UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-12

| PLYMOUTH INDUSTRIAL REIT, INC. |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PLYMOUTH INDUSTRIAL REIT, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 15, 2015

To Our Stockholders:

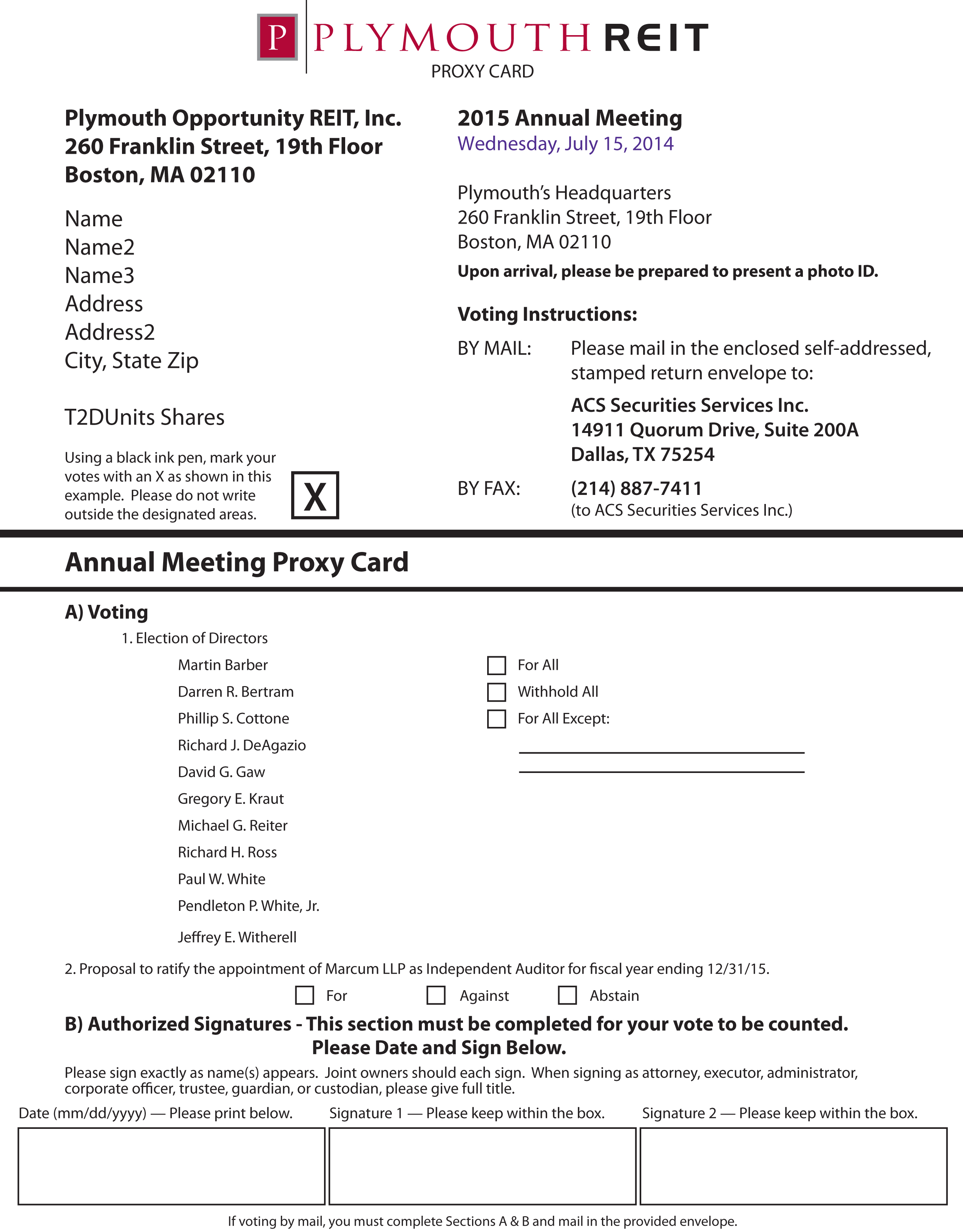

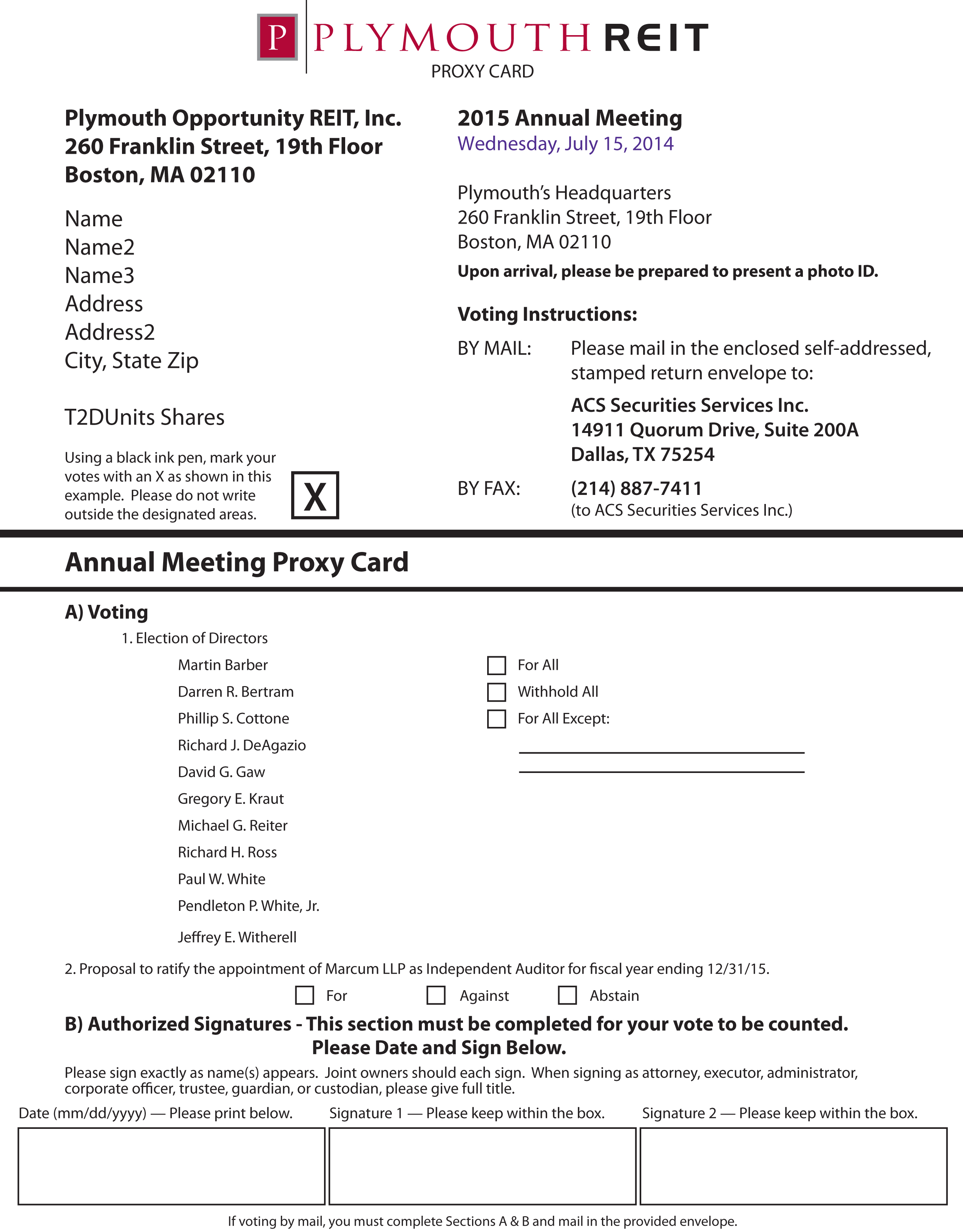

You are invited to attend our annual meeting of stockholders that will be held at the offices of Plymouth Industrial REIT, Inc., 260 Franklin Street, 19th Floor, Massachusetts 02110 on Wednesday, July 15, 2015 at 10:00 a.m., Eastern Daylight Time. The purpose of the meeting is to vote on the following proposals.

| Proposal 1: |

To elect 11 directors to hold office for one year terms expiring at the 2016 annual meeting of stockholders or until their successors are elected and qualified.

| |

| Proposal 2: |

To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015.

| |

| Proposal 3: | To take action upon any other business as may properly come before the meeting, including approving any motion to adjourn to a later time to permit further solicitation of proxies if necessary to establish a quorum or to obtain additional votes in favor of the proposals. |

Stockholders of record at the close of business on April 30, 2015 are entitled to notice of, and to vote at, the annual meeting. This proxy statement, a proxy card and our 2014 annual report to stockholders is being mailed to you on or about May 4, 2015. A copy of this proxy statement and our 2014 annual report to stockholders have been posted and made available for viewing online at http://www.plymouthreit.com/plymouth/proxy/2014-proxy-ar.pdf. Paper copies will be provided without charge upon written request.

YOUR VOTE IS IMPORTANT. The presence, in person or represented by proxy, of a majority of the shares of common stock entitled to vote at the annual meeting as of the record date is necessary to constitute a quorum at the annual meeting. Accordingly, you are asked to vote and return your proxy, whether or not you plan to attend the annual meeting.

By Order of the Board of Directors,

/s/ Pendleton White, Jr.

Pendleton White, Jr.

President, Chief Investment Officer and Secretary

May 4, 2015

Boston, Massachusetts

Table of Contents

| Page | |

| INTRODUCTION | 1 |

| Who May Vote | 1 |

| How You May Vote | 1 |

| How You May Revoke Your Proxy | 1 |

| Quorum | 2 |

| Required Vote | 2 |

| Adjournments | 2 |

| Cost of Proxy Solicitation | 2 |

| PROPOSAL 1 — ELECTION OF DIRECTORS | 3 |

| General | 3 |

| Nomination of Directors | 3 |

| Nominees | 4 |

| BOARD OF DIRECTORS AND COMMITTEE MATTERS | 7 |

| Board of Directors | 7 |

| Board Leadership Structure; Board Role in Risk Oversight | 7 |

| Board Committees | 8 |

| Code of Business Conduct and Ethics | 10 |

| Board Meetings | 10 |

| Corporate Governance | 11 |

| Executive Officers and Directors | 12 |

| Compensation of Directors | 13 |

| STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 14 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 14 |

| EXECUTIVE COMPENSATION | 15 |

| Summary Compensation Table | 15 |

| Base Salaries | 16 |

| Cash Bonuses | 16 |

| Other Elements of Compensation Retirement Plans | 16 |

| Executive Compensation Arrangements | 16 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 17 |

| PROPOSAL 2 — RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 19 |

| PROPOSAL 3 — ADJOURNMENT OF THE SPECIAL MEETING | 20 |

| OTHER MATTERS | 20 |

| STOCKHOLDER PROPOSALS | 20 |

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

July 15, 2015

Plymouth Industrial REIT, Inc.

260 Franklin Street, 19th Floor

Boston, Massachusetts 02110

The board of directors of Plymouth Industrial REIT, Inc. ("we," "us," "our" or the "company") is soliciting proxies to be used at our 2015 annual meeting of stockholders to be held at 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110, on Wednesday, July 15, 2015, at 10:00 a.m., Eastern Daylight Time. This proxy statement and accompanying proxy card are first being made available to stockholders on or about May 4, 2015. This proxy statement and our 2014 annual report to stockholders have been posted and made available for viewing online at http://www.plymouthreit.com/plymouth/proxy/2014-proxy-ar.pdf. Our 2014 annual report to stockholders does not constitute part of this proxy statement.

Who May Vote

Only stockholders of record at the close of business on April 30, 2015, the record date, are entitled to notice of, and to vote at, the annual meeting. As of April 30, 2015, we had 1,327,859 shares of common stock issued and outstanding. Each common stockholder of record on the record date is entitled to one vote on each matter properly brought before the annual meeting for each common share held.

How You May Vote

You may vote using any of the following methods:

| · | BY FAX: Mark, sign and date the proxy card and fax it to ACS Securities, Inc. at (214) 887-7411. After indicating your votes by fax, you will not need to submit any further proxy materials by mail. The named proxies will vote your shares according to your directions. If you submit a signed proxy card without indicating your vote, the person voting will vote your shares FOR each of the proposals. |

| · | BY MAIL: Mark, sign, and date the proxy card and return it in the postage-paid envelope we have provided, or return it to Plymouth Industrial REIT, Inc., Attn.: Corporate Secretary, 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110. The named proxies will vote your shares according to your directions. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your shares FOR each of the proposals. |

| · | BY ATTENDING THE ANNUAL MEETING AND VOTING IN PERSON. |

The persons authorized under the proxies will vote on any other business that may properly come before the annual meeting, including a proposal to adjourn or postpone the annual meeting to permit us to solicit additional proxies if necessary to establish a quorum or to obtain additional votes in favor of any proposal, according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. We do not anticipate that any other matters will be raised at the meeting.

How You May Revoke Your Proxy

You may revoke your proxy at any time before it is exercised by:

| · | giving written notice of revocation to Plymouth Industrial REIT, Inc., Attn.: Corporate Secretary, 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110; |

| · | timely delivering a properly executed, later-dated proxy; or |

| · | voting in person at the annual meeting |

Voting by proxy will in no way limit your right to vote at the annual meeting if you later decide to attend in person. Please sign and return your proxy promptly to assure that your shares are represented at the annual meeting.

| 1 |

Quorum

The presence, in person or represented by proxy, of a majority of the shares of common stock entitled to vote at the annual meeting as of the record date is necessary to constitute a quorum at the annual meeting. However, if a quorum is not present at the annual meeting, the stockholders, present in person or represented by proxy, have the power to adjourn the annual meeting until a quorum is present or represented. Pursuant to our bylaws, abstentions are counted as present and entitled to vote for purposes of determining a quorum at the annual meeting. Shares held by brokers or nominees as to which instructions have not been received from the beneficial owners of the shares and as to which the brokers or nominees do not have discretionary voting power on a particular matter (referred to as "broker non-votes") will be counted as present and entitled to vote for the purpose of determining the presence of a quorum at the annual meeting.

Required Vote

With regard to the election of directors, you may vote "FOR ALL" of the nominees, you may withhold your vote for all of the nominees by voting "WITHHOLD ALL," or you may vote for all of the nominees except for certain nominees by voting "FOR ALL EXCEPT," and listing the names of the nominee(s) for whom you want your vote withheld in the space provided on the proxy card. Under our charter, a majority of the shares entitled to vote and present in person or by proxy at an annual meeting at which a quorum is present is required for the election of the directors. This means that, of the shares entitled to vote and present in person or by proxy at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such shares in order to be elected to the board of directors. Because of this majority vote requirement, "withhold" votes will have the effect of a vote against each nominee for director. Broker non-votes (discussed above), since they are not entitled to vote, will have no effect on the determination of this proposal. If an incumbent director nominee fails to receive the required number of votes for reelection, then under Maryland law, he will continue to serve as a "holdover" director until his successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the board of directors.

With regard to the proposal relating to the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2015, you may vote "FOR" or "AGAINST" the proposal, or you may "ABSTAIN" from voting on the proposal. Under our bylaws, a majority of the votes cast at an annual meeting at which a quorum is present is required for the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the year ending December 31, 2015. Abstentions and broker non-votes will not count as votes actually cast with respect to determining if a majority vote is obtained under our bylaws and will have no effect on the determination of this proposal. If you submit a proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the board of directors.

Adjournments

Although it is not currently expected, the annual meeting may be adjourned for the purpose of soliciting additional proxies. Any adjournment may be made without notice by announcement at the annual meeting of the new date, time and place of the annual meeting. At the adjourned meeting the company may transact any business that might have been transacted at the original annual meeting. If the adjournment is for more than 30 days or if, after the adjournment, a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each registered stockholder entitled to vote at the annual meeting. Whether or not a quorum exists, holders of a majority of the shares of the company’s common stock present in person or represented by proxy at the annual meeting and entitled to vote thereat may adjourn the annual meeting. Any signed proxies received by the company in which no voting instructions are provided on such matter will be voted in favor of an adjournment in these circumstances. Abstentions and broker non-votes will have no effect on Proposal 3 to adjourn the meeting. Any adjournment of the annual meeting for the purpose of soliciting additional proxies will allow the company’s stockholders who have already returned their proxies to revoke them at any time prior to their use at the annual meeting as adjourned.

Cost of Proxy Solicitation

The cost of soliciting proxies will be borne by us. Proxies may be solicited on our behalf by our directors and officers, in person, by mail, telephone, facsimile or by other electronic means. In accordance with regulations of the Securities and Exchange Commission (SEC), we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in mailing proxies and proxy materials to and soliciting proxies from the beneficial owners of our common stock.

| 2 |

PROPOSAL 1 ─ ELECTION OF DIRECTORS

General

At the annual meeting, 11 directors will be elected by the stockholders, each to serve for a term of one year until the next annual meeting of stockholders and until his successor has been duly elected and qualified, or until the earliest of his resignation or retirement.

The persons named in the enclosed proxy will vote your shares as you specify on the enclosed proxy. If you return your properly executed proxy but fail to specify how you want your shares voted, the shares will be voted in favor of the nominees listed below. The board of directors has proposed the following nominees for election as directors at the annual meeting. Each of the nominees is currently a member of the board of directors.

Each director has consented to being named in this proxy statement and to serve if elected. The board of directors knows of no reason why such directors would be unable to serve. If any of the directors should for any reason become unable to serve, then valid proxies will be voted for the election of such substitute nominee as the board of directors may designate, the board of directors may reduce the number of directors to eliminate the vacancy or the position may remain vacant.

Nomination of Directors

General

The nominating and corporate governance committee of our board of directors will consider nominees for director positions made by stockholders, and will evaluate all nominees using the same standards, regardless of who recommended the nominee. Stockholders should send nominations to Philip S. Cottone, c/o Plymouth Industrial REIT, Inc., 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110. Any stockholder nominations proposed for consideration by the governance and nominating committee should include the nominee’s name and qualifications for board membership. See "Stockholder Proposals."

Unless filled by a vote of the stockholders as permitted by the Maryland General Corporation Law, a vacancy that results from the removal of a director will be filled by a vote of a majority of the remaining directors. Any vacancy on the board of directors for any other cause will be filled by a vote of a majority of the remaining directors, even if such majority vote is less than a quorum. The board of directors believes that the primary reason for creating a standing nominating committee is to ensure that candidates for independent director positions can be identified and their qualifications assessed under a process free from conflicts of interest with us.

Board Membership Criteria

We believe members of our board of directors should meet the following criteria: (1) have significant business or public experience that is relevant and beneficial to the board of directors and the company, (2) are willing and able to make a sufficient time commitment to our affairs in order to effectively perform the duties of a director, including regular attendance of board meetings and committee meetings, (3) are individuals of character and integrity, (4) are individuals with inquiring minds who are willing to speak their minds and challenge and stimulate management, and (5) represent the interests of the company as a whole and not only the interests of a particular stockholder or group.

Since each nominee for director is currently on our board, we also considered the significant contributions that each such individual has made to our board and its committees during his tenure as a director. We believe that each of the director nominees possesses the knowledge, experience, integrity and judgment necessary to make independent decisions and a willingness to devote adequate time to board duties. In addition, we believe that each of the nominees brings his own particular experiences and set of skills, giving the board, as a whole, competence and experience to perform its obligations and responsibilities. The board does not have a formal policy with regard to the consideration of diversity in identifying director nominees. However, the board values diversity, in its broadest sense, including, but not limited to, profession, geography, gender, ethnicity, skills and experience and strives to nominate directors so that as a group, the board will possess the appropriate talent, skills and expertise to oversee the company’s business.

| 3 |

Nominees

Jeffrey E. Witherell

Mr. Witherell is our Chief Executive Officer and Chairman of the Board and has held these positions since the formation of the company. He oversees all aspects of our business activities, including the acquisition, management and disposition of assets. Mr. Witherell has been involved in real estate investment, development and banking activities for over 25 years. He, along with Mr. White, formed Plymouth Industrial REIT in 2011. From April 2008 thru 2011 he was engaged in the formation and operation of Plymouth Group Real Estate and Plymouth Real Estate Capital LLC, a FINRA registered broker/dealer. From April 2000 to March 2008, Mr. Witherell was employed as an investment executive with Franklin Street Properties Corp., a publicly traded REIT, and its subsidiary, FSP Investments LLC. During that time, Mr. Witherell was involved in the acquisition and syndication of 34 separate property investments, structured as single asset REITs, in 12 states, which raised in the aggregate approximately $1.2 billion. Mr. Witherell graduated from Emmanuel College in Boston with a bachelor of science degree in business and is a member of several real estate organizations, including the Urban Land Institute (ULI) and NAIOP. He is a board member of AdventCare Inc., a Massachusetts based nonprofit organization that owns and operates skilled nursing facilities. In addition, he holds FINRA Series 7, 63, 79 and Series 24 General Securities Principal licenses. Mr. Witherell was selected as a director because of his ability to lead our company and his detailed knowledge of our strategic opportunities, challenges, competition, financial position and business.

Pendleton P. White, Jr.

Mr. White is our President and Chief Investment Officer and one of our directors. He has served in these positions since the formation of the company. Along with Mr. Witherell, Mr. White actively participates in the management of our company and is primarily responsible for the overall investment strategy and acquisition activities. Mr. White has over 25 years of experience in commercial real estate, serving in numerous capacities including investment banking, property acquisitions and leasing. From November 2008 through March 2011, Mr. White was engaged in the formation of Plymouth Group Real Estate. Prior to that, Mr. White was Executive Vice President and Managing Director at Scanlan Kemper Bard (SKB) from September 2006 through November 2008, where he ran SKB’s East Coast office and managed the funding of SKB Real Estate Investors Fund I. From March 2002 through September 2006, Mr. White was employed as an investment executive with Franklin Street Properties Corp., a publicly traded REIT, and its subsidiary, FSP Investments LLC. During that time, Mr. White was involved in the acquisition and syndication of numerous structured REITs throughout the United States. Mr. White received a bachelor of science degree from Boston University and is a member of several real estate organizations, including ULI and NAIOP. Mr. White was selected as a director because of his extensive knowledge and insight regarding industrial properties and detailed knowledge of our acquisition and operational opportunities and challenges.

Martin Barber

Mr. Barber is one of our independent directors, a position he has held since February 2015. He is currently a director of several public and private companies in the United States and the United Kingdom and manages personal investments. From 1981 to 2006 he served as Chairman of CenterPoint Properties Trust Inc., an NYSE listed REIT which was the first industrial REIT established in the United States. Mr. Barber was selected as a director because of his extensive experience with real estate ownership and management and his experience with public REITs.

Darren R. Bertram

Mr. Bertram is one of our independent directors, a position he has held since February 2015. He has been the Chief Executive Officer of Nevada Hospice and Palliative Care, Inc., a holding company owning several businesses involved in healthcare and real estate, from May 2006 to the present. Prior to joining Nevada Hospice, he practiced law with several firms. Mr. Bertram has a bachelor of arts degree and a law degree from the University of Illinois. Mr. Bertram was selected as a director because of his extensive experience with real estate ownership and management.

| 4 |

Philip S. Cottone

Mr. Cottone is one of our independent directors and chairman of the compensation committee, positions he has held since November 2011. He is an attorney by background and is currently a mediator and arbitrator for FINRA, the American Arbitration Association, and the Counselors of Real Estate, primarily in securities, real estate and general commercial matters. He is an officer of the Executive Committee of the governing Council of the Dispute Resolution Section of the American Bar Association, has been certified by the International Mediation Institute at The Hague and is a member of the American College of Civil Trial Mediators. From 2003 to December of 2007, he was a member of the Board of Directors of Government Properties Trust (NYSE—GPT) and Chair of the Nominating and Governance Committee, and from 2004 to December 2008 he was lead director of Boston Capital REIT, a public, non-traded REIT. From 1972 to 1981, Mr. Cottone was senior real estate officer and group executive of IU International (NYSE—IU), a $2 billion Fortune 100 company, and previously, from 1966 to 1972, he was Manager of Real Estate at the Port of New York Authority where, among other things he was responsible for acquisition of the World Trade Center property in Manhattan. In 1981 he co-founded Ascott Investment Corporation, an investment, development and syndication company headquartered in Philadelphia, and as Chairman and CEO, a position he still holds, and founder of its captive broker dealer, he headed a staff of 65 in the capital raising, acquisition, management and sale of more than thirty real estate programs in fourteen states. From 1977 through 1983 and again from 1998 through 2002, he was General Counsel and a member of the Executive Committee of the International Right of Way Association, and from 1988 to 1997, he was Trustee and Treasurer of the IRWA Foundation. In 1988, he was national President of RESSI, the Real Estate Securities & Syndication Institute, and in 2004 he was national Chair of the Counselors of Real Estate, both divisions of the National Association of Realtors. From 1985 to 1991, he was Governor of the National Association of Securities Dealers, the predecessor to FINRA, and Vice Chairman in 1991. For ten years from 1995 to 2005 he was an adjunct on the faculty of the Real Estate Institute at New York University teaching a course he wrote in real estate securities. Mr. Cottone has an A.B from Columbia College (1961) where he was awarded the Burdette Kinne Memorial Prize for Humanities and an L.L.B. from NYU where he received the Administrative Law prize. Mr. Cottone was selected as a director because of his extensive investment and finance experience, board service and corporate governance experience.

Richard J. DeAgazio

Mr. DeAgazio is one of our independent directors and chairman of our corporate governance committee, positions he has held since November 2011. He has been the principal of Ironsides Assoc. LLC., a consulting company in marketing and sales in the financial services industry, since he founded the company in June 2007. In 1981, he joined Boston Capital Corp., a diversified real estate and investment banking firm, which, through its various investment funds, owns over $12 billion in real estate assets, as Executive Vice President and Principal. He founded and served as the President of Boston Capital Securities, Inc., a FINRA-registered broker dealer, which is an affiliate of Boston Capital Corp., from 1981 through December 2007. Mr. DeAgazio formerly served on the National Board of Governors of FINRA and served as a member of the National Adjudicatory Council of FINRA. He was the Vice Chairman of FINRA’s District 11, and served as Chairman of the FINRA’s Statutory Disqualification Subcommittee of the National Business Conduct Committee. He also served on the FINRA State Liaison Committee, the Direct Participation Program Committee and as Chairman of the Nominating Committee. He is a founder and past President of the National Real Estate Investment Association. He is past President of the National Real Estate Securities and Syndication Institute and past President of the Real Estate Securities and Syndication Institute (MA Chapter). Prior to joining Boston Capital in 1981, Mr. DeAgazio was the Senior Vice President and Director of the Brokerage Division of Dresdner Securities (USA), Inc., an international investment-banking firm owned by four major European banks, and was a Vice President of Burgess & Leith/Advest. He was member of the Boston Stock Exchange for 42 years. He was on the Board of Directors of Cognistar Corporation and FurnitureFind.com. He currently serves as a Vice-Chairman of the board of Trustees of Bunker Hill Community College, the Board of Trustees of Junior Achievement of Massachusetts and the Board of Advisors for the Ron Burton Kid’s Training Village and is on the Board of Corporators of Northeastern University. He graduated from Northeastern University. Mr. DeAgazio was selected as a director because of his extensive senior executive officer and board service experience and experience with real estate operations.

David G. Gaw

Mr. Gaw is one of our independent directors and chairman of our audit committee, positions he has held since November 2011. He is currently a real estate project consultant and is managing personal investments. From November 2009 through January 2011, Mr. Gaw served as Chief Financial Officer of Pyramid Hotels and Resorts, a REIT that focused on hospitality properties. From September 2008 through November 2009, Mr. Gaw was engaged in managing his personal investments. From June 2007 to September 2008, he was Chief Financial Officer of Berkshire Development, a private real estate developer that focused on retail development. From April 2001 until June 2007, he served as the Senior Vice President, Chief Financial Officer and Treasurer of Heritage Property Investment Trust, Inc., a publicly traded REIT listed on the NYSE. Mr. Gaw was serving in those capacities when Heritage Property engaged in its initial public offering. Mr. Gaw served as Senior Vice President of Boston Properties, Inc., a publicly traded REIT listed on the NYSE, from 1982 - 2000, and also served as its Chief Financial Officer beginning at the time of its initial public offering in 1997. Mr. Gaw received a bachelor of science degree and an MBA from Suffolk University. Mr. Gaw was selected as a director because of his extensive experience with financial reporting, accounting and controls and REIT management.

| 5 |

Gregory E. Kraut

Mr. Kraut is one of our independent directors, a position he has held since November 2014. Mr. Kraut has been a Principal of Avison Young, a commercial real estate services firm, since he founded the company’s New York office in September 2011. Prior to joining Avison Young, he was a First Vice President of CB Richard Ellis in the firm’s New York office from 2005 to 2011. Mr. Kraut has had a career of over 17 years in tenant representation, including acquisition, disposition and strategic planning for local and multi- market clients. He is affiliated with numerous real estate groups, including serving as a member of the B’nai B’rith Real Estate Board of Directors and the AIPAC Real Estate Division Executive Council. Mr. Kraut has been named a Commercial Observer Top 100 in New York City Real Estate for the past three years. He received a bachelor’s degree from the “Elliot School” at George Washington University. Mr. Kraut was selected as a director because of his extensive experience with real estate tenant relationships and his general experience with real estate operations.

Michael G. Reiter

Mr. Reiter is one of our independent directors, a position he has held since February 2015. From April 2007 to January 2014, he was the Senior Vice President of AR Capital (formerly known as American Realty Capital), a company engaged in the creation, sponsorship and management of entities that invest in a wide range of real estate. From January to December 2014, Mr. Reiter was a Senior Vice President of American Realty Capital Properties, a publicly traded REIT (NASDAQ: ARCP) specializing in retail properties. Prior to that, from November 2004 to April 2007, he was a Director of Investments at BTR Capital, a real estate private equity venture managed by Savills-Studley, Inc. He began his career as an accountant at Ernst & Young LLP and is a certified public accountant. Mr. Reiter has a Bachelor of Science Degree in Economics from the University of Wisconsin and a Master of Science Degree in Accountancy from the University of Notre Dame. Mr. Reiter was selected as a director because of his extensive experience with real estate capital markets and finance and the management of publicly listed and non-listed REITs.

Richard H. Ross

Mr. Ross is one of our independent directors, a position he has held since November 2014. Mr. Ross has been the Chief Executive Officer of Trade Street Residential, Inc., a NASDAQ listed (TRSE) multi-family REIT since February 2014. Prior to that, Mr. Ross was the Chief Financial Officer of Trade Street from August 2013 until February 2014. During 2012 and 2103, he was a Principal of Chiron Consulting, LLC, a firm which he founded that provided focused financial and operating solutions for a primarily real estate clientele. During 2011, Mr. Ross managed personal investments. He was the Chief Financial Officer of Branch Properties, LLC, a real estate company, from 1995 to 1997 and 1998 to 2010. Mr. Ross received a Bachelor of Science degree in Accounting from the University of Florida and is a Certified Public Accountant. He was selected as a director because of his experience as an executive officer of a public REIT and his extensive experience with real estate finance and operations.

Paul W. White

Mr. White is one of our independent directors, a position he has held since November 2014. Mr. White has been the President of Ram Island Holdings, LLC, a fully integrated real estate investment and management company focused on long-term ownership and operation of real estate assets, since he founded the company is June 2014. Prior to that, he was a Vice President of The Related Companies, L.P., a multi-national real estate firm focused on developing, owning and operating residential rental properties and mixed-use projects, from 2007 to 2014. Mr. White received a Bachelor of Arts degree in Economics from Oregon State University and a Masters of Sciences-Real Estate degree from New York University. He was selected as a director because of his extensive investment and finance experience and his experience with real estate operations.

Each of Messrs. Barber, Bertram, Kraut, Reiter, Ross and Paul White was elected to our board of directors pursuant to an agreement entered into among our company and the lenders under our senior secured loan agreement. Pursuant to the agreement, the lenders have the right to nominate up to six people to be appointed to our board of directors, to serve until such time the indebtedness under our senior secured loan agreement has been paid in full or until they are otherwise removed pursuant to the terms of the agreement.

The board of directors unanimously recommends that you vote FOR the election of directors, as set forth in Proposal 1.

| 6 |

BOARD OF DIRECTORS AND COMMITTEE MATTERS

Board of Directors

Pursuant to our Second Articles of Amendment and Restatement (articles) and our bylaws, our business, property and affairs are managed under the direction of our board of directors. Members of the board are kept informed of the company’s business through discussions with the Chairman of the Board and executive officers, by reviewing materials provided to them and by participating in meetings of the board and its committees. Board members have complete access to the company’s management team and the independent registered public accounting firm. The board and each of the key committees — Audit, Compensation and Nominating, and Corporate Governance — also have authority to retain, at the company’s expense, outside counsel, consultants or other advisors in the performance of their duties. Although our shares are not listed for trading on any national securities exchange, our corporate governance guidelines require that a majority of the board be independent within the meaning of standards established by the New York Stock Exchange (NYSE). All of the members of the audit committee, the compensation committee and the nominating and corporate governance committee are independent as defined by the NYSE.

Board Leadership Structure; Board Role in Risk Oversight

Leadership Structure

Our board does not have a policy regarding the leadership structure of the Company. The leadership structure of a company may be determined based on a number of different factors and circumstances, including the company’s position, history, size, culture, board size and composition. Since the Company’s formation in 2011, Jeffrey E. Witherell has served as our Chief Executive Officer and as our Chairman of the Board. Mr. Witherell has substantial experience in the real estate business. At this time, our board believes that Mr. Witherell’s combined role as Chief Executive Officer and Chairman of the Board enables the company to obtain the greatest benefit from Mr. Witherell’s extensive knowledge of and experience with the company and its business while at the same time promoting unified leadership and direction for our board and executive management without duplication of effort and cost.

Given our board size and composition, the relatively small size of our company and management team and financial position, at this time, our board believes the company and our stockholders are best served by our current leadership structure. Our board believes that it is able to provide effective independent oversight of the company’s business and affairs, including risks facing the company, through the leadership of our independent directors, the independent committees of our board and the other corporate governance structures and processes the company has in place.

Nine of our 11 currently serving directors are non-management directors and are independent. All of our directors are free to call a meeting or executive session of our board, suggest the inclusion of items on the agenda for meetings of our board or raise subjects that are not on the agenda for that meeting. In addition, our board and each committee have complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. Our board also holds executive sessions of only non-management directors in order to promote discussion among the non-management directors and assure independent oversight of management. The chairman of our audit committee presides over these executive sessions.

Our audit committee, which is comprised entirely of independent directors, performs oversight functions independent of management. Among various other responsibilities set forth in the audit committee charter, the audit committee oversees the accounting and financial reporting processes as well as legal, compliance and risk management matters. The chair of the audit committee is responsible for directing the work of the committee in fulfilling its responsibilities. In addition, the board will also carry out its oversight function by forming a special committee comprised entirely of independent directors to review and take action with respect to related party transactions and related matters.

The board evaluates the board leadership structure in light of the company’s changing requirements and circumstances to ensure that it remains the most appropriate structure for the company and our stockholders. At this time, the company continues to believe its current leadership structure consisting of a Chairman who also serves as Chief Executive Officer and three board committees separately chaired by and comprised solely of independent members of our board remains the most appropriate leadership structure for the company and our stockholders.

| 7 |

Corporate Governance Profile

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| • | our board of directors is not classified, instead, each of our directors is subject to re-election annually; |

| • | of the 11 persons who serve on our board of directors, nine, or approximately 82%, of our directors satisfy the listing standards for independence of the NYSE and Rule 10A-3 under the Exchange Act; |

| • | one of our directors qualifies as an “audit committee financial expert” as defined by the SEC; |

| • | we have opted out of the business combination and control share acquisition statutes in the MGCL; and |

| • | we do not have a stockholder rights plan. |

Our directors stay informed about our business by attending meetings of our board of directors and its committees and through supplemental reports and communications. Our independent directors will meet regularly in executive sessions without the presence of our corporate officers or non-independent directors.

Role of the Board in Risk Oversight

One of the key functions of our board of directors is informed oversight of our risk management process. Our board of directors administers this oversight function directly, with support from its three standing committees, the audit committee, the nominating and corporate governance committee and the compensation committee, each of which addresses risks specific to their respective areas of oversight. In particular, our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Board Committees

Our board of directors has established three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The principal functions of each committee are briefly described below. We intend to comply with the listing requirements and other rules and regulations of the NYSE, as amended or modified from time to time, and each of these committees will be comprised exclusively of independent directors. Additionally, our board of directors may from time to time establish certain other committees to facilitate the management of our company.

The board’s current standing committees are as follows:

| Name | Audit Committee |

Compensation Committee |

Nominations and Corporate Governance Committee |

| Philip S. Cottone | M | M | X |

| Richard J. DeAgazio | M | X | M |

| David G. Gaw | X | M | M |

|

X = Chairman M= Member |

| 8 |

Audit Committee

Our audit committee consists of our three independent directors. The chairman of our audit committee qualifies as an “audit committee financial expert” as that term is defined by the applicable SEC regulations and NYSE corporate governance listing standards. Our board of directors has determined that each of the audit committee members is “financially literate” as that term is defined by the NYSE corporate governance listing standards. We have adopted an audit committee charter, which details the principal functions of the audit committee, including oversight related to:

| • | our accounting and financial reporting processes; |

| • | the integrity of our consolidated financial statements and financial reporting process; |

| • | our systems of disclosure controls and procedures and internal control over financial reporting; |

| • | our compliance with financial, legal and regulatory requirements; |

| • | the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; the performance of our internal audit function; and |

| • | our overall risk profile. |

The audit committee is also be responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The audit committee also prepares the audit committee report required by SEC regulations to be included in our annual proxy statement. Mr. Gaw has been designated as chair and Messrs. Cottone and DeAgazio have been appointed as members of the audit committee.

Compensation Committee

Our compensation committee consists of our three independent directors. We have adopted a compensation committee charter, which details the principal functions of the compensation committee, including:

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to our co-chief executive officers’ compensation, evaluating our co-chief executive officers’ performance in light of such goals and objectives and determining and approving the remuneration of our co-chief executive officers based on such evaluation; |

| • | reviewing and approving the compensation, if any, of all of our other officers; |

| • | reviewing our executive compensation policies and plans; |

| • | implementing and administering our incentive compensation equity-based remuneration plans; |

| • | assisting management in complying with our proxy statement and annual report disclosure requirements; |

| • | producing a report on executive compensation to be included in our annual proxy statement; and |

| • | reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. |

Mr. Cottone has been designated as chair and Messrs. DeAgazio and Gaw have been appointed as members of the compensation committee.

| 9 |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of our three independent directors. We have adopted a nominating and corporate governance committee charter, which details the principal functions of the nominating and corporate governance committee, including:

| • | identifying and recommending to the full board of directors qualified candidates for election as directors to fill vacancies on the board or at the annual meeting of stockholders; |

| • | developing and recommending to our board of directors corporate governance guidelines and implementing and monitoring such guidelines; |

| • | reviewing and making recommendations on matters involving the general operation of our board of directors, including board size and composition, and committee composition and structure; |

| • | recommending to our board of directors nominees for each committee of our board of directors; |

| • | annually facilitating the assessment of our board of directors’ performance as a whole and of the individual directors, as required by applicable law, regulations and the NYSE corporate governance listing standards; and |

| • | overseeing our board of directors’ evaluation of management. |

In identifying and recommending nominees for election as directors, the nominating and corporate governance committee may consider diversity of relevant experience, expertise and background. Mr. DeAgazio has been designated as chair and Messrs. Cottone and Gaw have been appointed as members of the nominating and corporate governance committee.

Code of Business Conduct and Ethics

Our board of directors has established a code of business conduct and ethics that applies to our officers, directors and employees. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote:

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| • | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; compliance with laws, rules and regulations; |

| • | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| • | accountability for adherence to the code of business conduct and ethics. |

Any waiver of the code of business conduct and ethics for our executive officers or directors must be approved by a majority of our independent directors, and any such waiver shall be promptly disclosed as required by law or NYSE regulations.

Board Meetings

During fiscal 2014, the board of directors held five meetings. Each director attended, either in person or by teleconference, 100% of the board and committee meetings on which the director served that were held while the director was a member of the board or committee, as applicable. All of our directors are strongly encouraged to attend our annual meeting of stockholders. There were five directors at the time of our 2014 annual meeting of stockholders, and all directors attended the meeting, either in person or by teleconference.

| 10 |

Corporate Governance

Committee Charters

Our board has adopted: (1) an audit committee charter, a nominating and corporate governance committee charter and a compensation committee charter; (2) standards of independence for our directors; and (3) a code of conduct and ethics for all directors, officers and employees. The charters of our audit committee, governance and nominating committee and compensation committee are available on our website.

Communications with the Board

Individuals may communicate with the board by sending a letter to:

Chairman, Nominating and Corporate Governance Committee

Plymouth Industrial REIT, Inc.

260 Franklin Street

19th Floor

Boston, Massachusetts 02110

All directors have access to this correspondence. Communications that are intended specifically for non-management directors should be sent to the street address noted above, to the attention of the chairman of the nominating and corporate governance committee. In accordance with instructions from the board, the corporate secretary reviews all correspondence, organizes the communications for review by the board, and posts communications to the full board or individual directors as appropriate. Advertisements, solicitations for periodical or other subscriptions, and similar communications generally are not forwarded to the directors.

Code of Conduct and Ethics

Our board of directors has established a code of business conduct and ethics. Among other matters, the code of business conduct and ethics is designed to deter wrongdoing and to promote:

| ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| ● | compliance with applicable governmental laws, rules and regulations; |

| ● | prompt internal reporting of violations of the code to appropriate persons identified in the code; and |

| ● | accountability for adherence to the code. |

Waivers to the code of business conduct and ethics will only be granted by the nominating and corporate governance committee of the board. The committee has never granted any waiver to the code. If the committee grants any waiver from the code of business conduct and ethics to any of our officers, we expect to disclose the waiver within five business days on the corporate governance section of our corporate website at www.plymouthreit.com. A copy of our code of conduct will be provided to any person without charge, upon request. All requests should be directed to Corporate Secretary, Plymouth Industrial REIT, Inc., 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110.

Compensation Committee Interlocks and Insider Participation

During 2014, the compensation committee consisted of Messrs. DeAgazio (chairman), Cottone and Gaw. None of these individuals has at any time served as an officer of the company. No member of the compensation committee has any interlocking relationship with any other company that requires disclosure under this heading. None of our executive officers served as a director or member of the compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

| 11 |

Executive Officers and Directors

We have provided below certain information about our executive officers and directors. All of our directors have terms expiring on the date of the 2015 annual meeting and are being nominated for re-election to serve until 2016 annual meeting and until his or her successor is elected and qualified.

| Name and Address(1) | Position(s) | Age(2) | Year First Became a Director | |||

| Jeffrey E. Witherell | Chairman of the Board, Chief Executive Officer and Director | 50 | 2011 | |||

| Pendleton P. White, Jr. | President, Chief Investment Officer, Secretary and Director | 55 | 2011 | |||

| Daniel C. Wright | Chief Financial Officer and Treasurer | 66 | N/A | |||

| James M. Connolly | Senior Vice President and Chief Operating Officer | 52 | N/A | |||

| Anne Alger Hayward | Senior Vice President and General Counsel | 63 | N/A | |||

| Martin Barber | Director | 70 | 2015 | |||

| Darren R. Bertram | Director | 42 | 2015 | |||

| Philip S. Cottone | Director | 75 | 2011 | |||

| Richard J. DeAgazio | Director | 70 | 2011 | |||

| David G. Gaw | Director | 63 | 2011 | |||

| Gregory E. Kraut | Director | 39 | 2014 | |||

| Michael G. Reiter | Director | 37 | 2015 | |||

| Richard H. Ross | Director | 56 | 2014 | |||

| Paul W. White | Director | 34 | 2014 | |||

_________ (1) The address of each named officer and director is 260 Franklin Street, 19th Floor, Boston, Massachusetts 02110 (2) As of April 30, 2015 | ||||||

The backgrounds of Messrs. Witherell, White, Cottone, DeAgazio, Gaw, Kraut, Reiter, Ross, and White are described under "Proposal 1 – Election of Directors – Nominees" elsewhere in this proxy statement.

Daniel C. Wright. Mr. Wright is the Executive Vice President and Chief Financial Officer of our company, and has held those positions since May 2014. He is responsible for the financial performance, compliance and regulatory reporting. Mr. Wright has over 30 years of significant accounting and financial reporting experience within the real estate industry. Prior to joining Plymouth, he was a principal with Carleton Advisory Group where he was responsible for providing financial and operational expertise to commercial real estate and hospitality investment firms. From 2005 thru 2009, he was the CFO at Pyramid Advisors in Boston where he directed the financial and legal operations across an $8 billion portfolio of properties and 7,600 employees. While at Pyramid he provided leadership and oversight to 9 financial executives and was additionally responsible for the placement of over $1.5 billion of securitized debt. From 1999 to 2005, Mr. Wright was the CFO at Prism Venture Partners where he managed the financial and legal affairs of the company. Assets under management grew from $150 million to over $1 billion in 40 separate investments under his tenure. From 1995 to 1999, he was the CFO for Leggat McCall Properties in Boston, where he responsible for the financial performance of the firm. From 1982 to 1995, Mr. Wright was affiliated with Sheraton Hotels where he held several successive positions including Internal Audit Director, Director of Strategic Projects and Planning, and Director of Corporate Development. Additionally he was the Senior Vice President and Division Controller of the Pacific Division based in Honolulu, Hawaii, where he managed the financial operations across six countries. Mr. Wright holds a BSBA from Babson College and a Juris Doctorate from Suffolk University Law School. He is a former CPA, a member of the Massachusetts Bar, the Massachusetts Society of Public Accountants, and the American Institute of Certified Public Accountants.

| 12 |

James M. Connolly. Mr. Connolly is a Senior Vice President and the Chief Operating Officer of our company. He has served as the Director of Asset Management since May 2011 and has direct responsibility for overseeing the day to day operating activities of our properties. Mr. Connolly is an experienced real estate asset management executive with a significant background in property level and portfolio wide operations. From 1998 to May 2011, Mr. Connolly was employed with Nortel Corporation, where he held positions as Global Leader Real Estate Asset Management from 1998 through December 2003, Director of Real Estate Finance from January 2004 through December 2008, Director of Real Estate for Europe, Middle East and Africa from December 2008 through March 2009, and Director of Real Estate Asset Management from April 2009 through May 2011. His responsibilities included asset, property and facilities management functions across Nortel’s global portfolio of office, industrial, and distribution properties. In addition, he managed internal and external personnel on a national and global basis. Prior to Nortel, Mr. Connolly was affiliated with Bay Networks from 1996 to 1998 and Raytheon from 1986 to 1996 where his responsibilities with those companies included facility finance and property administration. Mr. Connolly holds a BSBA from the University of Massachusetts and an MBA in Real Estate Financial Management from Northeastern University, and is a member of several real estate organizations including NAIOP.

Anne Alger Hayward. Ms. Hayward is our Senior Vice President and General Counsel and has served in these positions since March 2011. She also serves as Senior Vice President and General Counsel to Plymouth Real Estate Capital, LLC, our dealer manager. Ms. Hayward is responsible for the overall legal operations and compliance of our company. Ms. Hayward has over 30 years of experience in the practice of law, specializing in project finance, securities, equipment leasing and real estate transactional matters. She has structured and documented a wide variety of complex commercial transactions and public and private equity and debt securities offerings. Prior to joining Plymouth, from November 2007 through February 2011 she was General Counsel at Shane & Associates, Ltd., a Boston-based privately held real estate development and management company. Prior thereto, from April 2004 to November 2007 she was employed by Atlantic Exchange Company, an Internal Revenue Code Section 1031 exchange accommodator. Ms. Hayward is a graduate of Skidmore College and New England School of Law. She holds FINRA Series 22 and 63 licenses, is a licensed real estate broker, and is a member of the Massachusetts and Federal District Court Bars.

Compensation of Directors

Directors who are also our executive officers receive no compensation for board service. The following table discloses compensation paid to members serving on our board of directors in 2014.

2014 Board of Directors Compensation

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Total ($) | |||

| Martin Barber | — | — | — | |||

| Darren R. Bertram | — | — | — | |||

| Philip S. Cottone | 37,000 | — | 37,000 | |||

| Richard J. DeAgazio | 37,000 | — | 37,000 | |||

| David G. Gaw | 37,000 | — | 37,000 | |||

| Gregory E. Kraut | 3,740 | — | 3,740 | |||

| Michael G. Reiter | — | — | — | |||

| Richard H. Ross | 3,740 | — | 3,740 | |||

| Paul W. White | 3,740 | — | 3,740 | |||

| ______ |

| (1) | There were no stock awards granted to directors during the year ended December 31, 2014. The number of stock awards held by all directors as of December 31, 2014 was 90,053 shares. |

| 13 |

During 2014, our non-officer directors received compensation according to the following guidelines:

| Annual retainer fee | $25,000 | |

| Fee for each board meeting attended | 1,000 | |

| Audit committee chairman retainer | 5,000 | |

| Retainer for chairman of other committees | 5,000 | |

| Fee for each committee meeting attended | 500 |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 30, 2015 by (1) each current director, (2) each named executive officer, and (3) all current directors and executive officers as a group. No stockholder known to us owns beneficially more than 5% of our common stock. The number of shares beneficially owned by each entity, person, director or executive officer is determined under the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power or investment power. Unless otherwise indicated, each person has sole voting and investment power (or shares such powers with his spouse) with respect to the shares set forth in the following table.

| Directors and Executive Officers (1) | Amount and Nature of Beneficial Ownership |

Percent of Class (2) | ||

| Martin Barber | - 0 - | - | ||

| Darren R. Bertram | - 0 - | - | ||

| David G. Gaw | 13,042 | * | ||

| Richard J. DeAgazio | 11,438 | * | ||

| Philip S. Cottone | 11,948 | * | ||

| Gregory E. Kraut | - 0 - | - | ||

| Michael G. Reiter | - 0 - | - | ||

| Richard H. Ross | - 0 - | - | ||

| Paul W. White | - 0 - | - | ||

| Jeffrey E. Witherell | 53,409(3) | 4.0 | ||

| Pendleton P. White, Jr. | 53,409(3) | 4.0 | ||

| Daniel C. Wright | - 0 - | - | ||

| All directors and executive officers as a group (14 persons) | 143,246 | 10.8% |

| ___________ | |

| * | Beneficial ownership of less than 1% of the class is omitted. |

| (1) | The address of each director and executive officer is that of the company. |

| (2) | The percentage of shares owned provided in the table is based on 1,327,859 shares outstanding as of April 30, 2015. Percentage of beneficial ownership by a person as of a particular date is calculated by dividing the number of shares beneficially owned by such person as of April 30, 2015 by the sum of the number of shares of common stock outstanding as of such date. |

| (3) | Includes 53,302 shares of common stock owned by Plymouth Group Real Estate of which Messrs. Witherell and White may be deemed to be the beneficial owners. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file reports of holdings and transactions in our securities with the SEC. Executive officers, directors and greater than 10% beneficial owners are required by applicable regulations to furnish us with copies of all Section 16(a) forms they file with the SEC.

Based solely upon a review of the reports furnished to us with respect to fiscal 2014, we believe that all SEC filing requirements applicable to our directors and executive officers and 10% beneficial owners were satisfied during the year ended December 31, 2014.

| 14 |

EXECUTIVE COMPENSATION

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below. Prior to May 2014, we were externally advised by Plymouth Real Estate Investors, Inc., an affiliate of the company, pursuant to the terms of an advisory agreement. As a result, we have no employees prior to the termination of the advisory agreement in May 2014. Applicable SEC rules require that a registrant provide information regarding the material components of its executive compensation program with respect to the last two completed fiscal years. However, because we did not have any employees until May 2014, no compensation was paid to any of our named executive officers prior to that term.

Summary Compensation Table

As noted above, we did not have any employees until May 2014 and, accordingly, we did not pay any compensation to Messrs. Witherell, White and Wright, our named executive officers prior to that time. Below is a Summary Compensation Table setting forth certain compensation that we paid our named executive officers during 2015 following the completion of this offering, in order to provide some understanding of our expected compensation levels.

| Name and Principal Position | Salary | Bonus | Stock Awards | All Other Compensation(1) |

Total |

| Jeffrey E. Witherell— | $145,000 | — | — | $854 | $145,854 |

| Chief Executive Officer | |||||

| Pendleton P. White, Jr.— | $117,000 | — | — | $14,441 | $131,441 |

| President and Chief | |||||

| Investment Officer | |||||

| Daniel C. Wright— | $99,167 | — | — | $12,345 | $111,512 |

| Executive Vice President | |||||

| and Chief Financial Officer |

| __________ | ||

| (1) | Represents reimbursement of up to $10,000 annually for reasonable professional expenses and advice from professional advisors and amounts paid by us for healthcare benefits for each officer. | |

Outstanding Equity Awards at Fiscal Year-End December 31, 2014

None of our named executive officers held any equity awards at December 31, 2014.

Base Salaries

Our named executive officers earn annualized base salaries that are commensurate with their positions and are expected to provide a steady source of income sufficient to permit these officers to focus their time and attention on their work duties and responsibilities. The annual base salaries of our named executive officers, which will be effective as of the completion of this offering, are set forth in the Summary Compensation Table above.

Cash Bonuses

Our named executive officers and certain employees will be eligible to earn annual bonuses based on the attainment of specified performance objectives established by our compensation committee. Eligibility to receive these cash bonuses is expected to incentivize our named executive officers to strive to attain company and/or individual performance goals that further our interests and the interests of our stockholders. The applicable terms and conditions of the cash bonuses will be determined by our compensation committee.

| 15 |

Other Elements of Compensation Retirement Plans

The Internal Revenue Code of 1986, as amended, or the Code, allows eligible employees to defer a portion of their compensation, within prescribed limits, on a pre-tax basis through contributions to a 401(k) plan. We expect to establish a 401(k) retirement savings plan for our employees, including our named executive officers, who satisfy certain eligibility requirements. We expect that our named executive officers will be eligible to participate in the 401(k) plan on the same terms as other full-time employees.

Employee Benefits and Perquisites

We expect that our full-time employees, including our named executive officers, will be eligible to participate in health and welfare benefit plans, which will provide medical, dental, prescription and other health and related benefits. We may also implement additional benefit and other perquisite programs as our compensation committee determines appropriate, though we do not expect any such additional benefits and perquisites to constitute a material component of our named executive officers’ compensation package.

Additional Compensation Components

As we formulate and implement our compensation program, we may provide different and/or additional compensation components, benefits and/or perquisites to our named executive officers, to ensure that we provide a balanced and comprehensive compensation structure. We believe that it is important to maintain flexibility to adapt our compensation structure at this time to properly attract, motivate and retain the top executive talent for which we compete.

Executive Compensation Arrangements

In September 2014, we entered into employment agreements with certain executive officers of the company, including Messrs. Witherell, White and Wright. The following is a summary of the material terms of the agreements.

Under the agreements, Mr. Witherell serves as Chief Executive Officer of our company, Mr. White serves as President and Chief Investment Officer of our company and Mr. Wright serves as Chief Financial Officer of our company. Each will report directly to the board. The initial term of the employment agreements will end on the third anniversary of the date thereof. On that date, and on each subsequent one year anniversary of such date, the term of the employment agreements will automatically be extended for one year, unless earlier terminated. Pursuant to the employment agreements, during the terms of Messrs. Witherell’s and White’s employment, we will nominate each for election as a director.

Under the employment agreements, Messrs. Witherell, White and Wright receive initial annual base salaries in the amounts reflected in the “Summary Compensation Table” above, which are subject to increase at the discretion of our compensation committee. In addition, each of Messrs. Witherell, White and Wright will be eligible to receive an annual discretionary cash performance bonus targeted at 100% of the executive’s then-current annual base salary. The actual amount of any such bonuses will be determined by reference to the attainment of applicable company and/or individual performance objectives, as determined by our compensation committee. Beginning in calendar year 2015 and for each calendar year thereafter, Messrs. Witherell, White and Wright will each be eligible to receive an annual equity award, as determined by our compensation committee in its sole discretion. Messrs. Witherell, White and Wright will also be eligible to participate in customary health, welfare and fringe benefit plans, and, subject to certain restrictions, healthcare benefits will be provided to them and their eligible dependents at our sole expense. Each of Messrs. Witherell, White and Wright will accrue four weeks of paid vacation per year.

| 16 |

Pursuant to the terms of the employment agreements, if Mr. Witherell’s, Mr. White’s or Mr. Wright’s employment is terminated by the company without “cause,” by the executive for “good reason” (each as defined in the applicable employment agreement) or because the company elects not to renew the term of the employment agreement then, in addition to any accrued amounts, the executive will be entitled to receive the following:

| • | An amount, payable over a 12-month period, equal to (a) three times with respect to Mr. Witherell and (b) two times with respect to Messrs. White and Wright the sum of (1) the executive’s annual base salary then in effect, (2) the average annual bonus earned by the executive for the two prior fiscal years (substituting target bonus in the average for any fiscal year not yet completed if fewer than two fiscal years have been completed) and (3) the average value of any annual equity awards(s) made to the executive during the prior two fiscal years (excluding the initial grant of restricted stock described above, any award(s) granted pursuant to a multi-year, outperformance or long-term performance program and any other non-recurring awards), or if fewer than two years have elapsed, over such lesser number of years; and |

| • | accelerated vesting of all outstanding equity awards held by the executive as of the termination date; and company-paid continuation healthcare coverage for 18 months after the termination date. |

The executive’s right to receive the severance payments and benefits described above is subject to his delivery and non-revocation of an effective general release of claims in favor of the company. The employment agreements also contain customary confidentiality and non-solicitation provisions.

Upon a termination of employment by reason of death or disability, the executive or his estate will be entitled to accelerated vesting of all outstanding equity awards held by the executive as of the termination date, in addition to any accrued amounts. In addition, upon a change in control of the company (as defined in the Plan), Messrs. Witherell, White and Wright will be entitled to accelerated vesting of all outstanding equity awards held by such executive as of the date of the change in control. In addition, under the employment agreements, to the extent that any change in control payment or benefit would be subject to an excise tax imposed in connection with Section 4999 of the Code, such payments and/or benefits may be subject to a “best pay cap” reduction to the extent necessary so that the executive receives the greater of the (a) net amount of the change in control payments and benefits reduced such that such payments and benefits will not be subject to the excise tax and (b) net amount of the change in control payments and benefits without such reduction.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Management is responsible for the financial reporting process, including the system of internal controls, and for the preparation of consolidated financial statements in accordance with GAAP. The company’s independent registered public accounting firm is responsible for auditing those financial statements and expressing an opinion as to their conformity with GAAP. Our responsibility is to oversee and review these processes. We are not, however, professionally engaged in the practice of accounting or auditing, and do not provide any expert or other special assurance as to such financial statements concerning compliance with the laws, regulations or GAAP or as to the independence of the registered public accounting firm. We rely, without independent verification, on the information provided to us and on the representations made by management and the independent registered public accounting firm. Our meetings are designed, among other things, to facilitate and encourage communication among the committee, management, and the company’s independent registered public accounting firm. We discussed with our auditors the overall scope and plans for their audit.

We have reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2014 with management and our auditors. We also discussed with management and our auditors the process used to support certifications by the company’s chief executive officer and chief financial officer that are required by the SEC and the Sarbanes-Oxley Act of 2002 to accompany the company’s periodic filings with the SEC.

| 17 |

In addition, the audit committee obtained from our auditors and reviewed the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding our auditors' communications with the audit committee concerning independence, discussed with our auditors any relationships that may impact their objectivity and independence, and satisfied itself as to their independence. When considering our auditors' independence, we considered whether its provision of services to the company beyond those rendered in connection with their audit of the company’s consolidated financial statements and reviews of the company’s consolidated financial statements, including in its Quarterly Reports on Form 10-Q, was compatible with maintaining their independence. We also reviewed, among other things, the audit and non-audit services performed by, and the amount of fees paid for such services to our auditors. The audit committee also discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those required to be discussed by the Statement on Auditing Standards (SAS) No. 61, as amended, "Certification of Statements and Auditing Standards."

Based on our review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the audit committee charter, we recommended to the board of directors (and the board has approved) that the audited financial statements for the year ended December 31, 2014 be included in the company’s Annual Report on Form 10-K for filing with the SEC. We have selected Marcum LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, 2015.

The undersigned members of the audit committee have furnished this report to the board of directors.

Respectfully Submitted,

Audit Committee

David G. Gaw, Chairman

Richard J. DeAgazio

Philip S. Cottone

| 18 |

PROPOSAL 2 ─ RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Braver P.C. served as our independent auditors to audit our financial statements for the fiscal year ending December 31, 2013. Effective January 1, 2014, Braver P.C. combined its practice with Marcum LLP, and Marcum LLP, as the surviving entity, became the company's independent auditors for the fiscal year ended December 31, 2014. Accordingly, the fees paid for the audit of the financial statements for the fiscal year ended December 31, 2013 are reflected as having been paid to Marcum LLP.

Aggregate fees billed to us by our independent auditors for the fiscal years ended December 31, 2014 and 2013 are set forth below.

| Fees | 2014 | 2013 | ||||||

| Audit Fees (1) | ||||||||

| Marcum LLP | $ | 234,567 | $ | 73,340 | ||||

| Audit-Related Fees (2) | ||||||||

| Marcum LLP | 880,117 | -0- | ||||||

| Tax Fees (3) | ||||||||

| Marcum LLP | 21,942 | 46,623 | ||||||

| All Other Fees | — | — | ||||||

| Total | $ | 1,136,626 | $ | 119,963 | ||||

| _______ | |

| (1) | Fees for audit services billed in 2014 and 2013 consisted of audit of the company’s annual financial statements, reviews of the Company’s quarterly financial statements, consents and other services related to SEC matters, including services rendered in connection with the company’s registration statement on Form S-11. |

| (2) | Fees for audit-related services billed in 2014 and 2013 consisted of services that are reasonably related to the performance of the audit or the review of financial statements, including the preparation of audit required by regulation S-X Rule 3-14 relative to significant acquisitions. |