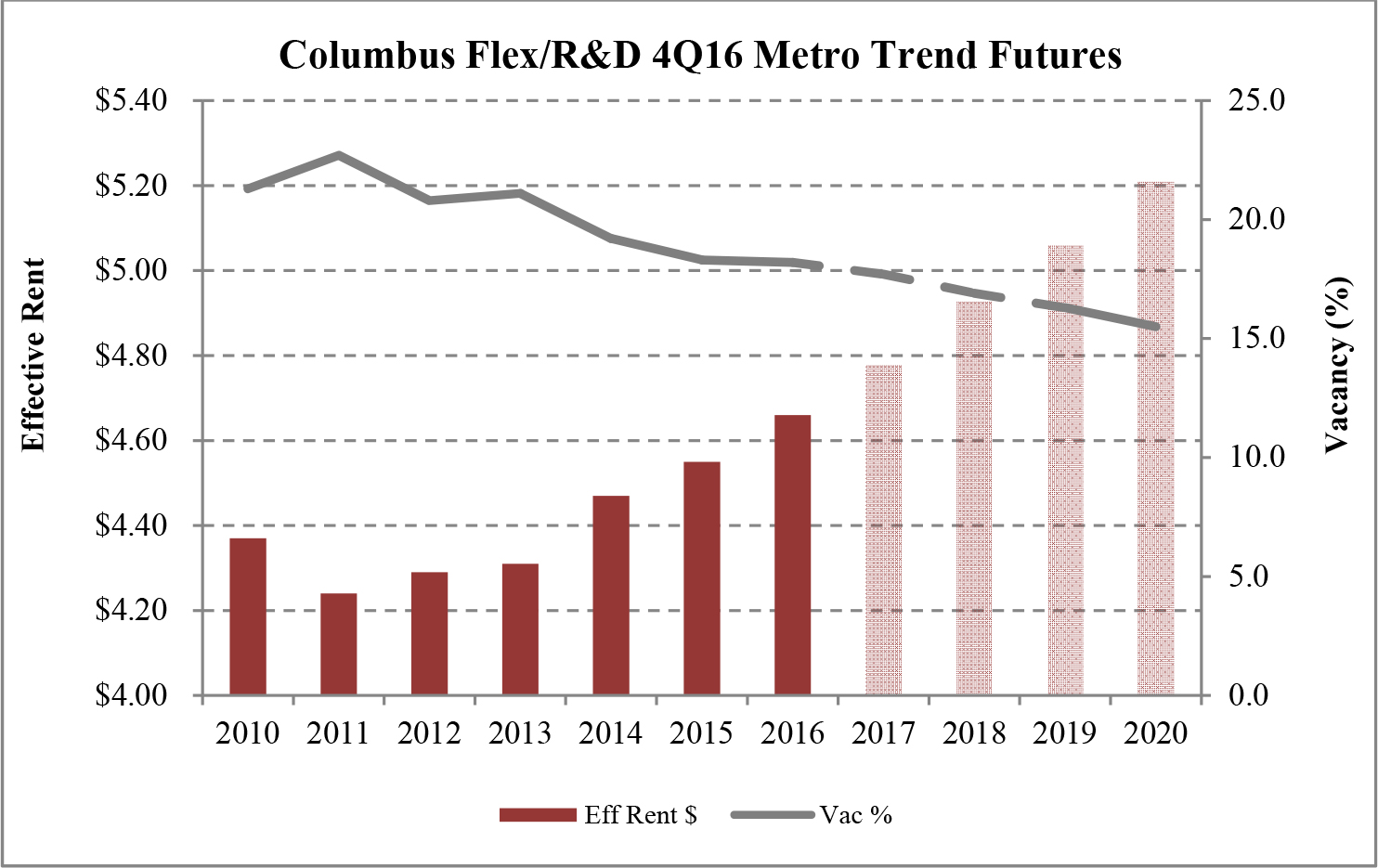

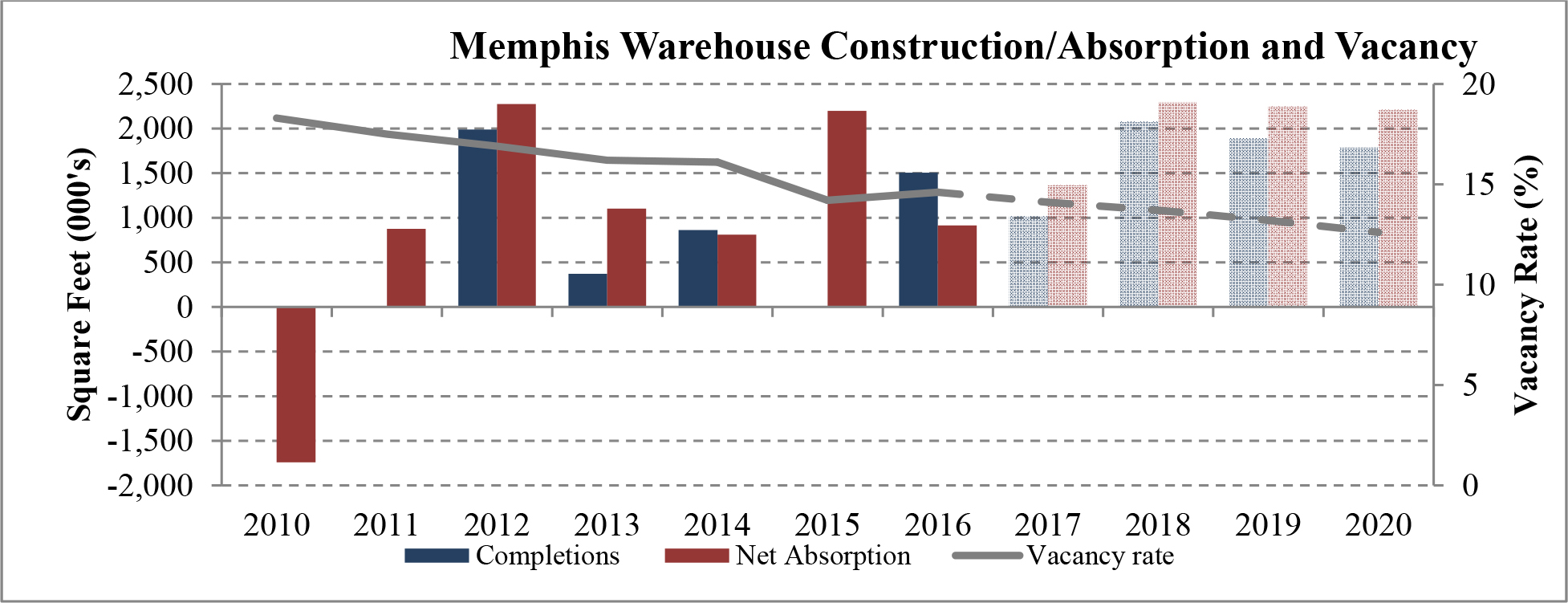

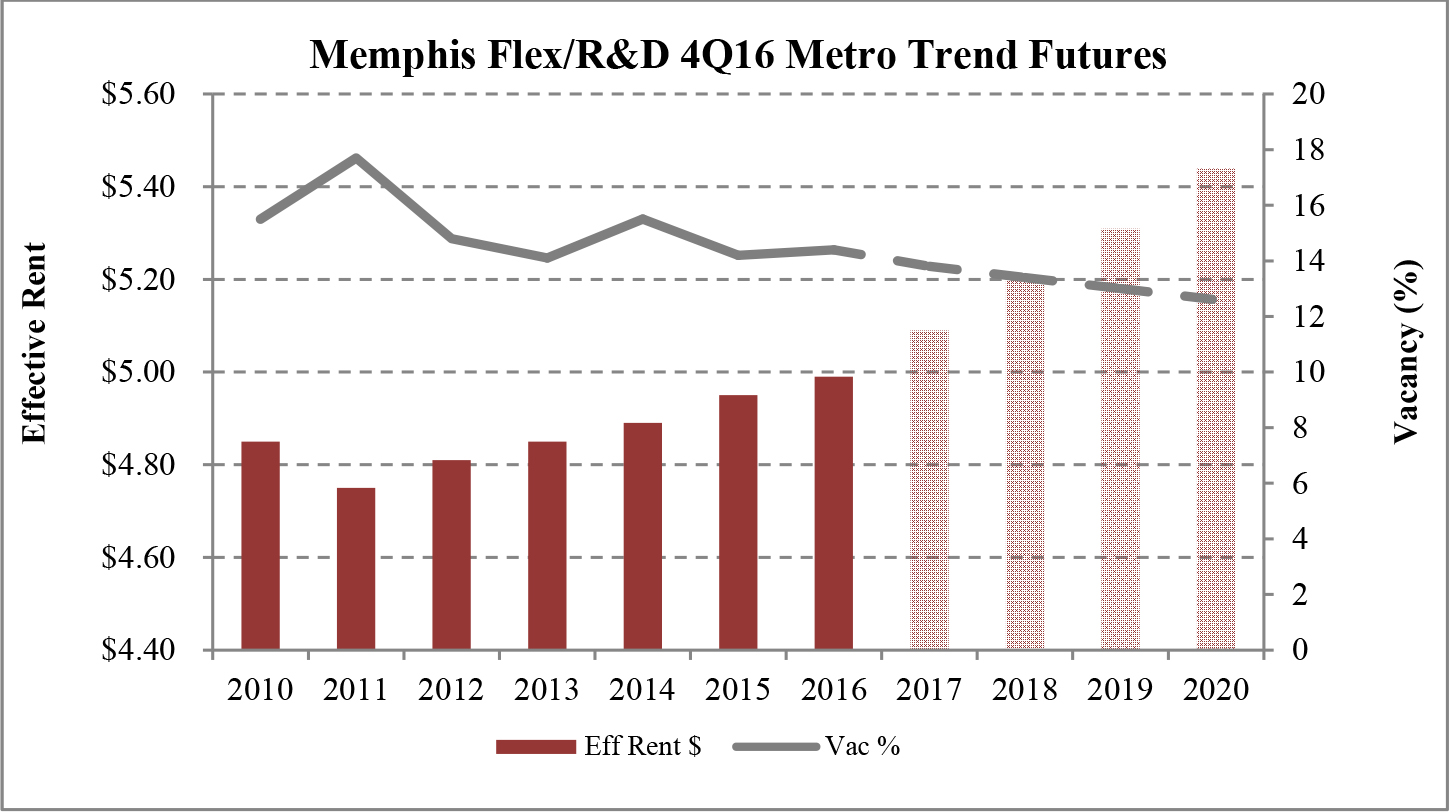

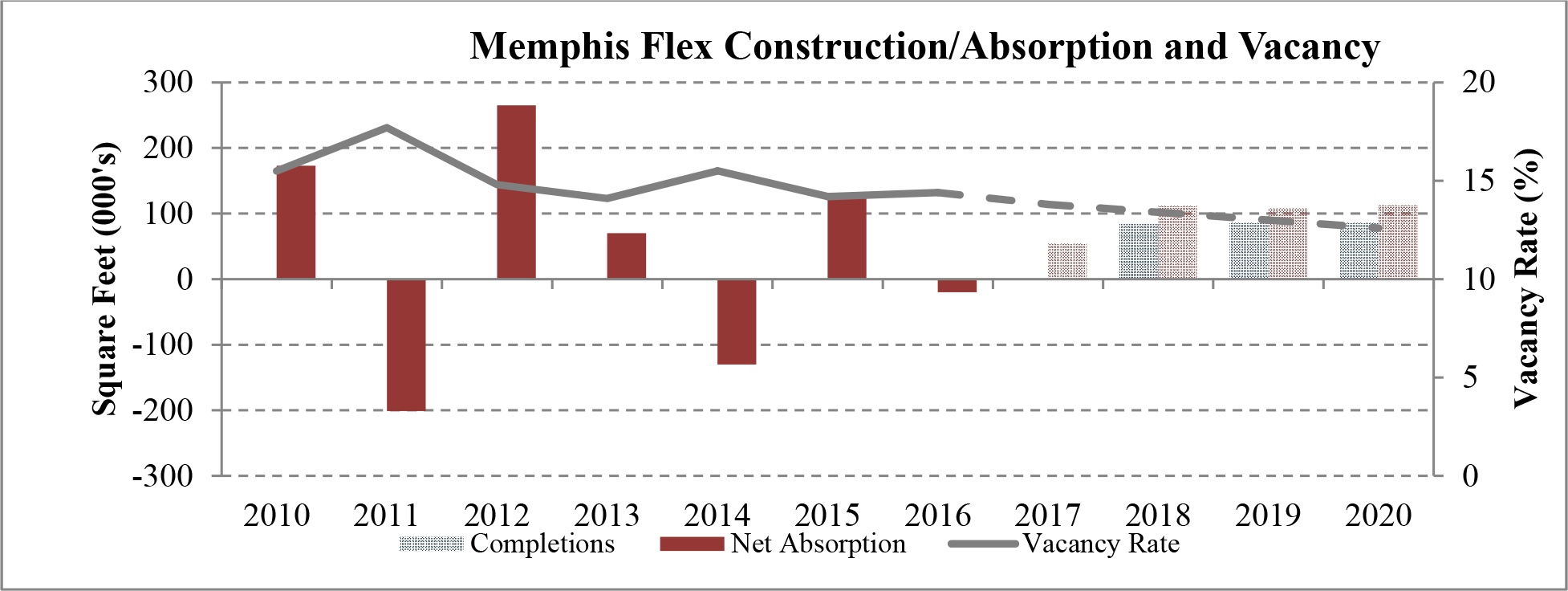

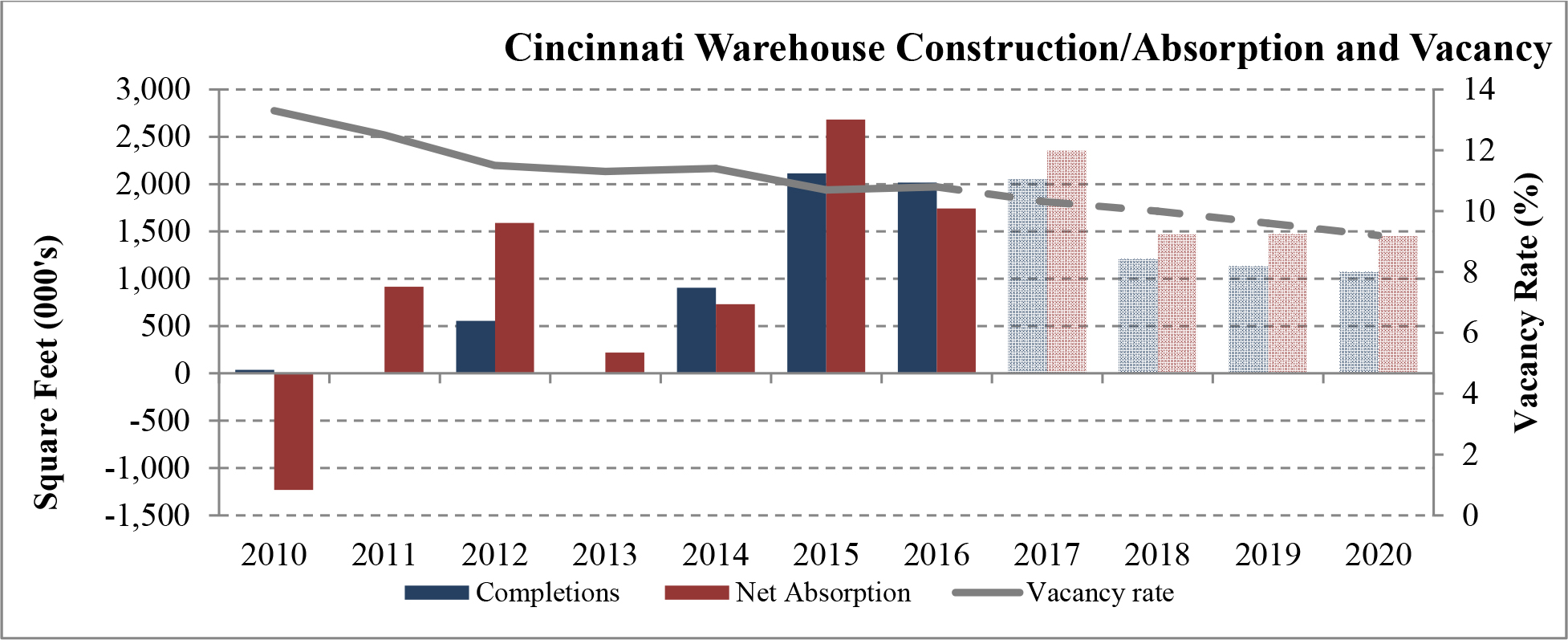

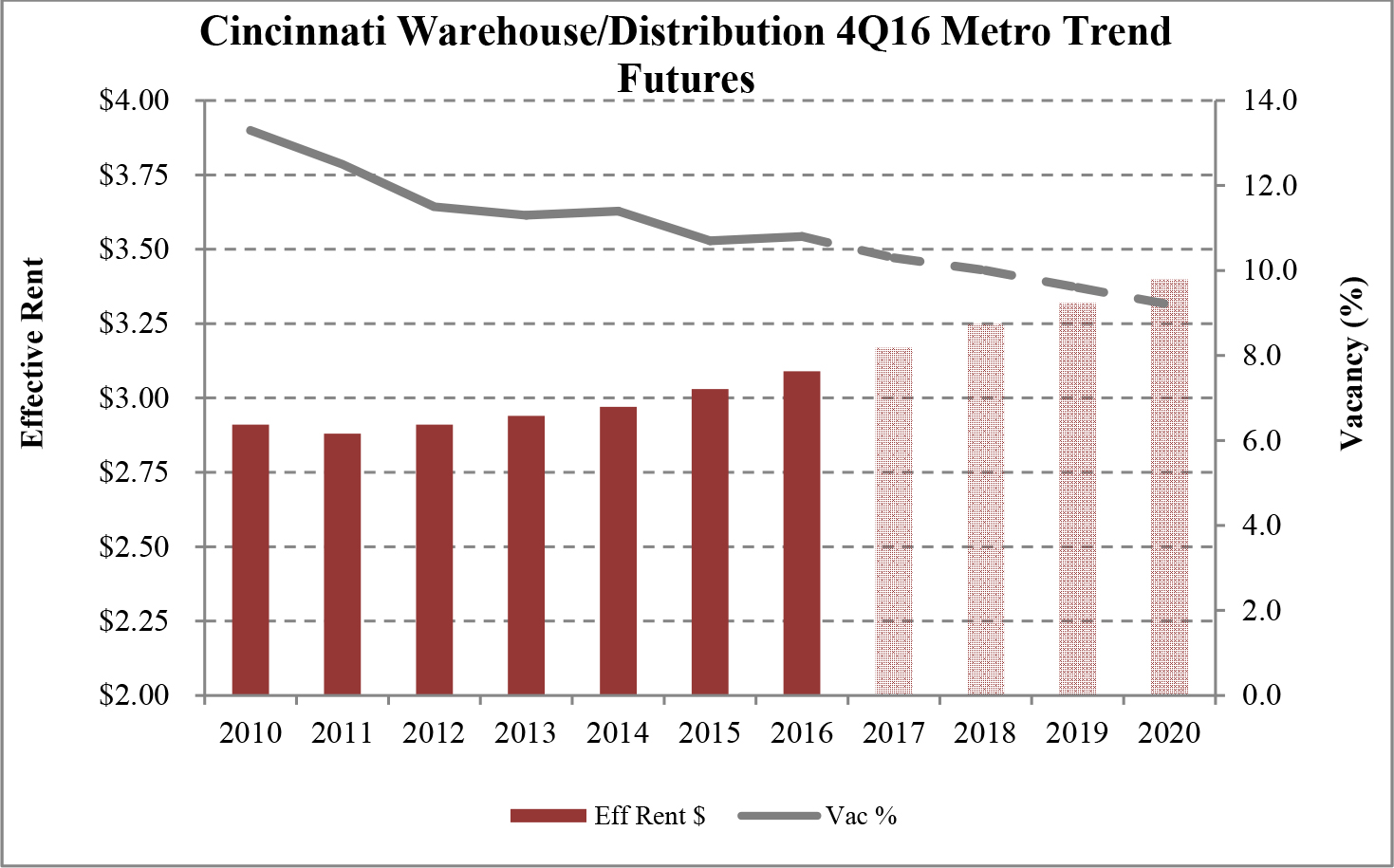

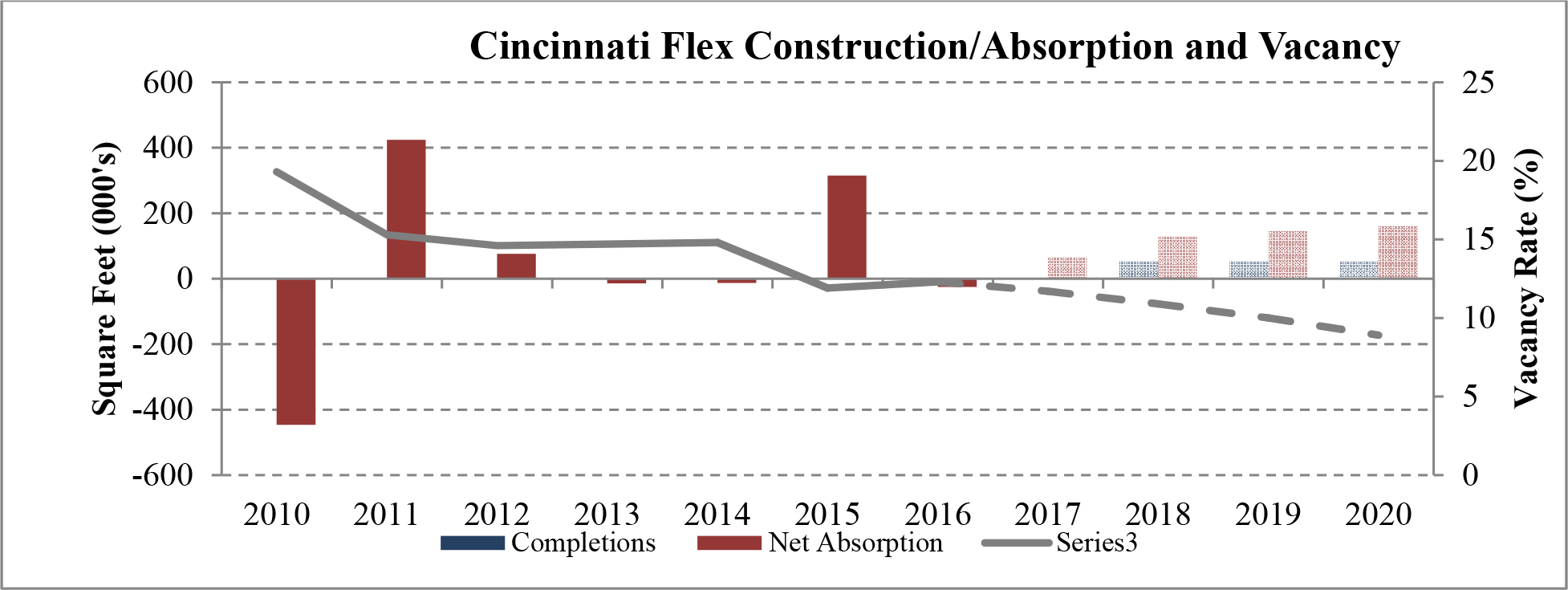

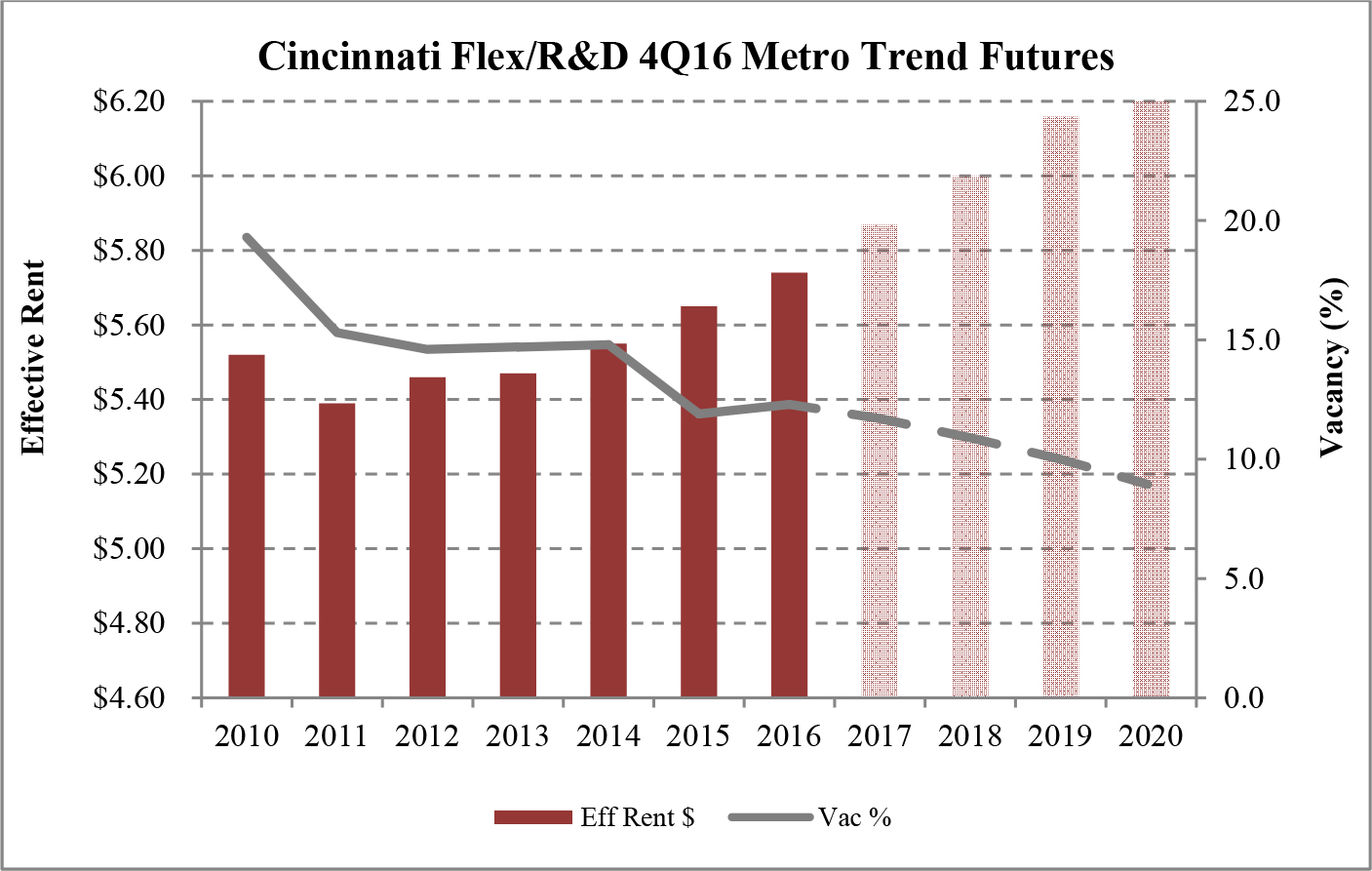

Limited new construction and growing demand for industrial properties will cause vacancy rates to fall and rental rates to rise as confirmed by REIS, Inc.’s, or REIS, data and projections on occupancy and effective rental forecasts for both the 6.4 billion square foot warehouse/distribution and 1.2 billion square foot U.S. Flex/R&D markets, which, as illustrated in the two graphs below, show an increase in effective rents since 2011 and a declining vacancy rate through 2020.

|

|

| Figure 5 (Source: REIS) | Figure 6 (Source: REIS) |

In the longer term, industrial real estate fundamentals are expected to continue to be strong, as the sector is uniquely positioned to benefit from current economic trends, including increased trade growth, inventory rebuilding, and increased industrial output. Additionally, developing trends point to a strong near-to medium-term outlook for the sector. For example, the growth of big-box warehouses serving large online retailers close to population centers is forecasted to gain popularity, which we believe could potentially influence smaller e-retailers to do the same.

6

Increased e-commerce has a positive impact on warehouse demand, as it tends to transfer retail tenants to warehouses. According to CBRE, U.S. e-commerce sales now comprise 8% of all US retail sales, up from 5.8% in 2013 and 1.5% in 2003. With massive increase in online sales over the past 15 years, e-commerce companies have had to make major investments in infrastructure and facilities to keep pace with demand. This is expected to continue, as online sales keep growing with traditional brick and mortar retailers employing multi-channel sale strategies. Additionally, this emergence of e-commerce and the growth of internet retailers and wholesalers are expanding the universe of tenants seeking industrial space in our target markets, which should drive demand and rent growth into the future.

Manufacturing is also likely to play an increased role in the industrial sector’s recovery. With energy prices and labor costs down, we believe that the fundamentals support a sustained resurgence in domestic manufacturing. Lack of supply may be a hurdle for continued demand growth, as some markets are already reporting shortages of space in certain asset types.

The Company Portfolio

As of the date of this prospectus, we have a minority interest in and operate 20 industrial buildings with an aggregate of approximately 4.0 million square feet of rentable space that as of March 31, 2017 was 98.4% occupied. Upon completion of this offering and the Torchlight Transactions, we will own 100% of the interest in each of the 20 properties listed below. The following table provides certain information with respect to the Company Portfolio as of March 31, 2017.

| Metro | Address | Property Type | Year Built/

Renovated (1) | Square Footage | Occupancy | Annualized

Rent (2) | Percent

of Total Annualized Rent | Annualized

Rent/Square Foot (3) | ||||||||||||||||||||

| Chicago, IL | 3940 Stern Avenue | Warehouse/Light Manufacturing | 1987 | 146,798 | 100 | % | $ | 623,891 | 4.4 | % | $ | 4.25 | ||||||||||||||||

| Chicago, IL | 1875 Holmes Road | Warehouse/Light Manufacturing | 1989 | 134,415 | 100 | % | $ | 641,706 | 4.6 | % | $ | 4.77 | ||||||||||||||||

| Chicago, IL | 1355 Holmes Road | Warehouse/ Distribution | 1975/1998 | 82,456 | 100 | % | $ | 387,477 | 2.8 | % | $ | 4.70 | ||||||||||||||||

| Chicago, IL | 2401 Commerce Drive | Warehouse/Flex | 1994/2009 | 78,574 | 100 | % | $ | 584,663 | 4.2 | % | $ | 7.44 | ||||||||||||||||

| Chicago, IL | 189 Seegers Road | Warehouse/Light Manufacturing | 1972 | 25,000 | 100 | % | $ | 162,365 | 1.2 | % | $ | 6.49 | ||||||||||||||||

| Chicago, IL | 11351 W. 183rd Street | Warehouse/ Distribution | 2000 | 18,768 | 100 | % | $ | 186,889 | 1.3 | % | $ | 9.96 | ||||||||||||||||

| Cincinnati, OH | Mostellar Distribution Center I & II | Warehouse/Light Manufacturing | 1959 | 358,386 | 100 | % | $ | 1,044,049 | 7.4 | % | $ | 2.91 | ||||||||||||||||

| Cincinnati, OH | 4115 Thunderbird Lane | Warehouse/Light Manufacturing | 1991 | 70,000 | 100 | % | $ | 234,500 | 1.7 | % | $ | 3.35 | ||||||||||||||||

| Florence, KY | 7585 Empire Drive | Warehouse/Light Manufacturing | 1973 | 148,415 | 100 | % | $ | 412,785 | 2.9 | % | $ | 2.78 | ||||||||||||||||

| Columbus, OH | 3500 Southwest Boulevard | Warehouse/ Distribution | 1992 | 527,127 | 100 | % | $ | 1,782,634 | 12.7 | % | $ | 3.38 | ||||||||||||||||

| Columbus, OH | 3100 Creekside Parkway | Warehouse/ Distribution | 1999 | 340,000 | 100 | % | $ | 1,003,000 | 7.1 | % | $ | 2.95 | ||||||||||||||||

| Columbus, OH | 8288 Green Meadows Dr. | Warehouse/ Distribution | 1988 | 300,000 | 100 | % | $ | 906,000 | 6.4 | % | $ | 3.02 | ||||||||||||||||

| Columbus, OH | 8273 Green Meadows Dr. | Warehouse/ Distribution | 1996/2007 | 77,271 | 100 | % | $ | 355,765 | 2.5 | % | $ | 4.60 | ||||||||||||||||

| Columbus, OH | 7001 American Pkwy | Warehouse/ Distribution | 1986/2007 & 2012 | 54,100 | 100 | % | $ | 175,824 | 1.2 | % | $ | 3.25 | ||||||||||||||||

| Memphis, TN | 6005, 6045 & 6075 Shelby Dr. | Warehouse/ Distribution | 1989 | 202,303 | 69.3 | % | $ | 424,078 | 3.0 | % | $ | 3.03 | ||||||||||||||||

| Jackson, TN | 210 American Dr. | Warehouse/ Distribution | 1967/1981 & 2013 | 638,400 | 100 | % | $ | 1,404,480 | 10.0 | % | $ | 2.20 | ||||||||||||||||

| Atlanta, GA | 32 Dart Road | Warehouse/Light Manufacturing | 1988/2014 | 194,800 | 100 | % | $ | 516,228 | 3.7 | % | $ | 2.65 | ||||||||||||||||

| Portland, ME | 56 Milliken Road | Warehouse/Light Manufacturing | 1966,

1995, 2005 & 2013 | 200,625 | 100 | % | $ | 1,036,449 | 7.4 | % | $ | 5.17 | ||||||||||||||||

| Marlton, NJ | 4 East Stow Road | Warehouse/Distribution | 1986 | 156,279 | 100 | % | $ | 834,900 | 5.9 | % | $ | 5.34 | ||||||||||||||||

| Cleveland, OH | 1755 Enterprise Parkway | Warehouse/Light Manufacturing | 1979/2005 | 255,570 | 100 | % | $ | 1,354,762 | 9.6 | % | $ | 5.30 | ||||||||||||||||

| Industrial Properties -- Total/Weighted Average | 4,009,287 | 98.4 | % | $ | 14,072,447 | 100.0 | % | $ | 3.57 | |||||||||||||||||||

_______________

| (1) | Renovation means significant upgrades, alterations or additions to building areas, interiors, exteriors and/or systems. |

| (2) | Annualized base rent is calculated by multiplying (i) rental payments (defined as cash rents before abatements) for the month ended March 31, 2017 by (ii) 12. On March 31, 2017, there were no rental abatements or concessions in effect that would impact cash rent. |

| (3) | Calculated by multiplying (i) rental payments (defined as cash rents before abatements) for the month ended March 31, 2017, by (ii) 12, and then dividing by leased square feet for such property as of March 31, 2017. |

Acquisition Pipeline

Our executive management and acquisition teams maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants. We believe these relationships and our research-driven origination methods provide us access to off-market and lightly marketed acquisition opportunities, many of which may not be available to our competitors. Furthermore, we believe that a significant portion of the approximately 15.4 billion square feet of industrial space in the U.S. falls within our target investment criteria and that there will be ample supply of attractive acquisition opportunities in the future.

In the normal course of our business, we regularly evaluate the market for industrial properties to identify potential acquisition targets. As of the date of this prospectus, we are evaluating approximately $350 million of potential acquisitions in our target markets that we have identified as warranting further investment consideration after an initial review. We do not have any relationship with the sellers of the properties we are evaluating. As of the date of this prospectus, we have neither entered into any letters of intent or purchase agreements with respect to any potential acquisitions, nor have we begun a comprehensive due diligence review with respect to any of these properties. Accordingly, we do not believe that the acquisition of any of the properties under evaluation is probable as of the date of this prospectus.

7

Torchlight Transactions

Redemption of Preferred Interests in Joint Venture

We and Torchlight are party to a joint venture agreement with respect to Plymouth Industrial 20, dated as of October 17, 2016. Each of the properties in the Company Portfolio is owned by Plymouth Industrial 20, in which we currently own a 0.5% interest and Torchlight owns a 99.5% interest, or the Preferred Interests. We are required to redeem the Preferred Interests on or before June 16, 2017, for $25.0 million, which will be paid by a combination of $20.0 million in cash with a portion of the net proceeds from this offering and 263,158 shares of our common stock to be issued in a private placement concurrently with the closing of this offering, which shares will be registered for resale following the first anniversary of the closing of this offering. The shares issuable upon exercise of the warrants will be registered for resale following the first anniversary of the closing of this offering. See “Use of Proceeds” and “Structure of Our Company—Torchlight Transactions.” In the event we do not make the required payment by June 16, 2017, Torchlight has the right to acquire our ownership in Plymouth Industrial 20 LLC for $1.

Termination of Participation Right

As partial consideration for making the Torchlight Mezzanine Loan (as defined below), Plymouth Industrial 20, the borrower under the Torchlight Mezzanine Loan, granted Torchlight, in its capacity as lender, a profit participation in the form of the right to receive 25% of net income and capital proceeds generated by the Company Portfolio following debt service payments and associated costs, or the TL Participation. Pursuant to the Letter Agreement between Torchlight and us, dated as of March 3, 2017, or the Letter Agreement, we have the right to terminate the TL Participation in consideration for the private issuance of warrants to Torchlight to acquire 250,000 shares of our common stock, which we expect to issue concurrently with the closing of this offering. See “Description of Capital Stock—Warrants”.

We refer to the transactions described above collectively as the “Torchlight Transactions.” See “Structure of Our Company—Torchlight Transactions.”

Stockholders Agreement with Torchlight

Immediately upon completion of this offering and the Torchlight Transactions, we intend to enter into a stockholders agreement with Torchlight, or the Stockholders Agreement, in order to establish various arrangements and restrictions with respect to governance of our company and certain rights that will be granted to the Torchlight in connection with the Torchlight Transactions while Torchlight maintains beneficial ownership of at least 2.5% of our common stock. These rights and restrictions will include a board nomination right and certain customary registration and preemptive rights. We will also be prohibited from issuing preferred stock until Torchlight falls below the ownership threshold described above. See “Management—Torchlight Stockholders Agreement.”

Existing Debt Structure

AIG Loan

On October 17, 2016, certain indirect subsidiaries of our operating partnership entered into a senior secured loan agreement with investment entities managed by AIG Asset Management, or the AIG Loan Agreement, which provides for a loan, or the AIG Loan, of $120 million, bearing interest at 4.08% per annum, and a seven-year term. As of March 31, 2017, there was $120 million outstanding under the AIG Loan Agreement. The AIG Loan Agreement provides for monthly payments of interest only for the first three years of the term and thereafter monthly principal and interest payments based on a 27-year amortization period. Our operating partnership used the net proceeds of the AIG Loan to partially repay the outstanding principal and accrued interest under our then-existing senior secured loan agreement. We are currently in technical violation of the net worth covenant in the AIG loan agreement, which we believe was the result of a drafting error. On May 3, 2017, we entered into an agreement with AIG pursuant to which AIG has agreed to waive this default from October 17, 2016 up to and including June 30, 2017. We believe that we will be in compliance with all covenants under the AIG Loan Agreement upon the closing of this offering.

The borrowings under the AIG Loan Agreement are secured by first lien mortgages on all of the properties in the Company Portfolio. The obligations under the AIG Loan Agreement are also guaranteed by our company and each of our operating partnership’s wholly-owned subsidiaries.

Torchlight Mezzanine Loan

On October 17, 2016, Plymouth Industrial 20 entered into a mezzanine loan agreement, or the Torchlight Mezzanine Loan Agreement, with Torchlight, which provides for a loan of $30 million, or the Torchlight Mezzanine Loan. The Torchlight Mezzanine Loan has a seven-year term and bears interest at 15% per annum, of which 7% percent is paid currently during the first four years of the term and 10% is paid for the remainder of the term. The Torchlight Mezzanine Loan requires Plymouth Industrial 20 to pay a repayment premium equal to the difference between (x) the sum of 150% of the principal being repaid (excluding accrued interest) and (y) the sum of the actual principal amount being repaid and current and accrued interest paid through the date of repayment. This repayment feature operates as a prepayment feature since the difference will be zero at maturity. The borrowings under the Torchlight Mezzanine Loan are secured by, among other things, pledges of the equity interest in Plymouth Industrial 20 and each of its property-owning subsidiaries. The proceeds of the Torchlight Mezzanine Loan were used to partially repay the outstanding principal and accrued interest under our then-existing senior secured loan agreement.

8

Summary Risk Factors

An investment in our common stock involves material risks. You should consider carefully the risks described below and under “Risk Factors” before purchasing shares of our common stock in this offering:

| • | The Company Portfolio is concentrated in the industrial real estate sector, and our business would be materially and adversely affected by an economic downturn in that sector. | |

| • | The Company Portfolio is geographically concentrated in seven states, which causes us to be especially susceptible to adverse developments in those markets. | |

| • | The Company Portfolio is comprised almost entirely of Class B industrial properties in secondary markets, which subjects us to risk associated with concentrating the Company Portfolio on such assets. | |

| • | We are subject to risks associated with single-tenant leases, and the default by one or more tenants could materially and adversely affect our results of operations and financial condition. | |

| • | We are subject to risks related to tenant concentration, which could materially adversely affect our cash flows, results of operations and financial condition. | |

| • | We may be unable to renew leases, lease vacant space or re-lease space as leases expire. | |

| • | We may be unable to identify and complete acquisitions of properties that meet our investment criteria, which may have a material adverse effect on our growth prospects. | |

| • | We may be unable to source “off-market” or “lightly-marketed” deal flows in the future, which may have a material adverse effect on our growth. | |

| • | Our success depends on key personnel whose continued service is not guaranteed, and the departure of one or more of our key personnel could adversely affect our ability to manage our business and to implement our growth strategies, or could create a negative perception in the capital markets. | |

| • | Our charter and bylaws, the partnership agreement of our operating partnership and Maryland law contain provisions that may delay, defer or prevent a change of control transaction. | |

| • | Failure to maintain our qualification as a REIT would have significant adverse consequences to us and the per share trading price of our common stock. | |

| • | We may be unable to make distributions at expected levels, and we may be required to borrow funds to make distributions. | |

| • | The number of shares of our common stock available for future issuance or sale could adversely affect the trading price of our common stock. |

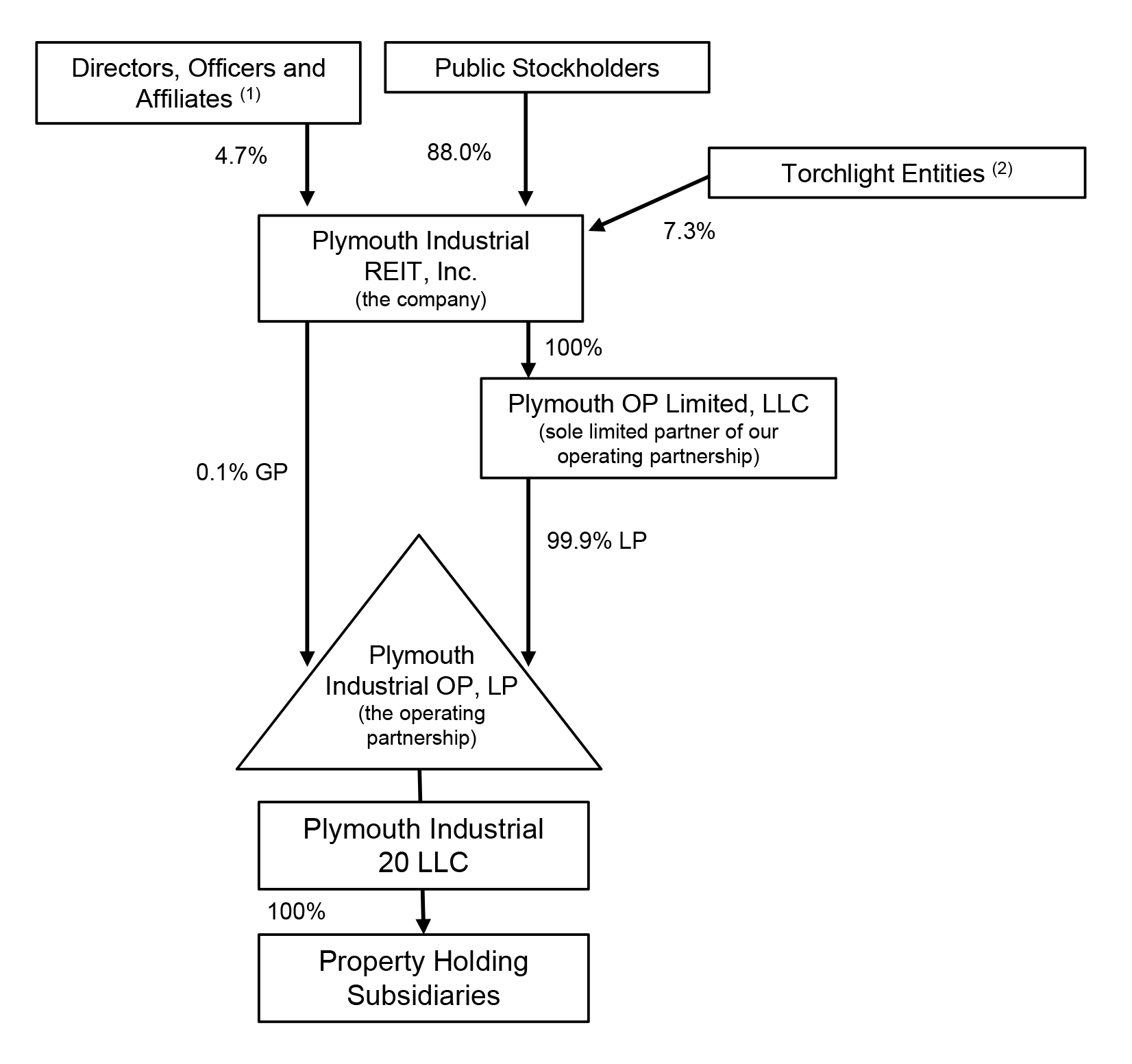

Structure and Formation of Our Company

Our Company

We were formed as a Maryland corporation in March 2011 and previously conducted business as Plymouth Opportunity REIT, Inc. We conduct our business through an UPREIT structure in which our properties are owned by our operating partnership directly or through subsidiaries, as described below under “—Our Operating Partnership.” We are the sole general partner of our operating partnership and, upon completion of this offering and the redemption of the Preferred Interests, we will directly or indirectly own 100% of the OP units in our operating partnership and its subsidiaries. Our board of directors oversees our business and affairs.

Our Operating Partnership

Our operating partnership was formed as a Delaware limited partnership in March 2011. Substantially all of our assets are held by, and our operations are conducted through, our operating partnership. We will contribute the net proceeds from this offering to our operating partnership in exchange for OP units. Our interest in our operating partnership will generally entitle us to share in cash distributions from, and in the profits and losses of, our operating partnership in proportion to our percentage ownership. As the sole general partner of our operating partnership, we will generally have the exclusive power under the partnership agreement to manage and conduct its business and affairs, subject to certain limited approval and voting rights of the limited partners, which are described more fully below in “Description of the Partnership Agreement of Plymouth Industrial OP, LP.”

9

Corporate Structure

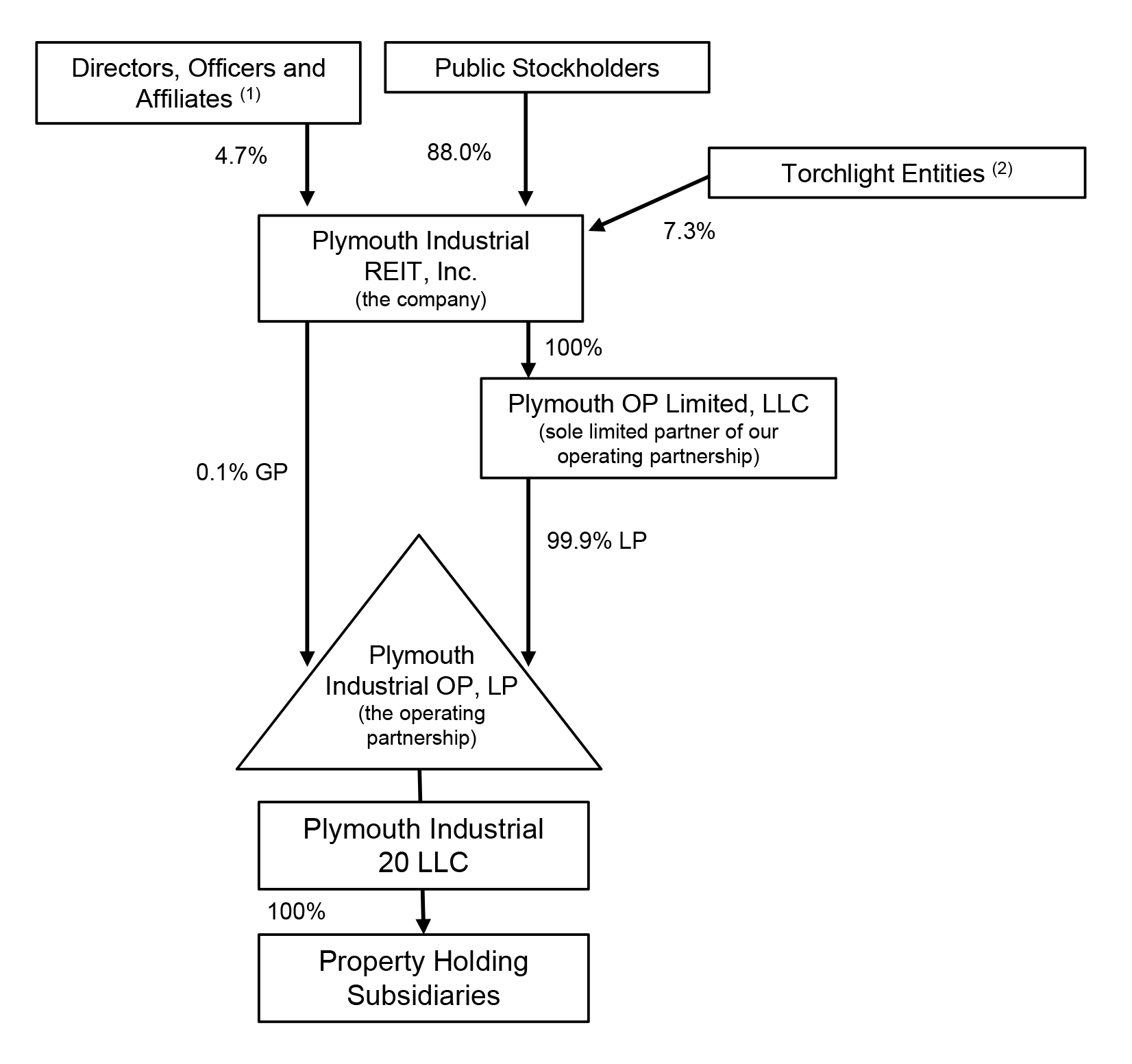

The chart below reflects our organizational structure immediately following completion of this offering and the Torchlight Transactions.

________________

| (1) | Reflects (a) an aggregate of 115,790 restricted shares of common stock to be granted to our executive officers and, (b) an aggregate of 15,789 restricted shares of common stock to be granted to our independent directors, in each case, concurrently with the completion of this offering. | |

| (2) | Reflects an aggregate of 263,158 shares of our common stock to be issued to DOF IV Plymouth PM, LLC in the Torchlight Transactions, and excludes warrants exercisable for 250,000 shares of common stock to be issued to DOF IV REIT Holdings, LLC in the Torchlight Transactions. |

Conflicts of Interest

Each of our executive officers entered into an employment agreement with us in April 2017. See “Executive Compensation—Executive Compensation Arrangements.” We may choose not to enforce, or to enforce less vigorously, our rights under these agreements because of our desire to maintain our ongoing relationships with members of our senior management, with possible negative impact on stockholders. Moreover, these agreements were not negotiated at arm’s length and certain of our executive officers had the ability to influence the types and level of benefits that they will receive from us under these agreements.

Conflicts of interest may exist or could arise in the future as a result of the relationships between us and our affiliates, on the one hand, and our operating partnership or any partner thereof, on the other. Our directors and officers have duties to our company under Maryland law in connection with their management of our company. At the same time, we, as the general partner of our operating partnership, have fiduciary duties and obligations to our operating partnership and its limited partners under Maryland law and the partnership agreement of our operating partnership in connection with the management of our operating partnership. Our fiduciary duties and obligations as the general partner of our operating partnership may come into conflict with the duties of our directors and officers to our company. We have adopted policies that are designed to eliminate or minimize certain potential conflicts of interests, and the partnership agreement of our operating partnership provides that, in the event of a conflict between the interests of us or our stockholders and the interests of our operating partnership or any of its limited partners, we may give priority to the separate interests of our company or our stockholders, including with respect to tax consequences to limited partners, assignees or our stockholders. See “Policies With Respect to Certain Activities—Conflict of Interest Policy” and “Description of the Partnership Agreement of Plymouth Industrial OP, LP.”

10

Tax Status

We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2012 and we believe that our organization and method of operation enable us to meet the requirements for qualification and taxation as a REIT. To maintain REIT qualification, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income (determined without regard to the deduction for dividends paid and any net capital gain) to our stockholders. As a REIT, we generally will not be subject to federal income tax on our taxable income we currently distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income or property. In addition, the income of any taxable REIT subsidiary that we own will be subject to taxation at regular corporate rates. See “Material U.S. Federal Income Tax Considerations.”

Distribution Policy

We made quarterly distributions in shares of our common stock beginning with the fiscal quarter ended September 30, 2012 through the fiscal quarter ended March 31, 2014. Following completion of this offering, we intend to make regular quarterly cash distributions to holders of shares of our common stock. Any future distributions we make will be at the discretion of our board of directors and will depend upon our earnings and financial condition, maintenance of our REIT qualification, applicable restrictions contained in the Maryland General Corporation Law, or the MGCL, and such other factors as our board may determine in its sole discretion. We anticipate that our estimated cash available for distribution will exceed the annual distribution requirements applicable to REITs. However, under some circumstances, we may be required to pay distributions in excess of cash available for distribution in order to meet these distribution requirements and may need to use the proceeds from future equity and debt offerings, sell assets or borrow funds to make some distributions. We have no intention to use the net proceeds of this offering to make distributions nor do we intend to make distributions using shares of common stock. We cannot assure you that our distribution policy will not change in the future. See “Distribution Policy.”

Restrictions on Ownership

Due to limitations on the concentration of ownership of REIT stock imposed by the Internal Revenue Code of 1986, as amended, or the Code, our charter generally prohibits any person from actually, beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. Our charter permits our board of directors, in its sole and absolute discretion, to exempt a person, prospectively or retroactively, from one or both of the ownership limits if, among other conditions, the person’s ownership of our stock in excess of the ownership limits would not cause us to fail to qualify as a REIT. Our board of directors may waive the ownership limit with respect to a particular person if it: (i) determines that such ownership will not cause any individual’s beneficial ownership of shares of our stock to violate the ownership limit and that any exemption from the ownership limit will not jeopardize our status as a REIT and (ii) determines that such stockholder does not and will not own, actually or constructively, an interest in a tenant of ours (or a tenant of any entity whose operations are attributed in whole or in part to us) that would cause us to own, actually or constructively, more than a 9.8% interest (as set forth in Section 856(d)(2)(B) of the Code) in such tenant or that any such ownership would not cause us to fail to qualify as a REIT under the Code.

Emerging Growth Company

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Although these exemptions will be available to us, they will not have a material impact on our public reporting and disclosure.

We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier. We will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1.0 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year ending December 31, 2017, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt, or (iv) the date on which we are deemed a “large accelerated filer” under the Securities Act of 1933, as amended, or the Securities Act, or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Under the JOBS Act, emerging growth companies can take advantage of the extended transition period provided in Section 7(a)(2)(13) of the Securities Act for complying with new or revised accounting standards. However, we are choosing to “opt out” of such extended transition period and, as a result, we will comply with any such new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Our Corporate Information

Our principal executive offices are located at 260 Franklin Street, 6th Floor, Boston, Massachusetts 02110. Our telephone number is (617) 340-3814. Our website is www.plymouthreit.com. The information found on, or otherwise accessible through, our website is not incorporated into, and does not form a part of, this prospectus or any other report or document we file with or furnish to you.

11

The Offering

| Common stock offered by us | 2,900,000 shares of common stock (plus up to an additional 435,000 shares of common stock that we may issue and sell upon the exercise of the underwriters’ over-allotment option). | |

| Common stock to be issued to the Torchlight Entities(1) | 263,158 shares of common stock | |

| Common stock to be outstanding after completion of this offering and the Torchlight Transactions(2) | 3,626,702 shares of common stock | |

| Use of proceeds | We estimate that the net proceeds (after deducting the underwriting discount and commissions and offering expenses payable by us) we will receive from the sale of shares of our common stock in this offering will be approximately $50.1 million (or approximately $57.8 million if the underwriters exercise their over-allotment option in full). We will contribute the net proceeds we receive from this offering to our operating partnership in exchange for OP units. | |

| We expect our operating partnership will use approximately $20.0 million of the net proceeds from this offering to redeem the Preferred Interests. Our operating partnership is expected to use the remaining net proceeds to acquire and manage additional industrial properties and for general corporate purposes. | ||

| Prior to the full deployment of the net proceeds as described above, we intend to invest the undeployed net proceeds in interest-bearing short-term investment grade securities or money-market accounts that are consistent with our intention to qualify as a REIT, including, for example, government and government agency certificates, certificates of deposit and interest-bearing bank deposits. We expect that these initial investments will provide a lower net return than we expect to receive from investments in industrial properties. If the underwriters exercise their over-allotment option in full, we expect to use the additional approximately $7.7 million of net proceeds to acquire additional properties or for general corporate purposes. See “Use of Proceeds.” | ||

| Risk Factors | Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 16 and the other information included in this prospectus before investing in our common stock. | |

| NYSE MKT symbol | “PLYM” |

_____________________

| (1) | Represents shares of our common stock to be issued to the Torchlight Entities upon the completion of this offering, but excludes the 250,000 shares of common stock issuable upon the exercise of the warrants to be issued to the Torchlight Entities in connection with the Torchlight Transactions. |

| (2) | Includes (a) 2,900,000 shares of our common stock to be issued in this offering, (b) 263,158 shares of our common stock to be issued to the Torchlight Entities in connection with the Torchlight Transactions, (c) an aggregate of 15,789 restricted shares of common stock to be granted to our independent directors concurrently with the completion of this offering and (d) an aggregate of 115,790 restricted shares of common stock to be granted to our executive officers concurrently with the completion of this offering. Excludes (a) 435,000 shares of our common stock issuable upon the exercise of the underwriter’s over-allotment option in full, (b) 243,421 shares of our common stock available for future issuance under our 2014 Incentive Award Plan, and (c) 250,000 shares of our common stock issuable upon the exercise of the warrants to be issued to the Torchlight Entities in connection with the Torchlight Transactions. |

12

Summary Selected Financial Information

You should read the following summary financial and operating data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” our unaudited pro forma consolidated financial statements and related notes and the historical consolidated financial statements and related notes included elsewhere in the prospectus.

The unaudited pro forma consolidated balance sheet data is presented as if this offering and the Torchlight Transactions had occurred on March 31, 2017, and the unaudited pro forma statements of operations and other data for the three months ended March 31, 2017 and the year ended December 31, 2016 is presented as if this offering and the Torchlight Transactions had occurred on January 1, 2016. The pro forma consolidated financial information is not necessarily indicative of what our actual financial condition would have been as of March 31, 2017 or what our actual results of operations would have been assuming this offering had been completed as of January 1, 2016, nor does it purport to represent our future financial position or results of operations.

The summary unaudited historical condensed consolidated balance sheet information on March 31, 2017 and 2016 and the statement of operations data for the three months ended March 31, 2017 and March 31, 2016 have been derived from our financial statements included elsewhere in this prospectus. The summary historical consolidated balance sheet information as of December 31, 2016 and 2015, and the historical consolidated statement of operations data for the years ended December 31, 2016 and 2015 on pages 13 and 14 have been derived from the company’s consolidated financial statements, which were audited by Marcum LLP, our independent registered public accounting firm, and are included elsewhere in this prospectus.

| ($ in thousands) | As of March 31, | As of December 31, | ||||||||||||||||||

| Pro Forma | Historical | Historical | ||||||||||||||||||

| 2017 | 2017 | 2016 | 2016 | 2015 | ||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Rental property, net of accumulated depreciation | $ | 121,207 | $ | 121,207 | $ | 128,170 | $ | 123,059 | $ | 129,714 | ||||||||||

| Investment in real estate joint venture | — | — | 2,968 | — | 2,987 | |||||||||||||||

| Cash and other assets | 36,719 | 6,626 | 2,819 | 12,154 | 2,577 | |||||||||||||||

| Deferred lease intangibles, net | 9,610 | 9,610 | 13,560 | 10,533 | 14,773 | |||||||||||||||

| Total assets | 167,536 | 137,443 | 147,517 | 145,746 | 150,051 | |||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 4,870 | 4,870 | 5,870 | 5,352 | 4,268 | |||||||||||||||

| Deferred lease intangibles, net | 1,278 | 1,278 | 1,806 | 1,405 | 1,941 | |||||||||||||||

| Senior secured debt, net | 116,258 | 116,258 | 199,500 | 116,053 | 196,800 | |||||||||||||||

| Deferred interest | 207 | 207 | 15,696 | 207 | 8,081 | |||||||||||||||

| Mezzanine debt to investor, net | 29,292 | 29,292 | — | 29,262 | — | |||||||||||||||

| Redeemable preferred member interest | — | 25,000 | — | 31,043 | — | |||||||||||||||

| Total liabilities | 151,905 | 176,905 | 222,872 | 183,322 | 211,090 | |||||||||||||||

| Plymouth Industrial REIT, Inc. stockholders’ equity (deficit) | 15,631 | (98,467 | ) | (75,335 | ) | (98,026 | ) | (61,039 | ) | |||||||||||

| Non-controlling interest | — | 59,005 | — | 60,450 | — | |||||||||||||||

| Total equity (deficit) | $ | 15,631 | $ | (39,462 | ) | $ | (75,335 | ) | $ | (37,576 | ) | $ | (61,039 | ) | ||||||

13

| (In thousands) | Three Months Ended March 31, | Year Ended December 31, | ||||||||||||||||||||||

| Pro

Forma Consolidated | Historical Consolidated | Pro

Forma Consolidated | Historical Consolidated | |||||||||||||||||||||

| 2017 | 2017 | 2016 | 2016 | 2016 | 2015 | |||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||

| Rental revenue | $ | 4,938 | $ | 4,938 | $ | 4,808 | $ | 19,658 | $ | 19,658 | $ | 19,290 | ||||||||||||

| Equity investment income (loss) | 1 | 1 | 30 | 230 | 230 | (85 | ) | |||||||||||||||||

| Total revenues | 4,939 | 4,939 | 4,838 | 19,888 | 19,888 | 19,205 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Property | 1,408 | 1,408 | 1,412 | 5,927 | 5,927 | 5,751 | ||||||||||||||||||

| Depreciation and amortization | 2,772 | 2,772 | 3,028 | 11,674 | 11,674 | 12,136 | ||||||||||||||||||

| General and administrative | 886 | 724 | 911 | 4,392 | 3,742 | 4,688 | ||||||||||||||||||

| Acquisition costs | — | — | 19 | — | — | 1,061 | ||||||||||||||||||

| Offering costs | — | — | — | — | — | 938 | ||||||||||||||||||

| Total operating expenses | 5,066 | 4,904 | 5,370 | 21,993 | 21,343 | 24,574 | ||||||||||||||||||

| Operating income (loss) | (127 | ) | 35 | (532 | ) | (2,105 | ) | (1,455 | ) | (5,369 | ) | |||||||||||||

| Other income (expense): | ||||||||||||||||||||||||

| Gain on disposition of equity investment | — | — | — | 2,846 | 2,846 | 1,380 | ||||||||||||||||||

| Interest expense | (2,603 | ) | (2,941 | ) | (13,784 | ) | (40,189 | ) | (40,679 | ) | (44,676 | ) | ||||||||||||

| Total other income (expense) | (2,603 | ) | (2,941 | ) | (13,784 | ) | (37,343 | ) | (37,833 | ) | (43,296 | ) | ||||||||||||

| Net (loss) | (2,730 | ) | (2,906 | ) | (14,316 | ) | (39,448 | ) | $ | (39,288 | ) | $ | (48,665 | ) | ||||||||||

| Net loss attributable to non-controlling interest | — | (2,465 | ) | — | — | (2,301 | ) | — | ||||||||||||||||

| Net loss attributable to Plymouth Industrial REIT, Inc. common stockholders | $ | (2,730 | ) | $ | (441 | ) | $ | (14,316 | ) | $ | (39,448 | ) | $ | (36,987 | ) | $ | (48,665 | ) | ||||||

14

| (In thousands) | Three Months Ended March 31, | Year Ended December 31, | ||||||||||||||||||||||

| Pro

Forma Consolidated | Historical Consolidated | Pro

Forma Consolidated | Historical Consolidated | |||||||||||||||||||||

| 2017 | 2017 | 2016 | 2016 | 2016 | 2015 | |||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||||||||||||

| Total in service Properties | 20 | 20 | 20 | 20 | 20 | 20 | ||||||||||||||||||

| NOI: (1) | ||||||||||||||||||||||||

| Net loss | $ | (2,730 | ) | $ | (2,906 | ) | $ | (14,316 | ) | $ | (39,448 | ) | $ | (39,288 | ) | $ | (48,665 | ) | ||||||

| General and administrative | 886 | 724 | 911 | 4,392 | 3,742 | 4,688 | ||||||||||||||||||

| Acquisition expense | — | — | 19 | — | — | 1,061 | ||||||||||||||||||

| Interest expense | 2,603 | 2,941 | 13,784 | 40,189 | 40,679 | 44,676 | ||||||||||||||||||

| Depreciation and amortization | 2,772 | 2,772 | 3,028 | 11,674 | 11,674 | 12,136 | ||||||||||||||||||

| Offering costs | — | — | — | — | — | 938 | ||||||||||||||||||

| Other (income) expense | (1 | ) | (1 | ) | (30 | ) | (3,076 | ) | (3,076 | ) | (1,295 | ) | ||||||||||||

| NOI | $ | 3,530 | $ | 3,530 | $ | 3,396 | $ | 13,731 | $ | 13,731 | $ | 13,539 | ||||||||||||

| EBITDA: (1) | ||||||||||||||||||||||||

| Net loss | $ | (2,730 | ) | $ | (2,906 | ) | $ | (14,316 | ) | $ | (39,448 | ) | $ | (39,288 | ) | $ | (48,665 | ) | ||||||

| Depreciation and amortization | 2,772 | 2,772 | 3,028 | 11,674 | 11,674 | 12,136 | ||||||||||||||||||

| Interest expense | 2,603 | 2,941 | 13,784 | 40,189 | 40,679 | 44,676 | ||||||||||||||||||

| EBITDA | $ | 2,645 | $ | 2,807 | $ | 2,496 | $ | 12,415 | $ | 13,065 | $ | 8,147 | ||||||||||||

| FFO: (1) | ||||||||||||||||||||||||

| Net loss | $ | (2,730 | ) | $ | (2,906 | ) | $ | (14,316 | ) | $ | (39,448 | ) | $ | (39,288 | ) | $ | (48,665 | ) | ||||||

| Depreciation and amortization | 2,772 | 2,772 | 3,028 | 11,674 | 11,674 | 12,136 | ||||||||||||||||||

| Gain on disposition of equity investment | — | — | — | (2,846 | ) | (2,846 | ) | (1,380 | ) | |||||||||||||||

| Adjustment for unconsolidated joint ventures | — | — | — | 452 | 452 | 1,363 | ||||||||||||||||||

| FFO | $ | 42 | $ | (134 | ) | $ | (11,288 | ) | $ | (30,168 | ) | $ | (30,008 | ) | $ | (36,546 | ) | |||||||

| AFFO: (1) | ||||||||||||||||||||||||

| FFO | $ | 42 | $ | (134 | ) | $ | (11,288 | ) | $ | (30,168 | ) | $ | (30,008 | ) | $ | (36,546 | ) | |||||||