Exhibit 10.2

PURCHASE AND SALE AGREEMENT

AND ESCROW INSTRUCTIONS

BY AND BETWEEN

SELLERS:

REW, L.L.C. and W Partners, LLC

both Indiana limited liability companies

BUYER:

Plymouth Industrial REIT, Inc.,

a Maryland corporation.

Dated as of: October 3, 2014

PURCHASE AND SALE AGREEMENT and escrow instructions

Buyer and Sellers hereby enter into this Purchase and Sale Agreement and Escrow Instructions (this “Agreement”) as of the Effective Date. In consideration of the mutual covenants set forth herein, Sellers agree to sell, convey, assign and transfer the Property to Buyer, and Buyer agrees to buy the Property from Sellers, on the terms and conditions set forth in this Agreement.

1. DEFINED TERMS. The terms listed below shall have the following meanings throughout this Agreement:

| Approvals: | All permits, licenses, franchises, certifications, authorizations, approvals and permits issued by any governmental or quasi-governmental authorities for the ownership, operation, use and occupancy of the Property or any part thereof, excluding applications for development approvals that have been denied. |

| Business Day: | Any day that is not a Saturday or Sunday or a legal holiday in the state in which the Real Property is located. |

| Broker: | Newmark Grubb Cressy & Everett |

| 4100 Edison Lakes Parkway – Suite 350 | |

| Mishawaka, IN 46545 | |

| Buyer: | Plymouth Industrial REIT, Inc., a Maryland corporation. |

| Buyer’s Address: | Plymouth Industrial REIT, Inc. |

| 260 Franklin Street – 19th Floor | |

| Boston, MA 02109 | |

| Attn: Pendleton White, Jr. | |

| Telephone: (617) 340-3861 | |

| Email: pen.white@plymouthrei.com | |

| With a copy to: | |

| Brown Rudnick LLP | |

| One Financial Center | |

| Boston, MA 02111 | |

| Attn: Kevin P. Joyce, Esq. | |

| Jeffrey L. Vigliotti, Esq. | |

| Telephone: (617) 856-8342 (KPJ) | |

| (617) 856-8494 (JLV) | |

| Email: KJoyce@brownrudnick.com | |

| jvigliotti@brownrudnick.com |

| 1 |

| Closing: | The consummation of the sale and purchase of the Property, as described in Section 8 below. |

| Closing Date: | The date which is the later to occur of (a) thirty (30) days following the initial public offering made by Buyer (or its assignee or designated affiliate), and (b) October 30, 2014, subject to extension and/or acceleration pursuant to Section 8(d); provided, however, that in no event shall Buyer have the right to extend the Closing Date past March 30, 2015. |

| Contingency Period: | The period commencing on the Effective Date and expiring at 5:00 p.m. (Eastern) on the date which is thirty (30) days (the “Scheduled Contingency Expiration Date”) thereafter, subject, however, to extension pursuant to Section 4. |

| Deposit: | Two Hundred Fifty Thousand and 00/100 Dollars ($250,000.00) (the “Initial Deposit”) together with any increase to the same if Buyer deposits the additional sums of Two Hundred Fifty Thousand Dollars and 00/100 ($250,000.00) (“First Extension Deposit”) and Two Hundred Fifty Thousand Dollars and 00/100 ($250,000.00) (“Second Extension Deposit”) with Escrow Holder pursuant to and subject to the terms of Section 2, Section 4, and Section 8. |

| Domain Rights: | All rights, control and ownership of the Websites, and all intellectual property rights and interests relating thereto or arising therefrom. |

| Effective Date: | October 3, 2014 |

| Escrow Holder: | Meridian Title Corporation |

| Escrow Holder’s Address: | Meridian Title Corporation |

| 202 S. Michigan St. | |

| South Bend, IN 46601 | |

| Attention: Mark Myers | |

| Telephone: 574-232-5845 | |

| Email: mmeyers@meridiantitle.com | |

| Exhibits: | Exhibit A-1 – Legal Description of the West Cleveland Parcel |

| Exhibit A-2 – Legal Description of the West Brick 1 Parcel | |

| Exhibit A-3 – Legal Description of the North Mayflower Parcel | |

| Exhibit A-4 – Legal Description of the West Carbonmill Parcel | |

| Exhibit A-5 – Legal Description of the Ameritech Parcel | |

| Exhibit B – Documents | |

| Exhibit C – Form of Tenant Estoppel | |

| Exhibit D – Form of Deed |

| 2 |

| Exhibit E – Form of Bill of Sale | |

| Exhibit F – Form of Assignment of Leases | |

| Exhibit G – Form of Assignment of Contracts | |

| Exhibit H – Form of FIRPTA Affidavit | |

| Exhibit I – Form of Audit Letter | |

| Exhibit J – Form of Seller's Closing Certificate | |

| Exhibit K – Existing Contracts | |

| Exhibit L – List of Leases | |

| Exhibit M – Disclosures | |

| Exhibit N – Intentionally Omitted | |

| Exhibit O – Intentionally Omitted | |

| Exhibit P – Intentionally Omitted | |

| Exhibit Q – Form of Non-Poaching Agreement | |

| Exhibit R – Form of Right of First Refusal | |

| Exhibit S – Description of Right of First Refusal Property | |

| Existing Contracts: | All written brokerage (other than the brokerage agreement regarding the sale of the Property to Buyer), service, maintenance, operating, repair, supply, purchase, consulting, professional service, advertising and other contracts to which Sellers, or their agents, representatives, employees or predecessors-in-interest is a party, relating to the operation or management of the Property (but excluding insurance contracts and any recorded documents evidencing the Permitted Exceptions). |

| Improvements: | All buildings and other improvements owned by Sellers located on or affixed to the Land, including, without limitation, the existing buildings containing approximately 667,000 rentable square feet (the “Buildings”) and the existing parking lots, together with all mechanical systems (including without limitation, all heating, air conditioning and ventilating systems and overhead doors), electrical equipment, facilities, equipment, conduits, motors, appliances, boiler pressure systems and equipment, air compressors, air lines, gas-fixed unit heaters, baseboard heating systems, water heaters and water coolers, plumbing fixtures, lighting systems (including all fluorescent and mercury vapor fixtures), transformers, switches, furnaces, bus ducts, controls, risers, facilities, installations and sprinkling systems to provide fire protection, security, heat, air conditioning, ventilation, exhaust, electrical power, light, telephone, storm drainage, gas, plumbing, refrigeration, sewer and water thereto, all internet exchange facilities, telecommunications networks and facilities base IP, conduits, fiber optic cables, all cable television fixtures and antenna, elevators, escalators, incinerators, disposals, rest room fixtures and other fixtures, equipment, motors and machinery located in or upon the Buildings, and other improvements now or hereafter on the Land. |

| 3 |

| Intangible Property: | All intangible property now or on the Closing Date owned by Sellers in connection with the Real Property or the Personal Property, if any, including without limitation all of Sellers’ right, title and interest in and to all environmental reports, soil reports, utility arrangements (except as expressly set forth herein), warranties, guarantees, indemnities, claims, licenses, applications, permits, governmental approvals, plans, drawings, specifications, surveys, maps, engineering reports and other technical descriptions, books and records, licenses, authorizations, applications, permits and all other Approvals, Domain Rights, Websites, insurance proceeds and condemnation awards, Seller’s right, title and interest in all Approved Contracts relating to the Real Property or the Personal Property, or any part thereof (but not Sellers’ obligations under any Rejected Contracts (as hereinafter defined)), and all other intangible rights used in connection with or relating to the Real Property or the Personal Property or any part thereof. |

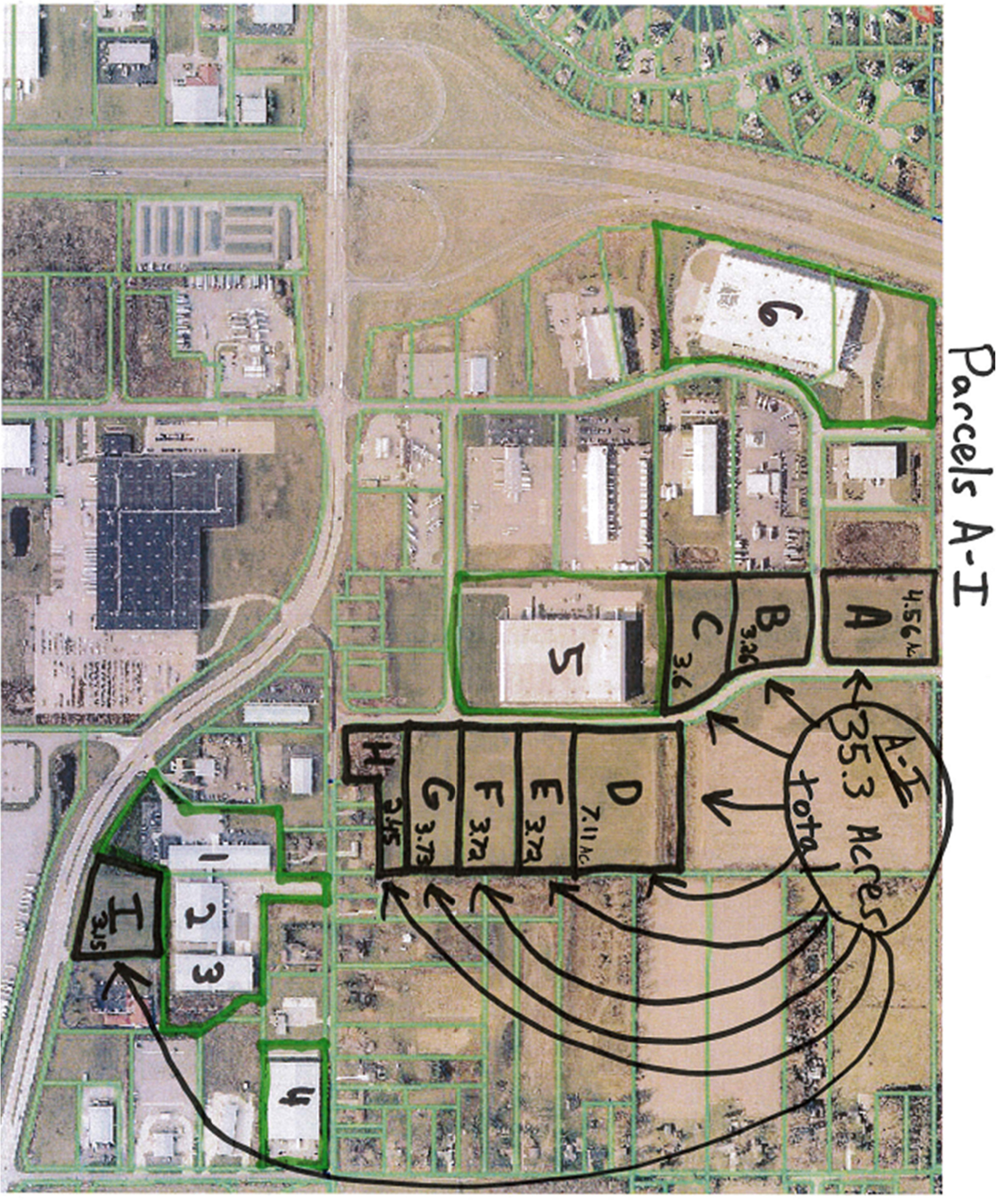

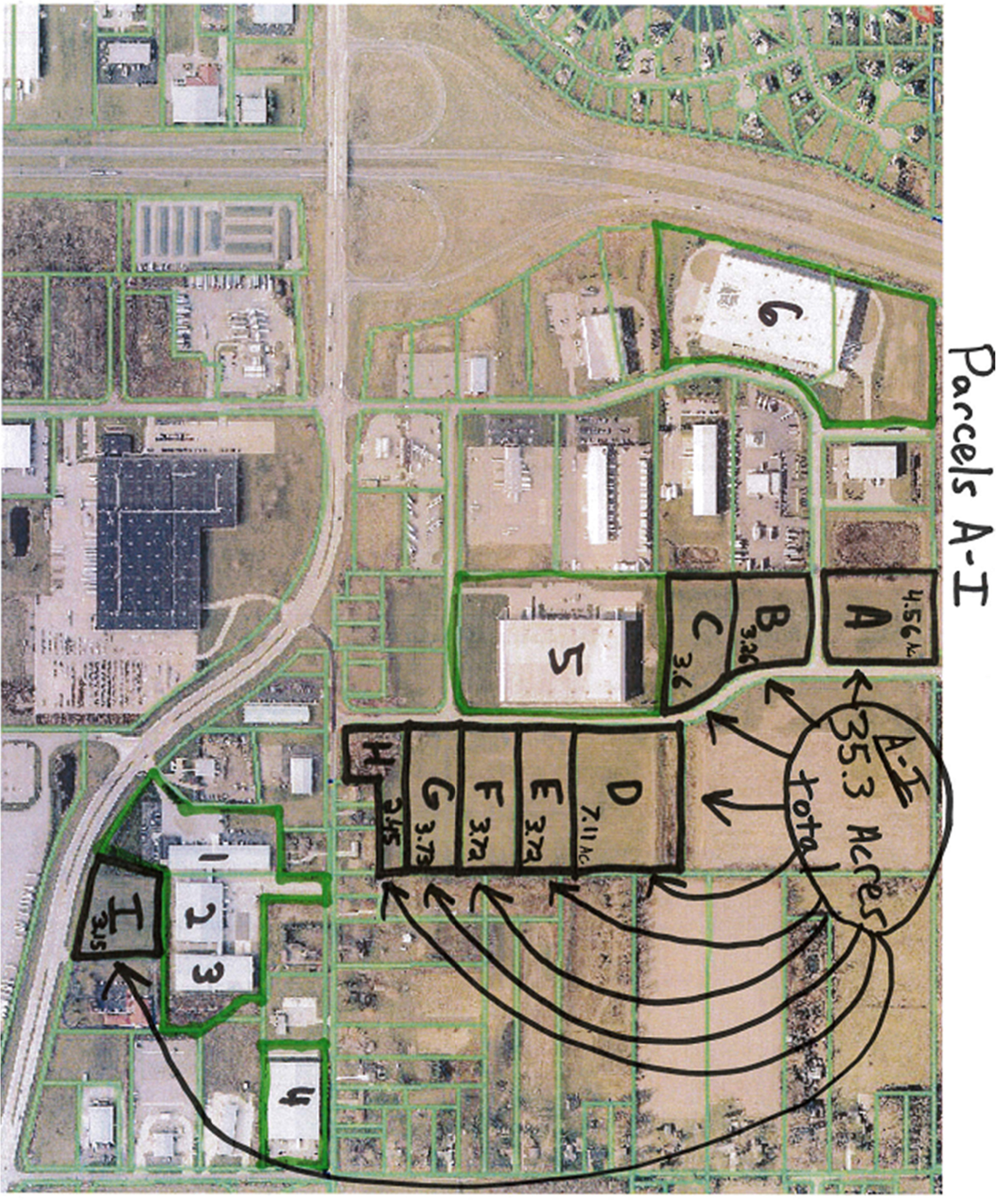

| Land: | The following parcels (collectively, the "Parcels", and each a "Parcel"), each located in City of South Bend, St. Joseph County, Indiana, together with all rights and interests appurtenant thereto, including, without limitation, any water and mineral rights, development rights, air rights, easements and all rights of Sellers in and to any strips and gores, alleys, passages or other rights-of-way: (i) that certain parcel of land commonly known as 5861 West Cleveland Road, more particularly described in Exhibit A-1 attached hereto (the "West Cleveland Parcel"); (ii) that certain parcel of land commonly known as 5502 West Brick Road #1 more particularly described in Exhibit A-2 attached hereto (the "West Brick 1 Parcel"); (iii) that certain parcel of land commonly known as 4491 North Mayflower Road more particularly described in Exhibit A-3, attached hereto (the "North Mayflower Parcel"); (iv) that certain parcel of land commonly known as 5855 West Carbonmill Drive more particularly described in Exhibit A-4, attached hereto (the "West Carbonmill Parcel"); and (v) that certain parcel of land commonly known as 4955 Ameritech Drive more particularly described in Exhibit A-5, attached hereto (the "Ameritech Parcel”). |

| Leases: | The leases and/or licenses of space in the Property in effect on the date hereof as listed on Exhibit L, together with leases of space in the Property entered into after the date hereof in accordance with the terms of this Agreement, together with all amendments and guaranties thereof. |

| 4 |

| Permitted Exceptions: | All of the following: applicable zoning and building ordinances and land use regulations for which there is no violation, the lien of taxes and assessments not yet delinquent, any exclusions from coverage set forth in the jacket of any Owner's Policy of Title Insurance, any exceptions caused by Buyer, its agents, representatives or employees, the rights of the tenants, as tenants only, under the Leases, public utility easements of record without encroachment by any of the Improvements, and any matters deemed to constitute Permitted Exceptions under Section 5(d) hereof. |

| Personal Property: | Any and all personal property owned by Sellers (if any) and located on the Real Property. |

| Property: | The Real Property, the Personal Property, the Approved Contracts (as defined in Section 4), the Leases and the Intangible Property. |

| Purchase Price: | Twenty Six Million Seven Hundred Thousand and 00/100 Dollars ($26,700,000.00) |

| Real Property: | The Land and the Improvements. |

| Sellers: | REW, L.L.C. and W Partners, LLC, each an Indiana limited liability company |

| Sellers’ Address: | REW, L.L.C. |

| 51500 Stratton Court, Granger, IN 46530 | |

| Attn: Robert E. Wozny | |

| Telephone: 574-340-0041 | |

| Email: N/A (notices via email to be delivered to the copy addresses below) | |

| With a copy to: | |

| Newmark Grubb Cressy & Everett | |

| 4100 Edison Lakes Parkway | |

| Mishawaka, IN 46545 | |

| Attn: Richard J. Doolittle | |

| Telephone: 574-271-4060 | |

| Email: RickDoolittle@cressyandeverett.com | |

| and | |

| Newmark Grubb Cressy & Everett | |

| . | 4100 Edison Lakes Parkway, Suite 350 |

| Mishawaka, IN 46545 | |

| Attn: John M. Laird, Esq | |

| Telephone: 574-485-1553 | |

| Email: johnlaird@cressyandeverett.com | |

| 5 |

| Tenant Inducement Costs: | All third-party payments, costs and expenses required to be paid or provided by Sellers, as landlords, pursuant to a Lease which is in the nature of a tenant inducement, including tenant improvement costs, tenant allowances, building lease buyout costs, landlord's work costs, brokerage commissions, reimbursement of tenant moving expenses and other out-of-pocket costs. |

| Title Company: | Commonwealth Land Title Insurance Company |

| c/o Meridian Title Corporation | |

| 202 South Michigan St. | |

| South Bend, IN 46601 | |

| Attn: Mr. Mark Myers | |

| Telephone: 574-232-5845 | |

| Email: mmeyers@meridiantitle.com | |

| Websites: | All domain names, web addresses and websites in which Sellers have an interest relating to the Property or any portion thereof, including, but not limited to, any other name given to the Property. |

2. DEPOSIT AND PAYMENT OF PURCHASE PRICE; INDEPENDENT CONSIDERATION. Unless this Agreement terminates prior to the expiration of the Contingency Period, within five (5) Business Days after the Contingency Period expires, Buyer shall deposit the Initial Deposit with Escrow Holder, at Escrow Holder’s office, by check or by wire transfer, funds in the amount of the Initial Deposit as a deposit on account of the Purchase Price. Immediately upon Escrow Holder’s receipt of the Initial Deposit (and, if applicable, the First Extension Deposit and Second Extension Deposit), Escrow Holder shall place the same in an single interest-bearing account reasonably acceptable to Buyer. The Deposit shall be deemed to include any interest accrued thereon. The Deposit (as and when paid to Escrow Holder) shall be held by Escrow Holder in accordance with this Agreement, and, if applicable, in accordance with Escrow Holder's standard form of escrow agreement which Buyer and Sellers agree to execute in addition to this Agreement.

If the transactions contemplated hereby close as provided herein, the Deposit shall be paid to Sellers and shall be credited toward the Purchase Price and Buyer shall pay through escrow to Sellers the balance of the Purchase Price net of all prorations and other adjustments provided for in this Agreement. If this Agreement is terminated pursuant to the terms hereof or if the transactions do not close, the Deposit shall be returned to Buyer or delivered to Sellers as otherwise specified in this Agreement.

Notwithstanding anything in this Agreement to the contrary, One Hundred and No/100 Dollars ($100.00) of the Deposit is delivered to the Escrow Holder for delivery by the Escrow Holder to Sellers as “Independent Contract Consideration”, and the Deposit is reduced by the amount of the Independent Contract Consideration so delivered to Sellers, which amount has been bargained for and agreed to as consideration for Sellers’ execution and delivery of this Agreement. At Closing, the Independent Contract Consideration shall not be applied to the Purchase Price.

| 6 |

3. DELIVERY OF MATERIALS FOR REVIEW. On or before the date which is five (5) Business Days after the Effective Date, Sellers shall deliver to Buyer at Buyer’s address set forth in Section 1 above, the materials listed on Exhibit B (collectively, the “Documents”) for Buyer's review, to the extent the same are in Sellers’ possession. In the alternative, at Sellers’ option and within the foregoing five (5) day period, Sellers may make the Documents available to Buyer on a secure web site, and in such event, Buyer agrees that any item to be delivered by Sellers under this Agreement shall be deemed delivered to the extent available to Buyer on such secured web site. Without limitation on the foregoing, Sellers shall make any other documents, files and information reasonably requested by Buyer concerning the Property and which are in Sellers’ possession or control available for Buyer’s inspection at Sellers’ general offices or such other location as shall be mutually convenient to the parties.

4. CONTINGENCIES. Buyer’s obligation under this Agreement to purchase the Property and consummate the transactions contemplated hereby is subject to and conditioned upon, among other things, the satisfaction or waiver by Buyer, in its sole and absolute discretion and in the manner hereinafter provided, of each of the contingencies (individually, a “Contingency”, and collectively, the “Contingencies”) set forth in this Section 4 in each case within the Contingency Period.

(a) Property Review. Beginning on the Effective Date and continuing until the expiration of the Contingency Period, Sellers shall have given Buyer an opportunity to conduct its due diligence review, investigation and analysis of the Property (the “Due Diligence Review”) independently or through agents of Buyer's own choosing, and Buyer shall have completed and shall be satisfied, in Buyer’s sole and absolute discretion, with Buyer’s Due Diligence Review, which may include, but shall not necessarily be limited to, Buyer’s review, investigation and analysis of: (i) all of the Documents; (ii) the physical condition of the Property; (iii) the adequacy and availability at reasonable prices of all necessary utilities, including, without limitation, the services necessary to operate the Improvements for Buyer’s intended use of the Property; (iv) the adequacy and suitability of applicable zoning and Approvals; (v) the Leases and the obligations from and to the tenants thereunder; (vi) market feasibility studies; and (vii) such tests and inspections of the Property as Buyer may deem necessary or desirable.

(b) Environmental Audit. On or before the expiration of the Contingency Period, Buyer shall have completed to the satisfaction of Buyer, in its sole and absolute discretion, and at its sole cost and expense, an environmental audit and assessment of the Real Property (the “Environmental Audit”), including but not limited to the performance of such tests and inspections as Buyer may deem necessary or desirable, subject to the terms and provisions hereof, in order to determine the presence or absence of any Hazardous Materials (as defined in Section 12(i) hereof).

(c) Tenant Estoppels. On or before the expiration of the Contingency Period, Buyer shall have received an estoppel certificate substantially in the form attached hereto as Exhibit C (the “Tenant Estoppel”), executed by each tenant under each of the Leases with respect to the status of such Lease, rent payments, tenant improvements, lease defaults and other matters relating to such Lease, and disclosing no defaults, disputes or other matters objectionable to Buyer in its sole and absolute discretion.

| 7 |

(d) Board Approval. On or before the expiration of the Contingency Period, Buyer shall have obtained approval for the transaction contemplated by this Agreement from its Board of Directors (“Board Approval”).

The foregoing Due Diligence Review, Environmental Audit, Tenant Estoppel and Board Approval Contingencies are solely for Buyer’s benefit and only Buyer may determine such Contingencies to be satisfied or waived in writing. Buyer shall have the Contingency Period in which to satisfy or waive such Contingencies by delivering written notice to Sellers with a copy to Escrow Holder. A Contingency shall be deemed not to have been satisfied or waived by Buyer unless prior to the expiration of the Contingency Period, Buyer shall deliver to Sellers a written notice to such effect (each such notice being herein referred to as an “Approval Notice”). If, at any time during the Contingency Period, Buyer determines in its sole and absolute discretion that a Phase II Environmental Site Assessment is necessary to determine whether the Contingencies have been satisfied, Buyer shall have the right to extend the Contingency Period for an additional thirty (30) days so that the Contingency Period will expire at 5:00 p.m. (Eastern) on the date which is sixty (60) days after the Effective Date; Buyer may exercise this extension right by delivering written notice to Sellers on or before 5:00 p.m. (Eastern) on the Scheduled Contingency Expiration Date.

If Buyer provides an Approval Notice for each of the Contingencies, then the Contingencies shall be deemed satisfied or waived and the parties shall, subject to the satisfaction of all other terms and conditions applicable to the respective parties’ obligations hereunder, be obligated to proceed to Closing. If Buyer does not provide an Approval Notice with respect to any or all of the Contingencies during the Contingency Period, then such Contingency(ies) shall be deemed not satisfied or waived, and this Agreement shall automatically terminate and be of no further force and effect at the end of the Contingency Period without the further action of either party. During the Contingency Period Buyer may elect not to purchase the Property for any reason or for no reason whatsoever, all in Buyer's sole and absolute discretion. Upon any such termination, Escrow Holder shall return the Deposit (if any) to Buyer and, except for those provisions of this Agreement which expressly survive the termination of this Agreement, the parties hereto shall have no further obligations hereunder.

Notwithstanding Sellers’ representation set forth in Section 12(d) of this Agreement, if it is discovered that any Existing Contracts exist, prior to the expiration of the Contingency Period, Buyer may furnish Sellers with a written notice of the contracts and agreements (the “Approved Contracts”) which Buyer has elected to assume at the Closing. All Existing Contracts not included in any such notice shall be excluded from the Property to be conveyed to Buyer, and are herein respectively referred to as the “Rejected Contracts”, and, if Buyer fails to deliver such notice, all Existing Contracts shall be deemed Rejected Contracts. Sellers shall at Sellers’ sole cost and expense terminate on or before the Closing Date all Rejected Contracts and shall deliver to Buyer evidence reasonably satisfactory to Buyer of Sellers’ termination on or prior to Closing of all Rejected Contracts. Notwithstanding anything contained herein to the contrary, Sellers agree to cause any existing property management agreements and any leasing listing agreements to be terminated effective as of the Closing Date and Sellers shall be solely responsible for any fees or payments due thereunder.

| 8 |

5. TITLE COMMITMENT; SURVEY; SEARCHES. Buyer’s obligation to purchase the Property and to consummate the transactions contemplated hereby shall also be subject to and conditioned upon Buyer’s having approved the condition of title to the Property and surveys of the Real Property in the manner provided for in this Section 5.

(a) Title Commitments. On or before the date which is ten (10) Business Days after the Effective Date, Sellers shall cause the Title Company to deliver commitments for each of the Parcels (collectively, the “Title Commitments”, and each a “Title Commitment”) to Buyer for the Title Policies (as defined in Section 6 hereof), issued by the Title Company showing Sellers as the owners of good and indefeasible fee simple title to the Real Property, together with legible copies of all documents (“Exception Documents”) referred to in Schedule B of the Title Commitments.

(b) Surveys. On or before the date which is five (5) Business Days after the Effective Date, Sellers shall deliver any existing surveys available of the Real Property to Buyer, and Sellers shall cooperate with Buyer to obtain, at Buyer's sole cost and expense, an update of Sellers’ existing surveys or, if necessary, new surveys from a surveyor licensed in the State of Indiana, which shall be certified to Buyer, Title Company and Buyer’s lender (if applicable) with a certification in accordance with the “Minimum Standard Detail Requirements for ALTA/ACSM Land Title Surveys,” jointly established and adopted by ALTA and NSPS in 2011 and including items 1, 2, 3, 4, 6(a), 6(b), 7(a), 7(b)(1), 7(c), 8, 9, 10, 11(a), 11(b), 13, 14, 16, 17, 18, 20 and 21 ($1,000,000.00 minimum) of Table A (collectively, the “Surveys”, and each a “Survey”).

(c) Searches. Buyer may obtain, at its sole cost and expense, current UCC, tax lien and judgment searches with respect to Sellers liens, security interests and adverse claims affecting Sellers or Sellers’ interest in the Real Property and/or the Personal Property (collectively, “Searches”).

(d) Permitted/Unpermitted Exceptions. Buyer shall have the right, up until on or before seven (7) Business Days before the end of the Contingency Period, to object in writing (“Buyer’s Exception Notice”) to any title matters that are not Permitted Exceptions which are disclosed in the Title Commitments or Surveys (herein collectively called “Liens”). Unless Buyer shall timely object to the Liens, such Liens shall be deemed to constitute additional Permitted Exceptions. Any exceptions which are timely objected to by Buyer shall be herein collectively called the “Title Objections.” If, on or before two (2) Business Days before the end of the Contingency Period, Sellers fail to cause or covenant to Buyer in writing to remove or endorse over any Title Objections prior to the Closing in a manner satisfactory to Buyer in its sole and absolute discretion (Sellers having no obligation to agree to cure or correct any such Title Objections), Buyer may elect, prior to the expiration of the Contingency Period to either (a) terminate this Agreement by giving written notice to Sellers and Escrow Holder or by failing to deliver the Approval Notice in accordance with Section 4, in either of which event the Deposit shall be paid to Buyer and, thereafter, the parties shall have no further rights or obligations hereunder except for those obligations which expressly survive the termination of

| 9 |

this Agreement, or (b) waive such Title Objections, in which event such Title Objections shall be deemed additional “Permitted Exceptions” and the Closing shall occur as herein provided without any reduction of or credit against the Purchase Price. Buyer shall have the right to amend Buyer’s Exception Notice (“Buyer’s Amended Exception Notice”) to object to any title matters that are not Permitted Exceptions which are disclosed in any supplemental reports or updates to the Title Commitments or Surveys delivered to Buyer after the end of the Contingency Period (which title matters were not reflected in the Title Commitments or Surveys provided to Buyer prior to the end of the Contingency Period) provided that Buyer objects to the same within five (5) days after Buyer’s receipt of the applicable supplemental reports or updates to the Title Commitments or Surveys but in no event after Closing. If Sellers fail to take the action requested by Buyer in Buyer’s Amended Exception Notice, Buyer may elect prior to Closing to proceed under either clause (a) or (b) of the sentence which precedes the immediately preceding sentence. Notwithstanding anything to the contrary contained in this Agreement, any Lien which is a financial encumbrance such as a mortgage, deed of trust, or other debt security, attachment, judgment, lien for delinquent real estate taxes and delinquent assessments, mechanic’s or materialmen’s lien, which is outstanding against the Property, or any part thereof, that is revealed or disclosed by the Title Commitments or any updates thereto and/or the Searches (herein such matters are referred to as “Financial Encumbrances”) shall in no event be deemed a Permitted Exception, and Sellers hereby covenant to remove all Financial Encumbrances on or before the Closing Date.

(e) Approved Title and Survey. The condition of title as approved by Buyer in accordance with this Section 5 is referred to herein as the “Approved Title” and the Surveys as approved by Buyer in accordance with this Section 5 is referred to herein as the “Approved Surveys”.

6. DEED; TITLE POLICY. Sellers shall convey the Real Property to Buyer by special warranty deeds substantially in the form of Exhibit D attached hereto (collectively, the “Deeds”, and each a “Deed”). As a condition to Buyer’s obligation to consummate the purchase of the Property and other transactions contemplated hereby, as of Closing the Title Company shall be unconditionally committed to issue to Buyer an ALTA extended coverage Owner’s Policy of Title Insurance for each of the Parcels in the amount of the Purchase Price allocable to each parcel, dated effective as of the date the Deeds are recorded and insuring Buyer (or its nominee or assignee, if applicable) as the owner of good and indefeasible fee simple title to the Real Property, free from all Financial Encumbrances and subject to no exceptions other than Permitted Exceptions, together with such endorsements as required by Buyer in the Buyer's Exception Notice, all in form and substance satisfactory to Buyer in its sole discretion (the “Title Policies”). Buyer shall be entitled to request that the Title Company provide such endorsements (or amendments) to the Title Policy as Buyer may require, provided that (a) such endorsements (or amendments) shall be at no cost to, and shall impose no additional liability on, Sellers except to the extent agreed to in writing by Sellers and (b) Buyer's obligations under this Agreement shall not be conditioned upon Buyer's ability to obtain such endorsements except to the extent the Title Company commits to their issuance prior to the expiration of the Contingency Period. Sellers shall deliver to the Title Company reasonable and customary instruments, documents, payments, indemnities, releases, evidence of authority and agreements relating to the issuance of the Title Policies based upon the requirements of Schedule B of the Title Commitments applicable to Sellers, including without limitation a no lien, gap and possession affidavit in a form reasonably acceptable to the Title Company (collectively, the “Owner’s Affidavit”).

| 10 |

7. PRORATIONS. The following prorations shall be made between Sellers and Buyer on the Closing Date, computed with income and expenses for the Closing Date itself being allocated to Buyer:

(a) Rents Payable Under Leases. The word “Rents” as used herein shall be deemed to include, without limitation, (i) fixed monthly rents and other fixed charges payable by the tenants under the Leases, (ii), any amounts payable by the tenants by reason of provisions of the Leases relating to escalations and pass-throughs of operating expenses and taxes, and adjustments for increases in the Consumer Price Index and the like, (iii) any percentage rents payable by the tenants under the Leases, if any, and (iv) rents or other charges payable by the tenants under the Leases for services of any kind provided to them (including, without limitation, making of repairs and improvements, the furnishing of heat, electricity, gas, water, other utilities and air-conditioning) for which a separate charge is made.

Sellers shall collect and retain all Rents due and payable prior to the Closing and Buyer shall receive a credit for all such collected Rents allocable to the period from and after the Closing Date, in each case, to the extent such Rents are actually received by Sellers prior to the Closing Date. Rents collected subsequent to the Closing Date, net of costs of collection, if any, shall first be applied to such tenant’s current Rent obligations and then to past due amounts in the reverse order in which they were due. Subject to the foregoing, any such Rents collected by Buyer shall, to the extent properly allocable to periods prior to the Closing, be paid, promptly after receipt, to the Sellers and any portion thereof properly allocable to periods from and after the Closing Date shall be retained by Buyer. The term “costs of collection” shall mean and include reasonable attorneys’ fees and other reasonable out-of-pocket costs incurred in collecting any Rents.

Sellers shall not be permitted after the Closing Date to institute proceedings against any tenant to collect any past due Rents for periods prior to the Closing Date; provided that Buyer agrees for six (6) months after Closing to bill tenants for such Rents and provided further that in no event shall Buyer be obligated to terminate a Lease or dispossess a tenant after Closing for failure to pay such Rents. If any past due Rents are not collected from the tenants owing such delinquent amounts, Buyer shall not be liable to Sellers for any such amounts.

Any advance or prepaid rental payments or deposits paid by tenants prior to the Closing Date and applicable to the period of time subsequent to the Closing Date and any security deposits or other amounts paid by tenants, together with any interest on both thereof to the extent such interest is due to tenants shall be credited to Buyer on the Closing Date. Except in the ordinary course of business, Sellers shall not apply any security deposits between the Effective Date and Closing.

No credit shall be given either party for accrued and unpaid Rent or any other non-current sums due from the tenants until said sums are paid.

| 11 |

(b) Rent Adjustments. Pending final adjustments and prorations, as provided in Section 7(a) above, to the extent that any additional rent, adjustment rent or escalation payments, if any, including, without limitation, insurance, utilities (to the extent not paid directly by tenants), common area maintenance and other operating costs and expenses (collectively, “Operating Costs”) in connection with the ownership, operation, maintenance and management of the Real Property, are paid by tenants to the landlord under the Leases based on an estimated payment basis (monthly, quarterly, or otherwise) for which a future reconciliation of actual Operating Costs to estimated payments is required to be performed at the end of a reconciliation period, Buyer and Sellers shall make an adjustment at Closing for the applicable reconciliation period (or periods, if the Leases do not have a common reconciliation period) based on a comparison of the actual Operating Costs to the estimated payments at and as of Closing. If, as of Closing, Sellers have received additional rent, adjustment rent or escalation payments in excess of the amount that tenants will be required to pay, based on the actual Operating Costs as of Closing, Buyer shall receive a credit in the amount of such excess. If, as of Closing, Sellers have received additional rent, adjustment rent or escalation payments that are less than the amount that tenants would be required to pay based on the actual Operating Costs as of Closing, Sellers shall receive the same from Buyer following Closing but only after Buyer collects the same from the applicable tenants. Operating Costs that are not payable by tenants either directly or reimbursable under the Leases shall be prorated between Sellers and Buyer and shall be reasonably estimated by the parties if final bills are not available.

(c) Taxes and Assessments. Sellers represent that real estate taxes and special assessments, if any, assessed against the Property are the responsibility of tenants. Based on this representation, real estate taxes and special assessments will not be prorated and will not be included in rent adjustments for purposes of this Section 7 .

(d) Utilities. Sellers represent that all utilities are the responsibility of tenants. Therefore, charges attributable to the Property for utilities and fuel, including, without limitation, steam, water, electricity, gas and oil shall be only be prorated to the extent such charges are not directly paid by tenants, and, if so prorated, shall be prorated as of the Closing Date.

(e) Other Prorations. Charges payable under the Approved Contracts (if any) assigned to Buyer pursuant to this Agreement shall be prorated as of the Closing Date. Buyer shall also receive a credit equal to any past due payments (including interest or penalties due) from Sellers to any of the other parties to the Approved Contracts (if any).

Sellers represent that all insurance costs are the responsibility of tenants, and Sellers and Buyer agree that (1) none of the insurance policies relating to the Property will be assigned to Buyer (and Sellers shall pay any cancellation fees resulting from the termination of such policies) and (2) no employees of Sellers performing services at the Property shall be employed by Buyer. Accordingly, there will be no prorations for insurance premiums or payroll, and Sellers shall be liable for all premiums and payroll expenses in connection with the foregoing.

If Sellers have made any deposit with any utility company or local authority in connection with services to be provided to the Property, such deposits shall, if Buyer so requests and if assignable, be assigned to Buyer at the Closing and Sellers shall receive a credit equal to the amounts so assigned. Sellers shall cooperate with Buyer to transfer all utility services to Buyer at Closing.

In no event shall any costs of the operation or maintenance of the Property applicable to the period prior to the Closing be borne by Buyer.

Buyer shall be responsible for all Tenant Inducement Costs for or related to all new Leases (i.e., including, without limitation, any amendment to an existing Lease) signed after the Effective Date with Buyer's prior written consent pursuant to Section 14(c). Sellers shall have no responsibility, whatsoever, with respect to any Tenant Inducement Costs for which Buyer is expressly responsible under this paragraph (and to the extent Sellers have paid, or is otherwise responsible for, any such Tenant Inducement Costs described in this paragraph at any time following the Effective Date of this Agreement and prior to Closing, Sellers shall receive a proration credit therefor at Closing). Except for the specific Tenant Inducement Costs for which Buyer is responsible under this paragraph, Buyer shall receive at the Closing a credit toward the Purchase Price equal to all unpaid and outstanding Tenant Inducement Costs under all Leases.

The prorations and credits provided for in this Section 7 shall be made on the basis of a written statement prepared by Escrow Holder and approved by both parties. At least five (5) Business Days prior to the Closing Date, Escrow Holder, using information provided by Sellers, shall provide Buyer with a preliminary proration and closing statement, together with backup documentation and substantiating the prorations provided for and the calculations performed, in order that Buyer may verify Sellers’ methods and calculations. In the event any prorations made pursuant hereto shall prove incorrect for any reason whatsoever, either party shall be entitled to an adjustment to correct the same provided that it makes written demand on the other within six (6) months after the Closing Date. The provisions of this Section 7 shall survive the Closing.

8. CLOSING.

(a) Closing Requirements. The consummation of the sale and purchase of the Property (the “Closing”) shall be effected through a closing escrow which shall be established by Sellers and Buyer with the Escrow Holder utilizing a so-called “New York Style Closing” (i.e., meaning a Closing which has, on the Closing Date, the concurrent delivery of the documents of title, transfer of interests, delivery of the Title Policy or “marked-up” title commitment as described herein and the payment of the Purchase Price). Sellers shall provide any customary affidavits or undertakings to the Title Company necessary for the afore-described “New York Style” type of Closing to occur. All documents to be delivered at the Closing and all payments to be made shall be delivered on or before the Closing Date as provided herein.

(b) Additional Conditions to Closing. It is a condition to Buyer’s obligation to proceed to Closing and to consummate the transactions contemplated hereby, that, as of the Closing Date, (i) all of the Sellers’ representations and warranties hereunder shall be true and correct in all material respects and Seller’s Closing Certificate delivered pursuant to Section 9 hereof shall not disclose any material qualifications or material changes in Sellers’ representations and warranties set forth in Section 12 hereof; (ii) each of Sellers shall have performed in all material respects all of its covenants hereunder; (iii) this Agreement shall not

| 12 |

have terminated during the Contingency Period; (iv) the Title Company shall be unconditionally committed to issue the Title Policy at Closing; and (v) each Seller shall have delivered all other documents and other deliveries listed in Section 9 hereof. If any condition to Buyer’s obligations hereunder is not fulfilled, including any condition not set forth in this Section 8(b), then Buyer shall have the right to terminate this Agreement by written notice to Sellers delivered on or before the Closing Date, in which event the Deposit shall be returned to Buyer, all obligations of the parties hereto shall thereupon cease (except for those which survive the early termination of this Agreement as expressly provided herein) and this Agreement shall thereafter be of no further force and effect, unless such failure of condition constitutes a default on the part of Sellers under any other provision of this Agreement, in which case the terms of Section 11(b) shall also apply.

(c) Sellers’ Conditions to Closing. It is a condition to Sellers’ obligation to proceed to Closing and to consummate the transactions contemplated hereby, that, as of the Closing Date, (i) all of the Buyer’s representations and warranties hereunder shall be true and correct in all material respects; (ii) Buyer shall have performed in all material respects all of its covenants hereunder; (iii) this Agreement shall not have terminated during the Contingency Period; and (iv) Buyer shall have delivered all other documents and other deliveries required of it under Section 9 hereof. If any condition to Seller’s obligations set forth in this Section 8(c) hereunder is not fulfilled, including any condition not, then Sellers shall have the right to terminate this Agreement by written notice to Buyer, in which event all obligations of the parties hereto shall thereupon cease (except for those which survive the early termination of this Agreement as expressly set forth herein) and this Agreement shall thereafter be of no further force and effect, and Sellers shall be entitled to the Deposit in accordance with Section 11(a) of this Agreement if Buyer failed to consummate the Closing when required with all Buyer’s conditions precedent to Closing having been satisfied, but otherwise the Deposit shall be returned to Buyer.

(d) Buyer’s Extension Right. Buyer shall have the right to extend the Closing Date for up to sixty (60) days for any reason (the "First Extension Period") by (i) giving Sellers written notice of such election on or before 5:00 p.m. (Eastern) on the date that is two (2) Business Days prior to the then-scheduled Closing Date and (ii) depositing the First Extension Deposit in immediately available funds with the Escrow Holder on or before such time. In addition, in the event that Buyer requires an additional extension in order to address its or its affiliated parties' filing and disclosure requirements as a real estate investment trust and/or the requirements of the Securities and Exchange Commission, Buyer shall have the right to further extend the Closing Date for up to an additional ninety (90) days (the "Second Extension Period") by (i) giving Sellers written notice of such election on or before 5:00 p.m. (Eastern) on the date that is two (2) Business Days prior to the then-scheduled Closing Date (as previously extended), and (ii) depositing the Second Extension Deposit in immediately available funds with the Escrow Holder on or before such time. Sellers agree that Buyer shall have the option to close at any time during the First Extension Period or the Second Extension Period upon five (5) Business Days prior notice to Sellers. Notwithstanding the foregoing, in no event shall Buyer have the right to extend the Closing Date to a date later than March 30, 2015.

| 13 |

9. ESCROW.

(a) Sellers’ Closing Deliveries. On or prior to the Closing Date, each Seller shall deliver to Escrow Holder the following documents and materials for each of the Parcels owned by it, all of which shall be in such form and substance as required hereunder:

(i) Deed; Transfer Declarations. A Deed, duly executed, acknowledged and in recordable form, accompanied by any necessary transfer tax declarations of Seller as may be required under applicable law in order to permit the recording of the Deed.

(ii) Bill of Sale. A duly executed and acknowledged bill of sale for the Personal Property and Intangible Property, conveying to Buyer all of the Personal Property and Intangible Property in the form of Exhibit E attached hereto (the “Bill of Sale”).

(iii) Assignment of Leases. Two (2) originals of an assignment of the Leases and all guaranties thereof, duly executed and acknowledged by Seller in the form of Exhibit F attached hereto (the “Assignment of Leases”).

(iv) Assignment of Contracts. If any Approved Contracts exist, two (2) originals of an assignment of the Approved Contracts, duly executed and acknowledged by Seller and to the extent required under the terms of any Approved Contract, consented to by the other party to such Contract in the form of Exhibit G attached hereto (the “Assignment of Contracts”).

(v) Title Clearance Documents. An Owner’s Affidavit and a “gap” undertaking duly executed by Seller in a form reasonably acceptable to the Title Company.

(vi) FIRPTA Affidavit. A non-foreign certification, duly executed by Seller under penalty of perjury, certifying that Seller is not a “foreign person”, pursuant to Section 1445 (as may be amended) of the Internal Revenue Code of 1986, as amended in the form of Exhibit H attached hereto (“Section 1445”) (the “FIRPTA Affidavit”). If Seller shall fail or be unable to deliver the same, then Buyer shall have the right to withhold such portion of the Purchase Price as may be necessary, in the reasonable opinion of Buyer and its counsel, to comply with Section 1445 and applicable law.

(vii) Authority Documents. Such other documents as the Title Company may reasonably require including evidence confirming the due authorization, execution and delivery of this Agreement and the other documents to be executed in connection herewith by Seller.

(viii) Seller’s Closing Certificate. A certificate duly executed by Seller in the form of Exhibit J attached hereto (the “Seller’s Closing Certificate”).

(ix) Non-Poaching Agreement. An agreement limiting Sellers' and their affiliates’ rights to enter into agreements with tenants of the Property in the form attached hereto as Exhibit Q (the “Anti-Poaching Agreement”), duly executed by Sellers and its applicable affiliates and acknowledged.

| 14 |

(x) Right of First Refusal. An agreement granting Buyer a right of first refusal in the form attached hereto as Exhibit R (the “ROFR Agreement”) with regard to the properties identified on Exhibit S, duly executed by Sellers and/or its applicable affiliates, acknowledged and otherwise in recordable form.

(xi) Audit Letter. Two (2) originals of the Audit Letter contemplated by Section 32 of this Agreement, duly executed by Seller.

(xii) Other Instruments. Such other documents and instruments as are contemplated under the terms of this Agreement.

On or prior to the Closing Date, each Seller shall deliver to Buyer the following documents and materials, all of which shall be in form and substance reasonably acceptable to Buyer:

(1) Documents. Originals of all Documents to the extent in Seller's possession or control, if not already delivered, or copies of same to the extent originals do not exist and all books and records (including those in electronic format) reasonably required in connection with the maintenance and operation of the Property.

(2) Keys; Manuals. Keys to all entrance doors in the Improvements, properly tagged for identification, and, to the extent in Seller's possession or control, all operating manuals relating to operation of the equipment and systems which are part of the Property.

(3) Letters of Credit. With respect to any security deposits under Leases which are in the form of letters of credit, such letters of credit (including all amendments) together with a duly executed assignment of such letters of credit, in form required by the issuer of such letters of credit, which cites Buyer as the beneficiary thereof, along with the fees, if any, required to transfer such letters of credit to Buyer.

(4) Notices to Tenants. Notice to each of the tenants and any guarantors under the Leases, notifying them of the sale of the Property and directing them to pay all future rent as Buyer may direct.

(5) Notices to Parties Under Approved Contracts. If any Approved Contracts exist, notices to each of the parties (other than Seller) under the Approved Contracts, notifying them of the sale of the Property and directing them to address all matters relating to the Approved Contracts as Buyer may direct.

(6) Closing Statement. A duplicate counterpart of a closing statement (the “Closing Statement”) prepared by Escrow Holder, and signed by Seller, setting forth all prorations and credits required hereunder, signed by Seller.

| 15 |

(b) Buyer’s Deliveries at Closing. On or before the Closing Date, Buyer shall deliver to Escrow Holder the Purchase Price for the Property as provided in Section 2. On or prior to the Closing Date, Buyer shall deliver to Escrow Holder two (2) duly executed counterparts of each Assignment of Leases, each Assignment of Contracts (if any Approved Contracts exist), the ROFR Agreement, the Anti-Poaching Agreement and the Closing Statement and such other documents as the Title Company may reasonably require including evidence confirming the due authorization, execution and delivery of this Agreement and the other documents to be executed in connection herewith by Buyer.

(c) Closing Instructions. This Agreement shall constitute both an agreement between Buyer and Sellers and escrow instructions for Escrow Holder. If Escrow Holder requires separate or additional escrow instructions which it reasonably deems necessary for its protection, Sellers and Buyer hereby agree promptly upon request by Escrow Holder to execute and deliver to Escrow Holder such separate or additional standard escrow instructions of Escrow Holder (the “Additional Instructions”). In the event of any conflict or inconsistency between this Agreement and the Additional Instructions, this Agreement shall prevail and govern, and the Additional Instructions shall so provide. The Additional Instructions shall not modify or amend the provisions of this Agreement or impose any additional obligations upon either Sellers or Buyer, unless otherwise agreed to in writing by Sellers and Buyer.

(d) Procedures Upon Failure of Condition. Except as otherwise expressly provided herein, if any of the conditions set forth in this Agreement is not timely satisfied or waived for a reason other than the default of Buyer or Sellers in the performance of their respective obligations under this Agreement:

(i) This Agreement, the escrow and the respective rights and obligations of Sellers and Buyer hereunder shall terminate, subject to the survival of such obligations hereunder as survive such termination;

(ii) Escrow Holder shall promptly return to Buyer all funds of Buyer in its possession, including the Deposit, and to Sellers and Buyer all documents deposited by them respectively, which are then held by Escrow Holder; and

(iii) Any escrow cancellation and title charges shall be shared equally by Buyer and Sellers.

(e) Actions of Escrow Holder. On the Closing Date, provided Buyer and Sellers have satisfied (or waived in writing) the conditions set forth in this Agreement, Escrow Holder shall take the following actions:

(i) Cause each of the Deeds to be recorded in the Recording Location;

(ii) Deliver to Buyer the closing documents required to be delivered to Buyer under this Agreement and any supplemental instructions provided by Buyer;

(iii) Deliver to Sellers in cash or current funds, all sums due Sellers pursuant to this Agreement and any documents required to be delivered to Sellers under this Agreement and any supplemental instructions provided by Sellers;

(iv) Cause the Title Company to issue and deliver the Title Policy to Buyer; and

(v) Deliver to Sellers and Buyer the Closing Statement which has been certified by Escrow Holder to be true and correct.

10. CLOSING COSTS; PROPERTY COSTS. Sellers shall pay: (a) all title charges and premiums incurred for the Title Policies (but excluding Buyer's endorsements); (b) ½ of the escrow fees and other charges owing to Escrow Holder; and (c) all of the Sellers’ legal fees and expenses and the cost of all performances by Sellers of their obligations hereunder.

Buyer shall pay: (a) for all endorsements to the Title Policies requested by Buyer and all charges and premiums incurred for any lender’s policy and endorsements thereto; (b) ½ of the escrow fees and other charges owing to Escrow Holder; (c) transfer taxes, if any, payable in connection with the transfer of the Property to Buyer and the recording of the Deeds and the recording of any mortgages or other Buyer financing documents; (d) the cost of updating the Surveys; and (e) all of Buyer’s legal fees and expenses and the cost of all performances by Buyer of its obligations hereunder (including costs associated with its Due Diligence Review except as otherwise provided herein).

All other closing costs shall be allocated between Buyer and Sellers in accordance with local custom.

11. REMEDIES.

(a) LIQUIDATED DAMAGES ON BUYER’S DEFAULT. BUYER AND SELLERS HEREBY ACKNOWLEDGE AND AGREE THAT, IN THE EVENT THE CLOSING FAILS TO OCCUR DUE TO A BUYER DEFAULT (ALL OF THE CONDITIONS TO BUYER’S OBLIGATIONS TO CLOSE HAVING BEEN SATISFIED OR WAIVED), SELLERS WILL SUFFER DAMAGES IN AN AMOUNT WHICH WILL, DUE TO THE SPECIAL NATURE OF THE TRANSACTION CONTEMPLATED BY THIS AGREEMENT AND THE SPECIAL NATURE OF THE NEGOTIATIONS WHICH PRECEDED THIS AGREEMENT, BE IMPRACTICAL OR EXTREMELY DIFFICULT TO ASCERTAIN. IN ADDITION, BUYER WISHES TO HAVE A LIMITATION PLACED UPON THE POTENTIAL LIABILITY OF BUYER TO SELLERS IN THE EVENT THE CLOSING FAILS TO OCCUR DUE TO A BUYER DEFAULT, AND WISHES TO INDUCE SELLERS TO WAIVE OTHER REMEDIES WHICH SELLERS MAY HAVE IN THE EVENT OF SUCH A BUYER DEFAULT. BUYER AND SELLERS, AFTER DUE NEGOTIATION, HEREBY ACKNOWLEDGE AND AGREE THAT THE AMOUNT OF THE DEPOSIT REPRESENTS A REASONABLE ESTIMATE OF THE DAMAGES WHICH SELLERS WILL SUSTAIN IN THE EVENT OF SUCH BUYER DEFAULT. BUYER AND SELLERS HEREBY AGREE THAT SELLERS MAY, IN THE EVENT THE CLOSING FAILS TO OCCUR DUE TO A BUYER DEFAULT (ALL OF THE CONDITIONS TO BUYER’S OBLIGATIONS TO CLOSE HAVING BEEN SATISFIED OR WAIVED), AS ITS SOLE AND EXCLUSIVE REMEDY TERMINATE THIS AGREEMENT AND CANCEL THE ESCROW BY WRITTEN NOTICE TO BUYER AND ESCROW HOLDER, WHEREUPON ESCROW HOLDER SHALL DELIVER THE DEPOSIT TO SELLERS AND SELLERS SHALL RECEIVE THE DEPOSIT

| 16 |

AS LIQUIDATED DAMAGES FOR SUCH DEFAULT AND SELLERS WAIVE ALL OTHER REMEDIES. SUCH RETENTION OF THE DEPOSIT BY SELLERS IS INTENDED TO CONSTITUTE LIQUIDATED DAMAGES TO SELLERS AND SHALL NOT BE DEEMED TO CONSTITUTE A FORFEITURE OR PENALTY. FOLLOWING TERMINATION OF THIS AGREEMENT, CANCELLATION OF THE ESCROW AND THE DELIVERY TO AND RETENTION OF THE DEPOSIT BY SELLERS AS LIQUIDATED DAMAGES PURSUANT TO THIS SECTION 11(a), ALL OF THE RIGHTS AND OBLIGATIONS OF BUYER AND SELLERS UNDER THIS AGREEMENT SHALL BE TERMINATED SUBJECT TO SURVIVAL OF SUCH OBLIGATIONS HEREUNDER AS SURVIVE SUCH TERMINATION.

(b) Buyer’s Remedies. In the event of a default by Sellers under this Agreement, Buyer may, at its option, (i) terminate this Agreement in which case the Deposit shall be immediately returned to Buyer and Buyer shall be entitled to reimbursement from Sellers for all of Buyer’s out-of-pocket third party costs and expenses incurred in connection with this Agreement and Due Diligence Review, subject to a cap of Fifty Thousand Dollars ($50,000.00), or (ii) specifically enforce the terms and conditions of this Agreement.

(c) Aggregate Liability. Without limiting Buyer's specific performance remedy under Section 11(b), Sellers’ aggregate liability to Buyer under this Agreement after the Closing as a result of a breach of any representation or warranty or any other covenant or indemnity made by Sellers shall in no event collectively exceed Seven Hundred Fifty Thousand and 00/100 Dollars ($750,000.00) (the “Liability Cap”), in the aggregate. Notwithstanding the foregoing, the limitation of Sellers’ liability set forth in this Section 11(c) shall not apply to any liabilities or obligations of Sellers under Sections 7, 10, 21 and 28, or any Seller liability for claims brought under applicable law based on fraud or intentional misrepresentation.

(d) Limitation on Sellers’ Liability. In addition to the limitation set forth in Section 16 below, in the event that Buyer has knowledge, through its Due Diligence Review or otherwise, that any of the representations or warranties made by Sellers under this Agreement were not true or correct when made or that any Seller has breached a covenant hereunder, and if Buyer nevertheless closes the transaction contemplated by this Agreement, then Buyer shall be deemed to have waived any such representation and warranty or covenant breach (as applicable) and shall have no further claim against Sellers with respect thereto.

(e) Net Worth Covenant. Sellers covenant and agree that (a) at Closing, Sellers shall deposit, from the proceeds of the Purchase Price, an amount equal to the Liability Cap in an account established by Sellers with a bank or other financial institution and (b) during the Survival Period (as defined in Section 16 below) (and, in the event Buyer has made a timely claim(s) against Sellers pursuant to this Section 11, thereafter until the claim(s) have been fully resolved): (i) Sellers shall keep and maintain cash or cash equivalents in such account in an amount equal to the Liability Cap, (ii) Sellers shall not pledge, encumber or otherwise grant a security interest in such account or such cash or equivalents and (iii) Sellers shall not distribute or pay any such cash or cash equivalents to its members, partners, affiliates or any other third party.

| 17 |

12. SELLER’S REPRESENTATIONS AND WARRANTIES. As a material inducement to the execution and delivery of this Agreement by Buyer and the performance by Buyer of its duties and obligations hereunder, each Seller does hereby acknowledge, warrant, represent and agree to and with Buyer that as of the Effective Date and as of the Closing Date:

(a) Delivery of Written Materials. Seller has not made to Buyer any misstatement of any material fact relating to the Property, or this Agreement, nor failed to deliver to Buyer any written materials in Seller’s possession or of which Seller has knowledge which contain information that would have a material adverse impact on Buyer’s ability to use and operate the Property as it is currently being used and operated or the value of the Property.

(b) Compliance With Laws. Except as disclosed on Exhibit M, Seller has received no written notice of, and to Seller’s knowledge there are no violations of, any legal requirement affecting the Property which have not been entirely corrected.

(c) Litigation. Except as disclosed on Exhibit M, Seller has not received written notice of any pending or to Seller’s knowledge threatened litigation or governmental proceeding affecting Seller, or the Property, that relates to the Property, the validity or enforceability of this Agreement or any instrument or document to be delivered by Seller in connection with the transactions contemplated hereby.

(d) Existing Contracts. Seller is not a party to, and the Property is not subject to, any contract or agreement of any kind whatsoever, written or oral, with respect to the Property that would be binding upon the Property or Buyer after Closing, other than the Permitted Exceptions and the Leases.

(e) Proceedings. Except as disclosed on Exhibit M, there is no pending, or to Seller's knowledge, threatened litigation or other proceeding against Seller related to the Property, or which may affect Seller's ability to convey the Property (including without limitation any condemnation action).

(f) Due Authorization. Seller is a limited liability company organized, validly existing and in good standing under the laws of the State of Indiana. Seller has full power to execute, deliver and carry out the terms and provisions of this Agreement and each of the other agreements, instruments and documents herein required to be made or delivered by Seller pursuant hereto, and has taken all necessary action in connection with the execution, delivery and performance of this Agreement and such other agreements, instruments and documents. The individuals executing this Agreement and all other agreements, instruments and documents herein required to be made or delivered by Seller pursuant hereto on behalf of Seller are and shall be duly authorized to sign the same on Seller’s behalf and to bind Seller thereto.

(g) Enforceability. This Agreement has been, and each and all of the other agreements, instruments and documents herein required to be made or delivered by Seller pursuant hereto have been, or on the Closing Date will have been, executed by Seller and when so executed, are and shall be legal, valid, and binding obligations of Seller enforceable against Seller in accordance with their respective terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, and other similar laws affecting the rights of creditors generally and, as to enforceability, the general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

| 18 |

(h) No Conflict. The execution and delivery of, and consummation of the transactions contemplated by, this Agreement by Seller are not prohibited by, and will not conflict with, constitute grounds for termination of, or result in the breach of any agreement or instrument to which Seller is now a party or by which it or the Property is bound, or, to the knowledge of Seller, any order, rule or regulation of any court or other governmental agency or official.

(i) Environmental Matters. To Seller's knowledge and except as may be disclosed in the Documents none of the Property, including subsurface soil and groundwater, contains any Hazardous Materials. As used in this Agreement, “Hazardous Materials” shall mean any asbestos, flammable substances, explosives, radioactive materials, mold, PCB laden oil, hazardous waste, pollutants, contaminates, toxic substances, pollution or related materials specified as such in, or regulated under any federal, state or local laws, ordinances, rules, regulations or policies governing use, storage, treatment, transportation, manufacture, refinement, handling, production or disposal of such materials but excluding office supplies, cleaning materials, personal grooming items or other items that are sold for consumer or commercial use and typically used in other similar buildings or space.

(j) Leases. There are no other leases, licenses, subleases, occupancy agreements or other agreements for the use, possession or occupancy of any portions of the Real Property, other than those listed on Exhibit L attached to this Agreement. Exhibit L contains a true, correct and complete list of all currently existing Leases at the Property to which any Seller is a party; full, true and complete copies of all Leases and all amendments and guarantees relating thereto have heretofore been delivered to Buyer (or made available to Buyer as part of the Documents). To Seller's knowledge, each Lease is in full force and effect, and except as shown on Exhibit L, to Seller's knowledge, no rent or other amounts payable under the Leases is more than one (1) month in arrears or has been paid more than one (1) month in advance. Exhibit L sets forth a true and correct listing of all security deposits (indicating cash or letter of credit) or prepaid rentals made or paid by the tenants under the Leases. Except as shown in Exhibit L, Seller has not delivered any written notices of tenant default to any tenants under Leases which remain uncured, nor has Seller received any written notices of a landlord default from any tenants under Leases which remain uncured. None of Seller's interest in any Lease or of Seller's right to receive the rentals payable by the tenant thereunder has been assigned, conveyed, pledged or in any manner encumbered by Seller, except in connection with any existing financing encumbering the Property, which is to be repaid by Seller and released as of the Closing. Except as described on Exhibit L, no tenant has given written notice to Seller of any default or offsets, claims or defenses available to it. The only Tenant Inducement Costs in the nature of tenant improvement costs for space currently being leased under any Leases in effect as of the date hereof (whether in the form of direct payments therefor required of Seller or in the form of tenant improvement allowances payable by Seller) or for leasing commissions for leased premises currently being leased under any such Leases, in any such case which may hereafter be payable under or with respect to the Leases (and excluding, in any event any such Tenant Inducement Costs which may arise in connection with expansions or lease renewals/extensions hereafter occurring under or with respect to any such Leases) are identified in Exhibit L hereto.

| 19 |

(k) Bankruptcy Matters. Seller has not made a general assignment for the benefit of creditors, filed any voluntary petition in bankruptcy or suffered the filing of an involuntary petition by its creditors, suffered the appointment of a receiver to take possession of substantially all of its assets, suffered the attachment or other judicial seizure of substantially all of its assets, admitted its inability to pay its debts as they come due, or made an offer of settlement, extension or composition to its creditors generally.

(l) Approvals. Seller has heretofore delivered to Buyer (or will make available to Buyer as part of the Documents) true, full and complete copies, in all material respects, of all currently existing Approvals. Seller has not received any currently effective notice in writing of any uncured material breach or default under any of the Approvals.

(m) OFAC. Seller is not, nor will it become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control of the Department of the Treasury (including those named on OFAC's Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action.

(n) Licenses, Permits and Approvals. To Seller’s knowledge, Corporate Services, Inc. (“Corporate Services”), a tenant at the Property, held certain licenses, permits or approvals, which, among other things, grant Corporate Services the right to distribute pharmaceutical samples to practitioners and pharmaceutical company representatives in all 50 states as of the original date of sale which was March 3, 2011. Such licenses, permits and approvals are related to the property at 5681 Cleveland Road.

As used herein, phrases such as “to Seller’s knowledge” or like phrases mean the actual present and conscious awareness or knowledge of Robert E. Wozny (who is the managing member of Sellers), without any duty of inquiry or investigation; provided that so qualifying Seller’s knowledge shall in no event give rise to any personal liability on the part of such individual, or any other partner, member, officer or employee of Seller, on account of any breach of any representation or warranty made by Seller herein. Said terms do not include constructive knowledge, imputed knowledge, or knowledge Seller or such persons do not have but could have obtained through further investigation or inquiry. No broker, agent, or party other than Seller is authorized to make any representation or warranty for or on behalf of Seller.

13. BUYER’S REPRESENTATIONS AND WARRANTIES. As a material inducement to the execution and delivery of this Agreement by Sellers and the performance by Sellers of their duties and obligations hereunder, Buyer does hereby acknowledge, warrant, represent and agree to and with Sellers that as of the Effective Date and as of the Closing Date:

(a) Due Authorization. Buyer is a corporation organized, validly existing and in good standing under the laws of the State of Maryland. Buyer has or will have full power to execute, deliver and carry out the terms and provisions of this Agreement and each of the other agreements, instruments and documents herein required to be made or delivered by Buyer pursuant hereto, and, subject to Section 4(d) above, has or will have taken all necessary action to authorize the execution, delivery and performance of this Agreement and such other agreements, instruments and documents. The individuals executing this Agreement and all other agreements, instruments and documents herein required to be made or delivered by Buyer pursuant hereto on behalf of Buyer are or will be duly authorized to sign the same on Buyer’s behalf and to bind Buyer thereto.

| 20 |

(b) Enforceability. This Agreement has been, and each and all of the other agreements, instruments and documents herein required to be made or delivered by Buyer pursuant hereto have been, or on the Closing Date will have been, executed by Buyer or on behalf of Buyer, and when so executed, are and shall be legal, valid, and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, and other similar laws affecting the rights of creditors generally and, as to enforceability, the general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

(c) No Conflict. The execution and delivery of, and consummation of the transactions contemplated by, this Agreement by Buyer are not prohibited by, and will not conflict with, constitute grounds for termination of, or result in the breach of any agreement or instrument to which Buyer is now a party or by which it is bound, or any order, rule or regulation of any court or other governmental agency or official, which prohibition or conflict would have an adverse effect on Buyer’s ability to perform its obligations under this Agreement or the documents to be executed by Buyer in connection with this Agreement.

(d) OFAC. Buyer is not, nor will it become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Asset Control of the Department of the Treasury (including those named on OFAC's Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action.

(e) AS-IS. EXCEPT AS EXPRESSLY PROVIDED IN THIS AGREEMENT AND/OR THE DOCUMENTS DELIVERED AT CLOSING, SELLERS MAKE NO REPRESENTATIONS OR WARRANTIES, AND BUYER HEREBY ACKNOWLEDGES THAT NO REPRESENTATIONS HAVE BEEN MADE. EXCEPT AS EXPRESSLY PROVIDED IN THIS AGREEMENT AND/OR THE DOCUMENTS DELIVERED AT CLOSING, SELLERS SPECIFICALLY DISCLAIM, AND NEITHER SELLERS NOR ANY OTHER PERSON IS MAKING, ANY REPRESENTATION, WARRANTY OR ASSURANCE WHATSOEVER TO BUYER AND NO WARRANTIES OR REPRESENTATIONS OF ANY KIND OR CHARACTER, EITHER EXPRESS OR IMPLIED, ARE MADE BY SELLERS OR RELIED UPON BY BUYER WITH RESPECT TO THE STATUS OF TITLE TO OR THE MAINTENANCE, REPAIR, CONDITION, DESIGN OR MARKETABILITY OF THE PROPERTY, OR ANY PORTION THEREOF, INCLUDING BUT NOT LIMITED TO (A) ANY IMPLIED OR EXPRESS WARRANTY OF MERCHANTABILITY, (B) ANY IMPLIED OR EXPRESS WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE, (C) ANY IMPLIED OR EXPRESS WARRANTY OF CONFORMITY TO MODELS OR SAMPLES OF MATERIALS, (D) ANY RIGHTS OF BUYER UNDER APPLICABLE

| 21 |

STATUTES TO CLAIM DIMINUTION OF CONSIDERATION, (E) ANY CLAIM BY BUYER FOR DAMAGES BECAUSE OF DEFECTS, WHETHER KNOWN OR UNKNOWN, LATENT OR PATENT, WITH RESPECT TO THE IMPROVEMENTS OR THE PERSONAL PROPERTY, (F) THE FINANCIAL CONDITION OR PROSPECTS OF THE PROPERTY AND (G) THE COMPLIANCE OR LACK THEREOF OF THE REAL PROPERTY OR THE IMPROVEMENTS WITH GOVERNMENTAL REGULATIONS, IT BEING THE EXPRESS INTENTION OF SELLERS AND BUYER THAT, EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT AND THE DOCUMENTS TO BE DELIVERED AT THE CLOSING, THE PROPERTY WILL BE CONVEYED AND TRANSFERRED TO BUYER IN ITS PRESENT CONDITION AND STATE OF REPAIR, "AS IS" AND "WHERE IS", WITH ALL FAULTS. BUYER REPRESENTS THAT IT IS A KNOWLEDGEABLE, EXPERIENCED AND SOPHISTICATED BUYER OF REAL ESTATE, AND THAT IT IS RELYING SOLELY ON ITS OWN EXPERTISE AND THAT OF BUYER'S CONSULTANTS IN PURCHASING THE PROPERTY. EXCEPT FOR SELLERS’ REPRESENTATIONS AND WARRANTIES CONTAINED IN THIS AGREEMENT, BUYER ACKNOWLEDGES AND AGREES THAT IT WILL HAVE THE OPPORTUNITY TO CONDUCT SUCH INSPECTIONS, INVESTIGATIONS AND OTHER INDEPENDENT EXAMINATIONS OF THE PROPERTY AND RELATED MATTERS, INCLUDING BUT NOT LIMITED TO THE PHYSICAL AND ENVIRONMENTAL CONDITIONS THEREOF, DURING THE CONTINGENCY PERIOD AND WILL RELY UPON SAME AND NOT UPON ANY STATEMENTS OF SELLERS OR OF ANY MEMBER, MANAGER, OFFICER, DIRECTOR, AGENT OR ATTORNEY OF SELLERS. BUYER ACKNOWLEDGES THAT ALL INFORMATION OBTAINED BY BUYER WILL BE OBTAINED FROM A VARIETY OF SOURCES AND, EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, SELLERS WILL NOT BE DEEMED TO HAVE REPRESENTED OR WARRANTED THE COMPLETENESS, ADEQUACY, TRUTH OR ACCURACY OF ANY OF THE DUE DILIGENCE ITEMS OR OTHER SUCH INFORMATION HERETOFORE OR HEREAFTER FURNISHED TO BUYER. UPON CLOSING, BUYER ACKNOWLEDGES THE RISK THAT ADVERSE MATTERS, INCLUDING, BUT NOT LIMITED TO, ADVERSE PHYSICAL AND ENVIRONMENTAL CONDITIONS, MAY NOT HAVE BEEN REVEALED BY BUYER'S INSPECTIONS AND INVESTIGATIONS. BUYER ACKNOWLEDGES AND AGREES THAT UPON CLOSING, EXCEPT AS OTHERWISE EXPRESSLY SET FORTH IN THIS AGREEMENT AND DOCUMENTS DELIVERED AT CLOSING, SELLERS WILL SELL AND CONVEY TO BUYER, AND BUYER WILL ACCEPT THE PROPERTY, "AS IS, WHERE IS," WITH ALL FAULTS. BUYER FURTHER ACKNOWLEDGES AND AGREES THAT THERE ARE NO ORAL AGREEMENTS, WARRANTIES OR REPRESENTATIONS, COLLATERAL TO OR AFFECTING THE PROPERTY, BY SELLERS, ANY AGENT OF SELLERS OR ANY THIRD PARTY. SELLERS ARE NOT LIABLE OR BOUND IN ANY MANNER BY ANY ORAL OR WRITTEN STATEMENTS, REPRESENTATIONS OR INFORMATION PERTAINING TO THE PROPERTY FURNISHED BY ANY REAL ESTATE BROKER, AGENT, EMPLOYEE, SERVANT OR OTHER PERSON, UNLESS THE SAME ARE SPECIFICALLY SET FORTH OR REFERRED TO HEREIN. BUYER ACKNOWLEDGES THAT THE PURCHASE PRICE REFLECTS THE "AS IS, WHERE IS" NATURE OF THIS SALE AND ANY FAULTS, LIABILITIES, DEFECTS OR OTHER ADVERSE MATTERS THAT MAY BE ASSOCIATED WITH THE PROPERTY. BUYER, WITH BUYER'S COUNSEL, HAS FULLY REVIEWED THE DISCLAIMERS AND WAIVERS SET FORTH

| 22 |

IN THIS AGREEMENT, AND UNDERSTANDS THE SIGNIFICANCE AND EFFECT THEREOF. BUYER ACKNOWLEDGES AND AGREES THAT THE DISCLAIMERS AND OTHER AGREEMENTS SET FORTH HEREIN ARE AN INTEGRAL PART OF THIS AGREEMENT, AND THAT SELLERS WOULD NOT HAVE AGREED TO SELL THE PROPERTY TO BUYER FOR THE PURCHASE PRICE WITHOUT THE DISCLAIMER AND OTHER AGREEMENTS SET FORTH IN THIS AGREEMENT. THE TERMS AND CONDITIONS OF THIS PARAGRAPH WILL EXPRESSLY SURVIVE THE CLOSING.

14. ACTIONS AFTER THE EFFECTIVE DATE. The parties covenant to do the following through the Closing Date:

(a) Title. Except as otherwise specifically contemplated in this Agreement or as may be required by legal requirements, and without limiting any rights that tenants may have under their Leases, from and after the Effective Date, Sellers shall not make or permit any changes to the Property or to the condition of title to the Property that would change the Approved Title or the Approved Survey except with Buyer’s advance written consent, which consent shall not be unreasonably withheld prior to the expiration of the Contingency Period but may be withheld in Buyer's sole and absolute discretion after the expiration of the Contingency Period.

(b) Maintenance and Operation of Property. Sellers represent that insurance policies are maintained by the tenant and not the Sellers. Sellers shall not make any material alterations to or upon the Property or remove any of the Personal Property therefrom, except with Buyer's advance written consent, which consent shall not be unreasonably withheld. Sellers shall promptly advise Buyer in writing of any significant repair or improvement required to keep in the Property in such condition.

(c) Leases and Agreements. From and after the Effective Date, Sellers shall not enter into any new leases or other occupancy agreements for the Property without first obtaining Buyer's advance written consent which shall not be unreasonably withheld prior to the expiration of the Contingency Period but may be withheld in Buyer's sole and absolute discretion after the expiration of the Contingency Period. From and after the Effective Date, Sellers shall not terminate or amend any of the Leases or Approved Contracts (if any) or any other agreement concerning the Property, without Buyer’s advance written consent, which consent shall not be unreasonably withheld prior to the expiration of the Contingency Period but may be withheld in Buyer's sole and absolute discretion after the expiration of the Contingency Period, and Sellers shall continue to perform all of their obligations under the Leases and Approved Contracts (if any).

If Sellers request Buyer’s consent to any new lease or other occupancy agreement or amendment to any existing Lease, Sellers shall be required to provide Buyer with a reasonably detailed written summary of all of the material terms the proposed transaction along with an itemized list of all Tenant Inducement Costs which will be incurred in connection with the proposed transaction. Buyer shall give Sellers written notice of approval or disapproval of a proposed new lease or other occupancy agreement or amendment to any existing Lease within ten (10) days after Buyer’s receipt of the items described above. If Buyer does not respond to Sellers’ request within such time period, then Buyer will be deemed to have disapproved such new lease or other occupancy agreement or amendment to any existing Lease.

| 23 |

(d) Representations and Warranties. Each party shall use reasonable efforts to prevent any act or omission that would render any of its representations and warranties herein untrue or misleading, and shall promptly notify the other party in writing if such act or omission occurs.