Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

TABLE OF CONTENTS 3

TABLE OF CONTENTS 4

TABLE OF CONTENTS 5

TABLE OF CONTENTS 6

TRIDENT PORTFOLIO CONTENTS

32 DART ROAD CONTENTS

56 MILLIKEN STREET CONTENTS

1755 ENTERPRISE PARKWAY CONTENTS

4 EAST STOW ROAD CONTENTS

As filed with the Securities and Exchange Commission on February 5, 2015

Registration No. 333-196798

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

PLYMOUTH INDUSTRIAL REIT, INC.

(Exact name of registrant as specified in governing instruments)

260 Franklin Street, Suite 1900

Boston, Massachusetts 02110

(617) 340-3814

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Jeffrey E. Witherell

Chief Executive Officer

Plymouth Industrial REIT, Inc.

260 Franklin Street, Suite 1900

Boston, Massachusetts 02110

(617) 340-3814

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Kenneth L. Betts Schiff Hardin LLP 100 Crescent Court, Suite 350 Dallas, TX 75201 (214) 981-9900 |

Justin R. Salon Morrison & Foerster LLP 2000 Pennsylvania Avenue, NW, Suite 6000 Washington, D.C. 20006 (202) 887-1500 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale thereof is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED FEBRUARY 5, 2015

PRELIMINARY PROSPECTUS

Shares

Common Stock

Plymouth Industrial REIT, Inc. is a full service, vertically integrated, self-administered and self-managed real estate investment trust, or REIT, focused on the acquisition, ownership and management of single and multi-tenant distribution centers, warehouses and light industrial properties, primarily located in secondary and select primary markets across the Eastern half of the U.S. and Texas. We currently own and operate, or have an interest in, 21 industrial properties located in seven states with an aggregate of approximately 4,350,000 rentable square feet plus a 270 unit multifamily complex. Upon completion of this offering and the Acquisition Transactions, we will own and operate 35 industrial properties, located in ten states with an aggregate of approximately 6,250,000 rentable square feet.

This is our initial listed public offering. We are selling shares of our common stock, $0.01 par value per share in this offering. We currently anticipate that the offering price of our common stock will be between $ and $ per share.

Prior to this offering, there has been no public market for our shares. We have applied to list our common stock on the New York Stock Exchange, or the NYSE, under the symbol "PLYM."

We were formed as a Maryland corporation in March 2011. We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2012. To assist us in maintaining our qualification as a REIT, stockholders are generally restricted from beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. Our charter contains additional restrictions on the ownership and transfer of shares of our common stock. See "Description of Stock—Restrictions on Ownership and Transfer."

We are an "emerging growth company" under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and will be subject to reduced public company reporting requirements. Investing in our common stock involves significant risks. You should read the section entitled "Risk Factors" beginning on page 19 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common stock.

|

||||

| |

Per share |

Total |

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discount(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

The underwriters may also exercise their option to purchase up to an additional shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover over-allotments of shares, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2015.

The date of this prospectus is , 2015.

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or any information to which we have referred you. We have not, and the underwriters have not, authorized any other person to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates which are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

We use market data and industry forecasts and projections throughout this prospectus, including data from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers' experience in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently investigated or verified this information. Any forecasts prepared by REIS, Inc., or REIS, are based on data (including third-party

i

data), models and experience of various professionals, and are based on various assumptions, all of which are subject to change without notice. In addition, the projections obtained from REIS that we have included in this prospectus have not been expertized and are, therefore, solely our responsibility. As a result, REIS does not and will not have any liability or responsibility whatsoever for any market data and industry forecasts and projections that are contained in this prospectus or otherwise disseminated in connection with the offer or sale of our common stock. If you purchase our common stock, your sole recourse for any alleged or actual inaccuracies in the forecasts and projections used in this prospectus will be against us. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this prospectus.

In this prospectus:

ii

property-level operating expenses including allocated overhead. NOI excludes depreciation and amortization, general and administrative expenses, impairments, gain/loss on sale of real estate, interest expense and other non-operating expenses;

Our definitions of Class A industrial properties, Class B industrial properties, primary markets and secondary markets may vary from the definitions of these terms used by investors, analysts or other industrial REITs.

See "Management's Discussion and Analysis of Financial Condition and Results of Operations" for more detailed explanations of NOI, Earnings Before Interest, Taxes, Depreciation and Amortization, or EBITDA, and reconciliations of NOI, EBITDA and Funds from Operations, or FFO, to net income computed in accordance with GAAP.

iii

The following summary highlights information contained elsewhere in this prospectus. You should read carefully the entire prospectus, including "Risk Factors," our financial statements, pro forma financial information, and related notes appearing elsewhere in this prospectus, before making a decision to invest in our common stock.

Unless indicated otherwise, the information included in this prospectus assumes (i) no exercise of the underwriters' option to purchase up to additional shares of our common stock to cover over-allotments, if any, (ii) the completion of the Acquisition Transactions described in the prospectus, and (iii) the shares of common stock to be sold in this offering are sold at $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus.

Overview

We are a full service, vertically integrated, self-administered and self-managed Maryland corporation focused on the acquisition, ownership and management of single and multi-tenant Class B industrial properties, including distribution centers, warehouses and light industrial properties, primarily located in secondary and select primary markets across the Eastern half of the U.S. and Texas. For our definition of Class B industrial properties, see "—Our Investment and Growth Strategies—Investment Strategy." We currently own and operate, or have an interest in, 21 industrial properties located in seven states plus a 270 unit multifamily complex. Upon completion of this offering and the Acquisition Transactions, we will own and operate 35 industrial buildings, located in ten states with an aggregate of approximately 6,250,000 rentable square feet plus a 270 unit multifamily complex. As of September 30, 2014, the Company Portfolio was 97.6% leased to 50 separate tenants across 17 industry types.

We intend to continue to focus on the acquisition of industrial properties in secondary markets with net rentable square footage ranging between approximately 100 million and 300 million square feet, which we refer to as our target markets. We believe industrial properties in such target markets will provide superior and consistent cash flow returns at generally lower acquisition costs relative to industrial properties in primary markets. Further, we believe there is a greater potential for higher rates of appreciation in the value of industrial properties in our target markets relative to industrial properties in primary markets where we believe asset appreciation has already peaked in the years following the 2008-2009 recession.

We believe our target markets provide us with opportunities to acquire both stabilized properties generating favorable cash flows, as well as properties where we can enhance returns through value-add renovations and redevelopment. We focus primarily on the following investments:

We believe there are a significant number of attractive acquisition opportunities available to us in our target markets and that the fragmented and complex nature of our target markets generally make it difficult for less-experienced or less-focused investors to access comparable opportunities on a consistent basis. See "Market Overview."

Our company, which was formerly known as Plymouth Opportunity REIT, Inc., was founded in March 2011 by two of our executive officers, Jeffrey Witherell and Pendleton White, Jr., each of whom has at least 25 years of experience acquiring, owning and operating commercial real estate properties. Specifically, both were members of a team of senior investment executives that was responsible for the acquisition and capital formation of commercial properties for Franklin Street Properties (NYSE: FSP), a REIT based in Boston, MA, from 2000 to 2007, during which time Franklin Street listed its stock on

1

the American Stock Exchange. Following their time at Franklin Street, our founders recognized a growing opportunity in the Class B industrial space, particularly in secondary markets and select primary markets, following the 2008-2009 recession, and founded the company to participate in the cyclical recovery of the U.S. economy.

Competitive Strengths

We believe that our investment strategy and operating model distinguish us from other owners, operators and acquirers of industrial real estate in several important ways, including the following:

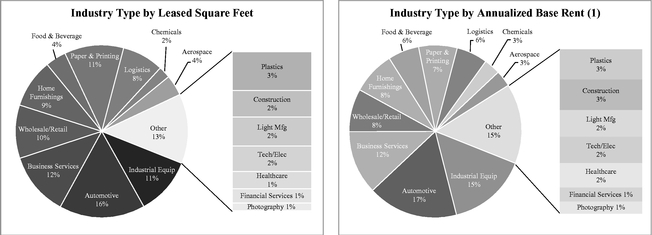

Focus on Acquiring Class B Industrial Properties with Stable and Predictable Cash Flows: We focus on Class B distribution centers, warehouses and light industrial properties rather than Class A industrial or other commercial properties for the following reasons, among others: fewer capital expenditure requirements, generally greater investment yields, overall greater tenant retention, generally higher current returns and lower earnings volatility. We believe the Company Portfolio is, and our future acquisitions will be, attractively positioned to participate in the recovering rental rates in our target markets while providing our stockholders with consistent income. As of September 30, 2014, the Company Portfolio was leased to 50 separate tenants across 17 industry types, which we believe reduces our exposure to tenant default risk and earnings volatility.

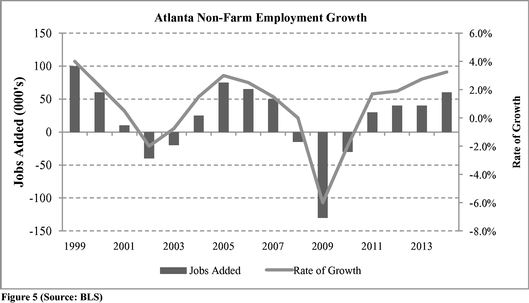

Strategic Focus on Secondary Markets: We intend to continue to focus on the acquisition of distribution centers, warehouses and light industrial properties in our target markets across the Eastern half of the U.S. and Texas. We believe that our target markets have exhibited, or will exhibit in the near future, positive demographic trends (i.e., population growth, decreasing unemployment rates, personal income growth and/or favorable tax climates), scarcity of available industrial space and favorable rental growth projections, which should help contribute to create superior long-term risk-adjusted returns.

Superior Access to Deal Flow: We believe our management team's extensive personal relationships and research-driven origination methods will provide us access to off-market and lightly marketed acquisition opportunities, many of which may not be available to our competitors. Off-market and lightly marketed transactions are characterized by a lack of a formal marketing process and a lack of widely disseminated marketing materials. Our executive management and acquisition teams maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants, and greater than 50% of the Company Portfolio was sourced in off-market or lightly marketed transactions. We believe that our sourcing approach will provide us access to a significant number of attractive investment opportunities.

Experienced Management Team: Each of the three senior members of our executive management team has over 25 years of significant real estate industry experience, with each member having previous public REIT or public real estate company experience. Led by Mr. Witherell, our Chairman and Chief Executive Officer, Mr. White, our President and Chief Investment Officer, and Mr. Wright, our Chief Financial Officer, our management team has significant experience in acquiring, owning, operating and managing commercial real estate, with a particular emphasis on industrial assets. Throughout their careers, Mr. Witherell and Mr. White have had primary responsibility for overseeing the acquisition, financing, ownership and management of more than ten million square feet of office and industrial properties in our target markets, while over the past 18 years Mr. Wright has served as the Chief Financial Officer of two real estate companies, one of which had approximately $8 billion in assets.

Growth-Oriented Capital Structure: Concurrently with or shortly after the completion of this offering, we expect to have approximately $25.7 million of secured indebtedness under our proposed revolving credit facility, which equates to an initial debt-to-total capitalization ratio of % based on the midpoint of the price range set forth on the front cover of this prospectus. We have negotiated a proposed revolving credit facility with a borrowing capacity of $60.0 million that we expect to have in

2

place concurrently with, or shortly after, the completion of this offering. We believe that our available cash and the expected remaining borrowing capacity under our anticipated credit facility, as well as financings secured by individual mortgages on our properties, combined with our ability to use OP units as acquisition currency, will provide us with significant financial flexibility to fund future growth while maintaining a target debt-to-EBITDA multiple in line with our peers.

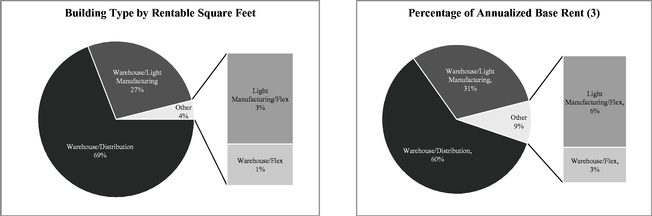

Our Investment and Growth Strategies

Our primary objective is to generate attractive risk-adjusted returns for our stockholders through dividends and capital appreciation primarily through the acquisition of Class B industrial properties located in secondary markets. We intend to focus our acquisition activities on our core property types, which include warehouse/distribution facilities and light manufacturing facilities, because we believe they generate higher tenant retention rates and require lower tenant improvement and re-leasing costs. To a lesser extent, we intend to focus on flex/office facilities (light assembly and research and development). We believe that pursuing the following strategies will enable us to achieve our investment objectives.

Investment Strategy

Our primary investment strategy is to acquire Class B industrial properties predominantly in secondary markets across the Eastern half of the U.S. and Texas. We generally define Class B industrial properties as industrial properties that are typically more than 15 years old, have clear heights between 18 and 26 feet and square footage between 50,000 and 500,000 square feet, with building systems that have adequate capacities to deliver the services currently needed by existing tenants, but may need upgrades for future tenants. In contrast, we define Class A industrial properties as industrial properties that typically are 15 years old or newer, have clear heights in excess of 26 feet and square footage in excess of 200,000 square feet, with energy efficient design characteristics suitable for current and future tenants.

We intend to acquire properties that we believe can achieve high initial yields and strong ongoing cash-on-cash returns and that exhibit the potential for increased rental growth in the near future. In addition, we may acquire Class A industrial properties that offer similar attractive return characteristics if the cost basis for such properties are comparable to those of Class B industrial properties in a given market or sub-market. While we will focus on investment opportunities in our target markets, we may make opportunistic acquisitions of Class A industrial properties or industrial properties in primary markets when we believe we can achieve attractive risk-adjusted returns. We believe the Acquisition Portfolio and the markets in which these properties are located are indicative of and consistent with our overall investment strategy.

Following this offering, we believe we will have a competitive advantage in sourcing attractive acquisitions because the competition for our target assets is primarily from local investors who are not likely to have ready access to debt or equity capital. In addition, our umbrella partnership real estate investment trust, or UPREIT, structure may enable us to acquire industrial properties on a non-cash basis in a tax efficient manner through the issuance of OP units as consideration for the transaction. We will also continue to develop our large existing network of relationships with real estate and financial intermediaries. These individuals and companies give us access to significant deal flow—both those broadly marketed and those exposed through only limited marketing. These properties will be acquired primarily from third-party owners of existing leased buildings and secondarily from owner-occupiers through sale-leaseback transactions.

Growth Strategies

We will seek to maximize our cash flows through effective asset management. Our asset management team intends to actively manage our directly owned properties in an effort to maintain high retention rates, lease vacant space, manage operating expenses and maintain our properties to an

3

appropriate standard. In doing so, we will seek to develop strong tenant relationships with all of our tenants and leverage those relationships and market knowledge to increase renewals, properly prepare tenants for rent increases, obtain early notification of departures to provide longer re-leasing periods and work with tenants to properly maintain the quality and attractiveness of our properties. Our asset management team will also collaborate with our internal credit function to actively monitor the credit profile of each of our tenants and prospective tenants on an ongoing basis.

Our asset management team functions include strategic planning and decision-making, centralized leasing activities and management of third-party leasing companies. Our asset management/credit team oversees property management activities relating to our properties which include controlling capital expenditures and expenses that are not reimbursable by tenants, making regular property inspections, overseeing rent collections and cost control and planning and budgeting activities. Tenant relations matters, including monitoring of tenant compliance with their property maintenance obligations and other lease provisions, will be handled by in-house personnel for most of our properties.

Financing Strategy

We intend to maintain a flexible and growth-oriented capital structure. Concurrently with or shortly after completion of this offering, we will have approximately $25.7 million of indebtedness to be outstanding under our proposed credit facility, which equates to an initial debt-to-total capitalization of %, based on the midpoint of the price range set forth on the front cover of this prospectus. To facilitate our acquisition strategy post-offering, we expect to have an additional $34.3 million of borrowing capacity under our proposed revolving credit facility and have the ability to mortgage individual properties up to a 65% debt-to-value ratio.

We expect to fund future property acquisitions through, among other things, borrowings under our proposed revolving credit facility and long-term secured and unsecured borrowings. We also anticipate using OP units to acquire properties from existing owners interested in tax-deferred transactions.

Investment Criteria

We believe that our market knowledge, operations systems and internal processes allow us to efficiently analyze the risks associated with an asset's ability to produce cash flow going forward. We blend fundamental real estate analysis with corporate credit analysis to make a probabilistic assessment of cash flows that will be realized in future periods. We also use data-driven and event-driven analytics and primary research to identify and pursue emerging investment opportunities. See "Business—Our Investment and Growth Strategies—Investment Criteria."

Our investment strategy focuses on Class B industrial properties in secondary markets for the following reasons:

4

Market Overview

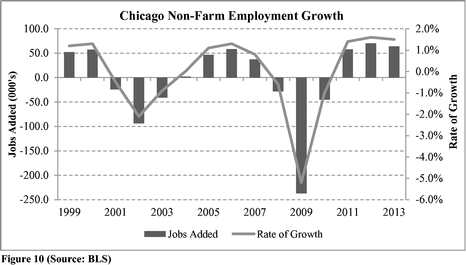

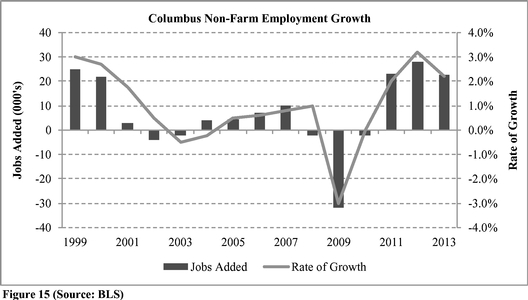

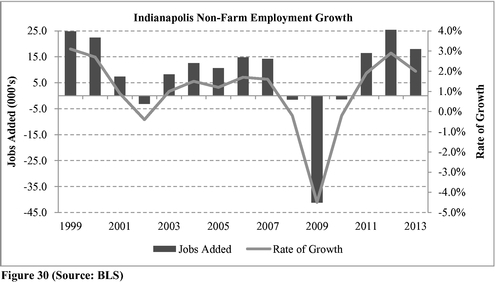

U.S. Economic Growth Accelerating

After a sluggish recovery from 2009 to 2013, where U.S. gross domestic product, or U.S. GDP, experienced modest annual increases of 2.0%, the U.S. economy grew 2.2% in 2014 and is poised to accelerate in 2015 and 2016. According to the United States Congressional Budget Office, or CBO, U.S. GDP is expected to grow by 2.8% in 2015 and 3.0% in 2016, based on its January 2015 report. This is expected to spur business growth and spending, push businesses to increase hiring rates, and drive down the unemployment rate. Additionally, this increase in U.S. GDP should increase trade, manufacturing and production, and consumer consumption, which we believe are key drivers in the performance of the U.S. industrial real estate market.

Industrial Trade

Industrial trade is one of the most important drivers of industrial real estate demand as import and export volume greatly determine the amount of space that is needed to store goods. Since the recession, exports have been one the key drivers of the recovery, with export levels currently up more than 10% from pre-recession levels. While import rates have not grown as quickly as export rates since the recession, import rates (excluding oil) have surpassed pre-recession levels, resulting in further increased demand for industrial real estate space. We believe that this recovery to import and export rates should continue to experience healthy growth during 2015, which should help drive demand for industrial space.

Manufacturing and Production

Manufacturing volume and production levels are other key components of industrial real estate performance since the level of goods that are manufactured and produced have a positive correlation with the amount of space needed to store such goods. According to the U.S. Federal Reserve's industrial production index, which measures the outputs of U.S. mines and factories, industrial production picked up pace in 2014 and maintained its momentum going into 2015. Due in large part to the surge in domestic energy production, the U.S. is enjoying lower energy costs, which, combined with more competitive labor costs, should allow industrial production to expand in 2015.

Consumer Consumption

Consumer consumption, which accounts for two-thirds of U.S. GDP, declined during the recession as high unemployment and stagnating wages forced people to cut back on non-essential spending. However, since 2010, total consumer spending has grown at an annual rate of 2.1%, while durable goods (a key industrial measure) has improved by 6.9%.

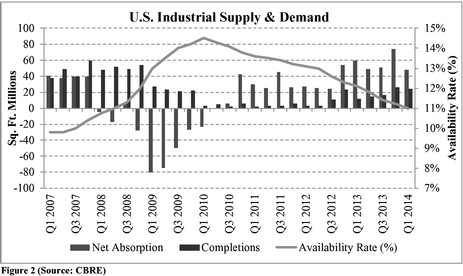

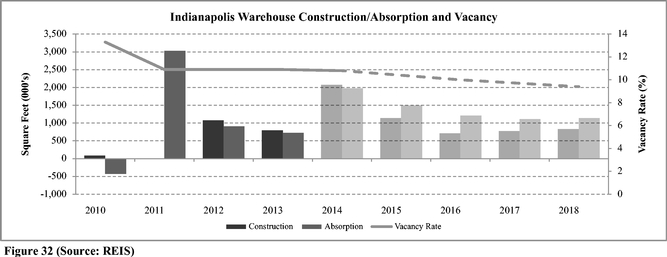

Industrial Real Estate Fundamentals Improving

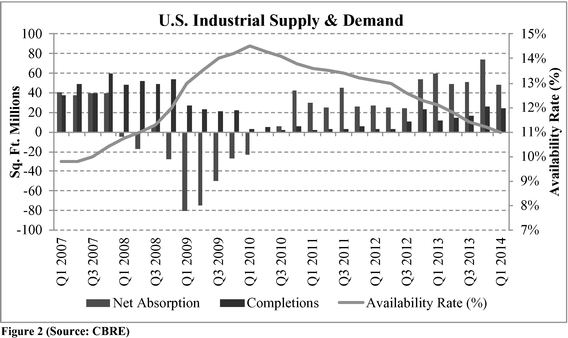

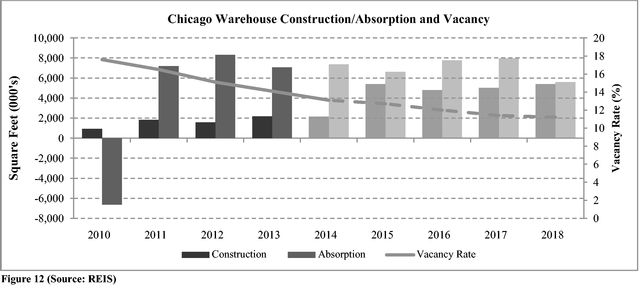

According to CB Richard Ellis, or CBRE, industrial real estate fundamentals going into 2015 are healthy, as exhibited by a fall in vacancy rates and a recovery in rent growth. We believe that while construction starts continue to remain limited and economic demand drivers continue to power

5

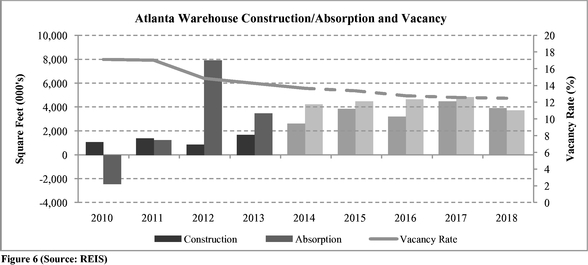

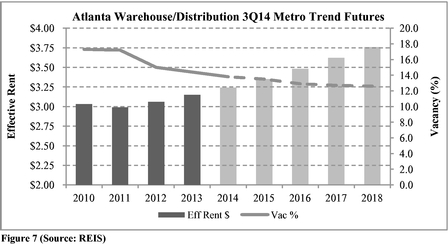

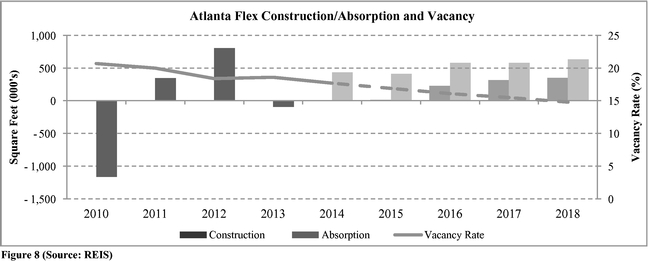

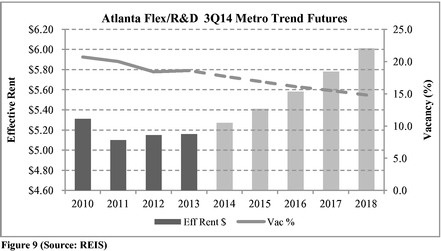

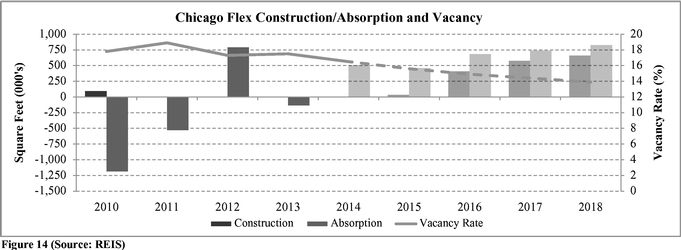

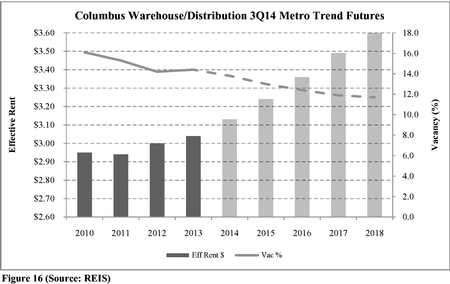

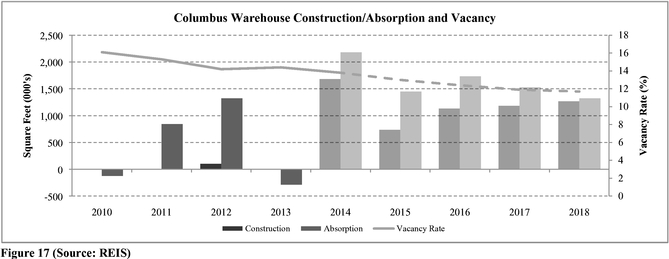

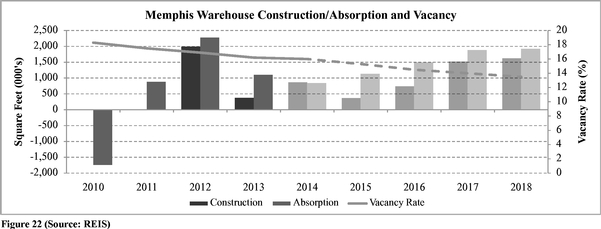

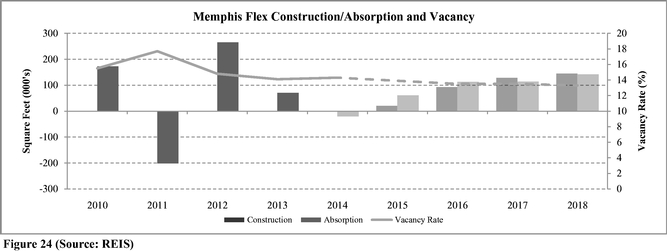

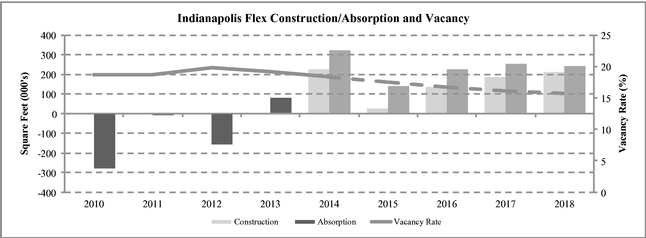

absorption, industrial fundamentals will continue to strengthen (see graph below). We also believe that, as a result of the lack of new construction and overall supply of industrial properties in many U.S. markets, vacancy rates will continue to fall until rent growth increases to a point where developers can justify undertaking more speculative projects.

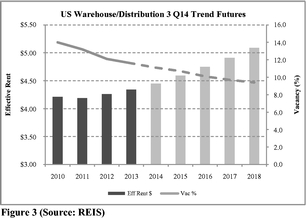

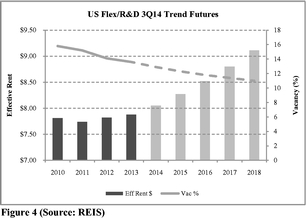

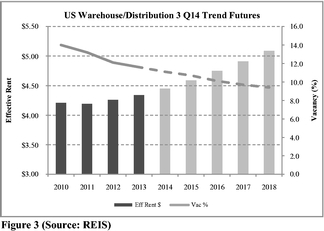

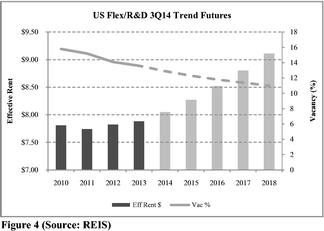

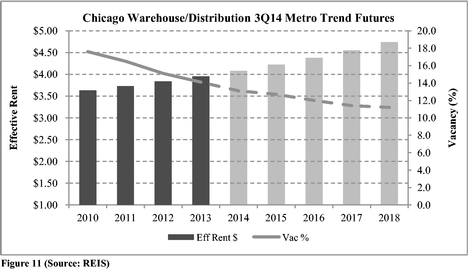

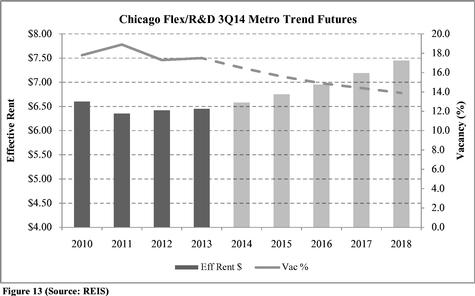

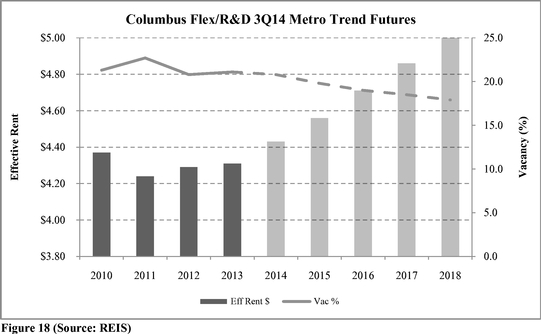

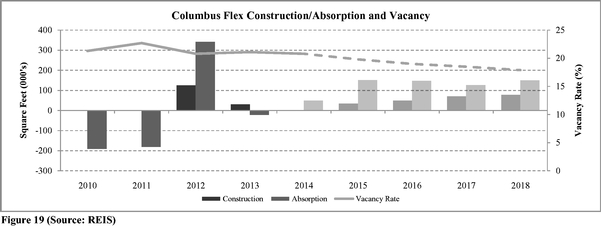

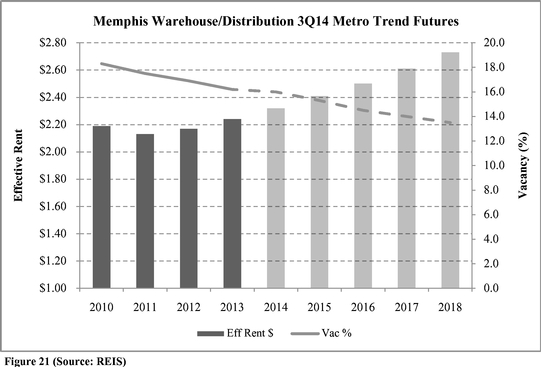

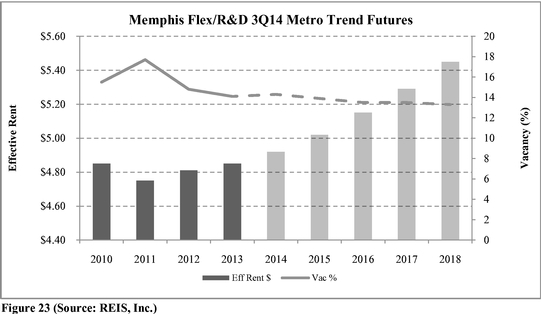

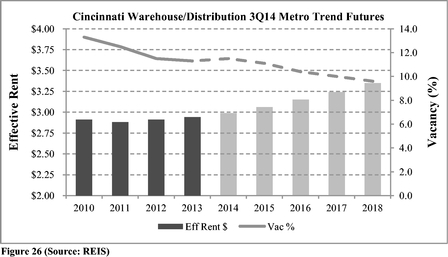

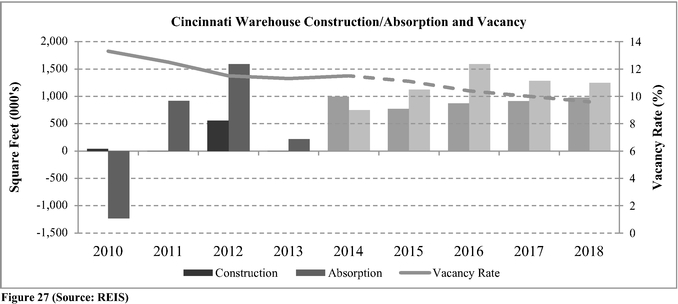

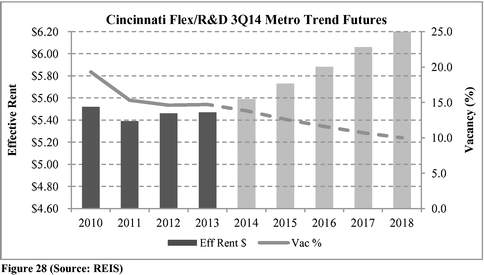

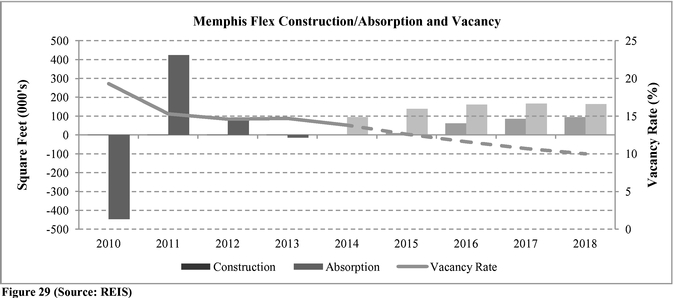

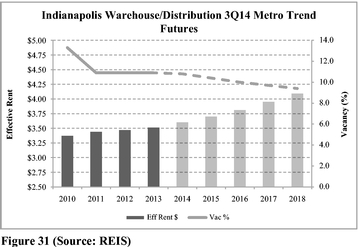

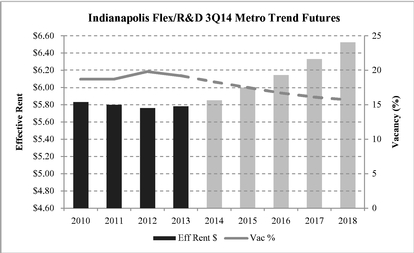

Additionally, REIS projects similar positive trends in both the 6.2 billion square foot warehouse/distribution and 1.2 billion square foot U.S Flex/R&D markets. As indicated below, effective rents have increased since 2011, and a decline in the vacancy rate is projected through 2018.

|

|

In the long term, industrial real estate fundamentals are expected to continue to be strong as the sector is uniquely positioned to benefit from current economic trends, including increased trade growth, inventory rebuilding and increased industrial output. Additionally, developing trends point to a strong near-to medium-term outlook for the sector. For example, the growth of big-box warehouses serving large online retailers close to population centers is forecasted to gain popularity, which we believe could potentially influence smaller e-retailers to do the same.

Increased e-commerce also has a positive impact on warehouse demand, as it tends to transfer retail tenants to warehouses. Additionally, the emergence of e-commerce and the growth of Internet retailers and wholesalers are expanding the universe of tenants seeking industrial space in our target markets.

6

Manufacturing is also likely to play an increased role in the industrial sector's recovery. With energy prices and labor costs down, we believe that the industrial real estate fundamentals support a sustained resurgence in domestic manufacturing.

Market Opportunity

Our strategy is to tap into forecasted U.S. economic growth by investing in industrial real estate that we believe will benefit from rental growth and increased tenant demand. We believe that in some cases there has already been significant growth and capitalization rate compression in primary markets in the Class A industrial sector, but an opportunity to take advantage of capitalization rate compression, favorable pricing and limited supply and competition still exists in secondary markets and in Class B industrial properties. While we will focus on the acquisition of Class B industrial properties in secondary markets, we may also make opportunistic acquisitions of Class A industrial properties and industrial properties in primary markets.

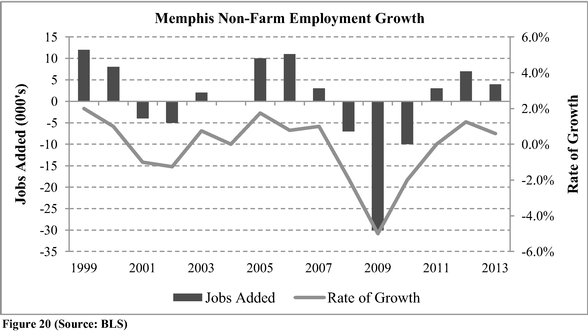

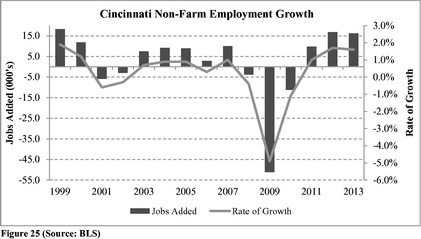

The Company Portfolio focuses on a select group of target markets, including Atlanta, Chicago, Columbus, Indianapolis and Memphis, which we believe possess certain characteristics that we believe are beneficial to industrial real estate investment. These characteristics include, but are not limited to, employment growth, recent and forecasted rent growth, a shortage of industrial development, and falling vacancy rates. We believe that these characteristics will allow us to increase rental rates, increase occupancy and drive value. For a more detailed overview of these markets, refer to the "Market Overview" section of this prospectus.

Acquisition Transactions

Concurrently with or shortly after the completion of this offering, we will complete a series of four transactions with unrelated third parties, which we refer to collectively as the Acquisition Transactions, pursuant to which we will acquire a fee simple interest in each of the 14 industrial properties in the Acquisition Portfolio totaling an aggregate of approximately 1,895,800 square feet leased to 14 tenants for an aggregate purchase price of approximately $79.5 million. We will fund the cash portion of the purchase of the Acquisition Transactions with the net proceeds from this offering. Generally, all the conditions to closing contained in each of the relevant purchase agreements related to the Acquisition Transactions have been satisfied, and other than the delivery of the purchase price, we have no obligation to any seller under any such purchase agreements.

The sellers in certain of the Acquisition Transactions will indemnify the company and our operating partnership for certain breaches of representations and warranties of the sellers regarding the relevant property being acquired after the completion of the applicable Acquisition Transaction.

The Company Portfolio

Upon completion of this offering and the Acquisition Transactions, together with the Existing Portfolio, we will own, or have an interest in, 35 industrial buildings. The following table provides certain information with respect to the Company Portfolio as of September 30, 2014, after giving effect to the Acquisition Transactions. We will own 100% fee simple ownership in the properties in the Acquisition Portfolio through wholly-owned subsidiaries of our operating partnership.

7

| |

|

|

|

|

|

|

|

Percent of Total Annualized Rent |

|

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Existing Portfolio |

Percent Ownership |

Year Built/ Renovated(2) |

Square Footage |

|

Annualized Rent(4) |

Annualized Rent/Square Foot(5) |

|||||||||||||||||||

Metro

|

Address | Property Type | Occupancy(3) | ||||||||||||||||||||||

Chicago, IL |

3940 Stern Avenue | Warehouse/Light Manufacturing | 100 | % | 1987 | 146,798 | 100 | % | $ | 540,216 | 2.24 | % | $ | 3.68 | |||||||||||

Chicago, IL |

1875 Holmes Road | Warehouse/Light Manufacturing | 100 | % | 1989 | 134,415 | 100 | % | $ | 571,264 | 2.58 | % | $ | 4.25 | |||||||||||

Chicago, IL |

1355 Holmes Road | Warehouse/Distribution | 100 | % | 1975/1999 | 82,456 | 100 | % | $ | 371,577 | 1.68 | % | $ | 4.51 | |||||||||||

Chicago, IL |

2401 Commerce Drive | Warehouse/Flex | 100 | % | 1994 | 78,574 | 100 | % | $ | 542,112 | 2.45 | % | $ | 6.90 | |||||||||||

Chicago, IL |

189 Seegers Road | Warehouse/Light Manufacturing | 100 | % | 1972 | 25,000 | 100 | % | $ | 156,000 | 0.70 | % | $ | 6.24 | |||||||||||

Chicago, IL |

11351 W. 183rd Street | Warehouse/Distribution | 100 | % | 2000 | 18,768 | 100 | % | $ | 174,355 | 0.79 | % | $ | 9.29 | |||||||||||

Cincinnati, OH |

Mostellar Distribution Center I & II | Warehouse/Light Manufacturing | 100 | % | 1959 | 358,386 | 100 | % | $ | 1,095,859 | 4.95 | % | $ | 3.06 | |||||||||||

Cincinnati, OH |

4115 Thunderbird Lane | Warehouse/Light Manufacturing | 100 | % | 1991 | 70,000 | 100 | % | $ | 224,000 | 1.01 | % | $ | 3.20 | |||||||||||

Florence, KY |

7585 Empire Drive | Warehouse/Light Manufacturing | 100 | % | 1973 | 148,415 | 100 | % | $ | 382,599 | 1.73 | % | $ | 2.58 | |||||||||||

Columbus, OH |

3500 Southwest Boulevard | Warehouse/Distribution | 100 | % | 1992 | 527,127 | 100 | % | $ | 1,782,634 | 8.05 | % | $ | 3.38 | |||||||||||

Columbus, OH |

3100 Creekside Parkway | Warehouse/Distribution | 100 | % | 2004 | 340,000 | 100 | % | $ | 952,000 | 4.30 | % | $ | 2.80 | |||||||||||

Columbus, OH |

8288 Green Meadows Dr. | Warehouse/Distribution | 100 | % | 1988 | 300,000 | 100 | % | $ | 861,000 | 3.89 | % | $ | 2.87 | |||||||||||

Columbus, OH |

8273 Green Meadows Dr. | Warehouse/Distribution | 100 | % | 1996/2007/2012 | 77,271 | 100 | % | $ | 337,983 | 1.53 | % | $ | 4.37 | |||||||||||

Columbus, OH |

7001 American Pkwy | Warehouse/Distribution | 100 | % | 1986/2007 | 54,100 | 100 | % | $ | 175,825 | 0.79 | % | $ | 3.25 | |||||||||||

Memphis, TN |

6005, 6045 & 6075 Shelby Dr. | Warehouse/Distribution | 100 | % | 1989 | 202,303 | 89.5 | % | $ | 499,345 | 2.25 | % | $ | 2.47 | |||||||||||

Jackson, TN |

210 American Dr. | Warehouse/Distribution | 100 | % | 1967/1981 | 638,400 | 100 | % | $ | 1,404,480 | 6.34 | % | $ | 2.20 | |||||||||||

Altanta, GA |

32 Dart Road | Warehouse/Light Manufacturing | 100 | % | 1988 | 194,800 | 100 | % | $ | 496,740 | 2.24 | % | $ | 2.55 | |||||||||||

Atlanta, GA(6) |

5400 Fulton Industrial Blvd | Warehouse/ Distribution | 50.3 | % | 1967/1995/2005/2013 | 343,423 | 100 | % | $ | 1,182,897 | 5.34 | % | $ | 3.44 | |||||||||||

Portland, ME |

56 Milliken Road | Warehouse/Light Manufacturing | 100 | % | 1966 | 200,625 | 100 | % | $ | 994,773 | 4.49 | % | $ | 4.96 | |||||||||||

Marlton, NJ |

4 East Stow Road | Warehouse/Distribution | 100 | % | 1986 | 156,634 | 97.7 | % | $ | 762,884 | 3.44 | % | $ | 4.87 | |||||||||||

Cleveland, OH |

1755 Enterprise Parkway | Warehouse/Light Manufacturing | 100 | % | 1979/2005 | 255,570 | 100.0 | % | $ | 1,294,652 | 5.84 | % | $ | 5.07 | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Existing Portfolio—Industrial Properties—Total/Weighted Average(1) |

4,353,065 | 99.4 | % | $ | 14,803,195 | 66.8 | % | $ | 3.40 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

8

| |

|

|

|

|

|

|

|

Percent of Total Annualized Rent |

|

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Acquisition Portfolio |

|

Year Built/ Renovated(1) |

|

|

Annualized Rent(3) |

Annualized Rent/Square Foot(4) |

|||||||||||||||||||

Metro

|

Address | Property Type | Percent Ownership | Square Footage | Occupancy(2) | ||||||||||||||||||||

South Bend, IN |

5861 West Cleveland | Warehouse/ Distribution | 100 | % | 1994 | 62,550 | 100 | % | $ | 187,650 | 0.85 | % | $ | 3.00 | |||||||||||

South Bend, IN |

5502 #1 & 2 West Brick Road | Warehouse/ Distribution | 100 | % | 1998 | 51,200 | 100 | % | $ | 153,600 | 1.37 | % | $ | 3.00 | |||||||||||

South Bend, IN |

4491 North Mayflower Road | Warehouse/ Distribution | 100 | % | 2000 | 77,000 | 100 | % | $ | 231,000 | 1.04 | % | $ | 3.00 | |||||||||||

South Bend, IN |

5855 West Carbonmill Drive | Warehouse/ Distribution | 100 | % | 2002 | 198,000 | 100 | % | $ | 792,000 | 3.58 | % | $ | 4.00 | |||||||||||

South Bend, IN |

4955 Ameritech Drive | Warehouse/ Distribution | 100 | % | 2004 | 228,000 | 100 | % | $ | 888,000 | 4.01 | % | $ | 3.89 | |||||||||||

Boston, MA |

1 Parlex Place | Light Manufacturing/Flex | 100 | % | 1968/1976/1982/1999 | 172,000 | 100 | % | $ | 1,400,000 | 6.32 | % | $ | 8.14 | |||||||||||

Cincinnati, OH |

9180 LeSaint Rd | Warehouse /Distribution | 100 | % | 1988 | 124,880 | 100 | % | $ | 403,362 | 1.82 | % | $ | 3.23 | |||||||||||

Cincinnati, OH |

3550 Symmes Road | Warehouse/ Distribution | 100 | % | 1996 | 301,479 | 58.1 | % | $ | 506,299 | 2.29 | % | $ | 1.68 | |||||||||||

Columbus, OH |

1615 Georgesville Road | Warehouse /Distribution | 100 | % | 1985 | 96,325 | 100 | % | $ | 306,663 | 1.38 | % | $ | 3.18 | |||||||||||

Indianapolis, IN |

8525 E 33rd | Warehouse /Distribution | 100 | % | 1978 | 320,000 | 100 | % | $ | 1,013,639 | 4.58 | % | $ | 3.17 | |||||||||||

Detroit, MI |

750 Standard Parkway | Warehouse/Light Manufacturing | 100 | % | 2010 | 57,118 | 100 | % | $ | 342,708 | 1.55 | % | $ | 6.00 | |||||||||||

Detroit, MI |

765 Standard Parkway | Warehouse/Light Manufacturing | 100 | % | 2011 | 45,320 | 100 | % | $ | 247,000 | 1.12 | % | $ | 5.45 | |||||||||||

Detroit, MI |

23300 Haggerty Rd | Warehouse/Light Manufacturing | 100 | % | 2000 | 84,717 | 100 | % | $ | 563,368 | 2.54 | % | $ | 6.65 | |||||||||||

Detroit, MI |

1857 Enterprise Dr | Warehouse/Light Manufacturing | 100 | % | 1986/2014 | 27,000 | 100 | % | $ | 160,650 | 0.73 | % | $ | 5.95 | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Acquisition Portfolio Totals |

1,895,839 | 93.3 | % | $ | 7,346,689 | 33.2 | % | $ | 3.88 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Company Portfolio—Total/Weighted Average |

6,248,904 | 97.6 | % | $ | 22,149,884 | 100 | % | $ | 3.54 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Existing Senior Secured Loan Agreement

Our company, our operating partnership and certain subsidiaries of our operating partnership have entered into a senior secured loan agreement with investment entities, or the Funds, managed by Senator Investment Group LP. As of January 31, 2015, there was $165 million of indebtedness outstanding under the senior secured loan agreement and $20 million of original issue discount. Our operating partnership used the net proceeds of the financing to acquire 20 industrial properties in the Existing Portfolio, to repay existing indebtedness, to pay fees and expenses and for working capital purposes. Pursuant to the terms of the senior secured loan agreement, the Funds have the right to nominate up to six persons to serve on our board of directors until such time as the indebtedness under the senior secured loan agreement has been paid in full.

The loans under the senior secured loan agreement bear interest at a current pay rate equal to 7% annum, coupled with payment-in-kind features with respect to the remaining interest at varying rates. The loans mature on April 28, 2015, subject to our operating partnership's option, subject to certain conditions, to extend the maturity date to October 28, 2015. The borrowings under the senior secured loan agreement are secured by first lien mortgages on all of the properties in the Existing Portfolio and pledges of equity interests in our operating partnership and its subsidiaries. Our operating partnership's obligations under the senior secured loan agreement are also guaranteed by our company and each of our operating partnership's wholly-owned subsidiaries.

The senior secured loan agreement contains customary representations and warranties, as well as affirmative and negative covenants. The negative covenants include restrictions on additional

9

indebtedness, restrictions on liens, fundamental changes, dispositions, restricted payments, change in nature of business, transactions with affiliates and burdensome agreements. The senior secured loan agreement contains financial covenants that require the maintenance of a debt service coverage ratio as of the last day of any fiscal quarter of 1.1 to 1.0 and an annual amount of net operating income of not less than $12.2 million. The senior secured loan agreement is subject to acceleration upon certain specified events of defaults, including breaches of representations or covenants, failure to pay other material indebtedness, failure to pay taxes or a change of control of our company, as defined in the senior secured loan agreement. As of January 31, 2015, we were in compliance with all covenants under the senior secured loan agreement.

Acquisition Pipeline

Our executive management and acquisition teams maintain a deep, broad network of relationships among key market participants, including property brokers, lenders, owners and tenants. We believe these relationships and our research-driven origination methods will provide us access to off-market and lightly marketed acquisition opportunities, many of which may not be available to our competitors. Furthermore, we believe that a significant portion of the approximately 13.8 billion square feet of industrial space in the U.S. falls within our target investment criteria and that there will be ample supply of attractive acquisition opportunities in the future.

In the normal course of our business, we regularly evaluate the market for industrial properties to identify potential acquisition targets. As of the date of this prospectus, we were evaluating approximately $350 million of potential acquisitions in our target markets that we have identified as warranting further investment consideration after an initial review. As of the date of this prospectus, we have neither entered into any letters of intent or purchase agreements with respect to any potential acquisitions nor have we begun a comprehensive due diligence review with respect to any of these properties. Accordingly, we do not believe that the acquisition of any of the properties under evaluation is probable as of the date of this prospectus.

Summary Risk Factors

An investment in our common stock involves material risks. You should consider carefully the risks described below and under "Risk Factors" before purchasing shares of our common stock in this offering:

10

Structure and Formation of Our Company

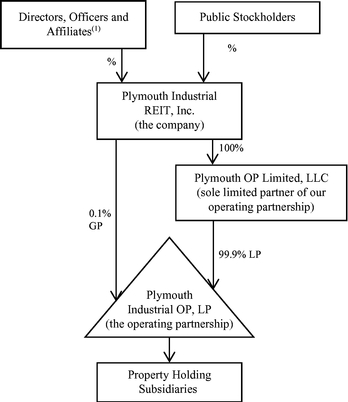

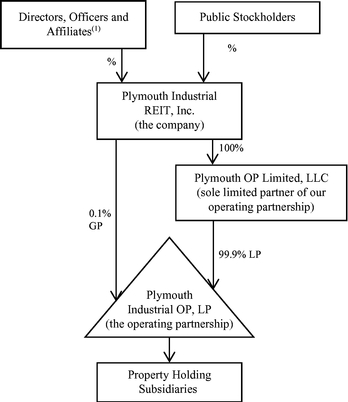

Our Company

We were formed as a Maryland corporation in March 2011 and previously conducted business as Plymouth Opportunity REIT, Inc. We conduct our business through an UPREIT structure in which our properties are owned by our operating partnership directly or through subsidiaries, as described below under "—Our Operating Partnership." We are the sole general partner of our operating partnership and, upon completion of this offering, we will own 100% of the OP units in our operating partnership. Our board of directors oversees our business and affairs.

Prior to May 2014, we were externally managed by Plymouth Real Estate Investors, Inc., or the advisor, an affiliate of our company, pursuant to the terms of an advisory agreement. The advisory agreement was terminated in May 2014 with no consideration being paid to the advisor as a result of such termination.

Our Operating Partnership

Our operating partnership was formed as a Delaware limited partnership in March 2011. Substantially all of our assets are held by, and our operations are conducted through, our operating partnership. We will contribute the net proceeds from this offering to our operating partnership in exchange for OP units therein. Our interest in our operating partnership will generally entitle us to share in cash distributions from, and in the profits and losses of, our operating partnership in proportion to our percentage ownership. As the sole general partner of our operating partnership, we will generally have the exclusive power under the partnership agreement to manage and conduct its business and affairs, subject to certain limited approval and voting rights of the limited partners, which are described more fully below in "Description of the Partnership Agreement of Plymouth Industrial OP, LP."

11

Corporate Structure

The chart below reflects our organization immediately following completion of this offering and the Acquisition Transactions.

Conflicts of Interest

We expect that our executive officers will enter into employment agreements with us effective upon the completion of this offering. See "Executive Compensation—Executive Compensation Arrangements." We may choose not to enforce, or to enforce less vigorously, our rights under these agreements because of our desire to maintain our ongoing relationships with members of our senior management, with possible negative impact on stockholders. Moreover, these agreements were not negotiated at arm's length and certain of our executive officers had the ability to influence the types and level of benefits that they will receive from us under these agreements.

Conflicts of interest may exist or could arise in the future as a result of the relationships between us and our affiliates, on the one hand, and our operating partnership or any partner thereof, on the other. Our directors and officers have duties to our company under Maryland law in connection with their management of our company. At the same time, we, as the general partner of our operating partnership, have fiduciary duties and obligations to our operating partnership and its limited partners under Maryland law and the partnership agreement of our operating partnership in connection with the management of our operating partnership. Our fiduciary duties and obligations as the general partner of our operating partnership may come into conflict with the duties of our directors and officers to our company. We have adopted policies that are designed to eliminate or minimize certain potential

12

conflicts of interests, and the partnership agreement of our operating partnership provides that, in the event of a conflict between the interests of us or our stockholders and the interests of our operating partnership or any of its limited partners, we may give priority to the separate interests of our company or our stockholders, including with respect to tax consequences to limited partners, assignees or our stockholders. See "Policies With Respect to Certain Activities—Conflict of Interest Policy" and "Description of the Partnership Agreement of Plymouth Industrial OP, LP."

Tax Status

We elected to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2012 and we believe that our organization and method of operation enable us to meet the requirements for qualification and taxation as a REIT. To maintain REIT qualification, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our taxable income to our stockholders. As a REIT, we generally will not be subject to federal income tax on our taxable income we currently distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to some federal, state and local taxes on our income or property. In addition, the income of any taxable REIT subsidiary that we own will be subject to taxation at regular corporate rates. See "Material U.S. Federal Income Tax Considerations."

Distribution Policy

We made quarterly distributions in shares of our common stock beginning with the fiscal quarter ended September 30, 2012 through the fiscal quarter ended March 31, 2014. Following completion of this offering, we intend to make regular quarterly cash distributions to holders of shares of our common stock. Any future distributions we make will be at the discretion of our board of directors and will depend upon our earnings and financial condition, maintenance of our REIT qualification, applicable restrictions contained in the Maryland General Corporation Law, or the MGCL, and such other factors as our board may determine in its sole discretion. We anticipate that our estimated cash available for distribution will exceed the annual distribution requirements applicable to REITs. However, under some circumstances, we may be required to pay distributions in excess of cash available for distribution in order to meet these distribution requirements and may need to use the proceeds from future equity and debt offerings, sell assets or borrow funds to make some distributions. We have no intention to use the net proceeds of this offering to make distributions nor do we intend to make distributions using shares of common stock. We cannot assure you that our distribution policy will not change in the future.

Restrictions on Ownership

Due to limitations on the concentration of ownership of REIT stock imposed by the Internal Revenue Code of 1986, as amended, or the Code, our charter generally prohibits any person from actually, beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. Our charter permits our board of directors, in its sole and absolute discretion, to exempt a person, prospectively or retroactively, from one or both of the ownership limits if, among other conditions, the person's ownership of our stock in excess of the ownership limits could not cause us to fail to qualify as a REIT. Our board of directors must waive the ownership limit with respect to a particular person if it: (i) determines that such ownership will not cause any individual's beneficial ownership of shares of our stock to violate the ownership limit and that any exemption from the ownership limit will not jeopardize our status as a REIT and (ii) determines that such stockholder does not and will not own, actually or constructively, an interest in a tenant of ours (or a tenant of any entity whose operations are

13

attributed in whole or in part to us) that would cause us to own, actually or constructively, more than a 9.8% interest (as set forth in Section 856(d)(2)(B) of the Code) in such tenant or that any such ownership would not cause us to fail to qualify as a REIT under the Code.

Emerging Growth Company

We are an "emerging growth company," as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. Although these exemptions will be available to us, they will not have a material impact on our public reporting and disclosure.

We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier. We will remain an "emerging growth company" until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1.0 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year ending December 31, 2017, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt, or (iv) the date on which we are deemed a "large accelerated filer" under the Securities Act of 1933, as amended, or the Securities Act, or the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Under the JOBS Act, emerging growth companies can take advantage of the extended transition period provided in Section 7(a)(2)(13) of the Securities Act for complying with new or revised accounting standards. However, we are choosing to "opt out" of such extended transition period and, as a result, we will comply with any such new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

14

Common stock offered by us |

shares of common stock (plus up to an additional shares of common stock that we may issue and sell upon the exercise of the underwriters' over-allotment option). | |

Common stock to be outstanding after completion of this offering |

shares of common stock(1) | |

Use of proceeds |

We estimate that the net proceeds (after deducting the underwriting discount and commissions and offering expenses of approximately $20.5 million, payable by us) we will receive from the sale of shares of our common stock in this offering will be approximately $229.5 million (or approximately million if the underwriters exercise their over-allotment option in full). We will contribute the net proceeds we receive from this offering to our operating partnership in exchange for OP units in our operating partnership. | |

|

We expect our operating partnership will use approximately (a) $174.3 million of the net proceeds from this offering to repay the indebtedness outstanding under our senior secured loan agreement, under which we borrowed funds to acquire a substantial portion of the Existing Portfolio, and (b) $53.8 million of the net proceeds of this offering to acquire the 14 industrial properties comprising the Acquisition Portfolio in connection with the completion of the Acquisition Transactions. Our operating partnership is expected to use the remaining net proceeds, if any, to acquire and manage additional industrial properties and for general corporate purposes. | |

|

Prior to the full deployment of the net proceeds as described above, we intend to invest the undeployed net proceeds in interest-bearing short-term investment grade securities or money-market accounts that are consistent with our intention to qualify as a REIT, including, for example, government and government agency certificates, certificates of deposit and interest-bearing bank deposits. We expect that these initial investments will provide a lower net return than we expect to receive from investments in industrial properties. If the underwriters exercise their over-allotment option in full, we expect to use the additional $ million of net proceeds to acquire additional properties or for general corporate purposes. See "Use of Proceeds." | |

Risk Factors |

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading "Risk Factors" beginning on page 18 and the other information included in this prospectus before investing in our common stock. | |

Proposed NYSE symbol |

"PLYM" |

15

Summary Selected Financial Information

You should read the following summary financial and operating data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operation," our unaudited pro forma consolidated financial statements and related notes and the historical combined financial statements and related notes included elsewhere in the prospectus.

The unaudited pro forma condensed consolidated balance sheet data is presented as if the acquisition of the Existing Portfolio, the Acquisition Transactions and this offering had occurred on September 30, 2014, and the unaudited pro forma statements of operations and other data for the nine months ended September 30, 2014 and the year ended December 31, 2013, is presented as if the acquisition of the Existing Portfolio, the Acquisition Transactions and this offering had occurred on January 1, 2013. The unaudited pro forma condensed consolidated financial statements include the effects of (i) the acquisition of the Existing Portfolio, (ii) the Acquisition Transactions and (iii) this offering. The pro forma consolidated financial information is not necessarily indicative of what our actual financial condition would have been as of September 30, 2014 or what our actual results of operations would have been assuming the acquisition of the Existing Portfolio, the Acquisition Transactions and this offering had been completed as of January 1, 2013, nor does it purport to represent our future financial position or results of operations.

The unaudited summary historical combined balance sheet information as of September 30, 2014 and statement of operations data for the nine months ended September 30, 2014 and 2013 have been derived from our financial statements included elsewhere in this prospectus. The summary historical consolidated balance sheet information as of December 31, 2013 and 2012, and the historical consolidated statement of operations data for the years ended December 31, 2013 and 2012 have been derived from the company's financial statements, which were audited by Marcum LLP (as of and for the year ended December 31, 2013) and KPMG LLP (as of and for the year ended December 31, 2012), independent registered public accountants, and are included elsewhere in this prospectus.

| |

As of September 30, | As of December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Pro Forma Consolidated |

Historical Consolidated |

Historical Consolidated |

|||||||||||||

| |

2014 | 2014 | 2013 | 2013 | 2012 | |||||||||||

| |

(Unaudited) |

(Unaudited) |

|

|

||||||||||||

| |

(in thousands) |

(in thousands) |

||||||||||||||

Balance Sheet Data |

||||||||||||||||

(End of Period): |

||||||||||||||||

Rental property, before accumulated depreciation |

$ | 193,874 | $ | — | $ | — | $ | — | $ | — | ||||||

Investments in non-consolidating real estate |

4,065 | $ | 4,628 | $ | 1,356 | $ | 4,831 | $ | 1,642 | |||||||

Cash and other assets |

8,162 | $ | 1,536 | $ | 4,192 | $ | 368 | $ | 201 | |||||||

Deferred offering costs |

— | 767 | — | — | — | |||||||||||

Deferred leasing intangibles |

55,705 | — | — | — | — | |||||||||||

Total assets |

261,806 | $ | 6,931 | $ | 5,548 | $ | 5,199 | $ | 1,843 | |||||||

Accounts payable and other liabilities |

2,859 | $ | 1,241 | $ | 403 | $ | 241 | $ | 431 | |||||||

Deferred leasing intangibles |

15,079 | — | — | |||||||||||||

Notes payable |

25,700 | $ | 2,000 | $ | — | $ | — | $ | — | |||||||

Total liabilities |

43,638 | $ | 3,241 | $ | 403 | $ | 241 | $ | 431 | |||||||

Stockholders' equity |

$ | 218,168 | $ | 3,690 | $ | 5,145 | $ | 4,958 | $ | 1,412 | ||||||

16

| |

Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Pro Forma Consolidated |

Historical Consolidated |

Pro Forma Consolidated |

Historical Consolidated |

|||||||||||||||

| |

2014 | 2014 | 2013 | 2013 | 2013 | 2012 | |||||||||||||

| |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|

|

||||||||||||||

| |

(in thousands) |

(in thousands) |

|||||||||||||||||

Statement of Operations Data: |

|||||||||||||||||||

Revenue |

|||||||||||||||||||

Rental revenues |

$ | 15,787 | $ | — | $ | — | $ | 20,108 | $ | — | $ | — | |||||||

Tenant reimbursements |

4,441 | — | — | 5,193 | — | — | |||||||||||||

Equity investment income (loss) |

187 | 254 | (177 | ) | (663 | ) | (588 | ) | (93 | ) | |||||||||

| | | | | | | | | | | | | | | | | | | | |

Total revenues |

20,415 | 254 | (177 | ) | 24,638 | (588 | ) | (93 | ) | ||||||||||

Expenses |

|||||||||||||||||||

Property expenses |

5,238 | — | — | 6,420 | — | — | |||||||||||||

General and administrative |

1,891 | 1,891 | 2,095 | 2,884 | 2,884 | 2,074 | |||||||||||||

Acquisition expense |

147 | 644 | — | — | — | — | |||||||||||||

Depreciation and amortization |

11,480 | — | — | 15,300 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses |

18,756 | 2,535 | 2,095 | 24,604 | 2,884 | 2,074 | |||||||||||||

Other expenses |

|||||||||||||||||||

Interest expense |

661 | 83 | — | 771 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total other expenses |

661 | 83 | — | 771 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total expenses |

19,417 |

2,618 |

2,095 |

25,375 |

2,884 |

2,074 |

|||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) |

$ | 998 | $ | (2,364 | ) | $ | (2,272 | ) | $ | (737 | ) | $ | (3,472 | ) | $ | (2,167 | ) | ||

| | | | | | | | | | | | | | | | | | | | |

17

| |

Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Pro Forma Consolidated |

Historical Consolidated |

Pro Forma Consolidated |

Historical Consolidated |

|||||||||||||||

| |

2014 | 2014 | 2013 | 2013 | 2013 | 2012 | |||||||||||||

| |

(Unaudited) |

(Unaudited) |

(Unaudited) |

|

|

||||||||||||||

| |

(in thousands) |

(in thousands) |

|||||||||||||||||

Total number of in-service properties |

35 | — | — | 35 | |||||||||||||||

NOI(1) |

|||||||||||||||||||

Rental revenue |

$ | 15,787 | $ | — | $ | — | $ | 20,108 | $ | — | $ | — | |||||||

Tenant recoveries |

4,441 | — | — | 5,193 | — | — | |||||||||||||

Other operating revenue (loss) |

187 | 254 | (177 | ) | (663 | ) | (588 | ) | (93 | ) | |||||||||

Property expenses |

(5,238 | ) | — | — | (6,420 | ) | — | — | |||||||||||

Other property expenses |

— | — | — | — | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

NOI |

$ | 15,177 | $ | 254 | $ | (177 | ) | $ | 18,218 | $ | (588 | ) | $ | (93 | ) | ||||

| | | | | | | | | | | | | | | | | | | | |

EBITDA(1) |

|||||||||||||||||||

Net income (loss) |

$ | 998 | $ | (2,364 | ) | $ | (2,272 | ) | $ | (737 | ) | $ | (3,472 | ) | $ | (2,167 | ) | ||

Interest expense |

661 | — | — | 771 | — | — | |||||||||||||

Depreciation and amortization |

11,480 | — | — | 15,300 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

EBITDA |

$ | 13,139 | $ | (2,364 | ) | $ | (2,272 | ) | $ | 15,334 | $ | (3,472 | ) | $ | (2,167 | ) | |||

| | | | | | | | | | | | | | | | | | | | |

FFO(1) |

|||||||||||||||||||

Net income (loss) |

$ | 998 | $ | (2,364 | ) | $ | (2,272 | ) | $ | (737 | ) | $ | (3,442 | ) | $ | (2,167 | ) | ||

Depreciation and amortization |

11,480 | — | — | 15,300 | — | — | |||||||||||||

Adjustment for unconsolidated real estate investment |

808 | 808 | 332 | 557 | 557 | 75 | |||||||||||||

Impairment of long-lived assets |

— | — | — | — | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

FFO |

$ | 13,286 | $ | (1,556 | ) | $ | (1,940 | ) | $ | 15,120 | $ | (2,915 | ) | $ | (2,092 | ) | |||

| | | | | | | | | | | | | | | | | | | | |

AFFO(1) |

|||||||||||||||||||

FFO |

$ | 13,286 | $ | (1,556 | ) | $ | (1,940 | ) | $ | 15,120 | $ | (2,915 | ) | $ | (2,092 | ) | |||

Amortization of above or accretion of below market intangibles, net |

(570 | ) | — | — | (671 | ) | — | — | |||||||||||

Acquisition costs |

147 | 644 | — | — | — | — | |||||||||||||

Non-cash equity compensation |

— | — | — | — | — | — | |||||||||||||

Distributions |

— | — | — | — | — | — | |||||||||||||

Straight-line rent |

(544 | ) | — | — | (725 | ) | — | — | |||||||||||

| | | | | | | | | | | | | | | | | | | | |

AFFO |

$ | 12,319 | $ | (912 | ) | $ | (1,940 | ) | $ | 13,724 | $ | (2,915 | ) | $ | (2,092 | ) | |||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

18

An investment in our common stock involves risks. In addition to other information in this prospectus, you should carefully consider the following risks before investing in our common stock. The occurrence of any of the following risks could materially and adversely affect our business, prospects, financial condition, results of operations and our ability to make cash distributions to our stockholders, which could cause you to lose all or a significant portion of your investment in our common stock. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. See "Cautionary Note Regarding Forward-Looking Statements."

Risks Related to Our Business and Operations

The Company Portfolio is concentrated in the industrial real estate sector, and our business would be adversely affected by an economic downturn in that sector.

Upon completion of the Acquisition Transactions, our assets will be comprised almost entirely of industrial facilities, including warehouse/distribution facilities, light manufacturing facilities and flex/office facilities. This concentration may expose us to the risk of economic downturns in the industrial real estate sector to a greater extent than if our properties were more diversified across other sectors of the real estate industry. In particular, an economic downturn affecting the market for industrial properties could have a material adverse effect on our results of operations, cash flows, financial condition and our ability to pay distributions to our stockholders.

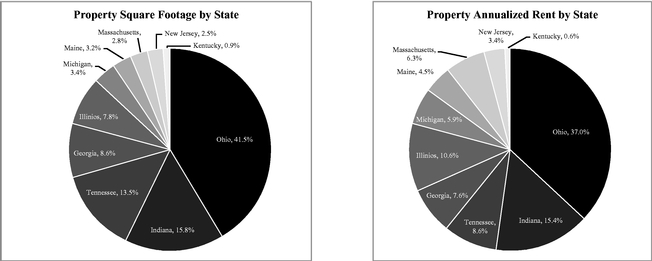

The Company Portfolio is geographically concentrated in ten states, which causes us to be especially susceptible to adverse developments in those markets.

In addition to general, regional, national and international economic conditions, our operating performance is impacted by the economic conditions of the specific geographic markets in which we have concentrations of properties. Upon completion of the Acquisition Transactions, the Company Portfolio will include holdings in the following states (which, as of the completion of the Acquisition Transactions, will account for the percentage of our total annualized rent indicated): Ohio (37.1%); Indiana (15.4%); Illinois (10.6%); Georgia (7.6%); Tennessee (8.6%); Michigan (5.9%); Massachusetts (6.3%); Maine (4.5%); New Jersey (3.4%) and Kentucky (0.6%). This geographic concentration could adversely affect our operating performance if conditions become less favorable in any of the states or regions in which we have a concentration of properties. We cannot assure you that any of our target markets will grow or that underlying real estate fundamentals will be favorable to owners and operators of industrial properties. Our operations may also be affected if competing properties are built in our target markets. Any adverse economic or real estate developments in our target markets, or any decrease in demand for industrial space resulting from the regulatory environment, business climate or energy or fiscal problems, could materially and adversely impact our financial condition, results of operations, cash flow, our ability to satisfy our debt service obligations and our ability to pay distributions to our stockholders.

The Company Portfolio is comprised almost entirely of Class B industrial properties in secondary markets, which subjects us to risks associated with concentrating the Company Portfolio on such assets.

The Company Portfolio is comprised of almost entirely Class B industrial properties in secondary markets. While we believe that Class B industrial properties in secondary markets have shown positive trends, we cannot give any assurance that these trends will continue. Any developments or circumstances that adversely affect the value of Class B industrial properties generally could have a more significant adverse impact on us than if the Company Portfolio was diversified by asset type, which could materially and adversely impact our financial condition, results of operations and ability to make distributions to our stockholders.

19

Our business strategy depends on achieving revenue growth from anticipated increases in demand for Class B industrial space in our target markets; accordingly, any delay or a weaker than anticipated economic recovery could materially and adversely affect us and our growth prospects.

Our business strategy depends on achieving revenue growth from anticipated near-term growth in demand for Class B industrial space in our target markets as a result of improving demographic trends and supply and demand fundamentals. As a result, any delay or a weaker than anticipated economic recovery, particularly in our target markets, could materially and adversely affect us and our growth prospects. Furthermore, even if economic conditions generally improve, we cannot provide any assurances that demand for Class B industrial space will increase from current levels. If demand does not increase in the near future, or if demand weakens, our future results of operations and our growth prospects could also be materially and adversely affected.

We may not be aware of characteristics or deficiencies involving any one or all of the properties in the Acquisition Portfolio, which could have a material adverse effect on our business.

Upon completion of this offering and the Acquisition Transactions, a portion of the Company Portfolio will be newly acquired properties. These properties may have characteristics or deficiencies unknown to us that could affect their valuation or revenue potential and such properties may not ultimately perform to our expectations. We cannot assure you that the operating performance of the properties will not decline under our management. Any characteristics or deficiencies in the Acquisition Portfolio that adversely affect the value of the properties or their revenue-generation potential could have a material adverse effect on our results of operations and financial condition.

We are subject to risks associated with single-tenant leases, and the default by one or more tenants could materially and adversely affect our results of operations and financial condition.

We are subject to the risk that the default, financial distress or bankruptcy of a single tenant could cause interruptions in the receipt of rental revenue and/or result in a vacancy, which is likely to result in the complete reduction in the operating cash flows generated by the property leased to that tenant and may decrease the value of that property. In addition, a majority of our leases generally require the tenant to pay all or substantially all of the operating expenses normally associated with the ownership of the property, such as utilities, real estate taxes, insurance and routine maintenance. Following a vacancy at a single-tenant property, we will be responsible for all of the operating costs at such property until it can be re-let, if at all.

We are subject to risks related to tenant concentration, which could materially adversely affect our cash flows, results of operations and financial condition.

On a pro forma basis as of September 30, 2014, after giving effect to this offering and the Acquisition Transactions, one of our tenants comprised approximately 10.8% of our total annualized rent and our top three tenants collectively comprised approximately 25.1% of our total annualized rent. As a result, our financial performance will be dependent, in large part, on the revenues generated from these significant tenants and, in turn, the financial condition of these tenants. In the event that a tenant occupying a significant portion of one or more of our properties or whose rental income represents a significant portion of the rental revenue at our properties were to experience financial weakness or file bankruptcy, it could have a material adverse effect on our cash flows, results of operations and financial condition.

We may be unable to renew leases, lease vacant space or re-lease space as leases expire.

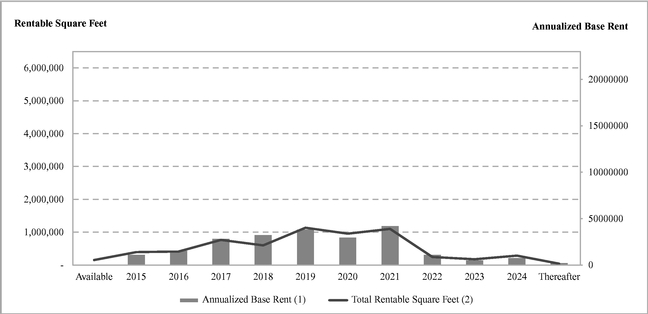

Following completion of the Acquisition Transactions, leases representing 4.9%, 6.9% and 12.7% of the rentable square footage of the industrial properties in the Company Portfolio will expire in the remainder of 2015, 2016 and 2017, respectively. We cannot assure you that our leases will be renewed or that our properties will be re-leased at rental rates equal to or above the current average rental rates or that we will not offer substantial rent abatements, tenant improvements, early termination

20

rights or below-market renewal options to attract new tenants or retain existing tenants. If the rental rates for our properties decrease, or if our existing tenants do not renew their leases or we do not re-lease a significant portion of our available space and space for which leases will expire, our financial condition, results of operations, cash flows and our ability to pay distributions on, and the per share trading price of, our common stock could be adversely affected.

We may be unable to identify and complete acquisitions of properties that meet our investment criteria, which may have a material adverse effect on our growth prospects.

Our primary investment strategy involves the acquisition of Class B industrial properties predominantly in larger secondary markets. These activities require us to identify suitable acquisition candidates or investment opportunities that meet our investment criteria and are compatible with our growth strategies. We may be unable to acquire properties identified as potential acquisition opportunities. Our ability to acquire properties on favorable terms, or at all, may expose us to the following significant risks:

If we are unable to finance property acquisitions or acquire properties on favorable terms, or at all, our financial condition, results of operations, cash flows and our ability to pay distributions on, and the per share trading price of, our common stock could be adversely affected. In addition, failure to identify or complete acquisitions of suitable properties could limit our growth.

Our acquisition activities may pose risks that could harm our business.