Exhibit 10.2

PURCHASE AND SALE AGREEMENT

BETWEEN

TPRF/ENTERPRISE, LLC

AS SELLER

AND

PLYMOUTH INDUSTRIAL REIT, INC.

AS PURCHASER

DATED AUGUST 6, 2014

TABLE OF CONTENTS

| Page No. | ||

| ARTICLE 1 BASIC INFORMATION | 1 | |

| Section 1.2 | Closing Costs | 2 |

| Section 1.3 | Notice Addresses: | 3 |

| ARTICLE 2 PROPERTY | 3 | |

| Section 2.1 | Property | 3 |

| ARTICLE 3 EARNEST MONEY | 4 | |

| Section 3.1 | Deposit and Investment of Earnest Money | 4 |

| Section 3.2 | Form; Failure to Deposit | 4 |

| Section 3.3 | Disposition of Earnest Money | 5 |

| Section 3.4 | Reimbursement of Seller’s Costs | 5 |

| ARTICLE 4 DUE DILIGENCE | 5 | |

| Section 4.1 | Due Diligence Materials To Be Delivered | 5 |

| Section 4.2 | Due Diligence Materials To Be Made Available | 7 |

| Section 4.3 | Physical Due Diligence | 7 |

| Section 4.4 | Due Diligence/Termination Right | 8 |

| Section 4.5 | Return of Documents and Reports | 8 |

| Section 4.6 | Service Contracts | 8 |

| Section 4.7 | Proprietary Information; Confidentiality | 9 |

| Section 4.8 | No Representation or Warranty by Seller | 9 |

| Section 4.9 | Purchaser's Responsibilities | 9 |

| Section 4.10 | Purchaser's Agreement to Indemnify | 10 |

| ARTICLE 5 TITLE AND SURVEY | 10 | |

| Section 5.1 | Title Commitment | 10 |

| Section 5.2 | New or Updated Survey | 10 |

| Section 5.3 | Title Review | 10 |

| Section 5.4 | Delivery of Title Policy at Closing | 11 |

| ARTICLE 6 OPERATIONS AND RISK OF LOSS | 12 | |

| Section 6.1 | Ongoing Operations | 12 |

| Section 6.2 | Damage | 13 |

| Section 6.3 | Condemnation | 14 |

| ARTICLE 7 CLOSING | 14 | |

| Section 7.1 | Closing | 14 |

| Section 7.2 | Conditions to Parties' Obligation to Close | 14 |

| Section 7.3 | Seller's Deliveries in Escrow | 15 |

| Section 7.4 | Purchaser's Deliveries in Escrow | 16 |

| Section 7.5 | Closing Statements | 16 |

| Section 7.6 | Purchase Price | 16 |

| Section 7.7 | Possession | 17 |

| Section 7.8 | Delivery of Books and Records | 17 |

| Section 7.9 | Notice to Tenants | 17 |

| ARTICLE 8 PRORATIONS, DEPOSITS, COMMISSIONS | 17 | |

| Section 8.1 | Prorations | 17 |

| Section 8.2 | Leasing Costs | 19 |

| Section 8.3 | Closing Costs | 19 |

| Section 8.4 | Final Adjustment After Closing | 19 |

| Section 8.5 | Tenant Deposits | 19 |

| Section 8.6 | Commissions | 20 |

| ARTICLE 9 REPRESENTATIONS AND WARRANTIES | 20 | |

| Section 9.1 | Seller's Representations and Warranties | 20 |

| Section 9.2 | Purchaser's Representations and Warranties | 21 |

| Section 9.3 | Survival of Representations and Warranties | 22 |

| ARTICLE 10 DEFAULT AND REMEDIES | 22 | |

| Section 10.1 | Seller's Remedies | 22 |

| Section 10.2 | Purchaser's Remedies | 23 |

| Section 10.3 | Attorneys' Fees | 23 |

| Section 10.4 | Other Expenses | 23 |

| ARTICLE 11 DISCLAIMERS, RELEASE AND INDEMNITY | 24 | |

| Section 11.1 | Disclaimers By Seller | 24 |

| Section 11.2 | Sale "As Is, Where Is" | 24 |

| Section 11.3 | Seller Released from Liability | 25 |

| Section 11.4 | "Hazardous Materials" Defined | 26 |

| Section 11.5 | Indemnity | 26 |

| Section 11.6 | Survival | 26 |

| ARTICLE 12 MISCELLANEOUS | 26 | |

| Section 12.1 | Parties Bound; Assignment | 26 |

| Section 12.2 | Headings | 27 |

| Section 12.3 | Invalidity and Waiver | 27 |

| Section 12.4 | Governing Law | 27 |

| Section 12.5 | Survival | 27 |

| Section 12.6 | Entirety and Amendments | 27 |

| Section 12.7 | Time | 27 |

| Section 12.8 | Confidentiality | 27 |

| Section 12.9 | No Electronic Transactions | 27 |

| Section 12.10 | Notices | 28 |

| Section 12.11 | Construction | 28 |

| Section 12.12 | Calculation of Time Periods | 28 |

| Section 12.13 | Execution in Counterparts | 28 |

| Section 12.14 | No Recordation | 28 |

| Section 12.15 | Further Assurances | 29 |

| Section 12.16 | Discharge of Obligations | 29 |

| Section 12.17 | ERISA | 29 |

| Section 12.18 | No Third Party Beneficiary | 29 |

| Section 12.19 | Reporting Person | 29 |

LIST OF DEFINED TERMS

| Page No. | |

| Additional Property Information | 7 |

| Agreement | 1 |

| Assignment | 15 |

| Broker | 2 |

| Casualty Notice | 12 |

| CERCLA | 25 |

| Closing | 14 |

| Closing Date | 2 |

| Code | 21 |

| Deed | 15 |

| Due Diligence Termination Notice | 8 |

| Earnest Money | 1 |

| Effective Date | 2 |

| ERISA | 21 |

| Escrow Agent | 1 |

| Hazardous Material | 26 |

| Hazardous Materials | 26 |

| Hazardous Substance | 26 |

| Improvements | 3 |

| Inspection Period | 2 |

| Intangible Personal Property | 4 |

| Land | 3 |

| Lease Files | 7 |

| Leases | 4 |

| Leasing Costs | 19 |

| Material Damage | 13 |

| Materially Damaged | 13 |

| Natural Gas Liquids | 26 |

| OFAC | 21 |

| Operating Statements | 6 |

| Permits and Warranties Permitted Exceptions | 11 |

| Permitted Outside Parties | 9 |

| Petroleum | 26 |

| Plan | 21 |

| Pollutant or Contaminant | 26 |

| Property | 3 |

| Property Documents | 8 |

| Property Information | 6 |

| Purchase Price | 1 |

| Purchaser | 1 |

| Real Property | 4 |

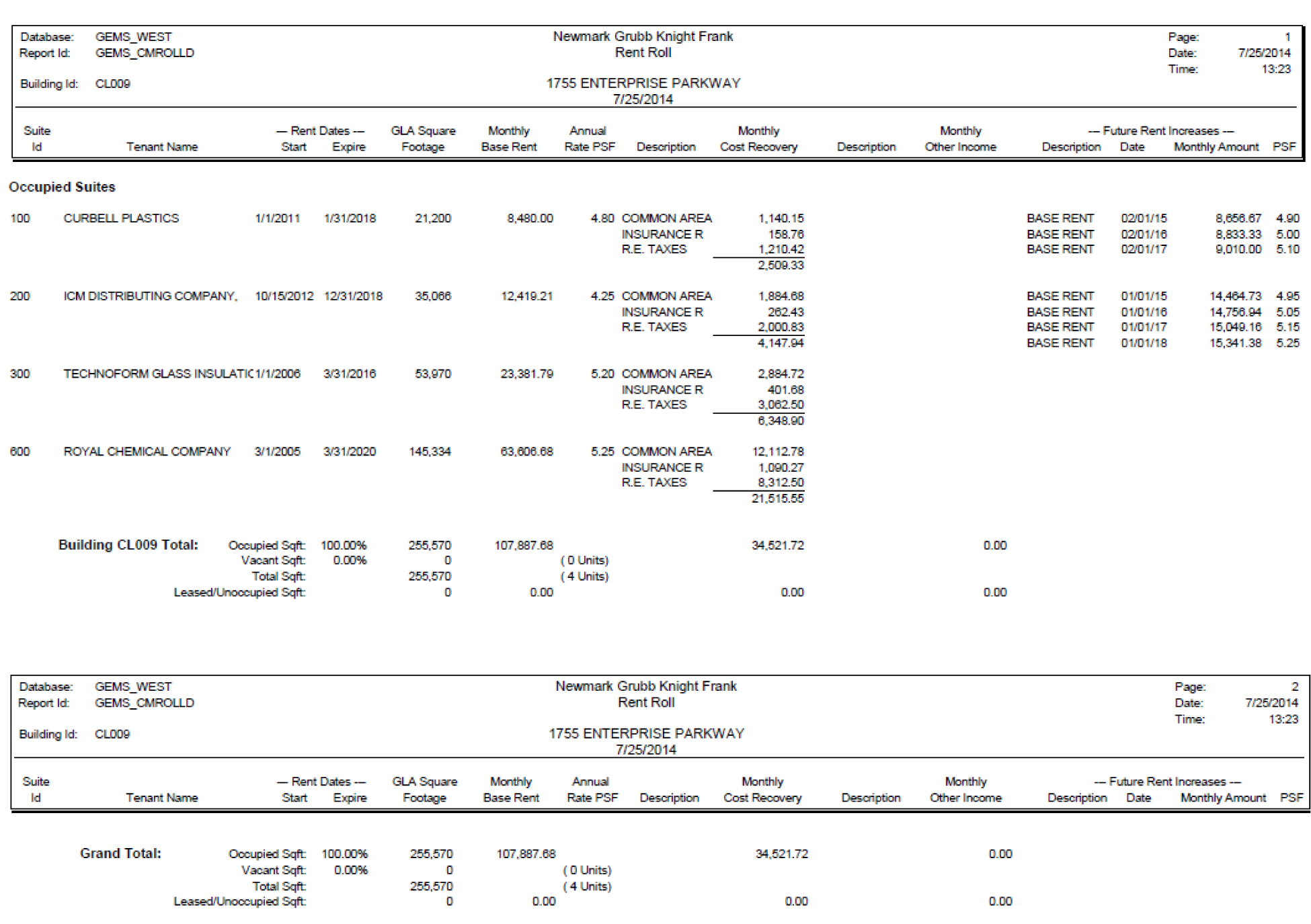

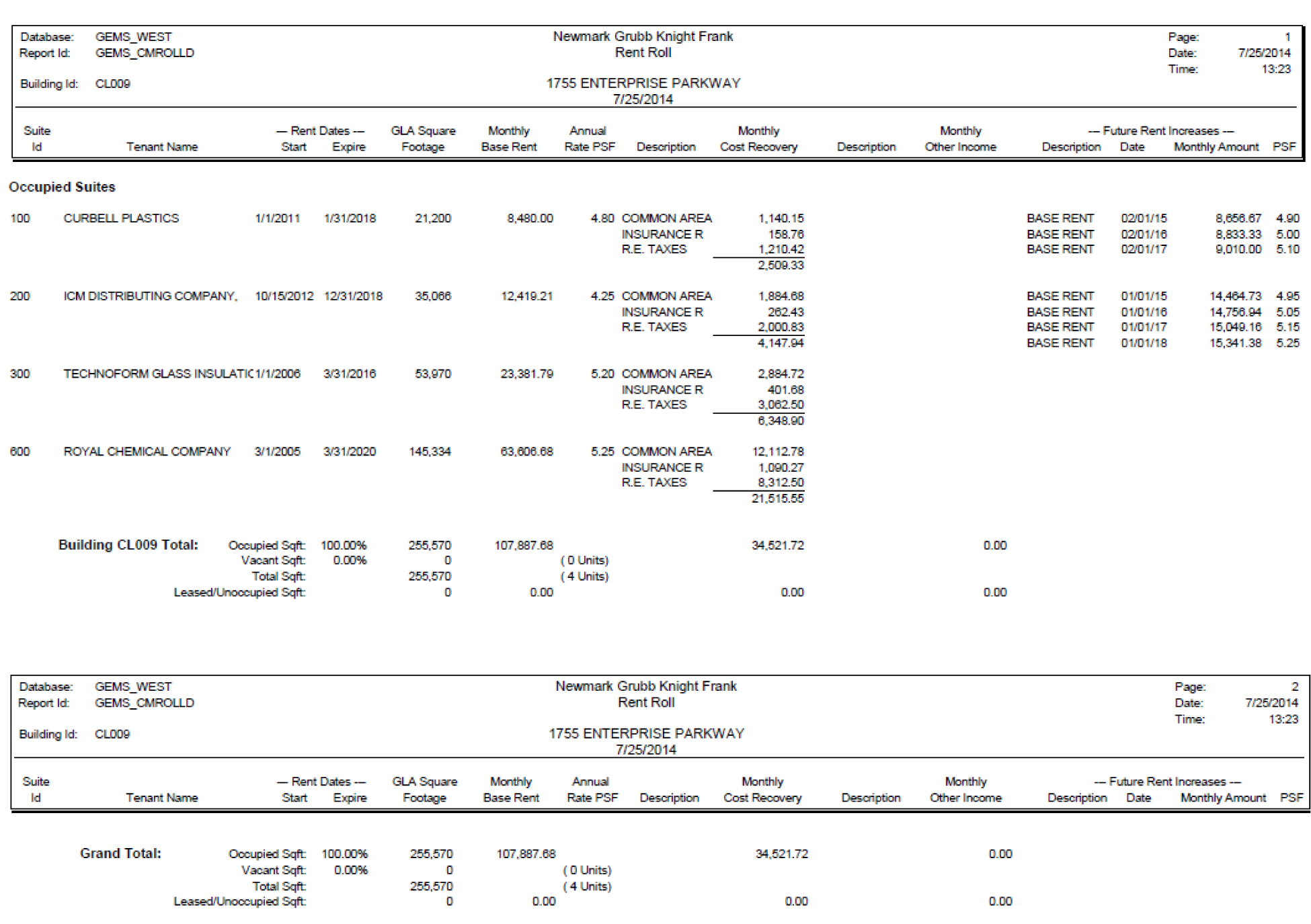

| Rent Roll | 6 |

| Report | 8 |

| Reports | 8 |

| Seller | 1 |

| Seller's Representative | 22 |

| Service Contracts | 4 |

| Survey | 10 |

| Survival Period | 22 |

| Tangible Personal Property | 4 |

| Taxes | 17 |

| Tenant Receivables | 17 |

| Title and Survey Review Period | 2 |

| Title Commitment | 10 |

| Title Commitment Delivery Date | 2 |

| Title Company | 1 |

| Title Policy | 11 |

| to Seller's knowledge | 22 |

| to the best of Seller's knowledge | 22 |

| Unbilled Tenant Receivables | 18 |

| Uncollected Delinquent Tenant Receivables | 18 |

PURCHASE AND SALE AGREEMENT

1755 Enterprise Parkway, Twinsburg, Ohio

This Purchase and Sale Agreement (this "Agreement") is made and entered into by and between Purchaser and Seller.

RECITALS

A. Defined terms are indicated by initial capital letters. Defined terms shall have the meaning set forth herein, whether or not such terms are used before or after the definitions are set forth.

B. Purchaser desires to purchase the Property and Seller desires to sell the Property, all upon the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual terms, provisions, covenants and agreements set forth herein, as well as the sums to be paid by Purchaser to Seller, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, Purchaser and Seller agree as follows:

ARTICLE

1

Basic Information

| 1.1.1 Seller: |

TPRF/ENTERPRISE, LLC, a Delaware limited liability company

|

| 1.1.2 Purchaser: |

PLYMOUTH INDUSTRIAL REIT, INC., a Maryland corporation

|

| 1.1.3 Purchase Price: | $15,000,000.00 |

| 1.1.4 Earnest Money: | $250,000.00, including interest thereon, to be deposited in accordance with 0 below. |

| 1.1.5 Title Company: |

Commonwealth Land Title Insurance Company, a division of Fidelity National Title 265 Franklin Street Boston, MA 02110 Attention: Robert J. Capozzi, Esq. Telephone: (617) 619-4808 E-mail: Robert.capozzi@fnf.com

|

| 1.1.6 Escrow Agent: |

Commonwealth Land Title Insurance Company, a division of Fidelity National Title 265 Franklin Street Boston, MA 02110 Attention: Robert J. Capozzi, Esq. Telephone: 617) 619-4808 E-mail: Robert.capozzi@fnf.com |

| PURCHASE AND SALE AGREEMENT – PAGE 1 |

| 1.1.7 Broker: | BGC Real Estate of Ohio, L.P., d/b/a Newmark Grubb Knight Frank Attention: Terry Coyne |

| 1.1.8 Effective Date: | The date on which this Agreement is executed by the latter to sign of Purchaser or Seller, as indicated on the signature page of this Agreement. If the execution date is left blank by either Purchaser or Seller, the Effective Date shall be the execution date inserted by the other party. |

| 1.1.9 Title and Survey Review Period: | The period ending at 5:00 p.m. (Eastern) on the date that is six (6) business days prior to the date of expiration of the Inspection Period. |

| 1.1.10 Inspection Period: | The period beginning on the Effective Date and expiring at 5:00 p.m. (Eastern) on the date which is forty-five (45) days thereafter. |

| 1.1.11 Closing Date: | Ten (10) days after expiration of the Inspection Period, or such earlier date as Purchaser and Seller may agree in writing. |

Section 1.2 Closing Costs. Closing costs shall be allocated and paid as follows:

| COST | RESPONSIBLE PARTY |

| Title Commitment required to be delivered pursuant to 0. | Purchaser |

| Basic premium for Title Policy required to be delivered pursuant to 0. | Seller |

| Premium for any upgrade of Title Policy for any additional coverage and any endorsements desired by Purchaser, any inspection fee charged by the Title Company, tax certificates, municipal and utility lien certificates, and any other Title Company charges | Purchaser |

| Costs of Survey and/or any revisions, modifications or recertifications thereto | Purchaser |

| Costs for UCC searches | Purchaser |

| Recording fees | Purchaser |

| Any deed taxes, documentary stamps, transfer taxes, intangible taxes, mortgage taxes or other similar taxes, fees or assessments | Purchaser |

| Any escrow fee charged by Escrow Agent for holding the Earnest Money or conducting the Closing | Purchaser: ½ Seller: ½ |

| Real Estate Sales Commission to Broker | Seller |

| All other closing costs, expenses, charges and fees | Purchaser |

| PURCHASE AND SALE AGREEMENT – PAGE 2 |

Section 1.3 Notice Addresses:

|

Purchaser: Plymouth Industrial REIT, Inc. 260 Franklin Street, Suite 1900 Boston, Massachusetts 02110 Attention: Pendleton White, Jr. Telephone: 617-340-3861 E-mail: pen.white@plymouthreit.com

|

Copy to: Brown Rudnick LLP One Financial Center Boston, Massachusetts 02111 Attention: Jeffrey L. Vigliotti Telephone: 617-856-8494 E-mail: jvigliotti@brownrudnick.com |

|

Seller: TPRF/Enterprise, LLC c/o Thackeray Partners Attention: Chris McNeer Telephone: 214-360-7874 E-mail: cm@thackeraypartners.com |

Copy to: Winstead PC 500 Winstead Building Dallas, Texas 75201 Attention: Greg Zimmerman Telephone: 214-745-5658 E-mail: gzimmerman@winstead.com

|

ARTICLE

2

Property

Section 2.1 Property. Subject to the terms and conditions of this Agreement, Seller agrees to sell to Purchaser, and Purchaser agrees to purchase from Seller, the following property (collectively, the "Property"):

2.1.1 Real Property. The land described in 0 attached hereto (the "Land"), together with (a) all improvements located thereon, but expressly excluding improvements and structures owned by any tenant ("Improvements"), (b) all right, title and interest of Seller, if any, in and to the rights, benefits, privileges, easements, tenements, hereditaments, and appurtenances thereon or in anywise appertaining thereto, and (c) all right, title, and interest of Seller, if any, in and to all strips and gores and any land lying in the bed of any street, road or alley, open or proposed, adjoining the Land (collectively, the "Real Property").

2.1.2 Leases. All of Seller's right, title and interest in all unexpired leases, subleases, licenses, occupancy agreements, and any other agreements for the use, possession, or occupancy of any portions of the Real Property (including, without limitation, signage rights), as of the Closing Date, including any amendments, extensions or other modifications of any of the foregoing and including any tenant guaranties delivered in connection with any of the foregoing (the "Leases").

2.1.3 Tangible Personal Property. All of Seller's right, title and interest in the equipment, machinery, furniture, furnishings, supplies and other tangible personal property, if any, owned by Seller and now or hereafter located in and used in connection with the operation, ownership or management of the Real Property (collectively, the "Tangible Personal Property").

| PURCHASE AND SALE AGREEMENT – PAGE 3 |

2.1.4 Intangible Personal Property. All of Seller's right, title and interest, if any, in all intangible personal property related to the Real Property and the Improvements, including, without limitation: all trade names and trademarks associated with the Real Property and the Improvements, including Seller's rights and interests, if any, in the name of the Real Property; any domain name associated with the Real Property; the plans and specifications and other architectural and engineering drawings for the Improvements, if any (to the extent assignable without cost to Seller unless Purchaser assumes the cost of such assignment); contract rights related to the operation, ownership or management of the Real Property, including maintenance, service, construction, supply and equipment rental contracts, if any, but not including Leases (collectively, the "Service Contracts") (but only to the extent assignable without cost to Seller unless Purchaser assumes the cost of such assignment and to the extent Seller's obligations thereunder are expressly assumed by Purchaser pursuant to this Agreement); warranties (to the extent assignable without cost to Seller unless Purchaser assumes the cost of such assignment); governmental permits, approvals and licenses, if any (to the extent assignable without cost to Seller unless Purchaser assumes the cost of such assignment); and telephone exchange numbers (to the extent assignable without cost to Seller unless Purchaser assumes the cost of such assignment) (all of the items described in this Section 0 collectively referred to as the "Intangible Personal Property"). Tangible Personal Property and Intangible Personal Property shall not include (a) any appraisals or other economic evaluations of, or projections with respect to, all or any portion of the Property, including, without limitation, budgets prepared by or on behalf of Seller or any affiliate of Seller, (b) any documents, materials or information which are subject to attorney/client, work product or similar privilege, which constitute attorney communications with respect to the Property and/or Seller, or which are subject to a confidentiality agreement, and (c) any trade name, mark or other identifying material that includes the name "Thackeray Partners" or any derivative thereof.

ARTICLE

3

Earnest Money

Section 3.1 Deposit and Investment of Earnest Money. If upon the expiration of the Inspection Period, this Agreement is still in force and effect, Purchaser shall, no later than the last day of the Inspection Period, deposit the Earnest Money with Escrow Agent. Escrow Agent shall invest the Earnest Money in government insured interest-bearing accounts satisfactory to Seller and Purchaser, shall not commingle the Earnest Money with any funds of Escrow Agent or others, and shall promptly provide Purchaser and Seller with confirmation of the investments made. Such account shall have no penalty for early withdrawal, and Purchaser accepts all risks with regard to such account.

Section 3.2 Form; Failure to Deposit. The Earnest Money shall be in the form of a certified or cashier's check or the wire transfer to Escrow Agent of immediately available U.S. federal funds. If Purchaser fails to timely deposit any portion of the Earnest Money within the time periods required, Seller may terminate this Agreement by written notice to Purchaser, in which event any Earnest Money that has previously been deposited by Purchaser with Escrow Agent shall be immediately delivered to Seller and thereafter the parties hereto shall have no further rights or obligations hereunder, except for rights and obligations which, by their terms, survive the termination hereof.

| PURCHASE AND SALE AGREEMENT – PAGE 4 |

Section 3.3 Disposition of Earnest Money. The Earnest Money shall be applied as a credit to the Purchase Price at Closing. In the event of a termination of this Agreement by either Seller or Purchaser for any reason following the expiration of the Inspection Period, Escrow Agent is authorized to deliver the Earnest Money to the party hereto entitled to same pursuant to the terms hereof on or before the tenth business day following receipt by Escrow Agent and the non-terminating party of written notice of such termination from the terminating party, unless the other party hereto notifies Escrow Agent that it disputes the right of the other party to receive the Earnest Money. In such event, Escrow Agent may interplead the Earnest Money into a court of competent jurisdiction in the county in which the Earnest Money has been deposited. All attorneys' fees and costs and Escrow Agent's costs and expenses incurred in connection with such interpleader shall be assessed against the party that is not awarded the Earnest Money, or if the Earnest Money is distributed in part to both parties, then in the inverse proportion of such distribution.

Section 3.4 Reimbursement of Seller’s Costs. Provided no default by Seller under this Agreement exists (which shall be subject to the provisions of Section 10.2 hereof), in the event that either Purchaser or Seller terminates this Agreement pursuant to any provision hereof other than Section 10.2, then Purchaser shall pay to Seller an amount equal to the lesser of (1) Seller's actual out-of-pocket expenditures incurred directly in connection with negotiating this Agreement, or (2) Fifteen Thousand and No/100 Dollars ($15,000.00), within twenty (20) business days following written demand thereof from Seller, which shall be accompanied by reasonable supporting documentation of actual expenditures. The provisions of this Section 3.4 shall survive the termination of this Agreement.

ARTICLE

4

Due Diligence

Section 4.1 Due Diligence Materials To Be Delivered. On or before five (5) business days after the Effective Date, Seller will deliver to Purchaser the following (the "Property Information"):

4.1.1 Rent Roll. A current rent roll ("Rent Roll") for the Property;

4.1.2 Operating Statements. Copy of operating statements of the Property for calendar years 2012, 2013 and the current year-to-date (“Operating Statements”), and copy of Seller’s operating expenditures, aged receivable reports, and rent payment histories pertaining to the Property for calendar year 2013 and the current year-to-date and Seller’s most recent budget for the Property, including the forthcoming year, if applicable;

4.1.3 Environmental Reports. Copy of any environmental, geotechnical, soil, engineering and drainage reports, assessments, audits and surveys related to the Property prepared for the benefit of Seller;

4.1.4 Tax Statements. Copy of ad valorem tax statements relating to the Property for the current tax period and for 2012 and 2013, including the Property’s tax identification number(s) and latest value renditions;

| PURCHASE AND SALE AGREEMENT – PAGE 5 |

4.1.5 Title and Survey. Copy of Seller's most current title insurance information and survey of the Property;

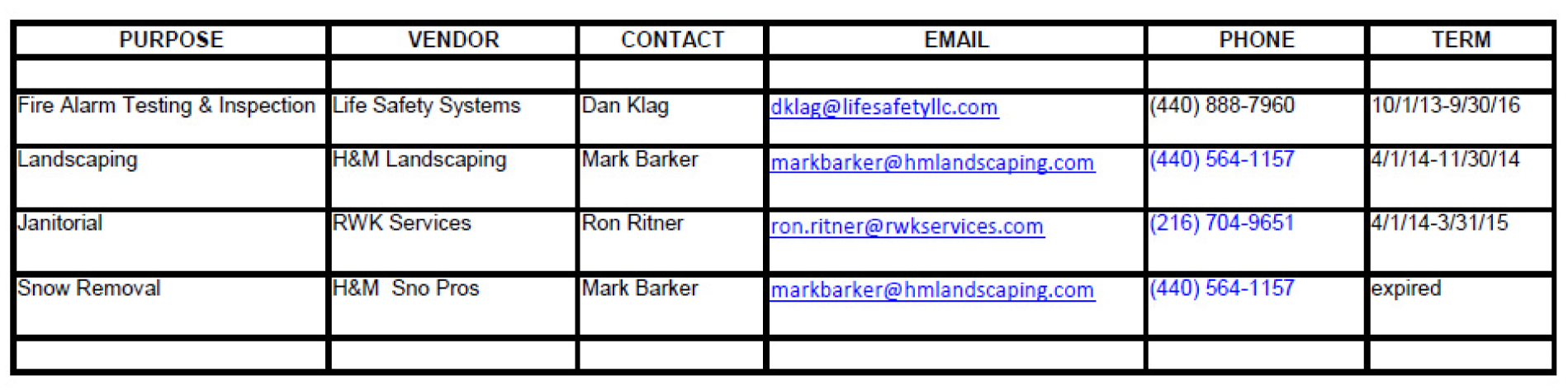

4.1.6 Service Contracts. A list, together with copies, of Service Contracts;

4.1.7 Personal Property. A list of Tangible Personal Property;

4.1.8 Leases. A list, together with copies, of any Leases;

4.1.9 Management and/or Leasing Agreements. Copies of any management and/or leasing agreements under which the Property is managed and/or leased;

4.1.10 Insurance. Copies of Seller’s certificate of insurance for the Property, a loss history relating to the Property for Seller’s period of ownership, and a list of any current claims relating to the Property, if any;

4.1.11 Tangible Personal Property. A current inventory of all tangible personal property and fixtures owned by Seller (if any);

4.1.12 Maintenance Records. All maintenance work orders for the 12 months preceding the Effective Date;

4.1.13 List of Capital Improvements. A list of all capital improvements performed on the Property within the prior 12 months;

4.1.14 Permits and Warranties. Copies of all warranties and guaranties (including without limitation any warranties on roofs, air conditioning units, fixtures and equipment), permits, certificates of occupancy, licenses and other approvals related to the Property (the “Permits and Warranties”);

4.1.15 Accounts Payable and Accounts Receivable Schedules. Copies of the then current accounts payable and accounts receivable schedules with respect to the Property; and

4.1.16 Commission Schedule and Agreements. A schedule and copies of all commission agreements related to the Leases or the Property, if any.

Except for the Rent Roll contemplated in Section 0, Seller's obligations to deliver the items listed in this 0 shall be limited to the extent such items are in the possession of Seller or its property management company.

Section 4.2 Additional Property Information. To the extent such items are in Seller's possession, Seller shall make available to Purchaser for Purchaser's review, at Seller's option at either the offices of Seller's property manager or at the Property, the following items and information (the "Additional Property Information") on or before the Property Information Delivery Date, and Purchaser at its expense shall have the right to make copies of same:

| PURCHASE AND SALE AGREEMENT – PAGE 6 |

4.2.1 Lease Files. The lease files for all tenants, including the Leases, amendments, guaranties, any letter agreements and assignments which are then in effect, whether on paper, in electronic format or other format ("Lease Files"); and

4.2.2 Plans and Specifications. Site plans, building plans and specifications relating to the Property.

Section 4.3 Physical Due Diligence. Commencing on the Effective Date and continuing until the Closing, Purchaser shall have reasonable access to the Property at all reasonable times during normal business hours, upon appropriate notice to tenants as permitted or required under the Leases, for the purpose of conducting reasonably necessary tests, including surveys and architectural, engineering, geotechnical and environmental inspections and tests, provided that (a) Purchaser must give Seller two full business days' prior telephone or written notice of any such inspection or test, and with respect to any intrusive inspection or test (i.e., core sampling or any environmental testing beyond a Phase I environmental site assessment) must obtain Seller's prior written consent (which consent may be given, withheld or conditioned in Seller's sole discretion), (b) prior to performing any inspection or test, Purchaser must deliver a certificate of insurance to Seller evidencing that Purchaser and its contractors, agents and representatives have in place reasonable amounts of commercial general liability insurance and workers compensation insurance for its activities on the Property in terms and amounts reasonably satisfactory to Seller covering any accident arising in connection with the presence of Purchaser, its contractors, agents and representatives on the Property, which insurance shall name Seller as an additional insured thereunder, and (c) all such tests shall be conducted by Purchaser in compliance with Purchaser's responsibilities set forth in 0 below. Purchaser shall bear the cost of all such inspections or tests and shall be responsible for and act as the generator with respect to any wastes generated by those tests. Subject to the provisions of 0 hereof, Purchaser or Purchaser's representatives may meet with any tenant; provided, however, Purchaser must contact Seller at least two full business days in advance by telephone to inform Seller of Purchaser's intended meeting and to allow Seller the opportunity to attend such meeting if Seller desires. Subject to the provisions of 0 hereof, Purchaser or Purchaser's representatives may meet with any governmental authority for the sole purpose of gathering information in connection with the transaction contemplated by this Agreement; provided, however, Purchaser must contact Seller at least two full business days in advance by telephone to inform Seller of Purchaser's intended meeting and to allow Seller the opportunity to attend such meeting if Seller desires.

Section 4.4 Due Diligence/Termination Right. Purchaser shall have through the last day of the Inspection Period in which to (a) examine, inspect, and investigate the Property Information and the Additional Property Information (collectively, the "Property Documents") and the Property and, in Purchaser's sole and absolute judgment and discretion, determine whether the Property is acceptable to Purchaser, (b) obtain all necessary internal approvals, and (c) satisfy all other contingencies of Purchaser. Notwithstanding anything to the contrary in this Agreement, Purchaser may terminate this Agreement for any reason or no reason by giving written notice of termination to Seller and Escrow Agent (the "Due Diligence Termination Notice") on or before the last day of the Inspection Period. If Purchaser does not give a Due Diligence Termination Notice, this Agreement shall continue in full force and effect, Purchaser shall be deemed to have waived its right to terminate this Agreement pursuant to this 0, and Purchaser shall be deemed to have acknowledged that it has received or had access to all Property Documents and conducted all inspections and tests of the Property that it considers important.

| PURCHASE AND SALE AGREEMENT – PAGE 7 |

Section 4.5 Return of Documents and Reports. As additional consideration for the transaction contemplated herein, Purchaser shall provide to Seller, promptly following written request of same by Seller, copies of all third party reports, investigations and studies, other than economic analyses (collectively, the "Reports" and, individually, a "Report") prepared for Purchaser in connection with its due diligence review of the Property, including, without limitation, any and all Reports involving structural or geological conditions, environmental, hazardous waste or hazardous substances contamination of the Property, if any. If requested by Seller, the Reports shall be delivered to Seller without any representation or warranty as to the completeness or accuracy of the Reports or any other matter relating thereto. Purchaser's obligation to deliver the Property Documents and the Reports to Seller upon request of Seller shall survive the termination of this Agreement.

Section 4.6 Service Contracts. On or prior to the last day of the Inspection Period, Purchaser will advise Seller in writing of which Service Contracts it will assume and for which Service Contracts Purchaser requests that Seller deliver written termination at or prior to Closing, provided Seller shall have no obligation to terminate, and Purchaser shall be obligated to assume, any Service Contracts which by their terms cannot be terminated without penalty or payment of a fee. Seller shall deliver at Closing notices of termination of all Service Contracts that are not so assumed. Purchaser must assume the obligations arising from and after the Closing Date under those Service Contracts (a) that Purchaser has agreed to assume, or that Purchaser is obligated to assume pursuant to this 0, and (b) for which a termination notice is delivered as of or prior to Closing but for which termination is not effective until after Closing. Notwithstanding the foregoing, Seller shall terminate any management agreement with any property manager and any leasing or brokerage agreements with respect to the Property effective as of the Closing Date and pay any and all costs and expenses of termination thereof and all commissions due thereunder.

Section 4.7 Proprietary Information; Confidentiality. Purchaser acknowledges that the Property Documents are proprietary and confidential and will be delivered to Purchaser solely to assist Purchaser in determining the feasibility of purchasing the Property. Purchaser shall not use the Property Documents for any purpose other than as set forth in the preceding sentence. Purchaser shall not disclose the contents of the Property Documents to any person other than to those persons who are responsible for determining the feasibility of Purchaser's acquisition of the Property and who have agreed to preserve the confidentiality of such information as required hereby (collectively, "Permitted Outside Parties"). At any time and from time to time, within two business days after Seller's request, Purchaser shall deliver to Seller a list of all parties to whom Purchaser has provided any Property Documents or any information taken from the Property Documents. Purchaser shall not divulge the contents of the Property Documents except in strict accordance with the confidentiality standards set forth in this 0. In permitting Purchaser to review the Property Documents or any other information, Seller has not waived any privilege or claim of confidentiality with respect thereto, and no third party benefits or relationships of any kind, either express or implied, have been offered, intended or created. As used hereunder, the term "Permitted Outside Parties" shall not include Seller's existing mortgage lender and Purchaser shall not deliver to Seller's existing mortgage lender any information relating to the Property unless approved by Seller in writing, in Seller's sole and absolute discretion. Notwithstanding anything to the contrary in this Agreement, the Purchaser may release information to its underwriters, lenders and other sources of financing and their agents and may include information regarding the Property in any filing made by Purchaser with the United States Securities and Exchange Commission pursuant to federal or state securities law or regulations, including but not limited to a Form S-11 registration or a Rule 3-14 audit or any similar or related filing made by Purchaser.

| PURCHASE AND SALE AGREEMENT – PAGE 8 |

Section 4.8 No Representation or Warranty by Seller. Purchaser acknowledges that, except as expressly set forth in this Agreement and/or any documents executed by Seller and delivered to Purchaser at Closing, Seller has not made and does not make any warranty or representation regarding the truth, accuracy or completeness of the Property Documents or the source(s) thereof. Purchaser further acknowledges that some if not all of the Property Documents were prepared by third parties other than Seller. Except as expressly set forth in this Agreement, Seller expressly disclaims any and all liability for representations or warranties, express or implied, statements of fact and other matters contained in such information, or for omissions from the Property Documents, or in any other written or oral communications transmitted or made available to Purchaser. Purchaser shall rely solely upon (a) its own investigation with respect to the Property, including, without limitation, the Property's physical, environmental or economic condition, compliance or lack of compliance with any ordinance, order, permit or regulation or any other attribute or matter relating thereto and (b) such representations, warranties and covenants of Seller as are expressly set forth in this Agreement. Seller has not undertaken any independent investigation as to the truth, accuracy or completeness of the Property Documents and are providing the Property Documents solely as an accommodation to Purchaser.

Section 4.9 Purchaser's Responsibilities. In conducting any inspections, investigations or tests of the Property and/or Property Documents, Purchaser and its agents and representatives shall: (a) not disturb the tenants or interfere with their use of the Property pursuant to their respective Leases; (b) not interfere with the operation and maintenance of the Property; (c) not damage any part of the Property or any personal property owned or held by any tenant or any third party; (d) not injure or otherwise cause bodily harm to Seller or its agents, guests, invitees, contractors and employees or any tenants or their guests or invitees; (e) comply with all applicable laws; (f) promptly pay when due the costs of all tests, investigations, and examinations done with regard to the Property; (g) not permit any liens to attach to the Real Property by reason of the exercise of its rights hereunder; (h) repair any damage to the Real Property resulting directly or indirectly from any such inspection or tests; and (i) not reveal or disclose prior to Closing any information obtained during the Inspection Period concerning the Property and the Property Documents to anyone other than the Permitted Outside Parties, in accordance with the confidentiality standards set forth in 0 above, or except as may be otherwise required by law.

Section 4.10 Purchaser's Agreement to Indemnify. Purchaser hereby agrees to indemnify, defend and hold Seller harmless from and against any and all liens, claims, causes of action, damages, liabilities and expenses (including reasonable attorneys' fees) arising out of Purchaser's inspections or tests permitted under this Agreement or any violation of the provisions of 0, 0 and 0; provided, however, the indemnity shall not extend to protect Seller from any pre-existing liabilities for matters merely discovered by Purchaser (i.e., latent environmental contamination) so long as Purchaser's actions do not aggravate any pre-existing liability of Seller. Purchaser also hereby agrees to indemnify, defend and hold any tenant harmless from and against any and all claims, causes of action, damages, liabilities and expenses which such tenant may suffer or incur due to Purchaser's breach of its obligation under 0 above to maintain the confidential nature of any Property Documents or other information relative to such tenant. Purchaser's obligations under this 0 shall survive the termination of this Agreement and shall survive the Closing.

| PURCHASE AND SALE AGREEMENT – PAGE 9 |

ARTICLE

5

Title and Survey

Section 5.1 Title Commitment. Prior to the Effective Date, Purchaser has caused to be prepared and delivered to Seller: (a) a current commitment for title insurance or preliminary title report (the "Title Commitment") issued by the Title Company, in the amount of the Purchase Price and on a ALTA 1992 Standard Form commitment, with Purchaser as the proposed insured, and (b) copies of all documents of record referred to in the Title Commitment as exceptions to title to the Property.

Section 5.2 New or Updated Survey. Purchaser may elect to obtain a new survey or revise, modify, or re-certify an existing survey ("Survey") as necessary in order for the Title Company to delete the survey exception from the Title Policy or to otherwise satisfy Purchaser's objectives.

Section 5.3 Title Review. During the Title and Survey Review Period, Purchaser shall review title to the Property as disclosed by the Title Commitment and the Survey. Purchaser shall have the right, up until expiration of the Title and Survey Review Period, to object in writing (“Purchaser’s Exception Notice”) to any title matters which are disclosed in the Title Commitment or Survey (herein collectively called “Liens”). Unless Purchaser shall timely object to the Liens, such Liens shall be deemed to constitute “Permitted Exceptions”. Any exceptions which are timely objected to by Purchaser shall be herein collectively called the “Title Objections.” If, on or before two (2) business days before the end of the Inspection Period, Seller fails to cause or covenant to Purchaser in writing to remove or endorse over any Title Objections prior to the Closing in a manner satisfactory to Purchaser in its sole and absolute discretion (Seller having no obligation to agree to cure or correct any such Title Objections), Purchaser may elect, prior to the expiration of the Inspection Period to either (a) terminate this Agreement by giving written notice to Seller and Escrow Agent, in which event the Earnest Money (if previously deposited by Purchaser) shall be returned to Purchaser and, thereafter, the parties shall have no further rights or obligations hereunder except for those obligations which expressly survive the termination of this Agreement, or (b) waive such Title Objections, in which event such Title Objections shall be deemed additional “Permitted Exceptions” and the Closing shall occur as herein provided without any reduction of or credit against the Purchase Price. Purchaser shall have the right to amend Purchaser’s Exception Notice (“Purchaser’s Amended Exception Notice”) to object to any title matters that are not Permitted Exceptions which are first disclosed in any supplemental reports or updates to the Title Commitment or Survey delivered to Purchaser after the end of the Inspection Period provided that Purchaser objects to the same within five (5) days after Purchaser’s receipt of the applicable supplemental reports or

| PURCHASE AND SALE AGREEMENT – PAGE 10 |

updates to the Title Commitment or Survey but in no event after Closing. If Seller fails to take the action requested by Purchaser in Purchaser’s Amended Exception Notice, Purchaser may elect prior to Closing to proceed under either clause (a) or (b) of the sentence which precedes the immediately preceding sentence. Notwithstanding anything to the contrary contained in this Agreement, any Lien which is a financial encumbrance created by or through Seller such as a mortgage, deed of trust, or other debt security, attachment, judgment, lien for delinquent real estate taxes and delinquent assessments, mechanic’s or materialmen’s lien, which is outstanding against the Property, or any part thereof, that is revealed or disclosed by the Title Commitment or by any updates thereto or by any UCC, tax lien and judgment searches with respect to Seller (herein such financial encumbrances are referred to as “Financial Encumbrances”) shall in no event be deemed a Permitted Exception, and Seller hereby covenants to remove all Financial Encumbrances on or before the Closing Date. Seller further agrees to remove any exceptions or encumbrances to title which are voluntarily created by, under or through Seller after the Effective Date without Purchaser's consent (if requested, such consent shall not be unreasonably withheld or delayed). The term "Permitted Exceptions" shall mean: the specific exceptions (excluding exceptions that are part of the promulgated title insurance form) in the Title Commitment and/or Survey (or if Purchaser does not obtain a Survey, all matters that a current, accurate survey of the Property would show) to which Purchaser has not timely objected as of the end of the Title and Survey Review Period and which Seller is not required to remove as provided above; matters created by, through or under Purchaser; real estate taxes not yet due and payable; rights of tenants under the Leases; and any licensees under any Service Contracts not terminated as of Closing.

Section 5.4 Delivery of Title Policy at Closing. In the event that the Title Company does not issue at Closing, or unconditionally commit at Closing to issue, to Purchaser, an extended coverage ALTA owner's form title policy (2006) in accordance with the Title Commitment, insuring Purchaser's title to the Property in the amount of the Purchase Price, subject only to the standard exceptions and exclusions from coverage contained in such policy and the Permitted Exceptions (the "Title Policy"), Purchaser shall have the right to terminate this Agreement, in which case the Earnest Money shall be immediately returned to Purchaser and the parties hereto shall have no further rights or obligations, other than those that by their terms survive the termination of this Agreement.

ARTICLE

6

Operations and Risk of Loss

Section 6.1 Ongoing Operations. From the Effective Date through Closing:

6.1.1 Leases and Service Contracts. Seller will perform its material obligations under the Leases and Service Contracts.

6.1.2 New Contracts. Except as provided in Section 0, Seller will not enter into any contract that will be an obligation affecting the Property subsequent to the Closing.

6.1.3 Maintenance of Improvements; Removal of Personal Property. Subject to 0 and 0, Seller shall maintain or cause the tenants, licensees and other occupants under the Leases to maintain all Improvements substantially in their present condition (ordinary wear and tear and casualty excepted) and in a manner consistent with Seller's maintenance of the Improvements during Seller's period of ownership. Seller will not remove any Tangible Personal Property except as may be required for necessary repair or replacement, and replacement shall be of approximately equal quality and quantity as the removed item of Tangible Personal Property.

| PURCHASE AND SALE AGREEMENT – PAGE 11 |

6.1.4 Leasing; Contracts. Seller will not amend or terminate any existing Lease or contract or enter into any new Lease or new contract that will affect the Property subsequent to the Closing without providing Purchaser (a) all relevant supporting documentation, as reasonably determined by Seller and Purchaser, including, without limitation, tenant, licensee or other third party financial information to the extent in Seller's possession, and (b) as to any such amendment or termination of a Lease or contract or new Lease or new contract that will affect the Property subsequent to the Closing and, in each case, which is to be executed after the expiration of the Inspection Period, Seller's request for Purchaser's approval. If Purchaser's consent is requested by Seller as to any amendment or termination of a Lease or contract that will be affect the Property subsequent to the Closing, or as to a new Lease or new contract that will be affect the Property subsequent to the Closing, Purchaser agrees to give Seller written notice of approval or disapproval of a proposed amendment or termination of a Lease or contract or new Lease or new contract that will be an obligation affecting the Property subsequent to the Closing within four (4) business days after Purchaser's receipt of the items in Section 00 and Section 00. If Purchaser does not respond to Seller's request within such time period, then Purchaser will be deemed to have approved such amendment, termination or new Lease or new contract. Purchaser's approval rights and obligations will vary depending on whether the request for approval from Seller is delivered to Purchaser before or after the expiration of the Inspection Period, as follows:

(1) With respect to a request for approval delivered by Seller to Purchaser before the expiration of the Inspection Period, Purchaser's consent shall not be required. Moreover, whether or not Purchaser consents to an amendment or termination of a Lease or contract or the entering into of a new Lease or new contract, Seller may amend or terminate a Lease or contract or enter into a new Lease or contract at any time prior to the expiration of the Inspection Period; however, if Purchaser does not consent to same or is not deemed to have approved same, and if Seller elects to amend or terminate a Lease or contract or enter into a new Lease or contract that will affect the Property subsequent to the Closing notwithstanding Purchaser's failure to approve same, then Purchaser may, at the time Seller notifies Purchaser of the execution of said amendment, termination or new Lease or contract that will affect the Property subsequent to the Closing, elect to terminate this Agreement and receive a return of the Earnest Money; provided that if Purchaser does not elect to terminate within five days after said notification from Seller, then Purchaser shall have waived its right to terminate pursuant to this Section 0.

(2) With respect to a request for approval delivered by Seller to Purchaser after the expiration of the Inspection Period, Purchaser may withhold its consent at its reasonable discretion, and Seller may not amend or terminate a Lease or contract or enter into a new Lease or new contract that will affect the Property subsequent to the Closing without Purchaser's written consent.

| PURCHASE AND SALE AGREEMENT – PAGE 12 |

Section 6.2 Damage. If prior to Closing the Property is damaged by fire or other casualty, Seller shall estimate the cost to repair and the time required to complete repairs and will provide Purchaser written notice of Seller's estimation (the "Casualty Notice") as soon as reasonably possible after the occurrence of the casualty.

6.2.1 Material. In the event of any Material Damage to or destruction of the Property or any portion thereof prior to Closing, either Seller or Purchaser may, at its option, terminate this Agreement by delivering written notice to the other on or before the expiration of 30 days after the date Seller delivers the Casualty Notice to Purchaser (and if necessary, the Closing Date shall be extended to give the parties the full thirty-day period to make such election and to obtain insurance settlement agreements with Seller's insurers). Upon any such termination, the Earnest Money shall be returned to Purchaser and the parties hereto shall have no further rights or obligations hereunder, other than those that by their terms survive the termination of this Agreement. If neither Seller nor Purchaser so terminates this Agreement within said 30-day period, then the parties shall proceed under this Agreement and close on schedule (subject to extension of Closing as provided above), and as of Closing Seller shall assign to Purchaser, without representation or warranty by or recourse against Seller, all of Seller's rights in and to any resulting insurance proceeds (including any rent loss insurance applicable to any period on and after the Closing Date) due Seller as a result of such damage or destruction and Purchaser shall assume full responsibility for all needed repairs, and Purchaser shall receive a credit at Closing for any deductible amount under such insurance policies (but the amount of the deductible plus insurance proceeds shall not exceed the lesser of (a) the cost of repair or (b) the Purchase Price and a pro rata share of the rental or business loss proceeds, if any). For the purposes of this Agreement, "Material Damage" and "Materially Damaged" means damage which, (a) in Seller's reasonable estimation, exceeds $200,000.00 to repair or (b) in Seller’s reasonable estimation will take longer than 120 days to repair.

6.2.2 Not Material. If the Property is not Materially Damaged, then neither Purchaser nor Seller shall have the right to terminate this Agreement, and Seller shall, at its option, either (a) repair the damage before the Closing in a manner reasonably satisfactory to Purchaser (and if necessary, Seller may extend the Closing Date up to 30 days to complete such repairs), or (b) credit Purchaser at Closing for the reasonable cost to complete the repair (in which case Seller shall retain all insurance proceeds and Purchaser shall assume full responsibility for all needed repairs).

Section 6.3 Condemnation. If proceedings in eminent domain are instituted with respect to the Property or any portion thereof, Purchaser may, at its option, by written notice to Seller given within ten days after Seller notifies Purchaser of such proceedings (and if necessary the Closing Date shall be automatically extended to give Purchaser the full ten-day period to make such election), either: (a) terminate this Agreement, in which case the Earnest Money shall be immediately returned to Purchaser and the parties hereto shall have no further rights or obligations, other than those that by their terms survive the termination of this Agreement, or (b) proceed under this Agreement, in which event Seller shall, at the Closing, assign to Purchaser its entire right, title and interest in and to any condemnation award, and Purchaser shall have the sole right after the Closing to negotiate and otherwise deal with the condemning authority in respect of such matter. If Purchaser does not give Seller written notice of its election within the time required above, then Purchaser shall be deemed to have elected option (b) above.

| PURCHASE AND SALE AGREEMENT – PAGE 13 |

ARTICLE

7

Closing

Section 7.1 Closing. The consummation of the transaction contemplated herein ("Closing") shall occur on the Closing Date at the offices of Escrow Agent (or such other location as may be mutually agreed upon by Seller and Purchaser). Funds shall be deposited into and held by Escrow Agent in a closing escrow account with a bank satisfactory to Purchaser and Seller. Upon satisfaction or completion of all closing conditions and deliveries, the parties shall direct Escrow Agent to immediately record and deliver the closing documents to the appropriate parties and make disbursements according to the closing statements executed by Seller and Purchaser.

Section 7.2 Conditions to Parties' Obligation to Close. In addition to all other conditions set forth herein, the obligation of Seller, on the one hand, and Purchaser, on the other hand, to consummate the transactions contemplated hereunder are conditioned upon the following:

7.2.1 Representations and Warranties. The other party's representations and warranties contained herein shall be true and correct in all material respects as of the Effective Date and the Closing Date, except for representations and warranties made as of, or limited by, a specific date, which will be true and correct in all material respects as of the specified date or as limited by the specified date;

7.2.2 Deliveries. As of the Closing Date, the other party shall have tendered all deliveries to be made at Closing; and

7.2.3 Actions, Suits, etc. There shall exist no pending or threatened actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, against the other party that would materially and adversely affect the operation or value of the Property or the other party's ability to perform its obligations under this Agreement.

7.2.4 Tenant Estoppel Certificates. On or before five (5) calendar days prior to the Closing Date, Seller shall deliver executed tenant estoppel certificates to Purchaser substantially in the form of Exhibit G (or, if a tenant's Lease specifies or contemplates another form of tenant estoppel certificate, then such other specified or contemplated form) executed by tenants occupying not less than 100% of the square feet in the Improvements leased to tenants, each such estoppel dated not more than thirty (30) days prior to the Closing Date and disclosing no defaults, disputes or other matters contrary to (a) any of Seller’s representations set forth in this Agreement or (b) any information set forth in the Lease Files . The failure of Seller to obtain any such tenant estoppel certificates shall not be a breach or default hereunder. If Seller is unable to deliver the tenant estoppel certificates referred to in this Section 7.2.4, or if the Seller delivers a Tenant Estoppel that discloses a default, dispute or other matter materially contrary to the information set forth in the Lease Files, then Purchaser's sole remedies and recourses shall be limited to either (a) waiving the requirement for the tenant estoppel certificate(s) in question and proceeding to Closing without reduction of the Purchase Price or (b) terminating this Agreement by immediate notification to Seller, in which event this Agreement shall be terminated as provided for in 0.

| PURCHASE AND SALE AGREEMENT – PAGE 14 |

So long as a party is not in default hereunder, if any condition to such party's obligation to proceed with the Closing hereunder has not been satisfied as of the Closing Date (or such earlier date as is provided herein), subject to any applicable notice and cure periods provided in 0 and 0, such party may, in its sole discretion, terminate this Agreement by delivering written notice to the other party on or before the Closing Date (or such earlier date as is provided herein), or elect to close (or to permit any such earlier termination deadline to pass) notwithstanding the non-satisfaction of such condition, in which event such party shall be deemed to have waived any such condition. In the event such party elects to close (or to permit any such earlier termination deadline to pass), notwithstanding the non-satisfaction of such condition, said party shall be deemed to have waived said condition, and there shall be no liability on the part of any other party hereto for breaches of representations and warranties of which the party electing to close had knowledge at the Closing.

Section 7.3 Seller's Deliveries in Escrow. As of or prior to the Closing Date, Seller shall deliver in escrow to Escrow Agent the following:

7.3.1 Deed. A limited warranty deed in the form of 0 hereto (or other limited warranty deed, as Seller's local counsel or Title Company shall advise, warranting title only against any party claiming by, through or under Seller) in form acceptable for recordation under the law of the state where the Property is located and including a list of Permitted Exceptions to which the conveyance shall be subject, executed and acknowledged by Seller, conveying to Purchaser Seller's interest in the Real Property (the "Deed");

7.3.2 Bill of Sale, Assignment and Assumption. A Bill of Sale, Assignment and Assumption of Leases and Contracts in the form of 0 attached hereto (the "Assignment"), executed and acknowledged by Seller, vesting in Purchaser, Seller's right, title and interest in and to the property described therein free of any claims, except for the Permitted Exceptions to the extent applicable;

7.3.3 Conveyancing or Transfer Tax Forms or Returns. Such conveyancing or transfer tax forms or returns, if any, as are required to be delivered or signed by Seller by applicable state and local law in connection with the conveyance of the Real Property;

7.3.4 FIRPTA. A Foreign Investment in Real Property Tax Act affidavit in the form of 0 hereto executed by Seller;

7.3.5 Authority. Evidence of the existence, organization and authority of Seller and of the authority of the persons executing documents on behalf of Seller reasonably satisfactory to the underwriter for the Title Policy;

7.3.6 Additional Documents. Any additional documents that Escrow Agent or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement (provided, however, no such additional document shall expand any obligation, covenant, representation or warranty of Seller or result in any new or additional obligation, covenant, representation or warranty of Seller under this Agreement beyond those expressly set forth in this Agreement); and

| PURCHASE AND SALE AGREEMENT – PAGE 15 |

7.3.7 Intentionally Omitted.

Section 7.4 Purchaser's Deliveries in Escrow. As of or prior to the Closing Date, Purchaser shall deliver in escrow to Escrow Agent the following:

7.4.1 Bill of Sale, Assignment and Assumption. The Assignment, executed and acknowledged by Purchaser;

7.4.2 Conveyancing or Transfer Tax Forms or Returns. Such conveyancing or transfer tax forms or returns, if any, as are required to be delivered or signed by Purchaser by applicable state and local law in connection with the conveyance of Real Property;

7.4.3 Authority. Evidence of the existence, organization and authority of Purchaser and of the authority of the persons executing documents on behalf of Purchaser reasonably satisfactory to the underwriter for the Title Policy; and

7.4.4 Additional Documents. Any additional documents that Seller, Escrow Agent or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement (provided, however, no such additional document shall expand any obligation, covenant, representation or warranty of Purchaser or result in any new or additional obligation, covenant, representation or warranty of Purchaser under this Agreement beyond those expressly set forth in this Agreement).

Section 7.5 Closing Statements. As of or prior to the Closing Date, Seller and Purchaser shall deposit with Escrow Agent executed closing statements consistent with this Agreement in the form required by Escrow Agent.

Section 7.6 Purchase Price. At or before 1:00 p.m. (Eastern) on the Closing Date, Purchaser shall deliver to Escrow Agent the Purchase Price, less the Earnest Money (which shall be applied to the Purchase Price), plus or minus applicable prorations, in immediate, same-day U.S. federal funds wired for credit into Escrow Agent's escrow account, which funds must be delivered in a manner to permit Escrow Agent to deliver good funds to Seller or its designee on the Closing Date (and, if requested by Seller, by wire transfer); in the event that Escrow Agent is unable to deliver good funds to Seller or its designee on the Closing Date, then the closing statements and related prorations will be revised as necessary.

Section 7.7 Possession. Seller shall deliver possession of the Property to Purchaser at the Closing subject only to the Permitted Exceptions.

Section 7.8 Delivery of Books and Records. Promptly following the Closing, Seller shall deliver to the offices of Purchaser's property manager or to the Real Property to the extent in Seller's or its property manager's possession or control: Lease Files; maintenance records and warranties; plans and specifications; licenses, permits and certificates of occupancy; copies or originals of all books and records of account, contracts, and copies of correspondence with tenants and suppliers; all advertising materials; booklets; and keys. In each case, Seller shall deliver such items, as applicable, in paper form, electronic and any other such form or format of such items as are in Seller’s possession or control.

| PURCHASE AND SALE AGREEMENT – PAGE 16 |

Section 7.9 Notice to Tenants. Seller and Purchaser shall each execute, and Purchaser shall deliver to each tenant immediately after the Closing, a notice regarding the sale in substantially the form of Exhibit E attached hereto, or such other form as may be required by applicable state law. This obligation on the part of Purchaser and Seller shall survive the Closing.

ARTICLE

8

Prorations, Deposits, Commissions

Section 8.1 Prorations. At Closing, the following items shall be prorated as of the date of Closing with all items of income and expense for the Property being borne by Purchaser from and after (and including) the date of Closing: Tenant Receivables (defined below) and other income and rents that have been collected by Seller as of Closing; fees and assessments; prepaid expenses and obligations under Service Contracts; accrued operating expenses; real and personal ad valorem taxes and any other governmental assessments ("Taxes"); and any assessments by private covenant for the then-current calendar year of Closing. Specifically, the following shall apply to such prorations and to post-Closing collections of Tenant Receivables:

8.1.1 Taxes. All Taxes attributable to the calendar year 2013 and payable in 2014, previously paid in full by Seller, shall be prorated between the parties on a cash basis, such that Seller shall receive a credit from Purchaser for the period commencing on the Closing Date and ending on December 31, 2014. Such proration shall be based on the final tax bill for such taxes and there shall be no reproration of such amounts. All Taxes attributable to calendar year 2014 and payable in 2015 shall be the sole responsibility of Purchaser without contribution from Seller. Any additional Taxes relating to the year of Closing or prior years arising out of a change in the use of the Real Property or a change in ownership shall be assumed by Purchaser effective as of Closing and paid by Purchaser when due and payable, and Purchaser shall indemnify Seller from and against any and all such Taxes, which indemnification obligation shall survive the Closing.

8.1.2 Utilities. Purchaser shall take all steps necessary to effectuate the transfer of all utilities to its name as of the Closing Date, and where necessary, post deposits with the utility companies. Seller shall cooperate as necessary to effectuate such transfers and ensure that all utility meters are read as of the Closing Date. Seller shall be entitled to recover any and all deposits held by any utility company as of the Closing Date.

8.1.3 Tenant Receivables. Rents due from tenants, licensees or other occupants under Leases and operating expenses and/or taxes payable by tenants under Leases (collectively, "Tenant Receivables") and not collected by Seller as of Closing shall not be prorated between Seller and Purchaser at Closing but shall be apportioned on the basis of the period for which the same is payable and if, as and when collected, as follows:

| PURCHASE AND SALE AGREEMENT – PAGE 17 |

(a) Tenant Receivables and other income received from tenants, licensees or other occupants under Leases after Closing shall be applied in the following order of priority: (A) first, to payment of the current Tenant Receivables then due for the month in which the Closing Date occurs, which amount shall be apportioned between Purchaser and Seller as of the Closing Date as set forth in 0 hereof (with Seller's portion thereof to be delivered to Seller); (B) second, to Tenant Receivables first coming due after Closing and applicable to the period of time after Closing, which amount shall be retained by Purchaser; (C) third, to payment of Tenant Receivables first coming due after Closing but applicable to the period of time before Closing, including, without limitation, the Tenant Receivables described in Section 00 below (collectively, "Unbilled Tenant Receivables"), which amount shall be delivered to Seller; and (D) thereafter, to delinquent Tenant Receivables which were due and payable as of Closing but not collected by Seller as of Closing (collectively, "Uncollected Delinquent Tenant Receivables"), which amount shall be delivered to Seller. Notwithstanding the foregoing, Seller shall have the right to pursue the collection of Uncollected Delinquent Tenant Receivables for a period of one year after Closing without prejudice to Seller's rights or Purchaser's obligations hereunder, provided, however, Seller shall have no right to cause any such tenant, licensee or other occupant to be evicted or to exercise any other "landlord" remedy (as set forth in such tenant's, licensee’s or occupant’s Lease) against such tenant other than to sue for collection. Any sums received by Purchaser to which Seller is entitled shall be held in trust for Seller on account of such past due rents payable to Seller, and Purchaser shall remit to Seller any such sums received by Purchaser to which Seller is entitled within ten (10) business days after receipt thereof less reasonable, actual costs and expenses of collection, including reasonable attorneys' fees, court costs and disbursements, if any. Seller expressly agrees that if Seller receives any amounts after the Closing Date which are attributable, in whole or in part, to any period after the Closing Date, Seller shall remit to Purchaser that portion of the monies so received by Seller to which Purchaser is entitled within ten (10) business days after receipt thereof. With respect to Unbilled Tenant Receivables, Purchaser covenants and agrees to (i) bill the same when billable and (ii) cooperate with Seller to determine the correct amount of operating expenses and/or taxes due. The provisions of this Section 00 shall survive the Closing.

(b) Without limiting the generality of the requirements of Section 00(B) above, if the final reconciliation or determination of operating expenses and/or taxes due under the Leases shows that a net amount is owed by Seller to Purchaser, said amount shall be paid by Seller to Purchaser within ten (10) business days of such final determination under the Leases. If the final determination of operating expenses and/or taxes due under the Leases shows that a net amount is owed by Purchaser to Seller, Purchaser shall, within ten business days of such final determination, remit said amount to Seller. Purchaser agrees to receive and hold any monies received on account of such past due expenses and/or taxes in trust for Seller and to pay same promptly to Seller as aforesaid. Seller represents that it has completed final reconciliation of operating expenses and taxes due under the Leases for the 2013 calendar year. The provisions of this Section 00 shall survive the Closing.

| PURCHASE AND SALE AGREEMENT – PAGE 18 |

Section 8.2 Leasing Costs. Seller agrees to pay or discharge at or prior to Closing all leasing commissions, costs for tenant improvements, lease buyout costs, moving allowances, design allowances, legal fees and other costs, expenses and allowances incurred in order to induce a tenant, license or other occupant to enter into a Lease or Lease renewal (collectively, "Leasing Costs") that are due and payable (whether before or after the Closing) with respect to Leases in force as of or prior to the Effective Date; provided, however, that Seller shall have no obligation to pay, and as of Closing Purchaser shall assume the obligation to pay, all Leasing Costs payable with respect to any option to renew or option to expand that has not been exercised prior to the Effective Date, which obligation shall survive the Closing. Additionally, as of Closing, Purchaser shall assume Seller's obligations for (a) Leasing Costs with respect to Leases in force as of or prior to the Effective Date for which Purchaser receives a credit at Closing, and (b) Leasing Costs incurred with respect to Leases and Lease renewals and extensions executed with Purchaser’s approval (as required by Section 6.1.4) subsequent to the Effective Date.

Section 8.3 Closing Costs. Closing costs shall be allocated between Seller and Purchaser in accordance with 0.

Section 8.4 Final Adjustment After Closing. If final bills are not available or cannot be issued prior to Closing for any item being prorated under 0 or if the parties find that an error has been made with respect to the prorations performed at Closing, then, in either case, Purchaser and Seller agree to allocate such items on a fair and equitable basis as soon as such bills are available, final adjustment to be made as soon as reasonably possible after the Closing. Payments in connection with the final adjustment shall be due within 30 days of written notice. All such rights and obligations shall survive the Closing.

Section 8.5 Tenant Deposits. All tenant, licensee and occupant security deposits collected and not applied by Seller (and interest thereon if required by law or contract) shall be transferred or credited to Purchaser at Closing. Notwithstanding the above, to the extent a tenant security deposit held by Seller is in the form of a letter of credit ("LOC") and such LOC is transferable solely by the beneficiary, Seller agrees to obtain and complete the required transfer form(s) from the financial institution that issued the LOC and deposit same with the original LOC into escrow at Closing together with payment of any transfer fees, which shall be delivered to the Purchaser after Closing. If the LOC cannot be unilaterally transferred by the beneficiary, then Seller shall have no obligation except to deliver said original LOC into escrow at Closing and Purchaser shall then be responsible for working directly with the tenant and/or financial institution after Closing to obtain a new LOC with Purchaser as the beneficiary at Purchaser’s cost. In such an event, if a default by the tenant should occur after the Closing that would give rise to the Landlord having the right to cash the existing LOC before a replacement LOC is obtained, and the proceeds of said LOC are assignable pursuant to its terms, then Seller agrees to cooperate with Purchaser in drawing upon said existing LOC so long as Purchaser (a) delivers the existing LOC back to Seller and (b) indemnifies Seller for any claims, liabilities, fees or expenses in connection with such action(s). As of the Closing, Purchaser shall assume Seller's obligations related to tenant, licensee and occupant security deposits, but only to the extent they are credited or transferred to Purchaser.

| PURCHASE AND SALE AGREEMENT – PAGE 19 |

Section 8.6 Commissions. Seller shall be responsible to Broker for a real estate sales commission at Closing (but only in the event of a Closing in strict accordance with this Agreement) in accordance with a separate agreement between Seller and Broker, and, in any event, Purchaser shall not be responsible to Broker for any commissions or other amounts. Broker may share its commission with any other licensed broker involved in this transaction, but the payment of the commission by Seller to Broker shall fully satisfy any obligations of Seller to pay a commission hereunder. Under no circumstances shall Seller owe a commission or other compensation directly to any other broker, agent or person. Any cooperating broker shall not be an affiliate, subsidiary or related in any way to Purchaser. Other than as stated above in this 0, Seller and Purchaser each represent and warrant to the other that no real estate brokerage commission is payable to any person or entity in connection with the transaction contemplated hereby, and each agrees to and does hereby indemnify and hold the other harmless against the payment of any commission to any other person or entity claiming by, through or under Seller or Purchaser, as applicable. This indemnification shall extend to any and all claims, liabilities, costs and expenses (including reasonable attorneys' fees and litigation costs) arising as a result of such claims and shall survive the Closing.

ARTICLE

9

Representations and Warranties

Section 9.1 Seller's Representations and Warranties. Seller represents and warrants to Purchaser that:

9.1.1 Organization and Authority. Seller has been duly organized, is validly existing, and is in good standing in the state in which it was formed. Seller has the full right, power, and authority and has obtained any and all consents required to enter into this Agreement and to consummate or cause to be consummated the transactions contemplated hereby. This Agreement has been, and all of the documents to be delivered by Seller at the Closing will be, authorized and executed and constitute, or will constitute, as appropriate, the valid and binding obligation of Seller, enforceable in accordance with their terms.

9.1.2 Conflicts and Pending Actions. There is no agreement to which Seller is a party or, an agreement by which the Property is bound, that is binding on Seller or the Property which is in conflict with this Agreement. To Seller’s knowledge, there is no pending or threatened litigation or governmental enforcement against Seller or in any way relating to the Property, which challenges or impairs Seller's ability to execute or perform its obligations under this Agreement.

9.1.3 Tenant Leases. As of the Effective Date, Exhibit F lists all tenants, licensees and subtenants of the Property under written Leases or other written agreements to which Seller is a party or to which Seller has consented in writing. To Seller’s knowledge, the Lease Files made available contain true and complete copies of the Leases in all material respects. The list of Leasing Costs set forth in Exhibit F is true and complete as of the Effective Date. The Rent Roll attached to Exhibit F is the Rent Roll used by Seller in the ordinary course of Seller’s business, which Rent Roll shows a true and correct listing of any security deposits (indicating cash or letter of credit) or prepaid rentals made or paid by the tenants. To Seller’s knowledge, no tenant, licensee or subtenants of the Property under written Leases or other written agreements to which Seller is a party or to which Seller has consented in writing is in default beyond any applicable cure period under any of the Leases.

| PURCHASE AND SALE AGREEMENT – PAGE 20 |

9.1.4 Service Contracts. To Seller's knowledge, the list of Service Contracts attached as Exhibit H includes all Service Contracts. Seller has not received any currently effective notice in writing of any uncured material default under any Service Contracts.

9.1.5 Permits and Warranties. To Seller’s knowledge, Seller has not received any currently effective notice in writing of any uncured material breach or default under any of the Permits and Warranties.

9.1.6 Delivery of Property Documents. To Seller’s knowledge, Seller has not omitted any information required to be included with the Property Information which would make the Property Information furnished misleading.

9.1.7 Notices from Governmental Authorities. Seller has received no written notice of any legal requirement affecting the Real Property, or any part thereof, that has not been corrected, except as may be reflected by the Property Documents or otherwise disclosed in writing to Purchaser.

9.1.8 Enforceability. This Agreement has been, and each and all of the other agreements, instruments and documents herein required to be made or delivered by Seller pursuant hereto have been, or on the Closing Date will have been, executed by Seller and when so executed, are and shall be legal, valid, and binding obligations of Seller enforceable against Seller in accordance with their respective terms, subject to all applicable bankruptcy, insolvency, reorganization, moratorium, and other similar laws affecting the rights of creditors generally and, as to enforceability, the general principles of equity (regardless of whether enforcement is sought in a proceeding in equity or at law).

9.1.9 Bankruptcy Matters. Seller has not made a general assignment for the benefit of creditors, filed any voluntary petition in bankruptcy or suffered the filing of an involuntary petition by its creditors, suffered the appointment of a receiver to take possession of substantially all of its assets, suffered the attachment or other judicial seizure of substantially all of its assets, admitted its inability to pay its debts as they come due, or made an offer of settlement, extension of composition to its creditors generally.

9.1.10 Prohibited Persons and Transactions. Neither Seller nor any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents is, nor will they become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Assets Control ("OFAC") of the Department of the Treasury (including those named on OFAC's Specially Designated Nationals and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not engage in any dealings or transactions or be otherwise associated with such persons or entities.

Section 9.2 Purchaser's Representations and Warranties. Purchaser represents and warrants to Seller that:

| PURCHASE AND SALE AGREEMENT – PAGE 21 |

9.2.1 Organization and Authority. Purchaser has been duly organized and is validly existing as a corporation in good standing in the State of Maryland and is qualified to do business in the state in which the Real Property is located. Purchaser has the full right and authority and has obtained or will obtain any and all consents required to enter into this Agreement and to consummate or cause to be consummated the transactions contemplated hereby. This Agreement and all of the documents to be delivered by Purchaser at the Closing will be authorized and properly executed and constitute, or will constitute, as appropriate, the valid and binding obligation of Purchaser, enforceable in accordance with their terms.

9.2.2 Conflicts and Pending Action. There is no agreement to which Purchaser is a party or to Purchaser's knowledge binding on Purchaser which is in conflict with this Agreement. There is no action or proceeding pending or, to Purchaser's knowledge, threatened against Purchaser which challenges or impairs Purchaser's ability to execute or perform its obligations under this Agreement.

9.2.3 ERISA. Purchaser is not an employee benefit plan (a "Plan") subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), or Section 4975 of the Internal Revenue Code of 1986, as amended (the "Code"), Purchaser's assets do not constitute "plan assets" within the meaning of the "plan asset regulations" (29.C.F.R. Section 2510.3-101), and Purchaser's acquisition of the Property will not constitute or result in a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code.

9.2.4 Prohibited Persons and Transactions. Neither Purchaser nor any of its affiliates, nor any of their respective partners, members, shareholders or other equity owners, and none of their respective employees, officers, directors, representatives or agents is, nor will they become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the OFAC of the Department of the Treasury (including those named on OFAC's Specially Designated and Blocked Persons List) or under any statute, executive order (including the September 24, 2001, Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not engage in any dealings or transactions or be otherwise associated with such persons or entities.